Tax HotlineFebruary 27, 2009 Service exporters get headache pill : CBEC introduces clarifications on export of serviceThe Central Board of Excise & Customs (“CBEC”) has finally vide its circular1 dated 24th February 2009 (“Circular”) brought about clarity to the long standing controversy on instances when a service would be considered as an exported service. FLASH BACKThe Export of Services Rules 2005 (“Rules”) sets out the conditions for different services to be treated as an exported service and thereby exempting the service from service tax in India. The Export of Services Rule, 2005 categorizes the services into three broad categories: Category I covers services that are related to immovable property, such architect services, general insurance services, construction services etc. A service will be said to be exported under this category if is provided in relation to an immovable property situated outside India. Category II covers all the services where the place of performance of service can be established, such as research agency services, survey and exploration of mineral services, storage and warehousing etc. A service will be said to be exported if the services are partly performed outside India. Category III is a residuary category which covers all the services which do not fall under Category I or II, such as business auxiliary services, management consultancy services, consulting engineer services, banking and other financial services etc. A service will be said to be exported under this category if the recipient of such service is located outside India. In addition to the above conditions, the Rules also provide that the services have to be “provided from India and used outside India” to be considered to have been exported. A lot of debate and confusion has arisen on the interpretation of the term “used outside India” and the CBEC has addressed the same by way of this Circular. CIRCULARThe CBEC has applied the well established rule of harmonious construction in its Circular. The term ‘used outside India’ has been harmoniously interpreted in the context of the characteristics of each category of service mentioned above. To clearly bring out the meaning the CBEC has given illustrations for each of the categories mentioned above. Category I An Indian architect prepares a design sitting in India for a property located in U.K. The CBEC has clarified that even if a design is prepared by an architect sitting in India for a property located in UK, it would have to be presumed that the service has been used outside India. Thus such a service shall not be taxable in India as it would be categorized as an Export of Service Category II An Indian event manager arranges a seminar in U.K for an Indian company. The CBEC clarified that these services will also be treated to have been used outside India, thereby characterizing it as export of services and not be liable to service tax in India. The rationale behind the said is that the place of performance is in U.K, even though the benefit of such a seminar may flow back to the employees serving the company in India. Category III Indian agents undertake marketing in India of goods of a foreign seller. In this case the agent undertakes all activities within India. For this category the CBEC clarified that the relevant factor to determine whether a service is an export of service is the location of the service receiver and not the place of performance. In this context, the phrase ‘used outside India’ is to be interpreted to mean that the benefit of the service should accrue outside India. Thus, for this category it may be possible that export of service may take place even when all the relevant activities take place in India so long as the benefits of these services accrue outside India. Therefore the service mentioned in the aforesaid illustration, in spite of being performed in India will be considered to be an exported service as the benefit of the same accrues outside India. CONCLUSION:While the above Circular lays down only a few example, the principal laid down by CBEC will go a long way in clarifying the ambiguities that were prevailing in characterization of service as an exported service. In fact CBEC has very clearly stated that in all the illustrations mentioned in the opening paragraph of the Circular, what is accruing outside India is the benefit in terms of promotion of business of a foreign company. Similar would be the treatment for other Category III [Rule 3(1)(iii)] services as well. Thus, the phrase ‘used outside India’ is to be interpreted to mean that the benefit of the service should accrue outside India, and it is possible that export of service may take place even when all the relevant activities take place in India so long as the benefits of these services accrue outside India. This interpretation will definitely bring relief in many cases, especially in cases of fund advisors present in India which provide a lot of services such as monitoring of investments in India, the ultimate benefit of which would accrue outside India, and hence such services should be considered to be exported outside India. The provisions of the above Circular combined with the recent reduction in the base service tax rate from 12% to 10% will definitely bring about a lot of relief for service exporters, including fund managers seeking services from fund advisors located in India.

1 Circular No:111/05/2009-ST DisclaimerThe contents of this hotline should not be construed as legal opinion. View detailed disclaimer. |

|

The Central Board of Excise & Customs (“CBEC”) has finally vide its circular1 dated 24th February 2009 (“Circular”) brought about clarity to the long standing controversy on instances when a service would be considered as an exported service.

FLASH BACKThe Export of Services Rules 2005 (“Rules”) sets out the conditions for different services to be treated as an exported service and thereby exempting the service from service tax in India.

The Export of Services Rule, 2005 categorizes the services into three broad categories:

Category I covers services that are related to immovable property, such architect services, general insurance services, construction services etc. A service will be said to be exported under this category if is provided in relation to an immovable property situated outside India.

Category II covers all the services where the place of performance of service can be established, such as research agency services, survey and exploration of mineral services, storage and warehousing etc. A service will be said to be exported if the services are partly performed outside India.

Category III is a residuary category which covers all the services which do not fall under Category I or II, such as business auxiliary services, management consultancy services, consulting engineer services, banking and other financial services etc. A service will be said to be exported under this category if the recipient of such service is located outside India.

In addition to the above conditions, the Rules also provide that the services have to be “provided from India and used outside India” to be considered to have been exported. A lot of debate and confusion has arisen on the interpretation of the term “used outside India” and the CBEC has addressed the same by way of this Circular.

CIRCULARThe CBEC has applied the well established rule of harmonious construction in its Circular. The term ‘used outside India’ has been harmoniously interpreted in the context of the characteristics of each category of service mentioned above. To clearly bring out the meaning the CBEC has given illustrations for each of the categories mentioned above.

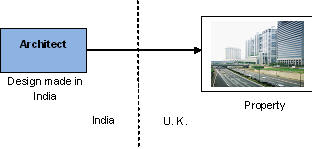

Category I

An Indian architect prepares a design sitting in India for a property located in U.K.

The CBEC has clarified that even if a design is prepared by an architect sitting in India for a property located in UK, it would have to be presumed that the service has been used outside India. Thus such a service shall not be taxable in India as it would be categorized as an Export of Service

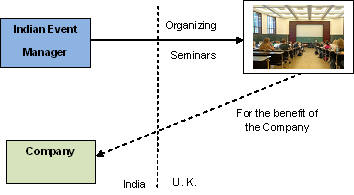

Category II

An Indian event manager arranges a seminar in U.K for an Indian company.

The CBEC clarified that these services will also be treated to have been used outside India, thereby characterizing it as export of services and not be liable to service tax in India. The rationale behind the said is that the place of performance is in U.K, even though the benefit of such a seminar may flow back to the employees serving the company in India.

Category III

Indian agents undertake marketing in India of goods of a foreign seller. In this case the agent undertakes all activities within India.

For this category the CBEC clarified that the relevant factor to determine whether a service is an export of service is the location of the service receiver and not the place of performance. In this context, the phrase ‘used outside India’ is to be interpreted to mean that the benefit of the service should accrue outside India. Thus, for this category it may be possible that export of service may take place even when all the relevant activities take place in India so long as the benefits of these services accrue outside India. Therefore the service mentioned in the aforesaid illustration, in spite of being performed in India will be considered to be an exported service as the benefit of the same accrues outside India.

CONCLUSION:While the above Circular lays down only a few example, the principal laid down by CBEC will go a long way in clarifying the ambiguities that were prevailing in characterization of service as an exported service. In fact CBEC has very clearly stated that in all the illustrations mentioned in the opening paragraph of the Circular, what is accruing outside India is the benefit in terms of promotion of business of a foreign company. Similar would be the treatment for other Category III [Rule 3(1)(iii)] services as well. Thus, the phrase ‘used outside India’ is to be interpreted to mean that the benefit of the service should accrue outside India, and it is possible that export of service may take place even when all the relevant activities take place in India so long as the benefits of these services accrue outside India. This interpretation will definitely bring relief in many cases, especially in cases of fund advisors present in India which provide a lot of services such as monitoring of investments in India, the ultimate benefit of which would accrue outside India, and hence such services should be considered to be exported outside India.

The provisions of the above Circular combined with the recent reduction in the base service tax rate from 12% to 10% will definitely bring about a lot of relief for service exporters, including fund managers seeking services from fund advisors located in India.

- Harshal Shah & Rajesh Simhan

You can direct your queries or comments to the authors

1 Circular No:111/05/2009-ST

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.

Research PapersMergers & Acquisitions New Age of Franchising Life Sciences 2025 |

Research Articles |

AudioCCI’s Deal Value Test Securities Market Regulator’s Continued Quest Against “Unfiltered” Financial Advice Digital Lending - Part 1 - What's New with NBFC P2Ps |

NDA ConnectConnect with us at events, |

NDA Hotline |