Tax HotlineDecember 29, 2020 Madras HC holds transfer of shares without consideration is not “gift” absent voluntariness, upholds levy of capital gains tax

In a recent decision,1 the Madras High Court (“Madras HC” or “Court”) held that an inter-company gift of shares made as part of a corporate restructuring exercise was not a valid gift and should be subject to capital gains tax under the Income-tax Act, 1961 (“ITA”). The Court held the transaction to be a circular transaction, undertaken to avoid tax by shifting profits outside India. BACKGROUNDRedington (India) Ltd. (“RI” or “Assessee”), a company incorporated in India, carried out operations in the Middle East and Africa through its wholly owned subsidiary: Redington Gulf FZE (“RG”). In 2008, a private equity firm (“PE firm”) evinced interest in investing in the Assessee’s Middle East and Africa operations. Pursuant thereto, the following steps were undertaken:

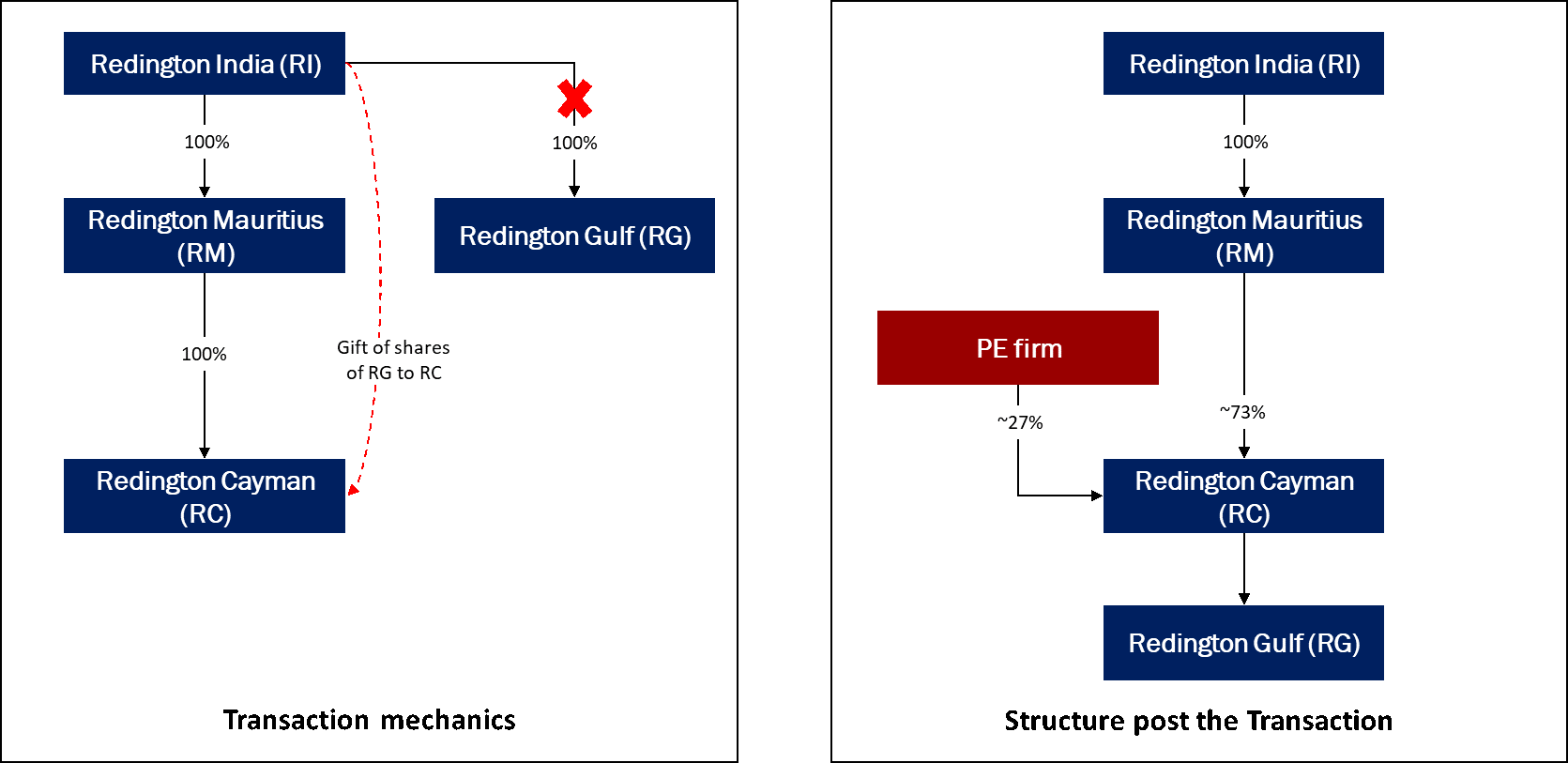

The Transaction is depicted below:

The Assessee’s case was selected for scrutiny and was referred to the Transfer Pricing Officer (“TPO”). The TPO passed a draft assessment order proposing inter-alia an addition for long-term capital gain (“LTCG”) arising on transfer of shares of RG to RC. The Dispute Resolution Panel upheld the LTCG addition, that was then confirmed in the final assessment order. On appeal, the Income-tax Appellate Tribunal (“ITAT”) held the transfer of shares without consideration to be a valid gift exempt from capital gains tax under section 47(iii) of the ITA. The Revenue preferred an appeal to the Madras HC against the ITAT’s order on the fundamental question:2 whether the ITAT was correct in holding that the transfer of shares by the Assessee to its subsidiary was to be considered a ‘gift’. MADRAS HC RULING

This is yet another in a line of recent decisions where courts and tax authorities have looked through structures from a pre-GAAR period, increasingly following a ‘substance over form’ approach. The Madras HC here has carefully analyzed the entire chain of events involved in the corporate restructuring to arrive at its narrative of tax avoidance. The Court has considered the steps involved, their timing, and the purpose of each entity involved, along with documentary evidence in the form of board resolutions, texts of share transfer deeds, and statements from company officials, to piece together a wholistic picture to set the context for the gift of shares. This exercise of the Court is reminiscent of the exercise undertaken by the Authority for Advance Rulings (“AAR”) in Bid Services Division5 where benefit under the India-Mauritius tax treaty was denied to the assessee, based on a review of the purpose of the Mauritius-based taxpayer and the timelines involved in its creation, that led the AAR to conclude that the entity had been set up only to avail of the Mauritius treaty benefits and did not possess the requisite substance. While High Courts do not typically delve into factual analyses in appeals before them, the Madras HC in this case has placed heavy reliance on the factual analysis undertaken by the lower authorities (specifically the TPO), and has commented on the ITAT’s silence on these factual aspects. Notably, the Madras HC did not simply remand the matter to the ITAT to look into the facts afresh. For multi-stepped corporate reorganizations, it is now more important than ever to evaluate the existence of commercial substance against not only statutory but also judicially developed anti-avoidance doctrine as the law keeps evolving, and to carefully review documentation with a close lens. On the law on corporate gifts, this decision of the Madras HC adds more dimension to the debate. In a recent decision the Bombay High Court in Asian Satellite Broadcast v. ITO,6 relying on a decision of the Gujarat High Court in Prakriya Pharmacem v. ITO,7 held unequivocally that by operation of section 47(iii) of the ITA, any transfer of a capital asset under a gift could not be taxed as capital gain. The Madras HC has distinguished these High Court decisions on the basis that the main question in Asian Satellite (supra) was the validity of a reopening notice on the allegation that the corporate gift was a colorable device, when the gift had initially been accepted as such by the assessing officer during the original assessments. These cases, the Madras HC held, do not involve fact patterns where the gift has been made in a context that clearly indicated avoidance. It highlighted the findings of the AAR in Orient Green Power Pte. Ltd.,8 which observed that a gift by a corporation to another corporation, though a subsidiary or an associate enterprise which is always claimed to be independent for tax purposes, is inherently a strange transaction. To postulate the idea that a corporation can give away its assets, free of cost or without any consideration, to another entity, even orally, points towards the possibility of dubious attempts at avoidance of tax payable. While the Madras HC’s blanket cynicism regarding corporate gifts may be critiqued as being too simplistic, its in-depth factual analysis drawn from the conduct of the entities inquiring into the substance of the transaction is the key takeaway. This line of jurisprudence, inquiring into issues with a lens of tax avoidance and profit shifting, has been on the rise since the OECD’s Base Erosion and Profit Shifting measures and allied domestic law changes; and it would be reasonable to assume that courts and tribunals are likely to continue looking through structures, in order to assess their substance, in most cases involving a claim of exemption or a concessional tax treatment. – Varsha Bhattacharya, Arijit Ghosh & Ipsita Agarwalla You can direct your queries or comments to the authors 1 T.C.A Nos. 590 & 591 of 2019 dated December 10, 2020. 2 Other questions were raised before the Madras HC arising out of the ITAT’s order with regard to trademark fee and bank/corporate guarantees. 3 (1985) 156 ITR 509 (SC) 4 (1981) 128 ITR 294 (SC) 5 In Re: Bid Services Division (Mauritius) Ltd., AAR No. 1270/2011, decision dated 10.02.2020. 6 [2020] 428 ITR 327 (Bombay) 7 [2016] 238 Taxman 185 (Gujarat) 8 (2012) 346 ITR 557 DisclaimerThe contents of this hotline should not be construed as legal opinion. View detailed disclaimer. |

|

- Inter-company transfer of shares without consideration held not to be exempt absent meeting criteria of valid “gift”; held subject to capital gains tax.

- Gift of shares to subsidiary held not to be valid gift as elements of ‘voluntariness’ and ‘absence of consideration’ were not supported by factual findings from board resolutions and share transfer deeds.

- Held that courts are entitled to lift the corporate veil to decipher the real intention behind a transaction, to conclude on the validity of a gift.

- Devise of gift held to be made for specific purpose of avoiding tax in India.

In a recent decision,1 the Madras High Court (“Madras HC” or “Court”) held that an inter-company gift of shares made as part of a corporate restructuring exercise was not a valid gift and should be subject to capital gains tax under the Income-tax Act, 1961 (“ITA”). The Court held the transaction to be a circular transaction, undertaken to avoid tax by shifting profits outside India.

BACKGROUNDRedington (India) Ltd. (“RI” or “Assessee”), a company incorporated in India, carried out operations in the Middle East and Africa through its wholly owned subsidiary: Redington Gulf FZE (“RG”). In 2008, a private equity firm (“PE firm”) evinced interest in investing in the Assessee’s Middle East and Africa operations. Pursuant thereto, the following steps were undertaken:

- Incorporation of Redington International Mauritius Limited (“RM”), Mauritius, in 2008 with an initial investment of USD 25,000 entirely held by Assessee

- RM thereafter incorporated Redington International (Holdings) Limited in the Cayman Islands (“RC”)

- On November 13, 2008, Assessee gifted its entire shareholding in RG to RC (“Transaction”) pursuant to which RG became a step-down subsidiary of RM

- The PE firm invested USD 65 million in RC for a 27.14% equity stake, valuing RC at USD 239 million.

The Transaction is depicted below:

The Assessee’s case was selected for scrutiny and was referred to the Transfer Pricing Officer (“TPO”). The TPO passed a draft assessment order proposing inter-alia an addition for long-term capital gain (“LTCG”) arising on transfer of shares of RG to RC. The Dispute Resolution Panel upheld the LTCG addition, that was then confirmed in the final assessment order. On appeal, the Income-tax Appellate Tribunal (“ITAT”) held the transfer of shares without consideration to be a valid gift exempt from capital gains tax under section 47(iii) of the ITA. The Revenue preferred an appeal to the Madras HC against the ITAT’s order on the fundamental question:2 whether the ITAT was correct in holding that the transfer of shares by the Assessee to its subsidiary was to be considered a ‘gift’.

MADRAS HC RULING- The Madras HC held that a company is capable of executing a gift, basis section 5 of the Transfer of Property Act, 1882 (“TOPA”), which considers a company a ‘living person’ capable of conveying property.

- On the validity of a gift, the Court noted the essential elements of a gift per section 122 of the TOPA: (i) the absence of consideration; (ii) a person being the donor; (iii) another person being the donee; (iv) the existence of voluntariness; (v) the subject matter of the gift; (vi) the transfer; and (vii) the acceptance. It observed that while there was no dispute regarding the general proposition as to what constitutes a valid gift, without considering the factual position it could not decide whether there was a valid gift under section 122 of the TOPA. It held that the tax authorities, as well as courts and tribunals, were entitled to lift the corporate veil to examine the real intention of parties in effecting transactions, in order to conclude whether the gifts were genuine.

- The Madras HC delved into the factual conclusions drawn by the TPO: that neither in the board resolutions, nor in the deeds of share transfer, was there is any mention of the word ‘gift’ or any other terms to indicate that the parties intended for the transfer to be a 'gift’. It was observed that the board resolution in fact stated that the transfer of shares towards re-structuring was to take place ‘with or without consideration’. It also noted the sworn statement of the Assessee’s Chief Financial Officer (admitting to re-structuring as the only rationale behind the gift). This indicated, as per the Court, that at the time when the board of directors of the Assessee took a decision to transfer its entire holdings in RG to RC, it did not consider the transfer to be a gratuitous transfer, and hence there was no element of voluntariness.

- The Court also found that along with the requisite element of ‘voluntariness’, the element of ‘absence of consideration’ was also missing as the Transaction was structured to accommodate the third-party investor, who had placed certain conditions even prior to effecting the transfer. The investment by the PE firm, it was held, constituted consideration and hence the transfer could not be a gift.

- The Court rejected the Assessee’s contention that in the absence of any consideration, capital gains tax could not be levied due to failure of computation mechanism. It distinguished the facts in Sunil Siddharthbhai v. CIT3 and CIT v. B.C. Srinivasa Shetty4 - cases relied on by the Assessee – on the basis that those decisions were rendered in ideal fact situations involving no allegations of tax avoidance against the assessee, while the case before them involved dubious transactions made in order to escape tax liability in India.

- On the question of tax avoidance, the Court affirmed the findings of the TPO holding that RC and RM were incorporated only to serve as conduit companies for the purpose of avoiding tax in India. It relied heavily on the TPO’s analysis as to how the structure enabled a loss in revenue for India caused by the shifting of profits outside the country, including calculations demonstrating how any dividends declared by RG would accrue to entities incorporated in low tax jurisdictions, to conclude that the transaction was circular in nature and set up only to avoid Indian taxes.

This is yet another in a line of recent decisions where courts and tax authorities have looked through structures from a pre-GAAR period, increasingly following a ‘substance over form’ approach.

The Madras HC here has carefully analyzed the entire chain of events involved in the corporate restructuring to arrive at its narrative of tax avoidance. The Court has considered the steps involved, their timing, and the purpose of each entity involved, along with documentary evidence in the form of board resolutions, texts of share transfer deeds, and statements from company officials, to piece together a wholistic picture to set the context for the gift of shares. This exercise of the Court is reminiscent of the exercise undertaken by the Authority for Advance Rulings (“AAR”) in Bid Services Division5 where benefit under the India-Mauritius tax treaty was denied to the assessee, based on a review of the purpose of the Mauritius-based taxpayer and the timelines involved in its creation, that led the AAR to conclude that the entity had been set up only to avail of the Mauritius treaty benefits and did not possess the requisite substance.

While High Courts do not typically delve into factual analyses in appeals before them, the Madras HC in this case has placed heavy reliance on the factual analysis undertaken by the lower authorities (specifically the TPO), and has commented on the ITAT’s silence on these factual aspects. Notably, the Madras HC did not simply remand the matter to the ITAT to look into the facts afresh. For multi-stepped corporate reorganizations, it is now more important than ever to evaluate the existence of commercial substance against not only statutory but also judicially developed anti-avoidance doctrine as the law keeps evolving, and to carefully review documentation with a close lens.

On the law on corporate gifts, this decision of the Madras HC adds more dimension to the debate. In a recent decision the Bombay High Court in Asian Satellite Broadcast v. ITO,6 relying on a decision of the Gujarat High Court in Prakriya Pharmacem v. ITO,7 held unequivocally that by operation of section 47(iii) of the ITA, any transfer of a capital asset under a gift could not be taxed as capital gain. The Madras HC has distinguished these High Court decisions on the basis that the main question in Asian Satellite (supra) was the validity of a reopening notice on the allegation that the corporate gift was a colorable device, when the gift had initially been accepted as such by the assessing officer during the original assessments. These cases, the Madras HC held, do not involve fact patterns where the gift has been made in a context that clearly indicated avoidance. It highlighted the findings of the AAR in Orient Green Power Pte. Ltd.,8 which observed that a gift by a corporation to another corporation, though a subsidiary or an associate enterprise which is always claimed to be independent for tax purposes, is inherently a strange transaction. To postulate the idea that a corporation can give away its assets, free of cost or without any consideration, to another entity, even orally, points towards the possibility of dubious attempts at avoidance of tax payable.

While the Madras HC’s blanket cynicism regarding corporate gifts may be critiqued as being too simplistic, its in-depth factual analysis drawn from the conduct of the entities inquiring into the substance of the transaction is the key takeaway. This line of jurisprudence, inquiring into issues with a lens of tax avoidance and profit shifting, has been on the rise since the OECD’s Base Erosion and Profit Shifting measures and allied domestic law changes; and it would be reasonable to assume that courts and tribunals are likely to continue looking through structures, in order to assess their substance, in most cases involving a claim of exemption or a concessional tax treatment.

– Varsha Bhattacharya, Arijit Ghosh & Ipsita Agarwalla

You can direct your queries or comments to the authors

1 T.C.A Nos. 590 & 591 of 2019 dated December 10, 2020.

2 Other questions were raised before the Madras HC arising out of the ITAT’s order with regard to trademark fee and bank/corporate guarantees.

3 (1985) 156 ITR 509 (SC)

4 (1981) 128 ITR 294 (SC)

5 In Re: Bid Services Division (Mauritius) Ltd., AAR No. 1270/2011, decision dated 10.02.2020.

6 [2020] 428 ITR 327 (Bombay)

7 [2016] 238 Taxman 185 (Gujarat)

8 (2012) 346 ITR 557

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.

Research PapersMergers & Acquisitions New Age of Franchising Life Sciences 2025 |

Research Articles |

AudioCCI’s Deal Value Test Securities Market Regulator’s Continued Quest Against “Unfiltered” Financial Advice Digital Lending - Part 1 - What's New with NBFC P2Ps |

NDA ConnectConnect with us at events, |

NDA Hotline |