Tax HotlineSeptember 14, 2016 Foreign Amalgamation Involving Indian Assets Exempt from Capital Gains Tax: Aar Relies On Non-Discrimination Clause in India-Italy DTAA

In a decision that significantly benefits foreign companies, the Authority for Advance Rulings (“AAR”) has ruled that merger of two non-resident companies with underlying assets (held through a branch) in India will not be liable to capital gains tax under the Income Tax Act 1961 (“ITA”) relying on Article 24 (Non-Discrimination clause) of the India–Italy Double Taxation Avoidance Agreements (“India-Italy DTAA”). The AAR, in the Banca Sella S.p.A case, has effectively extended the benefit under Section 47(vi) of the Income Tax Act 1961 (“ITA”) that exempts Indian companies from capital gains tax in the event of amalgamations to foreign companies as well. In addition to the aforesaid, the decision also reiterates the importance of calculating capital gains on the basis of real values as opposed to notional gains. BACKGROUND

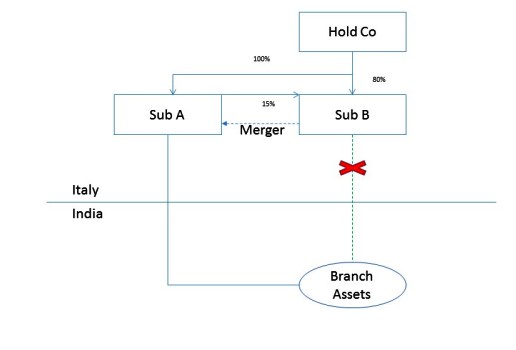

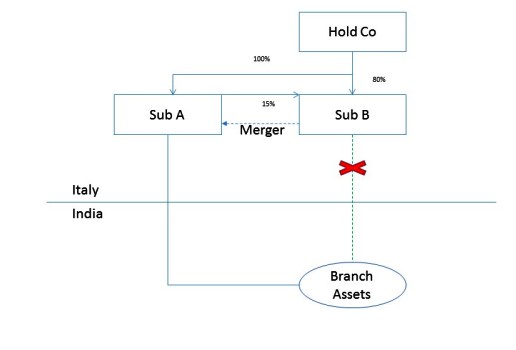

The applicant Banca Sella SPA (“BSS”/ “Applicant”/ “Sub A”), Italy is a banking company, part of an Italian group called Banca Sella Group (Gruppo Banca Sella), wholly owned by Banca Sella Holding S.p.A (“Hold Co”), Italy. Sub A primarily provides banking and financial services in Italy and abroad. Sella Servizi Bancari S.C.P.A (“SSBS”/ “Sub B”), an Italian company incorporated in 1999, rendered support services to the group entities, 15% equity of which was held by Sub A. Hold Co owned 80% of the equity in Sub B while the remaining was held by other group companies. In 2010, Sub B established a branch office in India (“BO”) which took over the information technology business from Sella Synergy India Private Limited (“SSIPL”), a subsidiary of the Hold Co in India, as a going concern, through a slump sale. The capital gains tax for this business transfer was duly paid by SSIPL. In 2011, Sub B merged with Sub A as part of an internal restructuring such that post-merger Sub B ceased to exist and all assets and liabilities including the assets of the BO were vested with Sub A. It is with respect to this merger that Sub A had sought a ruling from the Authority for Advance Rulings (“AAR”), inter alia, on the following issues:

Given how the Indian rules are drafted, including in particular the indirect transfer rules (which have been relied on by the Indian tax authorities to proceed after companies such as Vodafone), it is possible for offshore restructurings, amalgamations, liquidations, etc. to get caught within the Indian tax net and result in a tax liability for the parties involved. The widely worded withholding obligations do not help the situation as they impose an obligation on even a non-resident payor. In that backdrop, the AAR’s decision is favorable for foreign companies undertaking such internal restructuring and generally confirms their ability to rely on ND Clause under their respective treaties with India. The ruling is along the lines of the previous rulings that interpreted ND Clauses in DTAAs and international developments in the recent past. Indian rulings appear to have been influenced by the concept of discrimination as enshrined under Article 14 of the Indian Constitution dealing with substantive equality. Courts have either expressly or impliedly held that differentiation between residents and non-residents based on unreasonable grounds are impermissible. For instance in Daimler Chrysler India Private Limited v. Deputy Commissioner of Income Tax3 disallowing an Indian subsidiary of a German parent to carry forward and set off-losses under section 79 of the ITA was held to be discrimination under Article 24(4) of the treaty since the benefit was available to an Indian subsidiary with an Indian parent where both parents were listed in the respective national stock exchanges. While coming to this decision, drawing parallels to the position under the India-USA Tax Treaty, the tribunal noted that “differentiation is on unreasonable grounds and clearly a case of discrimination which is prohibited under Article 24 of the Indo German Tax treaty.” On a similar note, the European Court of Justice (“ECJ”) in the Schumaker case4 had noted that if the domestic rules of any state denies benefit to non-residents which are available to residents, it most likely will operate to the detriment of non-nationals since most non-residents are non-nationals (foreigners). Thus, taking a broader view, the ECJ stated that discrimination based on residence would constitute indirect discrimination based on nationality. The ITA under the section 47 provides relief to Indian companies by excluding various transactions to not be considered as ‘transfers’ such as demergers where the resulting company is an Indian company (47(vib), the exemption under 47(iv) wherein the transfer of a capital asset by a company to its Indian subsidiary is exempt, section 47(v) which exempts transfer of a capital asset by an Indian subsidiary to an Indian holding company. This ruling potentially opens the door for foreign companies (located in favorable treaty jurisdictions) for availing these domestic reliefs while restructuring. In addition to the concept of non-discrimination, the decision is also helpful in that it strikes down notional market value or other methods based on presumptions from being used for computing ‘consideration’ and it strongly reiterates the position that in the absence of consideration, capital gains cannot be computed. – Afaan Arshad, Meyyappan Nagappan & Mansi Seth You can direct your queries or comments to the authors 1 66 ITR 622 2 128 ITR 294 3 (2009) 29 SOT 202 (PUN) 4 Finanzamt Koln Altsadt v. Schumacker [1995] ECR I-225 (ECJ). DisclaimerThe contents of this hotline should not be construed as legal opinion. View detailed disclaimer. |

|

- Even if assets were transferred through a merger, notional market value of such assets cannot be value of consideration for purpose of computing capital gains tax and hence untaxable.

- Denial of tax benefits available to domestic companies to foreign companies is violative of the Non-Discrimination clause in DTAAs.

- Non-Discrimination clause afforded a wide interpretation implicitly similar to the concept of Article 14 of the Indian Constitution.

In a decision that significantly benefits foreign companies, the Authority for Advance Rulings (“AAR”) has ruled that merger of two non-resident companies with underlying assets (held through a branch) in India will not be liable to capital gains tax under the Income Tax Act 1961 (“ITA”) relying on Article 24 (Non-Discrimination clause) of the India–Italy Double Taxation Avoidance Agreements (“India-Italy DTAA”). The AAR, in the Banca Sella S.p.A case, has effectively extended the benefit under Section 47(vi) of the Income Tax Act 1961 (“ITA”) that exempts Indian companies from capital gains tax in the event of amalgamations to foreign companies as well. In addition to the aforesaid, the decision also reiterates the importance of calculating capital gains on the basis of real values as opposed to notional gains.

BACKGROUND

The applicant Banca Sella SPA (“BSS”/ “Applicant”/ “Sub A”), Italy is a banking company, part of an Italian group called Banca Sella Group (Gruppo Banca Sella), wholly owned by Banca Sella Holding S.p.A (“Hold Co”), Italy. Sub A primarily provides banking and financial services in Italy and abroad. Sella Servizi Bancari S.C.P.A (“SSBS”/ “Sub B”), an Italian company incorporated in 1999, rendered support services to the group entities, 15% equity of which was held by Sub A. Hold Co owned 80% of the equity in Sub B while the remaining was held by other group companies.

In 2010, Sub B established a branch office in India (“BO”) which took over the information technology business from Sella Synergy India Private Limited (“SSIPL”), a subsidiary of the Hold Co in India, as a going concern, through a slump sale. The capital gains tax for this business transfer was duly paid by SSIPL.

In 2011, Sub B merged with Sub A as part of an internal restructuring such that post-merger Sub B ceased to exist and all assets and liabilities including the assets of the BO were vested with Sub A. It is with respect to this merger that Sub A had sought a ruling from the Authority for Advance Rulings (“AAR”), inter alia, on the following issues:

- Whether the amalgamation of Sub A with Sub B results in the applicability of Indian capital gains tax in the hands of Sub B, Sub A or the shareholders, including the Hold Co?

- Assuming the aforementioned merger is liable to capital gains tax, whether by virtue of the Non-discrimination Clause (‘’NDC”) in Article 25 of the Indo-Italian DTAA, the exemption u/s 47(vi) of the ITA is available to Sub A?

-

Sub B, which was claimed by the revenue to be taxable in India as the transferor of the Indian BO, was held by the AAR to not be taxable for the following reasons:

-

Notional market value cannot be value of consideration for transfer of assets through a merger: Though the value of cost of acquisition was not disputed as it was the cost of acquisition of SSIPL during slump sale, it was the determination of the cost of consideration which was under dispute. The Revenue claimed that the value of consideration should be the notional market value of the BO at the time of the merger for computation of capital gains. The AAR rejected this argument based on the ratio in the Supreme Court judgment of CIT v. George Henderson & Co. Ltd.1 where it was held that “the market value of which is parted can never be the consideration that accrues on its transfer.” Further, applying the principles laid down in CIT v. B.C.Srinivasa Setty2 the AAR concluded that the charge of capital gains tax must fail as the gain was incalculable due to break down of computation provisions.

-

Denial of tax benefits available to domestic companies to foreign companies is violative of the Non-Discrimination clause in DTAAs – Applying the Non Discrimination (“ND”) clause under Article 25 of the India-Italy DTAA, the charge of capital gains tax should fail as Indian companies are exempt under the ITA for capital gains arising out of such transfer. The revenue argued that the relief under NDC is subject to Article 25(3) which entitles states to discriminate in certain instances, for instance while dealing with Permanent Establishments or personal allowances. Rejecting this argument the court held that the exception under Article 25(3) is only in cases of personal allowances, relief, reduction only in context of individuals and not companies thereby concluding that relief under the ITA is available to foreign companies in similar circumstances as Indian companies. The court held that:

“9…….If a case of amalgamation results in some special benefits to a local company and its shareholders, there is no reason to deny the same to a foreign company and its shareholders in similar case of amalgamation. We are of the opinion that non- discrimination clause seeks to ensure that both countries do not decline an allowance or exception only on the ground of nationality of taxpayers.”

-

-

Sub A, which was claimed by the revenue to be taxable in India due to extinguishment of its rights in the 15% shares in Sub B, was also held by the AAR to not be taxable as it did not receive any consideration as a result of the merger.

-

Lastly, for Hold Co and other shareholders, as they had parted with their shares in SSBS and not BO or its movable property, the AAR concluded that though capital gains has accrued to shareholders, it will not be chargeable to capital gains tax in India under Article 14(5) of India-Italy DTAA, which provides that ‘gains from the alienation of shares other those mentioned in paragraph 4 in a company which is a resident of a Contracting State may be taxed in that State’.

Given how the Indian rules are drafted, including in particular the indirect transfer rules (which have been relied on by the Indian tax authorities to proceed after companies such as Vodafone), it is possible for offshore restructurings, amalgamations, liquidations, etc. to get caught within the Indian tax net and result in a tax liability for the parties involved. The widely worded withholding obligations do not help the situation as they impose an obligation on even a non-resident payor. In that backdrop, the AAR’s decision is favorable for foreign companies undertaking such internal restructuring and generally confirms their ability to rely on ND Clause under their respective treaties with India.

The ruling is along the lines of the previous rulings that interpreted ND Clauses in DTAAs and international developments in the recent past. Indian rulings appear to have been influenced by the concept of discrimination as enshrined under Article 14 of the Indian Constitution dealing with substantive equality. Courts have either expressly or impliedly held that differentiation between residents and non-residents based on unreasonable grounds are impermissible.

For instance in Daimler Chrysler India Private Limited v. Deputy Commissioner of Income Tax3 disallowing an Indian subsidiary of a German parent to carry forward and set off-losses under section 79 of the ITA was held to be discrimination under Article 24(4) of the treaty since the benefit was available to an Indian subsidiary with an Indian parent where both parents were listed in the respective national stock exchanges. While coming to this decision, drawing parallels to the position under the India-USA Tax Treaty, the tribunal noted that “differentiation is on unreasonable grounds and clearly a case of discrimination which is prohibited under Article 24 of the Indo German Tax treaty.”

On a similar note, the European Court of Justice (“ECJ”) in the Schumaker case4 had noted that if the domestic rules of any state denies benefit to non-residents which are available to residents, it most likely will operate to the detriment of non-nationals since most non-residents are non-nationals (foreigners). Thus, taking a broader view, the ECJ stated that discrimination based on residence would constitute indirect discrimination based on nationality.

The ITA under the section 47 provides relief to Indian companies by excluding various transactions to not be considered as ‘transfers’ such as demergers where the resulting company is an Indian company (47(vib), the exemption under 47(iv) wherein the transfer of a capital asset by a company to its Indian subsidiary is exempt, section 47(v) which exempts transfer of a capital asset by an Indian subsidiary to an Indian holding company. This ruling potentially opens the door for foreign companies (located in favorable treaty jurisdictions) for availing these domestic reliefs while restructuring.

In addition to the concept of non-discrimination, the decision is also helpful in that it strikes down notional market value or other methods based on presumptions from being used for computing ‘consideration’ and it strongly reiterates the position that in the absence of consideration, capital gains cannot be computed.

– Afaan Arshad, Meyyappan Nagappan & Mansi Seth

You can direct your queries or comments to the authors

1 66 ITR 622

2 128 ITR 294

3 (2009) 29 SOT 202 (PUN)

4 Finanzamt Koln Altsadt v. Schumacker [1995] ECR I-225 (ECJ).

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.

Research PapersMergers & Acquisitions New Age of Franchising Life Sciences 2025 |

Research Articles |

AudioCCI’s Deal Value Test Securities Market Regulator’s Continued Quest Against “Unfiltered” Financial Advice Digital Lending - Part 1 - What's New with NBFC P2Ps |

NDA ConnectConnect with us at events, |

NDA Hotline |