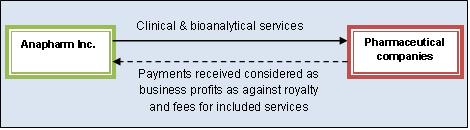

Tax HotlineSeptember 17, 2008 Payments received from Ranbaxy and Sandoz for bio-analytical services held not taxable in IndiaOn September 11, 2008, the Authority for Advance Rulings (“AAR”) pronounced, while considering the application of Anapharm Inc. (“Anapharm”), that the payments received from various pharmaceutical companies for providing clinical and bioanalytical services could not be considered as royalty payments or payments made for fees for included services and were hence not taxable in India. FACTS OF THE CURRENT CASEAnapharm, a company incorporated in Canada, had entered into agreements with two Indian pharmaceutical companies, namely Sandoz Pvt. Ltd., Ranbaxy Research Laboratories for rendering the services of bioequivalence and/or comparative bioavailability of the new generic drugs vis-à-vis the reference drugs already available in the market. Anapharm had developed methods/protocols for carrying out the evaluation work which were its own property and only the final reports and conclusions of the evaluation were provided to its clients. Also each new drug required a fresh evaluation to be undertaken. QUESTIONS BEFORE THE AAR

The question for consideration before the AAR was as follows: It was Anapharm’s contention that the services rendered by it to its clients did not make available any technical knowledge, experience, know-how or process or consist of the development and transfer of a technical plan or technical design and must therefore not be considered as ‘fees for included services’ under Article 12(4) of the Treaty. According to Anapharm, technology is considered to have been ‘made available’1 only when the recipient is enabled to apply that technology. On the other hand the Indian Income-tax Department (“Revenue”) argued that the fees paid to Anapharm were in the nature of ‘fees for included services’ and ‘royalty’ under Article 12 of the Treaty. According to the Revenue biotechnical services are, in fact, technical services and the test result is know-how and technical experience of Anapharm which it makes available to its clients at the time of furnishing its report. This was especially since Ranbaxy and Sandoz retained the ownership(s) of the tested samples, test compounds, and also patents arising from the research project. The AAR while deciding on the matter, relied upon the protocol to the India-USA Convention on avoidance of double taxation (“India-USA Convention”) which provides guidance in interpreting Article 12 of the India-USA Convention which is pari materia with Article 12(4) of the Treaty. The said protocol provides that ‘Generally speaking, technology will be considered ‘make available’ when the person acquiring the service is enabled to apply the technology. The fact that the provision of the service may require technical input by the person providing the service does not per se mean that technical knowledge, skills, etc., are made available to the person purchasing the service, within the meaning of paragraph 4(b). Similarly, the use of a product which embodies technology shall not per se be considered to make the technology available.’ The mere fact that technical skills were required to provide the commercial information the service rendered does not become a technical service. It is, thus reasonably clear that mere provision of technical services is not enough, but the service provider should also furnish his technical knowledge, experience etc. to the recipient such that the recipient can independently perform the technical function himself in the future without the assistance of the service provider. In the facts and circumstances of the case the AAR considered that the test reports are drug specific and the materials furnished by Anapharm will not in any way help the customers to facilitate further research and development of new drugs. Mere handing over tested samples and test compounds could not be equated with making technology, know-how, etc., available to Ranbaxy. Thus, the payment to Anapharm could not be regarded as fees for included services. Further, the income could not be taxed as royalty income since Anapharm only imparted its final conclusions which it draws from its own experience and by its own interest in retaining its secrets and means of production, which would prevent it from parting with its experience or transferring any knowhow. Thus Anapharm being in the business of providing bio-analytical services, the consideration received by it was considered to be business income. In view of Article 7 and 5 of the Treaty, such income could only be taxed in India if Anapharm had a permanent establishment in India and in the absence of which the same is not taxable in India. ANALYSISIn line with various earlier judgments, the present AAR decision rightly concludes that Anapharm is required to do a positive act of making available experience, skill or knowledge, in the absence of which the payment under consideration cannot be considered as ‘royalty’ or ‘fees for included services’. The AAR has also correctly applied international tax commentaries to differentiate between a know-how contract and a contract for provision of services. This decision goes hand in hand with the growth of the pharmaceutical industry in India and helps create a conducive environment for further growth of the booming pharma industry in India.

1 The connotations of expression 'make available' were considered by the Income Tax Appellate Tribunal in the case of Raymond Ltd. v/s. Dy. CIT, [ (2003) 80 TTJ (Mumbai) 120]. The Tribunal, after elaborate analysis of all the related aspects, observed that "Thus, the normal, plain and grammatical meaning of the language employed, in our understanding, is that a mere rendering of services is not roped in unless the person utilizing the services is able to make use of technical knowledge, etc., by himself in his business and or for his own benefit and without recourse to the performer of services, in future. The technical knowledge, experience, skill, etc. must remain with the person utilising the services even after the rendering of the services has come to an end. A transmission of the technical knowledge, experience, skills, etc. from the person rendering the services to the person utilising the same is contemplated by the article." DisclaimerThe contents of this hotline should not be construed as legal opinion. View detailed disclaimer. |

|

On September 11, 2008, the Authority for Advance Rulings (“AAR”) pronounced, while considering the application of Anapharm Inc. (“Anapharm”), that the payments received from various pharmaceutical companies for providing clinical and bioanalytical services could not be considered as royalty payments or payments made for fees for included services and were hence not taxable in India.

FACTS OF THE CURRENT CASEAnapharm, a company incorporated in Canada, had entered into agreements with two Indian pharmaceutical companies, namely Sandoz Pvt. Ltd., Ranbaxy Research Laboratories for rendering the services of bioequivalence and/or comparative bioavailability of the new generic drugs vis-à-vis the reference drugs already available in the market. Anapharm had developed methods/protocols for carrying out the evaluation work which were its own property and only the final reports and conclusions of the evaluation were provided to its clients. Also each new drug required a fresh evaluation to be undertaken.

The question for consideration before the AAR was as follows:

Whether the fees received by Anapharm from the Indian pharmaceutical companies for undertaking clinical and bio-analytical study and in terms of the agreements entered into with the said companies is subject to tax in India under the Income Tax Act, 1961 (“the Act”) and the India-Canada Double Tax Avoidance Agreement (“Treaty”)?

It was Anapharm’s contention that the services rendered by it to its clients did not make available any technical knowledge, experience, know-how or process or consist of the development and transfer of a technical plan or technical design and must therefore not be considered as ‘fees for included services’ under Article 12(4) of the Treaty. According to Anapharm, technology is considered to have been ‘made available’1 only when the recipient is enabled to apply that technology.

On the other hand the Indian Income-tax Department (“Revenue”) argued that the fees paid to Anapharm were in the nature of ‘fees for included services’ and ‘royalty’ under Article 12 of the Treaty. According to the Revenue biotechnical services are, in fact, technical services and the test result is know-how and technical experience of Anapharm which it makes available to its clients at the time of furnishing its report. This was especially since Ranbaxy and Sandoz retained the ownership(s) of the tested samples, test compounds, and also patents arising from the research project.

The AAR while deciding on the matter, relied upon the protocol to the India-USA Convention on avoidance of double taxation (“India-USA Convention”) which provides guidance in interpreting Article 12 of the India-USA Convention which is pari materia with Article 12(4) of the Treaty. The said protocol provides that ‘Generally speaking, technology will be considered ‘make available’ when the person acquiring the service is enabled to apply the technology. The fact that the provision of the service may require technical input by the person providing the service does not per se mean that technical knowledge, skills, etc., are made available to the person purchasing the service, within the meaning of paragraph 4(b). Similarly, the use of a product which embodies technology shall not per se be considered to make the technology available.’ The mere fact that technical skills were required to provide the commercial information the service rendered does not become a technical service. It is, thus reasonably clear that mere provision of technical services is not enough, but the service provider should also furnish his technical knowledge, experience etc. to the recipient such that the recipient can independently perform the technical function himself in the future without the assistance of the service provider.

In the facts and circumstances of the case the AAR considered that the test reports are drug specific and the materials furnished by Anapharm will not in any way help the customers to facilitate further research and development of new drugs. Mere handing over tested samples and test compounds could not be equated with making technology, know-how, etc., available to Ranbaxy. Thus, the payment to Anapharm could not be regarded as fees for included services. Further, the income could not be taxed as royalty income since Anapharm only imparted its final conclusions which it draws from its own experience and by its own interest in retaining its secrets and means of production, which would prevent it from parting with its experience or transferring any knowhow. Thus Anapharm being in the business of providing bio-analytical services, the consideration received by it was considered to be business income. In view of Article 7 and 5 of the Treaty, such income could only be taxed in India if Anapharm had a permanent establishment in India and in the absence of which the same is not taxable in India.

ANALYSISIn line with various earlier judgments, the present AAR decision rightly concludes that Anapharm is required to do a positive act of making available experience, skill or knowledge, in the absence of which the payment under consideration cannot be considered as ‘royalty’ or ‘fees for included services’. The AAR has also correctly applied international tax commentaries to differentiate between a know-how contract and a contract for provision of services. This decision goes hand in hand with the growth of the pharmaceutical industry in India and helps create a conducive environment for further growth of the booming pharma industry in India.

|

Advance rulings are generally available to non-residents and foreign companies for providing clarity with respect to their Indian tax liability in connection with transactions undertaken or proposed to be undertaken. These rulings are binding on the applicant and the revenue, but are not binding on others. However, they do carry persuasive value. Statutorily advance rulings are to be provided within 6 months.

|

1 The connotations of expression 'make available' were considered by the Income Tax Appellate Tribunal in the case of Raymond Ltd. v/s. Dy. CIT, [ (2003) 80 TTJ (Mumbai) 120]. The Tribunal, after elaborate analysis of all the related aspects, observed that "Thus, the normal, plain and grammatical meaning of the language employed, in our understanding, is that a mere rendering of services is not roped in unless the person utilizing the services is able to make use of technical knowledge, etc., by himself in his business and or for his own benefit and without recourse to the performer of services, in future. The technical knowledge, experience, skill, etc. must remain with the person utilising the services even after the rendering of the services has come to an end. A transmission of the technical knowledge, experience, skills, etc. from the person rendering the services to the person utilising the same is contemplated by the article."

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.

Research PapersMergers & Acquisitions New Age of Franchising Life Sciences 2025 |

Research Articles |

AudioCCI’s Deal Value Test Securities Market Regulator’s Continued Quest Against “Unfiltered” Financial Advice Digital Lending - Part 1 - What's New with NBFC P2Ps |

NDA ConnectConnect with us at events, |

NDA Hotline |