Investment Funds: Monthly DigestOctober 15, 2020 Term, Termination and Liquidation of an AIF: Indian legal considerations - April 2020During these unfortunate COVID-19 times, many funds could be facing issues pertaining to tenure of the fund (including extension, early termination and liquidation). In this edition of the monthly digest, we have discussed the term, termination and liquidation of Category I and Category II Alternative Investment Fund/s (“AIF” or “fund”) being closed-end funds, registered with the Securities and Exchange Board of India (“SEBI”) under the SEBI (Alternative Investment Funds) Regulations, 2012 (the “AIF Regulations”). Regulation 13(1) of the AIF Regulations requires the tenure of a Category I and Category II Alternative Investment Funds to be determined at the time of making the application itself. Further, extensions to the tenure are permitted for up to two years with an approval of at least two-third of investors by value. Typically, an AIF is intended to terminate automatically upon the expiry of its fixed tenure as set out in the relevant fund documents. However, an “early termination” clause is also stipulated in the governing documents of AIFs covering circumstances where an AIF may be wound up prior to its intended automatic expiry. The AIF Regulations also provide for early termination of an AIF. Fund managers and investors are generally aligned to make best efforts to continue the fund until its originally intended tenure, especially in long term funds where investments are expected to appreciate over time. The underlying objective is to maximize the value from the portfolio, and align the timing of the AIF’s tenure accordingly. The AIF should be able to make an ‘orderly exit’ from the portfolio, so that it is able to realise the expected exit value commensurate with the risk return profile of the asset class. The AIF Regulations draw a distinction between winding-up (or termination) and liquidation of an AIF1, whereby the latter is expected to take place within a year of the former, as discussed subsequently. This distinction becomes relevant in the context of investor giveback provisions. INDIAN LEGAL PROVISIONS ON WINDING UP OF AIFSRegulation 29 of the AIF Regulations (as charted out below) deals with winding up of AIF.

The AIF Regulations also permit the trustee of an AIF which is set up as a trust, to wind up the AIF without any investor consent, as long as the trustee is satisfied that such winding up is in the interests of investors of the AIF4. Once the AIF is wound up, the trustee / board of directors / designated partners (as the case may be) is/are required to intimate SEBI and the investors of the circumstances leading to such winding up. Further, the AIF Regulations require the AIF so wound up, to: (a) abstain from making any further investments on and from the date of such intimation as mentioned herein; and (b) liquidate its assets within a year from the date of such intimation as mentioned herein and distribute the proceeds accruing to the investor after satisfying the liabilities.5 CERTAIN FUND TERMS RELEVANT TO WINDING UPCertain fund terms which act in tandem with, or could impact the winding up of a closed-end fund are briefly discussed below:

Termination of a fund is an integral part of its life-cycle, in the same way as a “formation” of a fund is. There may be several reasons for terminating a fund including as stated in IOSCO’s report on good practices on voluntary termination9 being “weak investor demand, unfavourable economic conditions or commercial decisions by the entity responsible for the overall operation of the investment fund..” etc. Once the decision to terminate the AIF is arrived at and the AIF stands terminated, the liquidator proceeds for liquidation of the assets of the AIF within an agreed timeframe and in accordance with the constitutional documents of the AIF, subject always to the AIF Regulations. The investment manager of the AIF may act as the liquidator of the AIF and/or an external liquidator may be appointed for the orderly liquidation of the assets. The fees payable to such liquidator is generally paid out of the assets of the AIF. Upon liquidation, distribution of the assets is made in accordance with the distribution mechanism set out in the fund documents, after satisfying all the liabilities of the fund. In respect of any outstanding tax claims or liabilities arising out of the representations and warranties to the buyer of the portfolio from the AIF, the constitutional documents would provide for investor giveback mechanisms, tax indemnity from investors and carry clawback mechanism. It is unusual to have escrow mechanism set in place for unrealized but possible liabilities at the time of liquidation. However, if at the time of liquidation there are certain realized or ascertained liability, the same may be subject to escrow. It is imperative to have a definitive mechanism laid down in the constitutional documents of the AIF in to enable efficient liquidation. In this piece, we have only provided agnostic views for different types of AIFs (ignoring their strategy, nature of LPs, volume of track record etc.). Different views and options can be designed for AIFs depending on their distinguishing factors. – Nandini Pathak, Richie Sancheti & Parul Jain You can direct your queries or comments to the authors 1 Regulation 13(5) of the AIF Regulations. 2 Section 64(b) of the Limited Liability Partnerships Act, 2008 3 LLP – Limited Liability Partnership 4 Regulation 29(1)(b) of the AIF Regulations 5 Regulation 29 of the AIF Regulations 6 CIR/IMD/DF/14/2014 dated June 19, 2014 7 Regulation 13(5) of the AIF Regulations. 9 Report by The Board of The International Organization 8of Securities Commissions, no. FR23/2017, published in November 2017 DisclaimerThe contents of this hotline should not be construed as legal opinion. View detailed disclaimer. |

|

During these unfortunate COVID-19 times, many funds could be facing issues pertaining to tenure of the fund (including extension, early termination and liquidation).

In this edition of the monthly digest, we have discussed the term, termination and liquidation of Category I and Category II Alternative Investment Fund/s (“AIF” or “fund”) being closed-end funds, registered with the Securities and Exchange Board of India (“SEBI”) under the SEBI (Alternative Investment Funds) Regulations, 2012 (the “AIF Regulations”).

Regulation 13(1) of the AIF Regulations requires the tenure of a Category I and Category II Alternative Investment Funds to be determined at the time of making the application itself. Further, extensions to the tenure are permitted for up to two years with an approval of at least two-third of investors by value.

Typically, an AIF is intended to terminate automatically upon the expiry of its fixed tenure as set out in the relevant fund documents. However, an “early termination” clause is also stipulated in the governing documents of AIFs covering circumstances where an AIF may be wound up prior to its intended automatic expiry. The AIF Regulations also provide for early termination of an AIF.

Fund managers and investors are generally aligned to make best efforts to continue the fund until its originally intended tenure, especially in long term funds where investments are expected to appreciate over time. The underlying objective is to maximize the value from the portfolio, and align the timing of the AIF’s tenure accordingly. The AIF should be able to make an ‘orderly exit’ from the portfolio, so that it is able to realise the expected exit value commensurate with the risk return profile of the asset class.

The AIF Regulations draw a distinction between winding-up (or termination) and liquidation of an AIF1, whereby the latter is expected to take place within a year of the former, as discussed subsequently. This distinction becomes relevant in the context of investor giveback provisions.

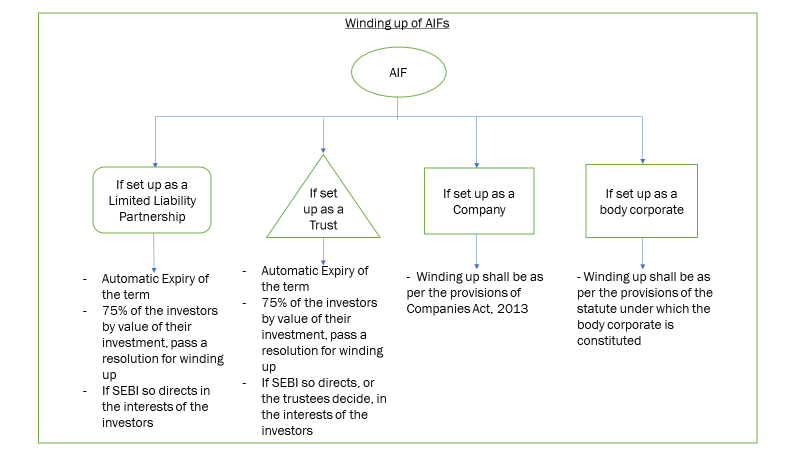

INDIAN LEGAL PROVISIONS ON WINDING UP OF AIFSRegulation 29 of the AIF Regulations (as charted out below) deals with winding up of AIF.

In addition to the above, the winding up of an AIF is also required to be governed by the law under which it is incorporated. For example, the Limited Liability Partnerships Act, 20082 provides for an LLP3 to be wound up compulsorily if there are less than 2 partners in the said LLP for a period of more than 6 months. Therefore, if an AIF is set up in the form of an LLP and has less than 2 partners for a period longer than 6 months, the said AIF may be wound up.

The AIF Regulations also permit the trustee of an AIF which is set up as a trust, to wind up the AIF without any investor consent, as long as the trustee is satisfied that such winding up is in the interests of investors of the AIF4.

Once the AIF is wound up, the trustee / board of directors / designated partners (as the case may be) is/are required to intimate SEBI and the investors of the circumstances leading to such winding up. Further, the AIF Regulations require the AIF so wound up, to: (a) abstain from making any further investments on and from the date of such intimation as mentioned herein; and (b) liquidate its assets within a year from the date of such intimation as mentioned herein and distribute the proceeds accruing to the investor after satisfying the liabilities.5

CERTAIN FUND TERMS RELEVANT TO WINDING UPCertain fund terms which act in tandem with, or could impact the winding up of a closed-end fund are briefly discussed below:

- Early termination

A common ground for early termination which is not governed by the AIF Regulations is if the investment manager determines that continuance of the AIF could amount to violation of any law, or certain bad acts have been established (upon adjudication) with respect to the manager or the AIF itself and the LPs have collectively decided to wind up the fund. Termination on such grounds could also lead to economic consequences for the AIF manager. - Failure to replace the Investment Manager

In the event that the AIF manager is removed, and the investors are unable to find a replacement investment manager with a 75% vote by value, then the dissenting investors are to be given the option to exit the AIF.6 The obligation to ensure such exit is on the outgoing AIF manager. This is an anomaly in the AIF Regulations as the outgoing AIF manager is not incentivized to provide an exit to the dissenting investors. In such cases, it is likely for the AIF manager to move towards winding up of the AIF. - Transfer of Units

Upon winding up, the AIF manager is allowed a period of a year to liquidate the AIF.7 Upon intimating investors of such winding up, the units of the AIF should not be permitted to be transferred even to affiliates to allow proper ascertainment of LPs’ liabilities and avoid any administrative (including time and cost) inefficiencies, given the statutory timelines at play. - Parallel Funds or AIVs

In case of any parallel funds or alternative investment vehicles (where such vehicle’s portfolio is a subset of or identical with the main fund), the termination of the main fund could trigger a termination of such other vehicle (even though no trigger events have taken place for such other vehicle), in the event that it is not possible to segregate the portfolio holding of such funds for inter alia legal reasons. - Restructuring / rebranding of the AIF

One consideration at the time of exit for many investment managers is to sell the investment vehicle as an ongoing concern to a new replacement GP for its own set of LPs, without disturbing the portfolio. However, in the context of Indian AIFs, it is yet to be seen whether only the AIF ‘registration’ is wound up while the entity holding such registration (whether a trust, an LLP, a company) is applying for a new AIF registration for the new GP.8 In case of units of an AIF, applicability of section 56(2)(x) of the Indian Income-tax Act, 1961 is often discussed. In the event that the LP secondary is done below the fair market value, section 56(2)(x) may apply if the units in question fall within the defined term 'securities'. Further, LP secondaries in case of an AIF could result in double taxation if LPs pay taxes on the consideration amount for the AIF units, and then are taxed on income received by them on such units as and when the AIF makes a distribution to them. - Confidentiality Provisions

During the tenure of the fund, Investors are (by statue and as a matter of commercial expectations) entitled to certain reports and information from time to time from the manager. Such information may include or be supported by confidential information about the manager, the trustee, the portfolio companies and sometimes even associates and affiliates of the said persons. The nature of information could be price sensitive and may be also used for unfair competitive advantage among businesses. Accordingly, Investors are generally subject to their confidentiality obligations for an agreed time period after the winding up (and liquidation).

Termination of a fund is an integral part of its life-cycle, in the same way as a “formation” of a fund is. There may be several reasons for terminating a fund including as stated in IOSCO’s report on good practices on voluntary termination9 being “weak investor demand, unfavourable economic conditions or commercial decisions by the entity responsible for the overall operation of the investment fund..” etc.

Once the decision to terminate the AIF is arrived at and the AIF stands terminated, the liquidator proceeds for liquidation of the assets of the AIF within an agreed timeframe and in accordance with the constitutional documents of the AIF, subject always to the AIF Regulations. The investment manager of the AIF may act as the liquidator of the AIF and/or an external liquidator may be appointed for the orderly liquidation of the assets. The fees payable to such liquidator is generally paid out of the assets of the AIF. Upon liquidation, distribution of the assets is made in accordance with the distribution mechanism set out in the fund documents, after satisfying all the liabilities of the fund.

In respect of any outstanding tax claims or liabilities arising out of the representations and warranties to the buyer of the portfolio from the AIF, the constitutional documents would provide for investor giveback mechanisms, tax indemnity from investors and carry clawback mechanism. It is unusual to have escrow mechanism set in place for unrealized but possible liabilities at the time of liquidation. However, if at the time of liquidation there are certain realized or ascertained liability, the same may be subject to escrow.

It is imperative to have a definitive mechanism laid down in the constitutional documents of the AIF in to enable efficient liquidation.

In this piece, we have only provided agnostic views for different types of AIFs (ignoring their strategy, nature of LPs, volume of track record etc.). Different views and options can be designed for AIFs depending on their distinguishing factors.

– Nandini Pathak, Richie Sancheti & Parul Jain

You can direct your queries or comments to the authors

1 Regulation 13(5) of the AIF Regulations.

2 Section 64(b) of the Limited Liability Partnerships Act, 2008

3 LLP – Limited Liability Partnership

4 Regulation 29(1)(b) of the AIF Regulations

5 Regulation 29 of the AIF Regulations

6 CIR/IMD/DF/14/2014 dated June 19, 2014

7 Regulation 13(5) of the AIF Regulations.

9 Report by The Board of The International Organization 8of Securities Commissions, no. FR23/2017, published in November 2017

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.

Research PapersMergers & Acquisitions New Age of Franchising Life Sciences 2025 |

Research Articles |

AudioCCI’s Deal Value Test Securities Market Regulator’s Continued Quest Against “Unfiltered” Financial Advice Digital Lending - Part 1 - What's New with NBFC P2Ps |

NDA ConnectConnect with us at events, |

NDA Hotline |