Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

M&A Hotline

June 26, 2009SEBI denies Takeover Exemption to Futuristic Garments

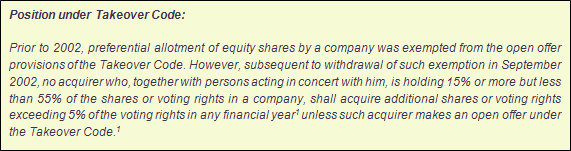

Securities and Exchange Board of India (“SEBI”) has by its order dated June 16, 2009, rejected the application (“Exemption Application”) made by the promoters of Surya Pharmaceutical Ltd. (“Target”) seeking an exemption from complying with the mandatory open offer1 requirement under Regulations 10, 11 and 12 of the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 1997 (“Takeover Code”)2.

BACKGROUND & FACTS

The promoters of the Target along with one of their group entities viz. Futuristic Garments Private Limited (“Acquirer”)3, were holding an aggregate of 35.15% equity stake in the Target. The Target had entered into an arrangement with Industrial Development Bank of India (“IDBI”) for IDBI to provide financial assistance by way of both fund based and non fund based loan to the tune of Rs. 380 million to the Target. As per the terms of the loan arrangement the promoters were required to maintain atleast 51% shareholding in the Target till the subsistence of the loan.

Accordingly, the Target sought to issue 4,700,000 zero coupon optionally convertible share warrants (“Convertible Warrants”) to the Acquirer. The Convertible Warrants were convertible into equity shares over a period of eighteen (18) months and upon conversion would consequently increase the equity stake of the promoters in the Target to 51.05%.4

The Exemption Application made to SEBI was based on the following grounds:

a. The new issuance and resultant increase in the equity stake would not amount to change in control of management of the Target.

b. The increase in shareholding is proposed pursuant to the condition imposed by IDBI for sanctioning the loan and the Target would be able to run its business more effectively by raising such additional capital.

c. The conditions of the stock market are not congenial to make an open offer at ‘this time’ due to volatility.

Recommendations / observation of the Takeover Panel5 on the Exemption Application

Based on the analysis of the Exemption Application, the SEBI Takeover Panel observed the following:

-

The Target had in one of their emails addressed to SEBI stated that if an exemption is granted by SEBI for thepreferential allotment, the Target shall be able to bring in about Rs. 340 million and therefore the financial assistance by IDBI may not be required immediately. Hence, the contention of the promoters to maintain the equity stake at 51% pursuant to the financing covenants of IDBI may not be relevant.

-

Such exemption for preferential allotment may be granted in extraordinary events like company becoming sick or infusion of funds by the promoters pursuant to corporate debt restructuring scheme6. However, the current case may not warrant such an exemption.

Accordingly, granting of such exemption was not favoured by the Takeover Panel.

SUBMISSIONS BY THE ACQUIRER

The following submissions were made by the Target to SEBI subsequent to the recommendations of the Takeover Panel:7

1. The financial assistance from IDBI was still imperative for the Target and the language in the aforesaid email did not convey the message correctly. Further, IDBI has indicated continued interest in the status of the enhancement of promoter’s stake for disbursement of financial assistance.

2. The Target was in dire need of financial assistance and hence SEBI should consider the Exemption Application favorably rather than waiting for the Target to become sick for want of funds and then to consider the Exemption application.

SEBI ORDER:

Subsequent to the recommendation by the Takeover Panel and the submission by the promoters, SEBI rejected the Exemption Application and directed the Acquirer to comply with the open offer requirement under Regulation 11(1) of the Takeover Code on the following grounds:

-

The acquisition of shares through preferential allotment is not exempted automatically from the applicability of the Takeover Code. Such exemptions under the residual Regulation 3(1)(l) of the Takeover Code may be granted in few instances like the company becoming sick or infusion of funds by the promoters / acquirers under the corporate debt restructuring mechanism and the current case does not warrant such exemption.

-

The contention that the condition of the stock market was not good for an open offer may not have much substance as the shareholders of the Target may want to dispose off their shareholding even in such a market.

-

The submissions of the Acquirer and the grounds for seeking an exemption under the Takeover Code are not convincing enough. Further, considering that there is around 65% public shareholding in the Company, granting of an exemption would deny an exit option to such large base of public shareholders and it would be adverse to their interest.

CONCLUSION

Though there exists an enabling provision under the Takeover Code authorizing SEBI to grant exemptions from the provisions of these regulations, such powers are very judicially exercised by SEBI. The exemptions granted in the past under this provision have been sparse to include only exceptional situations like increase in the shareholding pursuant to buy back of shares or infusion of fresh capital pursuant to scheme for debt reorganization with the banks and financial institutions. An exemption from the open offer requirement by SEBI in the current case could have resulted in large number of promoters applying for similar exemptions from Takeover Code to hike their stake in the company without providing an exit opportunity to the public shareholders.

| Team M&A |

| Sahil Shah / Vaidhyanadhan Iyer / Nishchal Joshipura |

_______________________

1 Regulation 21 - Open offer to acquire an additional 20% voting capital (equity shares) from the shareholders

2 The said application was made by the Target Company on behalf of the promoter under Regulation 3(1)(l) read with Regulation 4(2) of the Takeover Code

3 Existing shareholding of the Acquirer was 3.65%

4 This would result in the increase in equity stake of the promoters by 15.9%

5 Takeover Panel is a panel constituted by SEBI to make a recommendation on whether exemption from open offer requirement can be given to a particular case

6 Under this mechanism the lenders viz. banks and financial institutions and borrowers agree on a scheme of restructuring or repackaging their debts. The said restructuring may take various forms including extending the repayment period, reducing rate of interest, infusion of further funds by the promoters, conversion of interest due into capital, etc.

7 As a process, SEBI shall afford the applicant an opportunity of being heard before passing its order based on the facts of the case and recommendation by the Takeover Panel