Companies Act SeriesApril 30, 2014 Fund raising efforts of India Inc. to be hit by Companies Act, 2013

The Government of India has recently notified Companies Act, 2013 (“CA 2013”), which shall replace the erstwhile Companies Act, 1956 (“CA 1956”). To help understand the changes introduced under the CA 2013, we are undertaking a series of updates on the CA 2013 (“NDA CA 2013 Series”) analyzing the key changes and their implications for all stakeholders by setting out the practical aspects of some of the important changes introduced by CA 2013. For a quick look at the changes brought forth by the CA 2013, please refer to our previous hotline through this link. For our previous parts on this series, please click here. Having introduced and analysed the framework of the CA 2013 in the first part of this series here, we now analyse the changes to share capital and debentures and incidental issues and changes. Chapters III and IV of CA 2013 along with the Companies (Share Capital and Debentures) Rules, 2014 primarily govern issuance of shares, debentures and other convertible securities. While Chapter III deals with public issues and private placements, Chapter IV deals with the kinds of share capital, rights on shares and issuance of capital. There have been number of changes prescribed under the aforementioned chapters. This hotline analyses the aforesaid under broad heads. SHARE CAPITALi. Kinds of share capital: Both CA 1956 and CA 2013 envisage the same kinds of share capital: equity shares with voting rights, equity shares with differential rights as to dividend, voting or otherwise and preference shares. However, under CA 1956 these limitations on kinds of share capital applied only to public companies. Private companies under CA 1956 were not bound by these limitations and consequently could structure their share capital in the form and fashion that they deemed fit. The CA 2013 does not grant private companies a similar freedom.

ii. Shares with differential rights: Under CA 1956, only public companies were required to comply with the rules when issuing equity shares with differential voting rights or dividend. However, under the CA 2013, when either private companies or public companies issue equity shares with differential rights, they are required to certain conditions. The Companies (Share Capital and Debentures) Rules, 2014 prescribes several conditions for a company to issue equity shares with differential voting rights, some of the conditions are as follows:

iii. Voting on preference shares: Section 47 of CA 2013 prescribes restrictions on voting rights of preference shareholders. Although these restrictions mirror the restrictions that prevailed under the provisions of CA 1956, there are some differences:

CA 2013 has removed this distinction between cumulative and non-cumulative preference shares and entitles a preference shareholder to vote on every resolution placed before the company at any meeting if the company has not paid the dividend in respect of a class of preference shareholders for a period of consecutive 2 (two) or more years.

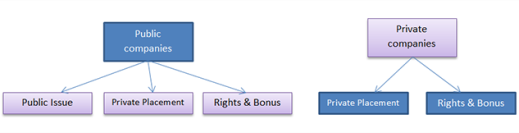

The CA 2013 sets out the manner in which a company can raise capital in securities as follows:

i. Private placement and preferential allotment of shares: The most common method of seeking private equity funding has been through the ‘preferential allotment’ route. The CA 1956 provided for moderate control over a preferential allotment. The main requirement prescribed under CA 1956 was procuring a special resolution by the shareholders of the company in favour of the preferential allotment. This too only applied to preferential allotments by public companies and not private companies. The board of directors of the private companies was vested with the authority to raise capital under CA 1956. The CA 2013 read along with the rules prescribed thereunder provide for vast changes in the manner in which this route can be used to raise capital. We have discussed these below:

ii. Bonus Shares: Under CA 2013, bonus shares may be issued to its members by a company out of its free reserves or security premium account or capital redemption reserve account. Issuance of bonus shares in lieu of dividend has been prohibited. Additionally, the decision of the board of directors of the company to issue bonus shares, once announced may not be withdrawn. iii. Issuance of shares at a discount: While CA 1956 permitted issuance of shares at a discount subject to, inter alia, Central Government approval, CA 2013 prohibits issuance of shares at a discount other than sweat equity shares. EXITi. Restriction on Transferability of shares in a public company: As per section 111A of CA 1956, the shares of a public company are “freely transferable”. Although, various High Courts4 have given judgments for and against the view that agreements entered into between shareholders of a public limited company that impose restrictions on transferability in the nature of rights of first refusal, drag along rights and tag along rights violate the criteria of “free transferability” of shares. There was no settled jurisprudence on this issue, as the Supreme Court has not come up with any decision on this issue. The position relating to transferability of shares of a public company has been addressed now under CA 2013. The proviso to Section 58(2) of the CA 2013, states that any contract or arrangement between two or more persons in the context of a public limited company with regard to transfer of securities shall be enforceable as contract. This proviso affirms the position of the Bombay High Court in Messers Holdings. It is now settled that even though shares of a public company are freely transferable, share transfer restrictions are enforceable as contract, for which action may be brought by the aggrieved party for injunction or damages.

ii. Buy-Back: Under CA 1956, a company was allowed to buy back its securities up to 25% (twenty five percent) of its total paid up equity capital in a financial year by a special resolution. As an exception to the rule, the CA 1956 permitted board to authorize a buy back of shares of up to 10% of the total paid-up equity capital and free reserves of the company without the requirement of a shareholder resolution but a cooling off period of 365 days had to be maintained between another board authorized buy back was undertaken. No such cooling off period was prescribed under the CA 1956 to be maintained between 2 shareholder approved buy backs or between a board approved buy back and a shareholder approved buy back. Consequently, in a calendar year (i.e. towards the end of one financial year and the beginning of another), if timed correctly, a company could buy back securities of up to 25% of its total outstanding paid-up equity capital twice. The CA 2013, whilst retaining the other requirements pertaining to buy backs as existing under the CA 1956, now prescribes a cooling off period of 365 days has to be maintained between any 2 buy backs, whether shareholder approved or board approved.

While CA 2013 has brought about a few welcome changes for investors and companies alike, it has equally introduced hurdles and additional compliance requirements which shall require significant re working on some of the existing structures and steps used by corporates for raising capital and managing the rights of strategic investors in the company along with the other shareholders including the promoters. Although it may be true that these added checks and restraints result from some of the scams that were discovered in the past wherein the provisions under CA 1956 were misused by some companies to, inter alia, siphon off money from the public, these changes will surely make doing business (or rather compliance with CA 2013) more challenging for India Inc.

You can direct your queries or comments to the authors 1 As per section 87 of CA 1956, the preference shareholders were entitled to vote on every resolution placed before the company at any meeting, if the payment of dividend remained due on (i) the cumulative preference shares, for an aggregate period of not less than 2 (two) years preceding the date of commencement of the meeting; and (ii) for non-cumulative preference shares, either in respect of a period of not less than 2 (two) years ending with the expiry of the financial year immediately preceding the commencement of the meeting or in respect of an aggregate period of not less than three years comprised in the 6 (six) years ending with the expiry of the financial year aforesaid. 2 Under section 247 of CA 2013, a Registered Valuer is a valuer who has the relevant qualifications and experience and is registered as a valuer as per rules prescribed. However, section 247 and the corresponding rules have not yet been notified. 3 Section 42 (6) of CA 2013 4 Pushpa Katoch v. Manu Maharani Hotels Limited, [2006]131CompCas42(Delhi); Messer Holdings Limited v Shyam Madanmohan Ruia and Ors, 2010(5)BomCR589 DisclaimerThe contents of this hotline should not be construed as legal opinion. View detailed disclaimer. |

|

- The new Companies Act makes structuring and raising capital challenging.

- No distinction between preferential allotment and private placement.

- Restrictions on transferability of shares in a public company, now permissible.

The Government of India has recently notified Companies Act, 2013 (“CA 2013”), which shall replace the erstwhile Companies Act, 1956 (“CA 1956”). To help understand the changes introduced under the CA 2013, we are undertaking a series of updates on the CA 2013 (“NDA CA 2013 Series”) analyzing the key changes and their implications for all stakeholders by setting out the practical aspects of some of the important changes introduced by CA 2013.

For a quick look at the changes brought forth by the CA 2013, please refer to our previous hotline through this link. For our previous parts on this series, please click here.

Having introduced and analysed the framework of the CA 2013 in the first part of this series here, we now analyse the changes to share capital and debentures and incidental issues and changes.

Chapters III and IV of CA 2013 along with the Companies (Share Capital and Debentures) Rules, 2014 primarily govern issuance of shares, debentures and other convertible securities. While Chapter III deals with public issues and private placements, Chapter IV deals with the kinds of share capital, rights on shares and issuance of capital.

There have been number of changes prescribed under the aforementioned chapters. This hotline analyses the aforesaid under broad heads.

SHARE CAPITALi. Kinds of share capital:

Both CA 1956 and CA 2013 envisage the same kinds of share capital: equity shares with voting rights, equity shares with differential rights as to dividend, voting or otherwise and preference shares. However, under CA 1956 these limitations on kinds of share capital applied only to public companies. Private companies under CA 1956 were not bound by these limitations and consequently could structure their share capital in the form and fashion that they deemed fit. The CA 2013 does not grant private companies a similar freedom.

|

Key Takeaway: Under CA 2013 both private companies and public companies can have share capital of 2 kinds only: (i) Equity shares with voting rights and equity shares with differential rights as to dividend, voting or otherwise and (ii) preference shares. |

ii. Shares with differential rights:

Under CA 1956, only public companies were required to comply with the rules when issuing equity shares with differential voting rights or dividend. However, under the CA 2013, when either private companies or public companies issue equity shares with differential rights, they are required to certain conditions. The Companies (Share Capital and Debentures) Rules, 2014 prescribes several conditions for a company to issue equity shares with differential voting rights, some of the conditions are as follows:

- Share with differential rights shall not exceed 26% (twenty six per cent) of the total post issue paid up equity share capital, including equity shares with differential rights issued at any point of time;

- The company shall have a consistent track record of distributable profits for the last 3 (three) years;

- The company should not have defaulted in filing financial statements and annual returns for the preceding 3 (three) financial years.

|

Key Takeaway: Structuring different economic rights for different class of equity shareholders may become difficult given the conditions that companies have to comply with under the Companies (Share Capital and Debentures) Rules, 2014. However, it is important to note that the rules issued under this chapter specifically mention that existing equity shares issued with differential rights will continue to have the rights provided at the time of their issuance, and have accordingly been grandfathered. |

iii. Voting on preference shares:

Section 47 of CA 2013 prescribes restrictions on voting rights of preference shareholders. Although these restrictions mirror the restrictions that prevailed under the provisions of CA 1956, there are some differences:

- As stated above, CA 1956 gave private companies the freedom to structure their share capital and consequently preference shareholders of a private company were not subject to the restrictions on voting under the legislature. The CA 2013 removes this flexibility and consequently preference shareholders of both private and public companies will be subject to these restrictions.

- The CA 1956 made a distinction between when preference shareholders holding cumulative or non-cumulative preference shares could exercise their respective voting rights. This distinction was based on the period for which the dividend remained unpaid.1

CA 2013 has removed this distinction between cumulative and non-cumulative preference shares and entitles a preference shareholder to vote on every resolution placed before the company at any meeting if the company has not paid the dividend in respect of a class of preference shareholders for a period of consecutive 2 (two) or more years.

|

Key Takeaway: Preference shares issued by private companies cannot have voting rights. |

The CA 2013 sets out the manner in which a company can raise capital in securities as follows:

i. Private placement and preferential allotment of shares:

The most common method of seeking private equity funding has been through the ‘preferential allotment’ route. The CA 1956 provided for moderate control over a preferential allotment. The main requirement prescribed under CA 1956 was procuring a special resolution by the shareholders of the company in favour of the preferential allotment. This too only applied to preferential allotments by public companies and not private companies. The board of directors of the private companies was vested with the authority to raise capital under CA 1956. The CA 2013 read along with the rules prescribed thereunder provide for vast changes in the manner in which this route can be used to raise capital. We have discussed these below:

- ‘Private placement’ and ‘preferential allotment’ made synonymous: Any offer of securities or invitation to subscribe to securities to 200 persons or less (excluding qualified institutional buyers and employees) in a financial year is a private placement under section 42(2) of the CA 2013. Needless to say, an offer of securities made to the existing shareholders of the company is a rights issue, different from a private placement. The CA 2013 requires that any private placement be made through the issuance of a private placement offer letter and other conditions prescribed. Within the ambit of raising capital, an offer of securities to a select group of individuals is seen differently from an offer of securities to the ‘public’, with the former being a private placement and the latter being a public offer. However, even within the ambit of a private placement, an allotment to a handful of investors as opposed to a larger group (not constituting ‘public’) may be not be on the same footing. A private placement that involves an offer of securities through an offer document to more than a handful of investors, as opposed to a preferential allotment to a handful of investors after a diligence and through the execution of individual transaction documents, should be controlled differently. The CA 1956 did not provide much clarity on this point and in any event the rules prescribed for any such placement only applied to public companies. A reading of sections 42 and 62 of CA 2013 read along with the corresponding rules issued thereunder suggests that a ‘private placement’ and ‘preferential allotment’ under sections 42 and 62, respectively are one and the same and they must both comply with the same provisions and procedures.

|

Key Takeaway: Issuance of securities to one or more persons but not exceeding 200 persons will have to comply with the requirements of section 42 and 62 of the CA 2013 and the corresponding rules issued thereunder. The conditions imposed in relation to private placements by companies seem to have been issued after the ruling of the Hon’ble Supreme Court of India in the case of Sahara Group wherein the companies Sahara India Real Estate Corporation Limited and Sahara Housing Investment Corporation Limited issued unsecured optionally fully-convertible debentures amounting to about Rs 240 billion to more than 20 million investors. |

- Offer Letter: Every private placement must be made through the issuance of an offer letter the prescribed format of which must be filed with the Registrar of Companies (“RoC”). The Offer Letter shall be accompanied with an application form for the persons receiving the Offer Letter to accept.

|

Key Takeaway: The Offer Letter under these provisions has to be in the prescribed format. Consequently, in addition to the definitive agreements that are typically entered into being subscription agreements and shareholder agreements, the company issuing capital will also have to issue an offer letter. The offer letter proceeds on the following heads of information (i) General Information about the company (ii) Particulars of the Offer (iii) Disclosures with regard to interest of directors, litigation (iv) Financial Position of the Company (v) Declarations by the company. This will entail substantial disclosures being made by a company to the RoC at the time of a private placement. |

- Offer Size: The value of the offer or invitation per person must be with an investment size of not less than INR 20,000 of face value of the securities;

|

Key Takeaway: The requirement of the offer being of a minimum of INR 20,000 of the face value per person seems stringent. It is unclear if the offer can be of INR 20,000 or above, with the actual investment amount made being lower than INR 20,000. If that is the case, the requirement of a minimum offer size is academic and can be circumvented by investors easily. On the other hand, if the investment must also be for a minimum amount of INR 20,000, it may pose a challenge to angel and venture capital investors who prefer to take limited shares at substantial premium, thereby not subscribing substantially at the face value of the shares. |

- Pricing: The price at which shares are issued under a preferential issue of shares (except in the case of a listed company) needs to be based on the valuation conducted by a Registered Valuer.2 Listed companies are required to comply with the relevant SEBI regulations.

|

Key Takeaway: The provisions relating to registered valuers are new and did not exist under the CA 1956 regime. Registered valuers have been given many duties and are required to discharge their duties in accordance with the rules prescribed, impartially and after doing diligence. Violation results in monetary penalties which may extend to Rs. 100,000 and imprisonment, if actions are found fraudulent. The provisions of the CA 2013 relating to registered valuers have not been notified but till the rules are notified, Chapter III of CA 2013 prescribes that during this time the pricing of shares must be valued by a SEBI registered merchant banker or a chartered accountant that has been in practice for at least 10 years. The Reserve Bank of India (“RBI”) in its First Bi-monthly Monetary Policy Statement, 2014-15 made a categorical statement stating that “as regards foreign direct investment (FDI), it has been decided to withdraw all the existing guidelines relating to valuation in case of any acquisition/sale of shares and accordingly, such transactions will henceforth be based on acceptable market practices. Operating guidelines will be notified separately”. Whilst we still await an official circular on these aspects, it may be said that pricing norms for issuance of capital from a CA 2013 perspective will still continue to prevail. However, all investors whether domestic or foreign will be on the same footing as regards pricing. |

- Share application money: Under CA 2013, securities in relation to any offer made to any person for the private placement of its securities, must be allotted to that person within 60 (sixty) days of receipt of the application money.3 The application money must be held in a separate bank account maintained with a scheduled bank and cannot be utilized for any purpose other than for adjustment against allotment of securities or repayment of monies. If the securities are not allotted within 60 (sixty) days, it must be returned within 15 (fifteen) days from the end of the 60 (sixty) day period. Any delay in returning monies entails an interest payment of 12%. There was no corresponding requirement in CA 1956.

|

Key Takeaway: The restrictions on share application monies are new and did not exist under the CA 1956 regime. Based on new requirements, structures which involved temporary financing to companies under the share application route may not work anymore. The RBI vide a circular issued in 2010 required that companies receiving FDI issue the securities to the investor within 180 days of the receipt of such funds or directed the company to refund these amounts. The CA 2013 is more stringent as it requires the allotment to be made within 2 months. |

- Shareholder resolution: The CA 2013 requires any private placement to be approved by a special resolution which must be acted upon within 12 months from the passing of the resolution. This applies to both private companies and public companies.

|

Key Takeaway: Private companies are no longer exempt from having to seek shareholder’s approval for a capital increase. This may add to the timelines for any transaction as calling a shareholders meeting requires 21 days clear notice to be given to the shareholders. For private and public companies, the CA 2013 retains the option to call for a shareholders meeting at shorter notice if consent is given in writing or by electronic mode by not less than 95% of the members entitled to vote at such meeting. |

- Convertible securities: The CA 2013 and the rules thereunder prescribe additional requirements to be complied with for issuances of convertible securities on a preferential basis. The main concern in the newly prescribed rules is the manner in which the convertible securities are to be priced. The rules require that where convertible securities are offered on a preferential basis with an option to apply for and get equity shares allotted, the price of the resultant shares shall be determined beforehand on the basis of a valuation report of a registered valuer. This leads to confusion as to whether a formula based conversion of convertible securities is permitted or whether the conversion price must be fixed at the time of issuance of the convertible securities.

|

Key Takeaway: There is no clarity on how to price a convertible instrument and whether a formula based conversion is permitted under the provisions of the CA 2013. |

ii. Bonus Shares:

Under CA 2013, bonus shares may be issued to its members by a company out of its free reserves or security premium account or capital redemption reserve account. Issuance of bonus shares in lieu of dividend has been prohibited. Additionally, the decision of the board of directors of the company to issue bonus shares, once announced may not be withdrawn.

iii. Issuance of shares at a discount:

While CA 1956 permitted issuance of shares at a discount subject to, inter alia, Central Government approval, CA 2013 prohibits issuance of shares at a discount other than sweat equity shares.

EXITi. Restriction on Transferability of shares in a public company:

As per section 111A of CA 1956, the shares of a public company are “freely transferable”. Although, various High Courts4 have given judgments for and against the view that agreements entered into between shareholders of a public limited company that impose restrictions on transferability in the nature of rights of first refusal, drag along rights and tag along rights violate the criteria of “free transferability” of shares. There was no settled jurisprudence on this issue, as the Supreme Court has not come up with any decision on this issue. The position relating to transferability of shares of a public company has been addressed now under CA 2013. The proviso to Section 58(2) of the CA 2013, states that any contract or arrangement between two or more persons in the context of a public limited company with regard to transfer of securities shall be enforceable as contract. This proviso affirms the position of the Bombay High Court in Messers Holdings. It is now settled that even though shares of a public company are freely transferable, share transfer restrictions are enforceable as contract, for which action may be brought by the aggrieved party for injunction or damages.

|

Key Takeaway: This is a welcome move for investors which clarifies the uncertainty regarding the enforceability of pre-emptive rights and drag and tag rights in public companies, and is expected to encourage more PIPE deals in the future. This being said the debate as to whether the articles of association of a company need to be amended to incorporate these provisions still continues. Whilst the CA 2013 may have recognized that restrictions on transfer are enforceable as a contract, the remedy may be limited to damages on enforcement. Reading this with section 44 of CA 2013 which states that the shares or debentures or other interest of any member in a company shall be movable property transferable in the manner provided by the articles of the company and the existing jurisprudence laid down by the Supreme Court, may still require the articles of association to be amended for the company to be bound by the transfer restrictions that shareholders bind themselves too. |

ii. Buy-Back:

Under CA 1956, a company was allowed to buy back its securities up to 25% (twenty five percent) of its total paid up equity capital in a financial year by a special resolution. As an exception to the rule, the CA 1956 permitted board to authorize a buy back of shares of up to 10% of the total paid-up equity capital and free reserves of the company without the requirement of a shareholder resolution but a cooling off period of 365 days had to be maintained between another board authorized buy back was undertaken. No such cooling off period was prescribed under the CA 1956 to be maintained between 2 shareholder approved buy backs or between a board approved buy back and a shareholder approved buy back. Consequently, in a calendar year (i.e. towards the end of one financial year and the beginning of another), if timed correctly, a company could buy back securities of up to 25% of its total outstanding paid-up equity capital twice. The CA 2013, whilst retaining the other requirements pertaining to buy backs as existing under the CA 1956, now prescribes a cooling off period of 365 days has to be maintained between any 2 buy backs, whether shareholder approved or board approved.

|

Key Takeaway: Under the CA 2013 a cooling off period of 365 days has to be maintained between any 2 buy backs, whether shareholder approved or board approved, removing the flexibility that existed under the CA 1956. |

While CA 2013 has brought about a few welcome changes for investors and companies alike, it has equally introduced hurdles and additional compliance requirements which shall require significant re working on some of the existing structures and steps used by corporates for raising capital and managing the rights of strategic investors in the company along with the other shareholders including the promoters. Although it may be true that these added checks and restraints result from some of the scams that were discovered in the past wherein the provisions under CA 1956 were misused by some companies to, inter alia, siphon off money from the public, these changes will surely make doing business (or rather compliance with CA 2013) more challenging for India Inc.

You can direct your queries or comments to the authors

1 As per section 87 of CA 1956, the preference shareholders were entitled to vote on every resolution placed before the company at any meeting, if the payment of dividend remained due on (i) the cumulative preference shares, for an aggregate period of not less than 2 (two) years preceding the date of commencement of the meeting; and (ii) for non-cumulative preference shares, either in respect of a period of not less than 2 (two) years ending with the expiry of the financial year immediately preceding the commencement of the meeting or in respect of an aggregate period of not less than three years comprised in the 6 (six) years ending with the expiry of the financial year aforesaid.

2 Under section 247 of CA 2013, a Registered Valuer is a valuer who has the relevant qualifications and experience and is registered as a valuer as per rules prescribed. However, section 247 and the corresponding rules have not yet been notified.

3 Section 42 (6) of CA 2013

4 Pushpa Katoch v. Manu Maharani Hotels Limited, [2006]131CompCas42(Delhi); Messer Holdings Limited v Shyam Madanmohan Ruia and Ors, 2010(5)BomCR589

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.

Research PapersDecoding Downstream Investment Mergers & Acquisitions New Age of Franchising |

Research Articles |

AudioCCI’s Deal Value Test Securities Market Regulator’s Continued Quest Against “Unfiltered” Financial Advice Digital Lending - Part 1 - What's New with NBFC P2Ps |

NDA ConnectConnect with us at events, |

NDA Hotline |