Competition Law HotlineOctober 21, 2014 Competition Commission’s landmark ruling cracks the whip on auto industry

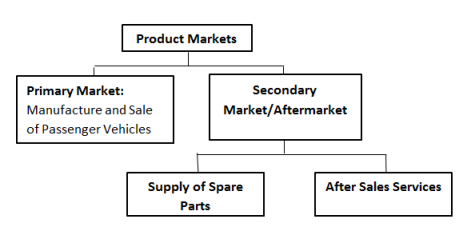

BACKGROUND The Competition Commission of India (“CCI / Commission”) recently imposed an aggregate penalty of Rs. 25.54 Billion (USD 420 Million) on fourteen car manufacturers or Original Equipment Manufacturers (“OEMs”) for creating anti-competitive effects through agreements for spares and after sales services1 (“Order”). A separate order would be passed in respect of Hyundai Motor India Limited, Mahindra Reva Electric Car Company (P) Ltd. and Premier Ltd. after hearing their case. The OEMs were found to be dominant in the markets for their respective brands and had abused their dominant position under Section 42 of the Competition Act, 2002 (“Act”) which affected around 20 Million car consumers. The Commission held that agreements with local Original Equipment Suppliers (“OESs”) adversely affected competition in the after sales and service market. The CCI held that through restrictive agreements and trade practices, OEMs caused entry barriers in secondary market for spare parts and diagnostic tools. CCI also noted that high margins (upto 4,817% mark-up) were exploitative and a manifestation of anti-competitive structure of the market. Interestingly, the Order has been signed by only three members as against seven members who constitute the Commission and who reportedly heard the matter.3 The Order is the first of its kind notably for holding that sale of spare parts and provision of services is a separate market distinct from the product itself, its review of agreements between manufacturers and dealers in a vertical arrangement, examination of restrictions from intellectual property rights (“IPRs”) and its sweeping directions. OEMs have been directed to allow OESs to allow sale and distribution of spares and diagnostic tools in the market with ‘no restrictions or impediments on the operation of independent repairers / garages’. Although the Commission noted several times the technical nature of spares and diagnostic tools in the secondary market, the directions to make these available to independent garages with unskilled repairers appear contrary to the observations. While artificial and oppressive restrictions ought to be struck down, the Order and the contentions of Director General (“DG”) do not demonstrate that due to actions of car manufacturers, new manufacturers for spares were prevented from entering the market. FACTSShamsher Kataria (“Informant”) filed the information under Section 19(1)(a)4 of the Act in January, 2011 against Honda Siel Cars India Ltd, Volkswagen India Pvt. Ltd. and Fiat India Automobiles Pvt. Ltd. alleging anti-competitive practices in respect of sale of spare parts of these companies. Relying on practices in European Union (“EU”) and the United States of America (“United States”), Informant contended that car manufacturers in India were charging higher prices for spare parts and maintenance services than their counterparts abroad. Further, there was complete restriction on availability of technological information, diagnostic tools and software programs required for servicing and repairing the automobiles to independent repair shops. The CCI after concluding that a prima facie case was made out directed the DG to conduct an investigation by its order dated April 26, 2011. The DG submitted the Report on July 11, 2012 (“Report”). REPORT OF DGCCI approved the DG’s request to investigate all car manufacturers in India as per the list maintained by the Society of Indian Automobile Manufacturers (“SIAM”), bringing in fourteen other OEMs in the scope of investigation by the DG. DG concluded that activities of OEMs were in violation of sections 3 and 4 of the Act.5 DG identified two separate markets for passenger vehicle sector in India as ‘relevant market’:

Conclusions in the Report:

DG analyzed the appreciable adverse effect on competition (“AAEC”) by examining vertical agreements that OEMs had with:

DG observed that OEMs were able to substantially mark-up prices for spares. Hence, DG concluded that vertical agreements entered into between OEMs and their authorized dealers cause AAEC in terms of conditions set forth under section 19(3) of the Act. REPLIES OF OPPOSITE PARTIES:OEMs contested the Report on various grounds.

CCI rejected the objection to jurisdiction and held that it had power to add additional parties in view of scheme of the Act and duties of the Commission as provided in Section 18 of the Act.6 CCI also rejected the ‘unified systems market’ contention and rejected the contention that consumers engaged in whole-life cost analysis. CCI substantially concurred with the DG that the relevant market would be related to spares. CCI held that to undertake a life-cost analysis, it was crucial that:

CCI concluded that OEMs were unable to demonstrate that they could, or consumers could, compute life-span costs and hence, rejected the systems market contention. Each OEM was the sole seller of its spares and diagnostic tools and that OEMs restricted authorized dealers from making sales in the open market. CCI also concluded that the OEMs created entry barriers for independent repairers, though how barriers have been put in place, or the nature of barriers has not been set out. CCI has also placed reliance on certain letters from independent repairers for its conclusion that spares were not provided in the open market. However, these letters do not appear to have been shown to the OEMs and no response has been elicited from the OEMs. The Commission dealt extensively with the pricing of spares and concluded that excessive mark-up was indicative of anti-competitive behavior. The Commission rejected contentions on share of revenue from spares (as a percentage of total revenue) by OEMs since OEMs did not submit ‘constituent elements of production costs’. Although the Commission concluded that OEMs restricted supply of spares and created barriers, OEMs were able to demonstrate that in the post-warranty period, that substantial proportion of consumers shifted to independent repairers. However, CCI rejected this assertion since OEMs did not provide the source of this information. CCI also rejected TTAs as a ground to refuse to deal in spares and diagnostic tools as TTAs did not prevent the OEMs from selling spares and diagnostic tools in the open market. CCI reasoned that sale of products with IPRs would not affect the IPRs if the products were sold in the open market by OESs. TTAs granted a right to exploit and did not confer the IPRs itself. CCI also rejected the contention of OEMs that:

The Commission examined the agreements and its effect on competition based on factors set out in Section 19(3) of the Act.7 If an agreement engendered efficiency but eliminated competition in the market, the Commission would strike it down. The Commission concluded that there were ‘hardcore’ restrictions imposed by the OEMs (restriction on supply of goods and restrictions on sale of goods to independent suppliers) and competitive process was eliminated by OEMs. Consequently, the Commission held that OEMs were in violation of Sections 3(4)(b), 3(4)(c), 3(4)(d, 4(2)(a)(i), 4(2)(c) and 4(2)(e) of the Act. A penalty of approximately Rs. 25.54 Billion was imposed on the OEMs (2% of total turnover). OEMs were also directed to allow OESs to sell spares and diagnostic tools in the open market and refrain from putting in place any impediments in the supply of spares and diagnostic tools. The Commission has directed that OEMs furnish an affidavit of compliance within 60 days of the Order. Presently, the Madras High Court has stayed the fine levied against MSIL amounting to Rs. 4.71 Billion. ANALYSISWhile the Order has been welcomed by the Automotive Component Manufacturers Association (“ACMA”), SIAM has criticized the Order.8 This is the first significant ruling on vertical restraints and excessive pricing under Section 4. This could be indicative of the Commission’s view on vertical agreements such as those between manufacturers and retailers. The Order has far-reaching implications for similarly placed industries such as electronic goods including software services where a manufacturer may impose restrictions on the manner in which spares and services are provided. However, certain valid points may be made against the Order. Rejection of ‘systems market’ has led to an incongruous situation where the consumption of spares has been analyzed independent of how consumers purchase cars. The incongruity is underscored since this automatically makes a manufacturer dominant as a consumer of a car will have to necessarily purchase spares of that particular car. Thus, it is the purchase of the car that determines the consumption of spares and consumption of spares is not an independent economic act by a consumer. The Commissions emphasis on open access of spares and diagnostic tools would seem misplaced since it ignores the technical nature of cars and its components and the special role of authorized dealers. Access to spares would also require training to use them since access to spares is defeated if there is faulty usage and compelling OEMs to provide access and training to independent garages and repairers defeats the role of an authorized dealer. Additionally, a manufacturer cannot be made liable if a consumer improperly uses the product and in such cases, warranty can be legitimately denied. The Commission’s conclusion of lack of market access to spares and conclusion of entry barrier is contrary to its own finding that after the warranty period, consumers approached independent garages. With 60,000 organized dealers and 300,000 un-organized dealers, the claim of lack of access to spares and services appears unfounded. The Commission’s emphasis solely on effect of the arrangement between OEMs and OESs and ignoring the reasonableness would seem improper. This is reinforced by OEMs contention that consumers opt for independent repairers in the post-warranty period and the prolific number of independent repairers. The Commission’s blanket imposition of 2% penalty on turnover would seem harsh given that no reasons have been provided as to why 2% penalty is appropriate and why 2% penalty was imposed on total turnover, given that only spares was identified as the relevant product. OEMs have thus been penalized in respect of turnover on cars as well even though cars were not subject matter of the complaint. The Competition Appellate Tribunal has emphasized the need for reasons while imposing penalty and has acknowledged that penalty should be imposed on ‘relevant turnover’ in Excel Crop Care Limited v. Competition Commission of India &Ors.9 Interestingly, auto component manufacturers’ role in the industry is being examined in other jurisdictions as well. China has imposed a penalty of approximately $200 Million on ten Japanese auto-parts and bearings manufacturers10 and South Africa is examining allegations that automotive component manufacturers colluded while bidding for tenders floated by car manufacturers.11 However, South Africa is examining these allegations in respect of the imports market rather than domestic market. Instances of price fixing are present in United States and EU as well and the regulators have examined similar allegations against automotive component manufacturers in these jurisdictions as well.12 While there may be a need to examine pricing and supply of products and services in the aftersales market, it is important that measures that affect fundamentals in the market and which cause more harm than good to consumers in the long run not be taken. POST ORDERCertain car companies had approached the Delhi High Court against the Order. Additionally, there is a challenge to the proceeding pending in the Madras High Court and the Delhi High Court has therefore directed car manufacturers to approach the Madras High Court.13 It is interesting to note that OEMs have approached the High Court in a writ petition rather than avail the statutory appeal, namely, appeal to the Competition Appellate Tribunal. A possible reason could be the nature of the challenge to the Order on the ground that the Order is vitiated by lack of jurisdiction and suffers from arbitrariness and hence, parties need not approach the statutory appellate authority.14 1 C-03/2011 2 Section 4: “Abuse of dominant position [(1)No enterprise or group] shall abuse its dominant position.] (2) There shall be an abuse of dominant position 4 [under sub-section (1), if an enterprise or a group].—- (a) directly or indirectly, imposes unfair or discriminatory— (i) condition in purchase or sale of goods or service; or (ii) price in purchase or sale (including predatory price) of goods or service. Explanation.— For the purposes of this clause, the unfair or discriminatory condition in purchase or sale of goods or service referred to in sub-clause (i) and unfair or discriminatory price in purchase or sale of goods (including predatory price) or service referred to in sub-clause (ii) shall not include such discriminatory condition or price which may be adopted to meet the competition; or (b) limits or restricts— (i) production of goods or provision of services or market therefor; or (ii) technical or scientific development relating to goods or services to the prejudice of consumers; or(c) indulges in practice or practices resulting in denial of market access 5 [in any manner]; or (d) makes conclusion of contracts subject to acceptance by other parties of supplementary obligations which, by their nature or according to commercial usage, have no connection with the subject of such contracts; or (e) uses its dominant position in one relevant market to enter into, or protect, other relevant market.” 3 HC seeks CCI response on plea of Mahindra, Tata available at http://www.indolink.com/displayArticleS.php?id=092714102007. 4 Section: 19.(1) The Commission may inquire into any alleged contravention of the provisions contained in subsection (1) of section 3 or sub-section (1) of section 4 either on its own motion or on— (a) 29[receipt of any information, in such manner and] accompanied by such fee as may be determined by regulations, from any person, consumer or their association or trade association; or 5 Anti-competitive agreements and abuse of dominant position, respectively, under the Act. 6 Section 18 - Subject to the provisions of this Act, it shall be the duty of the Commission to eliminate practices having adverse effect on competition, promote and sustain competition, protect the interests of consumers and ensure freedom of trade carried on by other participants, in markets in India. 7 19 (3) The Commission shall, while determining whether an agreement has an appreciable adverse effect on competition under section 3, have due regard to all or any of the following factors, namely:— (a) creation of barriers to new entrants in the market; (b) driving existing competitors out of the market; (c) foreclosure of competition by hindering entry into the market; (d) accrual of benefits to consumers; (e) improvements in production or distribution of goods or provision of services; (f) promotion of technical, scientific and economic development by means of production or distribution of goods or provision of services. 8 Car, component cos differ on CCI Order available at http://www.hindustantimes.com/business-news/car-components-cos-differ-on-cci-order/article1-1264010.aspx 9 Appeal No. 79 of 2012 dated October 29, 2013. 10 China Fines Japan Auto-Parts Makers $ 200 Million available at http://online.wsj.com/articles/china-fines-japan-auto-parts-makers-200-million-1408530257. 11 Competition Commission moves to investigate car industry available at http://mg.co.za/article/2014-10-13-competition-commission-to-investigate-collusion-in-car-industry/. 12 See Press Releases at http://www.justice.gov/atr/public/division-update/2014/auto-parts.html . See also in respect of EU, Antitrust: Commission fines producers of car and truck bearings € 953 Million in cartel settlement available at http://europa.eu/rapid/press-release_IP-14-280_en.htm. 13 Delhi High Court grants 3-weeks protection to Mercedes Benz from CCI Order available at http://articles.economictimes.indiatimes.com/2014-09-24/news/54279448_1_trade-norms-bmw-india-spare-parts. 14 Although details about the nature of the challenge is not available, newsreports suggest that challenge to constitutionality of certain provisions might form part of the challenge. See Note 3 above. DisclaimerThe contents of this hotline should not be construed as legal opinion. View detailed disclaimer. |

|

- CCI holds anti-competitive behavior would be tested in respect of sale of spares and diagnostic tools as the market for spares and diagnostic tools constitutes a separate market.

- Agreements between car manufacturers and dealers which restrict supply of spares and diagnostic tools in the open market held to be restrictive. Restrictions on supply in the market coupled with high margins on spares are anti-competitive.

- Restrictive conditions to protect intellectual property rights are protected only subject to a party demonstrating that the agency that administers intellectual property rights in India has validly recognized (or is about to recognize) such rights. Technology transfer agreements do afford such protection.

- Essential products should be supplied in the market and consumers will take decision of whether to procure from authorized dealer or from open stores. CCI relies on EU cases for this purpose.

- CCI directs that manufacturers take immediate remedial measures to make available products and services in the secondary market.

- Penalty of approximately Rs. 25 Billion (2% on total turnover) imposed on 14 car manufacturers and an order is awaited against three other manufacturers.

BACKGROUND

The Competition Commission of India (“CCI / Commission”) recently imposed an aggregate penalty of Rs. 25.54 Billion (USD 420 Million) on fourteen car manufacturers or Original Equipment Manufacturers (“OEMs”) for creating anti-competitive effects through agreements for spares and after sales services1 (“Order”). A separate order would be passed in respect of Hyundai Motor India Limited, Mahindra Reva Electric Car Company (P) Ltd. and Premier Ltd. after hearing their case. The OEMs were found to be dominant in the markets for their respective brands and had abused their dominant position under Section 42 of the Competition Act, 2002 (“Act”) which affected around 20 Million car consumers. The Commission held that agreements with local Original Equipment Suppliers (“OESs”) adversely affected competition in the after sales and service market. The CCI held that through restrictive agreements and trade practices, OEMs caused entry barriers in secondary market for spare parts and diagnostic tools. CCI also noted that high margins (upto 4,817% mark-up) were exploitative and a manifestation of anti-competitive structure of the market. Interestingly, the Order has been signed by only three members as against seven members who constitute the Commission and who reportedly heard the matter.3

The Order is the first of its kind notably for holding that sale of spare parts and provision of services is a separate market distinct from the product itself, its review of agreements between manufacturers and dealers in a vertical arrangement, examination of restrictions from intellectual property rights (“IPRs”) and its sweeping directions. OEMs have been directed to allow OESs to allow sale and distribution of spares and diagnostic tools in the market with ‘no restrictions or impediments on the operation of independent repairers / garages’.

Although the Commission noted several times the technical nature of spares and diagnostic tools in the secondary market, the directions to make these available to independent garages with unskilled repairers appear contrary to the observations. While artificial and oppressive restrictions ought to be struck down, the Order and the contentions of Director General (“DG”) do not demonstrate that due to actions of car manufacturers, new manufacturers for spares were prevented from entering the market.

FACTSShamsher Kataria (“Informant”) filed the information under Section 19(1)(a)4 of the Act in January, 2011 against Honda Siel Cars India Ltd, Volkswagen India Pvt. Ltd. and Fiat India Automobiles Pvt. Ltd. alleging anti-competitive practices in respect of sale of spare parts of these companies. Relying on practices in European Union (“EU”) and the United States of America (“United States”), Informant contended that car manufacturers in India were charging higher prices for spare parts and maintenance services than their counterparts abroad. Further, there was complete restriction on availability of technological information, diagnostic tools and software programs required for servicing and repairing the automobiles to independent repair shops.

The CCI after concluding that a prima facie case was made out directed the DG to conduct an investigation by its order dated April 26, 2011. The DG submitted the Report on July 11, 2012 (“Report”).

REPORT OF DGCCI approved the DG’s request to investigate all car manufacturers in India as per the list maintained by the Society of Indian Automobile Manufacturers (“SIAM”), bringing in fourteen other OEMs in the scope of investigation by the DG. DG concluded that activities of OEMs were in violation of sections 3 and 4 of the Act.5

DG identified two separate markets for passenger vehicle sector in India as ‘relevant market’:

Conclusions in the Report:

- Technical difference between various primary market products (i.e., differences within individual brands of a car manufacturer such as Maruti Alto, Maruti Ertiga, Maruti Dzire etc.) restricted consumers’ choice in complimentary products/services. Hence, consumers were ‘locked into’ aftermarket suppliers of the car purchased.

- Each OEM was in a dominant position in the supply of its spare parts for its brand of cars as the OEMs through restrictions limited the OESs from selling these spare parts in the open market. DG also found that even if there was no restrictive clause, OESs did not sell in the open market.

- OEMs were not able to demonstrate that they owned IPRs and technology transfer agreements (“TTAs”) were not covered by the exception under Section 3 (5) of the Act.

- Restrictive clauses in agreements between OEMs and OESs caused lack of supply in the open market of spare parts, tools and services.

DG analyzed the appreciable adverse effect on competition (“AAEC”) by examining vertical agreements that OEMs had with:

- local OESs who manufacture spare parts for OEMs for their assembly line or to be sold in the aftermarket through authorized dealers,

- overseas suppliers who supply OEMs with spare parts, and,

- dealers, through whom cars are sold and who provide after sales services.

DG observed that OEMs were able to substantially mark-up prices for spares. Hence, DG concluded that vertical agreements entered into between OEMs and their authorized dealers cause AAEC in terms of conditions set forth under section 19(3) of the Act.

REPLIES OF OPPOSITE PARTIES:OEMs contested the Report on various grounds.

- The fourteen OEMs added afresh by the DG objected to their addition and contended that CCI did not have the power to add them.

- The OEMs challenged the bifurcation of the market as primary and secondary and stated that the relevant market was actually an indivisible, unified ‘systems market’ where the market of the car itself and its spare parts were indivisible. OEMs reasoned that consumers purchase both at the same time. Further consumers while purchasing cars engage in ‘whole life costing’ where they anticipate future costs of ownership of the car.

- OEMs were dissuaded from setting supra-competitive prices (contesting the high mark-up) as it would harm an OEM’s profits on future sales of the primary product under what the OEMs termed as ‘reputation effects’. The OEMs contended they were not in a dominant position in the unified systems market as the market was robust with several competitors. OEMs also contended that the DG ignored statutory levies and other costs while computing the mark-up.

- OEMs refuted the finding that consumers were ‘locked-in’ and that consumers exclusively purchased only from authorized dealers. It was contended that after the warranty period, substantial percentage of consumers switched to independent repairers.

CCI rejected the objection to jurisdiction and held that it had power to add additional parties in view of scheme of the Act and duties of the Commission as provided in Section 18 of the Act.6 CCI also rejected the ‘unified systems market’ contention and rejected the contention that consumers engaged in whole-life cost analysis. CCI substantially concurred with the DG that the relevant market would be related to spares.

CCI held that to undertake a life-cost analysis, it was crucial that:

- data for life-cost analysis is available with the producer, and,

- at the time of purchase product in the primary market, consumers can compute cost likely to be incurred during the life-span of the product.

CCI concluded that OEMs were unable to demonstrate that they could, or consumers could, compute life-span costs and hence, rejected the systems market contention. Each OEM was the sole seller of its spares and diagnostic tools and that OEMs restricted authorized dealers from making sales in the open market. CCI also concluded that the OEMs created entry barriers for independent repairers, though how barriers have been put in place, or the nature of barriers has not been set out. CCI has also placed reliance on certain letters from independent repairers for its conclusion that spares were not provided in the open market. However, these letters do not appear to have been shown to the OEMs and no response has been elicited from the OEMs.

The Commission dealt extensively with the pricing of spares and concluded that excessive mark-up was indicative of anti-competitive behavior. The Commission rejected contentions on share of revenue from spares (as a percentage of total revenue) by OEMs since OEMs did not submit ‘constituent elements of production costs’. Although the Commission concluded that OEMs restricted supply of spares and created barriers, OEMs were able to demonstrate that in the post-warranty period, that substantial proportion of consumers shifted to independent repairers. However, CCI rejected this assertion since OEMs did not provide the source of this information.

CCI also rejected TTAs as a ground to refuse to deal in spares and diagnostic tools as TTAs did not prevent the OEMs from selling spares and diagnostic tools in the open market. CCI reasoned that sale of products with IPRs would not affect the IPRs if the products were sold in the open market by OESs. TTAs granted a right to exploit and did not confer the IPRs itself. CCI also rejected the contention of OEMs that:

- supply of spares and diagnostic tools in the open market would affect authorized dealers and existing distribution networks;

- independent repairers would not be able to use spares and diagnostic tools without requisite skills.

The Commission examined the agreements and its effect on competition based on factors set out in Section 19(3) of the Act.7 If an agreement engendered efficiency but eliminated competition in the market, the Commission would strike it down. The Commission concluded that there were ‘hardcore’ restrictions imposed by the OEMs (restriction on supply of goods and restrictions on sale of goods to independent suppliers) and competitive process was eliminated by OEMs.

Consequently, the Commission held that OEMs were in violation of Sections 3(4)(b), 3(4)(c), 3(4)(d, 4(2)(a)(i), 4(2)(c) and 4(2)(e) of the Act. A penalty of approximately Rs. 25.54 Billion was imposed on the OEMs (2% of total turnover). OEMs were also directed to allow OESs to sell spares and diagnostic tools in the open market and refrain from putting in place any impediments in the supply of spares and diagnostic tools. The Commission has directed that OEMs furnish an affidavit of compliance within 60 days of the Order.

Presently, the Madras High Court has stayed the fine levied against MSIL amounting to Rs. 4.71 Billion.

ANALYSISWhile the Order has been welcomed by the Automotive Component Manufacturers Association (“ACMA”), SIAM has criticized the Order.8 This is the first significant ruling on vertical restraints and excessive pricing under Section 4. This could be indicative of the Commission’s view on vertical agreements such as those between manufacturers and retailers. The Order has far-reaching implications for similarly placed industries such as electronic goods including software services where a manufacturer may impose restrictions on the manner in which spares and services are provided.

However, certain valid points may be made against the Order. Rejection of ‘systems market’ has led to an incongruous situation where the consumption of spares has been analyzed independent of how consumers purchase cars. The incongruity is underscored since this automatically makes a manufacturer dominant as a consumer of a car will have to necessarily purchase spares of that particular car. Thus, it is the purchase of the car that determines the consumption of spares and consumption of spares is not an independent economic act by a consumer.

The Commissions emphasis on open access of spares and diagnostic tools would seem misplaced since it ignores the technical nature of cars and its components and the special role of authorized dealers. Access to spares would also require training to use them since access to spares is defeated if there is faulty usage and compelling OEMs to provide access and training to independent garages and repairers defeats the role of an authorized dealer. Additionally, a manufacturer cannot be made liable if a consumer improperly uses the product and in such cases, warranty can be legitimately denied. The Commission’s conclusion of lack of market access to spares and conclusion of entry barrier is contrary to its own finding that after the warranty period, consumers approached independent garages. With 60,000 organized dealers and 300,000 un-organized dealers, the claim of lack of access to spares and services appears unfounded.

The Commission’s emphasis solely on effect of the arrangement between OEMs and OESs and ignoring the reasonableness would seem improper. This is reinforced by OEMs contention that consumers opt for independent repairers in the post-warranty period and the prolific number of independent repairers.

The Commission’s blanket imposition of 2% penalty on turnover would seem harsh given that no reasons have been provided as to why 2% penalty is appropriate and why 2% penalty was imposed on total turnover, given that only spares was identified as the relevant product. OEMs have thus been penalized in respect of turnover on cars as well even though cars were not subject matter of the complaint. The Competition Appellate Tribunal has emphasized the need for reasons while imposing penalty and has acknowledged that penalty should be imposed on ‘relevant turnover’ in Excel Crop Care Limited v. Competition Commission of India &Ors.9

Interestingly, auto component manufacturers’ role in the industry is being examined in other jurisdictions as well. China has imposed a penalty of approximately $200 Million on ten Japanese auto-parts and bearings manufacturers10 and South Africa is examining allegations that automotive component manufacturers colluded while bidding for tenders floated by car manufacturers.11 However, South Africa is examining these allegations in respect of the imports market rather than domestic market. Instances of price fixing are present in United States and EU as well and the regulators have examined similar allegations against automotive component manufacturers in these jurisdictions as well.12

While there may be a need to examine pricing and supply of products and services in the aftersales market, it is important that measures that affect fundamentals in the market and which cause more harm than good to consumers in the long run not be taken.

POST ORDERCertain car companies had approached the Delhi High Court against the Order. Additionally, there is a challenge to the proceeding pending in the Madras High Court and the Delhi High Court has therefore directed car manufacturers to approach the Madras High Court.13 It is interesting to note that OEMs have approached the High Court in a writ petition rather than avail the statutory appeal, namely, appeal to the Competition Appellate Tribunal. A possible reason could be the nature of the challenge to the Order on the ground that the Order is vitiated by lack of jurisdiction and suffers from arbitrariness and hence, parties need not approach the statutory appellate authority.14

1 C-03/2011

2 Section 4: “Abuse of dominant position

[(1)No enterprise or group] shall abuse its dominant position.]

(2) There shall be an abuse of dominant position 4

[under sub-section (1), if an enterprise or a group].—-

(a) directly or indirectly, imposes unfair or discriminatory—

(i) condition in purchase or sale of goods or service; or

(ii) price in purchase or sale (including predatory price) of goods or service.

Explanation.— For the purposes of this clause, the unfair or discriminatory

condition in purchase or sale of goods or service referred to in sub-clause (i) and

unfair or discriminatory price in purchase or sale of goods (including predatory

price) or service referred to in sub-clause (ii) shall not include such discriminatory

condition or price which may be adopted to meet the competition; or

(b) limits or restricts—

(i) production of goods or provision of services or market therefor; or

(ii) technical or scientific development relating to goods or services to

the prejudice of consumers; or(c) indulges in practice or practices resulting in denial of market access 5

[in

any manner]; or

(d) makes conclusion of contracts subject to acceptance by other parties of

supplementary obligations which, by their nature or according to

commercial usage, have no connection with the subject of such contracts;

or

(e) uses its dominant position in one relevant market to enter into, or protect,

other relevant market.”

3 HC seeks CCI response on plea of Mahindra, Tata available at http://www.indolink.com/displayArticleS.php?id=092714102007.

4 Section: 19.(1) The Commission may inquire into any alleged contravention of the provisions

contained in subsection (1) of section 3 or sub-section (1) of section 4 either on

its own motion or on—

(a) 29[receipt of any information, in such manner and] accompanied by such fee

as may be determined by regulations, from any person, consumer or their

association or trade association; or

5 Anti-competitive agreements and abuse of dominant position, respectively, under the Act.

6 Section 18 - Subject to the provisions of this Act, it shall be the duty of the Commission to eliminate practices having adverse effect on competition, promote and sustain competition, protect the interests of consumers and ensure freedom of trade carried on by other participants, in markets in India.

7 19 (3) The Commission shall, while determining whether an agreement has an appreciable adverse effect on competition under section 3, have due regard to all or any of the following factors, namely:—

(a) creation of barriers to new entrants in the market;

(b) driving existing competitors out of the market;

(c) foreclosure of competition by hindering entry into the market;

(d) accrual of benefits to consumers;

(e) improvements in production or distribution of goods or provision of services;

(f) promotion of technical, scientific and economic development by means of production or distribution of goods or provision of services.

8 Car, component cos differ on CCI Order available at http://www.hindustantimes.com/business-news/car-components-cos-differ-on-cci-order/article1-1264010.aspx

9 Appeal No. 79 of 2012 dated October 29, 2013.

10 China Fines Japan Auto-Parts Makers $ 200 Million available at http://online.wsj.com/articles/china-fines-japan-auto-parts-makers-200-million-1408530257.

11 Competition Commission moves to investigate car industry available at http://mg.co.za/article/2014-10-13-competition-commission-to-investigate-collusion-in-car-industry/.

12 See Press Releases at http://www.justice.gov/atr/public/division-update/2014/auto-parts.html . See also in respect of EU, Antitrust: Commission fines producers of car and truck bearings € 953 Million in cartel settlement available at http://europa.eu/rapid/press-release_IP-14-280_en.htm.

13 Delhi High Court grants 3-weeks protection to Mercedes Benz from CCI Order available at http://articles.economictimes.indiatimes.com/2014-09-24/news/54279448_1_trade-norms-bmw-india-spare-parts.

14 Although details about the nature of the challenge is not available, newsreports suggest that challenge to constitutionality of certain provisions might form part of the challenge. See Note 3 above.

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.

Research PapersMergers & Acquisitions New Age of Franchising Life Sciences 2025 |

Research Articles |

AudioCCI’s Deal Value Test Securities Market Regulator’s Continued Quest Against “Unfiltered” Financial Advice Digital Lending - Part 1 - What's New with NBFC P2Ps |

NDA ConnectConnect with us at events, |

NDA Hotline |