M&A HotlineSeptember 11, 2009 SEBI Provides Guidance on Creeping Acquisition Limit Pursuant to an AmalgamationOn August 26, 2009, the Securities and Exchange Board of India (“SEBI”) issued an informal guidance to Gulf Oil Corporation Ltd. under the SEBI (Informal Guidance) Scheme 2003.http://www.sebi.gov.in/informalguide/Gulfoil/gulfletter.pdf The guidance is as follows: I. the acquisition of shares/voting rights of a target company pursuant to an amalgamation effected under foreign law, would not trigger an open offer obligation under the Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations 1997, (the “Takeover Code”), and II. the acquirer would be entitled to acquire an additional 5% of the target under the creeping acquisition limit in Regulation 11 (1) of the Takeover Code, without triggering open offer requirements. In other words the acquisition under the amalgamation (as mentioned in I above) would not be included in the 5% limit in Regulation 11 (1). BACKGROUND:Ø Gulf Oil Corporation Ltd. (the “Target”) is an Indian company listed on the Bombay Stock Exchange and the National Stock Exchange. Gulf Oil International (Mauritius) Inc. (“GOIMI”) is the promoter of the Target and held 45.73% in the Target. Helvetia Mauritius Ltd. and Swallow Enterprises Mauritius Ltd. were overseas corporate bodies (“OCBs”), and held 2.67% and 0.63% respectively in the Target. Ø A proposal of amalgamation of the OCBs with GOIMI was approved on May 13, 2008. While the scheme itself provided that it would come into effect from May 2008, the Registrar of Companies, Mauritius issued a certificate of amalgamation only on April 23rd 2009. Ø Pursuant to the amalgamation, the beneficial ownership of shares of the Target held by the OCBs was transferred to GOIMI, resulting in an increase in its stake in the Target from 45.73% to 49.03%. A diagrammatic representation of the shareholding of the Target is provided below.

APPLICABLE PROVISIONS OF THE TAKEOVER CODE:Regulation 3 of the Takeover Code contains a list of matters that are exempt from the provisions of Regulations 10, 11 and 12 (which prescribe the open offer obligation). Regulation 3 (j) (ii) provides that Regulations 10, 11 and 12 would not be applicable to “an arrangement or reconstruction, including amalgamation or merger or demerger under any law or regulation, Indian or foreign”. Further Regulation 11(1) of the Takeover Code provides that if an acquirer holds between 15% and 55% of the shares or voting rights of the Target, he may acquire an additional 5% of the shares or voting rights, in any financial year ending on 31st March (commonly referred to as the creeping acquisition limit). Acquisition in excess of this limit will trigger the open offer obligation. QUERIES POSED TO THE SEBI BY THE ACQUIRER:A. Whether the increase in shareholding of the promoter, GOIMI, in the Target pursuant to the amalgamation is exempted under Regulation 3 of the Takeover Code? The SEBI held that the acquisition was exempted under Regulation 11 (1) which permitted the acquirer to consolidate its holdings upto 5% in a financial year, without triggering the open offer obligations under Regulation 11. Therefore, it was held that the question of exemption under Regulation 3(j)(ii) did not arise. B. Can GOIMI consolidate its holding in the Target by acquiring additional 5% shares under Regulation 11 in the same financial year? This question was relevant because of two issues: (a) While the scheme of amalgamation as agreed to by the parties was to have retrospective effect from May 2008, the Registrar of Companies in Mauritius approved the amalgamation only on April 23, 2009. Since Regulation 11(1) permits a 5% consolidation every financial year, it was relevant to establish whether the acquisition under the amalgamation took place in the financial year 2008-2009 or in the financial year 2009-2010. The SEBI held that since the Registrar of Companies had not provided for retrospective operation of the amalgamation, it was effective from April 23, 2009, the date of the certificate of amalgamation. (b) The second issue was whether in the financial year 2009-2010, under Regulation 11 (1), GOIMI could acquire an additional - 1.7% (in which case acquisition of 3.3% under the amalgamation would be included to compute the 5% limit under Regulation 11 (1)), or - 5% The SEBI noted that if the acquisition under the amalgamation had been more than 5%, it would have been exempt under Regulation 3 (j) (ii) from the open offer obligations. In such a case, the acquirer would be entitled to acquire an additional 5% of the shares or voting rights of the Target in the same financial year under Regulation 11(1) without triggering the open offer obligation. Applying the same rationale, the SEBI went on to state that in the instant case, the acquirer would be entitled to acquire an additional 5% of the Target in the same financial year (i.e. 2009-2010) without triggering the open offer obligation. Therefore an acquisition exempt under Regulation 3(j)(ii) will not be considered while acquiring shares/voting rights under the creeping acquisition limit. SOME OBSERVATIONS:(a) While SEBI’s conclusion appears to be correct the rationale seems to be questionable. They have exempted the acquisition under Regulation 11(1) and clarified that the question of exemption under Regulation 3(j)(ii) did not even arise but subsequently they relied on Regulation 3 (j)(ii) to permit acquisition of additional 5% shares in the same financial year. This confusion would not have arisen if the acquisition was exempted under the Regulation 3(j)(ii) in the first instance, which may be a better interpretation of the Takeover Code. SEBI appears to have taken the wrong turn but has managed to reach the correct destination. (b) The determination of the date of amalgamation by the SEBI appears to be irrelevant for the purposes of this guidance. Whether the amalgamation, and hence the acquisition, took place in the previous financial year 2008-2009, or in the current financial year 2009-2010, SEBI’s views would have been the same, because such amalgamation is exempted under Regulation 3 (j) (ii) and the acquirer would be entitled to purchase an additional 5% of the Target in both years (subject to the limit of 55%). (c) If, for instance, the acquisition had not qualified for the exemption under Regulation 3(j) (ii), then the acquisition would be covered under Regulation 11(1) and the date on which the acquisition became effective would be relevant. In this scenario if the SEBI had held the amalgamation to have become effective on April 23, 2009, then the acquirer would be entitled to acquire only another 1.7% of the Target in the same financial year. (a) Under Indian law, for a scheme of arrangement / merger/demerger to come into effect, it must be approved by the appropriate High Court. However, a court approval is not required in certain other countries (such as in this case, Mauritius, where the amalgamation was approved by the Registrar of Companies). If the relevant law does not require court approval for a amalgamation, then it would not be a requirement under Regulation 3 (j) (ii) either, and an acquisition under such amalgamation would be exempted from the open offer obligation under the Takeover Code.

DisclaimerThe contents of this hotline should not be construed as legal opinion. View detailed disclaimer. |

|

On August 26, 2009, the Securities and Exchange Board of India (“SEBI”) issued an informal guidance to Gulf Oil Corporation Ltd. under the SEBI (Informal Guidance) Scheme 2003.http://www.sebi.gov.in/informalguide/Gulfoil/gulfletter.pdf

The guidance is as follows:

I. the acquisition of shares/voting rights of a target company pursuant to an amalgamation effected under foreign law, would not trigger an open offer obligation under the Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations 1997, (the “Takeover Code”), and

II. the acquirer would be entitled to acquire an additional 5% of the target under the creeping acquisition limit in Regulation 11 (1) of the Takeover Code, without triggering open offer requirements. In other words the acquisition under the amalgamation (as mentioned in I above) would not be included in the 5% limit in Regulation 11 (1).

BACKGROUND:

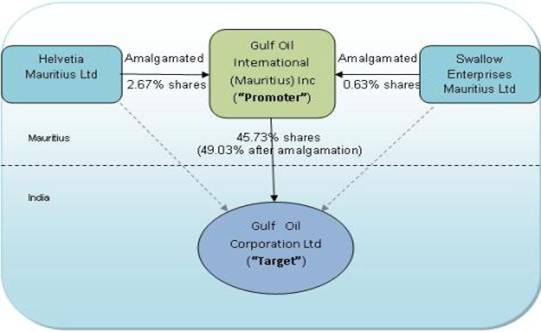

Ø Gulf Oil Corporation Ltd. (the “Target”) is an Indian company listed on the Bombay Stock Exchange and the National Stock Exchange. Gulf Oil International (Mauritius) Inc. (“GOIMI”) is the promoter of the Target and held 45.73% in the Target. Helvetia Mauritius Ltd. and Swallow Enterprises Mauritius Ltd. were overseas corporate bodies (“OCBs”), and held 2.67% and 0.63% respectively in the Target.

Ø A proposal of amalgamation of the OCBs with GOIMI was approved on May 13, 2008. While the scheme itself provided that it would come into effect from May 2008, the Registrar of Companies, Mauritius issued a certificate of amalgamation only on April 23rd 2009.

Ø Pursuant to the amalgamation, the beneficial ownership of shares of the Target held by the OCBs was transferred to GOIMI, resulting in an increase in its stake in the Target from 45.73% to 49.03%.

A diagrammatic representation of the shareholding of the Target is provided below.

APPLICABLE PROVISIONS OF THE TAKEOVER CODE:

Regulation 3 of the Takeover Code contains a list of matters that are exempt from the provisions of Regulations 10, 11 and 12 (which prescribe the open offer obligation). Regulation 3 (j) (ii) provides that Regulations 10, 11 and 12 would not be applicable to “an arrangement or reconstruction, including amalgamation or merger or demerger under any law or regulation, Indian or foreign”.

Further Regulation 11(1) of the Takeover Code provides that if an acquirer holds between 15% and 55% of the shares or voting rights of the Target, he may acquire an additional 5% of the shares or voting rights, in any financial year ending on 31st March (commonly referred to as the creeping acquisition limit). Acquisition in excess of this limit will trigger the open offer obligation.

QUERIES POSED TO THE SEBI BY THE ACQUIRER:

A. Whether the increase in shareholding of the promoter, GOIMI, in the Target pursuant to the amalgamation is exempted under Regulation 3 of the Takeover Code?

The SEBI held that the acquisition was exempted under Regulation 11 (1) which permitted the acquirer to consolidate its holdings upto 5% in a financial year, without triggering the open offer obligations under Regulation 11. Therefore, it was held that the question of exemption under Regulation 3(j)(ii) did not arise.

B. Can GOIMI consolidate its holding in the Target by acquiring additional 5% shares under Regulation 11 in the same financial year?

This question was relevant because of two issues:

(a) While the scheme of amalgamation as agreed to by the parties was to have retrospective effect from May 2008, the Registrar of Companies in Mauritius approved the amalgamation only on April 23, 2009. Since Regulation 11(1) permits a 5% consolidation every financial year, it was relevant to establish whether the acquisition under the amalgamation took place in the financial year 2008-2009 or in the financial year 2009-2010.

The SEBI held that since the Registrar of Companies had not provided for retrospective operation of the amalgamation, it was effective from April 23, 2009, the date of the certificate of amalgamation.

(b) The second issue was whether in the financial year 2009-2010, under Regulation 11 (1), GOIMI could acquire an additional

- 1.7% (in which case acquisition of 3.3% under the amalgamation would be included to compute the 5% limit under Regulation 11 (1)), or

- 5%

The SEBI noted that if the acquisition under the amalgamation had been more than 5%, it would have been exempt under Regulation 3 (j) (ii) from the open offer obligations. In such a case, the acquirer would be entitled to acquire an additional 5% of the shares or voting rights of the Target in the same financial year under Regulation 11(1) without triggering the open offer obligation. Applying the same rationale, the SEBI went on to state that in the instant case, the acquirer would be entitled to acquire an additional 5% of the Target in the same financial year (i.e. 2009-2010) without triggering the open offer obligation. Therefore an acquisition exempt under Regulation 3(j)(ii) will not be considered while acquiring shares/voting rights under the creeping acquisition limit.

SOME OBSERVATIONS:

(a) While SEBI’s conclusion appears to be correct the rationale seems to be questionable. They have exempted the acquisition under Regulation 11(1) and clarified that the question of exemption under Regulation 3(j)(ii) did not even arise but subsequently they relied on Regulation 3 (j)(ii) to permit acquisition of additional 5% shares in the same financial year. This confusion would not have arisen if the acquisition was exempted under the Regulation 3(j)(ii) in the first instance, which may be a better interpretation of the Takeover Code. SEBI appears to have taken the wrong turn but has managed to reach the correct destination.

(b) The determination of the date of amalgamation by the SEBI appears to be irrelevant for the purposes of this guidance. Whether the amalgamation, and hence the acquisition, took place in the previous financial year 2008-2009, or in the current financial year 2009-2010, SEBI’s views would have been the same, because such amalgamation is exempted under Regulation 3 (j) (ii) and the acquirer would be entitled to purchase an additional 5% of the Target in both years (subject to the limit of 55%).

(c) If, for instance, the acquisition had not qualified for the exemption under Regulation 3(j) (ii), then the acquisition would be covered under Regulation 11(1) and the date on which the acquisition became effective would be relevant. In this scenario if the SEBI had held the amalgamation to have become effective on April 23, 2009, then the acquirer would be entitled to acquire only another 1.7% of the Target in the same financial year.

(a) Under Indian law, for a scheme of arrangement / merger/demerger to come into effect, it must be approved by the appropriate High Court. However, a court approval is not required in certain other countries (such as in this case, Mauritius, where the amalgamation was approved by the Registrar of Companies). If the relevant law does not require court approval for a amalgamation, then it would not be a requirement under Regulation 3 (j) (ii) either, and an acquisition under such amalgamation would be exempted from the open offer obligation under the Takeover Code.

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.

Research PapersDecoding Downstream Investment Mergers & Acquisitions New Age of Franchising |

Research Articles |

AudioCCI’s Deal Value Test Securities Market Regulator’s Continued Quest Against “Unfiltered” Financial Advice Digital Lending - Part 1 - What's New with NBFC P2Ps |

NDA ConnectConnect with us at events, |

NDA Hotline |