Research ArticlesAugust 22, 2024 Navigating The Change in Shareholding and Management Rule for Non-Banking Financial Companies in India: A Practical Perspective

IntroductionNon-banking financial companies (“NBFCs”) refer to: (i) financial institutions that are companies; (ii) a non-banking institution that is a company having the principal business of either receiving deposits under schemes and arrangements or lending in any manner; or (iii) specified and notified non-banking institutions or a class of such institutions.1 There are multiple types of NBFCs in India, such as asset finance companies, investment companies, account aggregators, peer to peer lending platforms, core investment companies, housing finance companies (“HFC”), etc. In India, NBFCs are regulated by the Reserve Bank of India (“RBI”) through the rulemaking powers granted to it under the Reserve Bank of India Act, 1934 (“RBI Act”).2 Over the years, the RBI has developed numerous regulations and master directions to regulate NBFCs, the most recent of which is the Master Direction – Reserve Bank of India (Non-Banking Financial Company – Scale Based Regulation) Directions, 2023 (“Scale Based Regulations”) that bifurcates NBFCs into “layers” based on their size, activity and perceived riskiness.3 The Scale Based Regulations have been introduced inter alia in supersession of the Non-Banking Financial Company – Non-Systemically Important Non-Deposit taking (Reserve Bank) Directions, 2016 (“Non-Systemically Important Regulations”) and Non-Banking Financial Company – Systemically Important Non-Deposit taking Company and Deposit taking Company (Reserve Bank) Directions, 2016 (“Systemically Important Regulations”). Accordingly, NBFCs that were originally governed by these regulations shall now fall entirely under the purview of the Scale Based Regulations. However, for balance classes of NBFCs, other applicable regulations shall continue to govern such NBFC, in tandem, to the extent specified in the Scale Based Regulations.4 By way of example, the Non-Banking Financial Company – Housing Finance Company (Reserve Bank) Directions, 2021 (“HFC Directions”) shall continue to govern NBFC-HFCs. Pursuant to the rulemaking powers of the RBI in respect of NBFCs, two of the key rules within these regulations/ directions enacted by the RBI that are relevant from a deal-making perspective pertains to the prior approval of the RBI that is required pursuant to the: (i) Change in Shareholding Rule (as defined hereinafter); and (ii) Change in Management Rule (as defined hereinafter). Other than these, prior approval of the RBI is also required pursuant to the Change in Control Rule (as defined hereinafter). These rules particularly impact foreign institutional investors, such as impact investors and development finance institutions investing heavily in NBFCs. Within this backdrop, this article briefly analyses the scope of the Change in Shareholding Rule and Change in Management Rule. It also undertakes an examination of the practical challenges that NBFCs and investors alike may face when navigating the requirement of approval under these rules. Understanding the Change in Shareholding Rule and Change in Management RuleThe RBI originally released the Change in Shareholding Rule and Change in Management Rule vide the Non-Banking Financial Companies (Approval of Acquisition or Transfer of Control) Directions, 2015 (“RBI Directions 2015”),5 which was then separately imported and similarly worded within the underlying directions applicable to each class of NBFC to which these rules were intended to apply (such as the Non-Systemically Important Regulations,6 Systemically Important Regulations7 and the HFC Directions8). Subsequently, the RBI Directions 2015 were withdrawn. Broadly, as per the RBI Directions 2015, prior written approval of the RBI was required to be procured by an NBFC in the following three circumstances:

As mentioned above, the language of these rules was also slightly amended for specific classes of NBFCs. For instance, the Change in Shareholding Rule for an HFC accepting public deposits, under the HFC Directions, is as follows: “any change in the shareholding of an HFC accepting/ holding public deposits, including progressive increases over time, which would result in acquisition/ transfer of shareholding of 10 per cent or more of the paid-up equity capital of the HFC by/to a foreign investor”.9 The language for the Change in Shareholding Rule and Change in Management Rule, as per the Scale Based Regulations, is broadly as below:

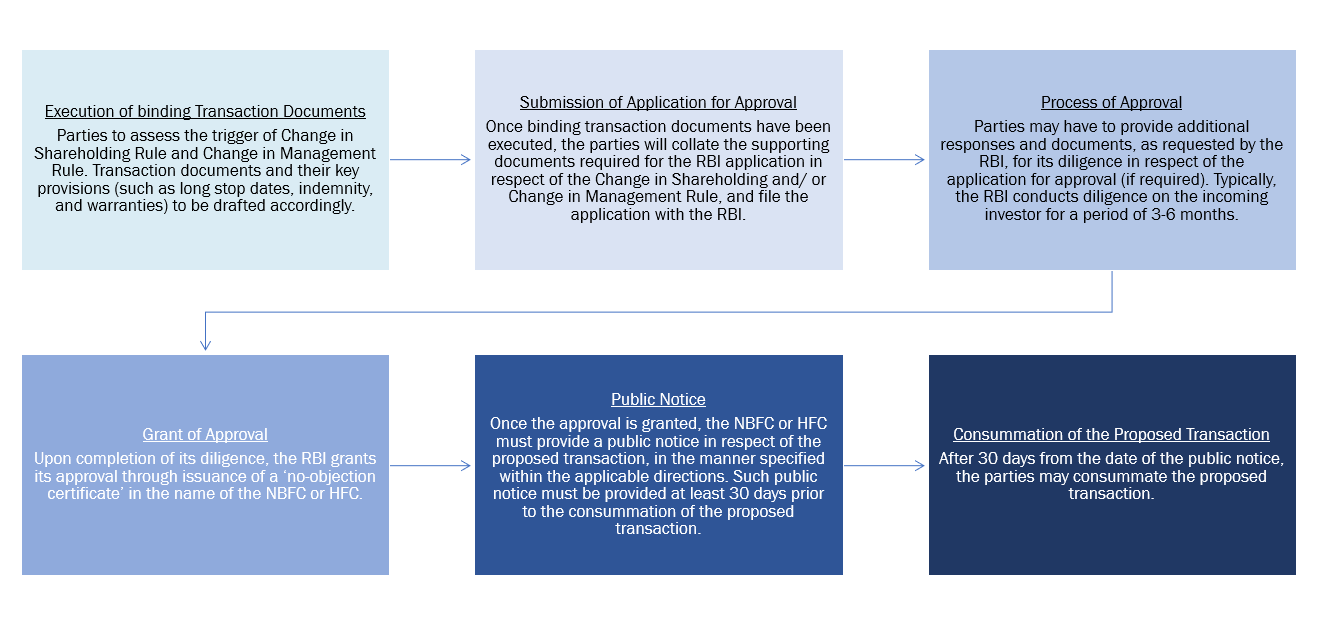

It is to be noted that the phrase “of the paid-up equity share capital of the Company” (which was present within the RBI Directions 2015, Non-Systemically Important Regulations, Systemically Important Regulations and the HFC Directions) is not added into the Scale Based Regulations (language for both of these are in red in the respective paragraphs above). Requirements under these rulesFor procuring an approval pursuant to the Change in Shareholding Rule or the Change in Management Rule, the NBFC must make a written application to the RBI on its letterhead, providing details of the proposed changes requiring its approval, along with specified supporting documents such as the information required in the annexure, a source of funds declaration, declarations in respect of the Negotiable Instruments Act, a bankers’ report, and a declaration on the status of specified supervisory compliances.10 Upon a perusal of these documents, and subject to the satisfaction of the RBI, a no-objection certificate is issued by it to the NBFC, granting its approval for consummation of the requested changes that are set out in the application. Upon receipt of this certificate / approval from the RBI, the NBFC has to provide a public notice of the proposed changes occurring due to the Change in Shareholding Rule or Change in Management Rule, at least 30 days prior to consummation of the change(s) for which approval was sought.11 Once this time has elapsed (and assuming that no objections have been received pursuant to the public notice provided by the NBFC), the requested change(s) may be consummated. A flow-chart of the steps to be followed by parties during investments into NBFCs, to assess the applicability and trigger of the Change in Shareholding Rule and Change in Management Rule and receive the RBI approval, is as follows:

AnalysisThere are two important takeaways, from a deal-making perspective, based on our analysis of the Change in Shareholding Rule and Change in Management Rule: Firstly, the text of both of these rules is company-centric in nature. In other words, the obligation to procure prior approval from the RBI is on the NBFC. However, approval is sought in respect of the underlying transaction, being the change in shareholding or management effectuated due to the entry of the incoming investor. Accordingly, any applications pursuant to the Change in Shareholding Rule or Change in Management Rule will be undertaken by the NBFC, for the incoming investor. The practical consequence of these rules is that the management of the NBFC, along with the incoming investor, will have to undertake a conjoint effort to obtain RBI approval for consummation of the transaction. However, the NBFC will be submitting the application and will therefore be the sole direct point of contact with the RBI for the entire approval process. Secondly, the text of the Change in Shareholding Rule is extremely broad in scope. Due to the presence of the phrase “including progressive increases over time” , the following types of transactions shall need to be assessed to determine the potential requirement of prior approval of the RBI: (i) multiple separate investments occurring simultaneously into an NBFC, which while individually smaller in size, may cumulatively lead to a 26% change in the share capital; (ii) any progressive increase in the share capital of an NBFC, which even if lower than 26% in terms of the individual post-closing shareholding of the incoming investor, leads to a 26% change in the share capital from the previous approval received from the RBI; and (iii) any single subsequent tranche of investment, by an investor that is partly invested in the NBFC, in case consummation of any subsequent tranche leads to a 26% change in the share capital of an NBFC. Therefore, parties must ensure that right from the structuring and preliminary documentation stage, the contours of their deal are analysed to assess the requirement of RBI’s approval under this rule. Impact of the Change in Shareholding Rule and Change in Management Rule on transactionsThe process of seeking approval of the RBI does not stop at the stage of submission of the application under the Change in Shareholding Rule and Change in Management Rule, as the RBI has the power to seek further clarification by way of written responses or relevant supporting documents, until it has enough relevant information to provide an approval. Additionally, since the timeline for grant of approval is not specified, this may impact the deal timelines and outcome. We have highlighted some key considerations arising from this process, for both the incoming investor and the NBFC, below: Key considerations for the incoming investor

Neither the Scale Based Regulations nor the HFC Directions provide timelines within which the approval shall be received. Accordingly, the incoming investor may have to account for this timeline and its impact on the ‘closing’ of the proposed transaction at the documentation stage. The investor must also ensure that an adequate buffer is built in within the ‘long stop date’ set forth in the transaction documents, and in such a manner that such date accounts both for: (i) the time taken to receive an approval; and (ii) the 30-day timeline for the public notice. Importantly, in the event that the proposed transaction may be subject to other regulatory approvals in India (such as the approval of the Competition Commission of India in respect of combinations exceeding the specified thresholds under Sections 5 and 6 of the Competition Act, 2002), the investor may additionally consider requiring the NBFC to apply for all such approvals simultaneously.

Being a discretionary body, the RBI has the power to requisition as many additional supporting documents or information that it deems necessary and adequate to conduct its “due diligence” on the incoming investor. Currently, the: (i) scope of information and documents that may be sought by the RBI, and (ii) the number of requisitions that can be sent across to the parties prior to grant of an approval, has not been specified within any of its directions. Especially in respect of the Change in Shareholding Rule, this may lead to circumstances wherein the RBI may requisition supporting documents or information that may be high in volume, confidential in nature, or require adequate internal clearances within the investor’s organization prior to their release. Common examples of such requisitions may include information about the group companies of an incoming investor in order to identify the ultimate beneficial owner of the investor, and details about the foreign regulators exercising jurisdiction upon the investor (along with all applicable registration certificates). While these requisitions are not generally time-bound at the NBFC’s end, the RBI has the discretion to impose a timeline within which responses and documents should be provided, which may further exacerbate the challenges of larger institutional investors in sourcing these documents. Further, given the absence of direct communication between the investor and the RBI, the investor may not always be able to understand the underlying concerns of the RBI or assist them in its resolution through direct communication, as all communications of the RBI occur only with the authorized representatives of the NBFC. This may be particularly detrimental in case the RBI believes that information submitted to it (within the supporting documents) is incomplete, inadequate or incorrect and requests for additional clarifications or amendments to the documents. Here, the investor would not be able to provide a direct explanation or response to the RBI and may have to liaise with the NBFC to convey the same, which may not be time efficient and can continue to leave room for misconstruction. Lastly, in respect of the Change in Management Rule, the proposed board nominee of the incoming investor may have to be amenable to respond to any additional requisitions requiring their personal identification details/ personal documents.

Non-receipt or denial of an approval would typically imply that the proposed transactions cannot be consummated. We have recently seen the RBI impose monetary penalties of over INR 1,00,000 (Indian Rupees One Lakh) on Nido Home Finance Limited12 and West End Housing Finance Limited13 for a failure to seek prior written approval of the RBI for change in shareholding pursuant to the HFC Directions.

Each of the Scale Based Regulations and HFC Directions are silent on the direct consequences in relation to a director that has already been appointed to the board, for whom prior approval under the Change in Management Rule has not been sought from the RBI. However, recent practice of the RBI reveals that NBFCs will be fined with a penalty in case of non-compliance with this rule – a recent fine of INR 5,00,000 was imposed by the RBI on Bajaj Housing Finance Limited, Pune, for non-receipt of prior approval under the Change in Management Rule.14 Penalties have also been imposed for similar violations on M/s Srestha Finvest Limited,15 Ashoka Viniyoga Limited,16 Sappers Finance and Consultancy Private Limited17 and M/s Swagatam Marketing Private Limited.18

The public notice to be provided pursuant to receipt of approval under the Change in Shareholding Rule and Change in Management Rule must feature within at least one leading national newspaper and one leading local vernacular newspaper (in the registered office of the NBFC). It must also indicate the intention of selling/ transferring ownership or control, provide particulars of the transferee, and the reasons for consummation of the transaction for which approval was sought.19 The disclosures under this public notice may lead to certain confidential or sensitive deal details becoming public information. Accordingly, in the event that the transaction is intended to be confidential, the incoming investor must: (i) at the structuring stage, analyse the requirement of an RBI approval, to understand whether approvals and the public notice will be triggered; and (ii) if the investor proceeds to the negotiation and documentation stage, ensure that sensitive details are not disclosed within the public notice, to the extent possible. Key considerations for the NBFC

The business models of NBFCs are generally capital-intensive, and often require funding within specified timelines in order to meet their targets. As mentioned above, the absence of specified timelines for grant of approval leads to the absence of clarity in respect of the ‘closing’ of the transaction. Additionally, even upon receipt of approval, the NBFC is supposed to provide a public notice for at least 30 days, which further extends the deal timeline. Accordingly, the NBFC must evaluate the deal timelines carefully and map it with their immediate and long-term funding requirements, in order to ensure business continuity.

Given the company-centric nature of the Change in Shareholding Rule and Change in Management Rule, the NBFC will have to ensure that: (i) all documents and information are submitted to the RBI by them on behalf of the investor in a timely manner; and (ii) the authorized representatives of the NFBC (generally, the signatories to the RBI application or the compliance officers) are in constant touch with the RBI to ensure that the timelines and expectations of the regulator are balanced with the investor’s turnaround time and disclosures. Additionally, care must be taken to ensure that miscommunication is avoided to the extent possible.

There may be cases in which the RBI may grant a ‘conditional’ approval pursuant to the Change in Shareholding Rule. By way of example, in the event that approval is sought for an investment undertaken through issuance of compulsory convertible preference shares, the RBI may grant approval for such investment, subject to the condition that prior approval is sought again upon their conversion into equity shares. The NBFC must monitor such approvals and ensure that their conditions are met going forward.

According to the erstwhile RBI Directions 2015, if a public notice was not provided in respect of the proposed transaction (upon receipt of approval), the RBI was entitled to undertake “adverse regulatory action including cancellation of the certificate of registration” against the NBFC.20 While there is absence of abundant clarity with respect to the scope of the “regulatory action” that may be undertaken by the RBI (other than cancellation of the certificate of registration or the imposition of penalties, details of which have been provided above), the NBFC must ensure that the applicable provisions of the governing directions are adhered to. ConclusionThe Change in Shareholding Rule and Change in Management Rule have a significant impact on investments into Indian NBFCs. The practical process/ challenges that may be associated with receipt of an RBI approval must be adequately assessed and factored into the transaction structuring and documentation, by the incoming investor and NBFC alike, in order to avoid a potential deal breakdown and other unintended consequences.

Authors Parina Muchhala and Nishchal Joshipura You can direct your queries or comments to the relevant member. 1Section 45I (f), RBI Act, available at: https://rbidocs.rbi.org.in/ rdocs/Publications/ PDFs/RBIA1934170510.PDF. 2See generally, Chapter III-B, RBI Act. 3Scale Based Regulations, available at: https://rbidocs.rbi.org.in/ rdocs/notification/ PDFs/NT1127AD09AD866 884557BD4DEEA150ACC91A.PDF. 4Ibid, Direction 4.3. 5RBI Directions 2015, available at: https://rbi.org.in/Scripts/NotificationUser.aspx?Id=9934&Mode=0. 6Regulation 61, Non-Systemically Important Regulations, available at: https://rbidocs.rbi.org.in/rdocs/content/pdfs/NSIND01092016_AN.pdf. 7Regulation 66, Systemically Important Regulations, available at: https://rbidocs.rbi.org.in/rdocs/content/pdfs/45MD01092016_AN1.pdf. 8Regulation 45, HFC Directions, available at: https://rbidocs.rbi.org.in/rdocs/content/pdfs/MD100017022021_A.pdf. 9Direction 45.2, HFC Directions 2021. 10Direction 4, RBI Directions 2015, as found in Direction 46 of the HFC Directions and Direction 42 of the Scale Based Regulations. 11Ibid. 12‘RBI imposes monetary penalty on Nido Home Finance Limited (formerly known as Edelweiss Housing Finance Limited), Mumbai’, available at: https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=56383. 13‘RBI imposes monetary penalty on West End Housing Finance Limited, Mumbai, Maharashtra’, available at: https://rbi.org.in/scripts/BS_PressReleaseDisplay.aspx?prid=56571. 14RBI imposes monetary penalty on Bajaj Housing Finance Limited, Pune’, available at: https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=57242. 15‘RBI imposes monetary penalty on M/s Srestha Finvest Limited, Chennai, Tamil Nadu’, available at: https://www.rbi.org.in/commonman/Upload/English/PressRelease/PDFs/PR264_M.pdf. 16‘RBI imposes monetary penalty on Ashoka Viniyoga Limited, New Delhi’, available at: https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=58479. 17‘RBI imposes monetary penalty on Sappers Finance and Consultancy Private Limited, Kolkata’, available at: https://www.rbi.org.in/ commonman/Upload/ English/PressRelease/ PDFs/PR1322_21112023.pdf. 18‘RBI imposes monetary penalty on M/s Swagatam Marketing Private Limited, Kolkata, Maharashtra’, available at: https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=54242. 19Direction 5, RBI Directions 2015 as found in, Direction 47 of the HFC Directions and Direction 42 of the Scale Based Regulations. 20Regulation 6, RBI Directions 2015. DisclaimerThe contents of this hotline should not be construed as legal opinion. View detailed disclaimer. |

|

-

Under the existing Scale Based Regulations, 2023 applicable to non-banking financial companies in India, changes in shareholding of 26% of more and changes to the management of 30% or more are currently subject to the prior approval of the Reserve Bank of India. Such approval has to be obtained by the non-banking financial company.

-

Considering that the changes in shareholding and management are effectuated by incoming investors, the approval is granted in respect of such changes and requires the incoming investors to work together with the non-banking financial companies.

-

Consummating these transactions without prior approval of the Reserve Bank of India may attract penalties payable by non-banking financial companies.

Introduction

Non-banking financial companies (“NBFCs”) refer to: (i) financial institutions that are companies; (ii) a non-banking institution that is a company having the principal business of either receiving deposits under schemes and arrangements or lending in any manner; or (iii) specified and notified non-banking institutions or a class of such institutions.1 There are multiple types of NBFCs in India, such as asset finance companies, investment companies, account aggregators, peer to peer lending platforms, core investment companies, housing finance companies (“HFC”), etc.

In India, NBFCs are regulated by the Reserve Bank of India (“RBI”) through the rulemaking powers granted to it under the Reserve Bank of India Act, 1934 (“RBI Act”).2 Over the years, the RBI has developed numerous regulations and master directions to regulate NBFCs, the most recent of which is the Master Direction – Reserve Bank of India (Non-Banking Financial Company – Scale Based Regulation) Directions, 2023 (“Scale Based Regulations”) that bifurcates NBFCs into “layers” based on their size, activity and perceived riskiness.3

The Scale Based Regulations have been introduced inter alia in supersession of the Non-Banking Financial Company – Non-Systemically Important Non-Deposit taking (Reserve Bank) Directions, 2016 (“Non-Systemically Important Regulations”) and Non-Banking Financial Company – Systemically Important Non-Deposit taking Company and Deposit taking Company (Reserve Bank) Directions, 2016 (“Systemically Important Regulations”). Accordingly, NBFCs that were originally governed by these regulations shall now fall entirely under the purview of the Scale Based Regulations. However, for balance classes of NBFCs, other applicable regulations shall continue to govern such NBFC, in tandem, to the extent specified in the Scale Based Regulations.4 By way of example, the Non-Banking Financial Company – Housing Finance Company (Reserve Bank) Directions, 2021 (“HFC Directions”) shall continue to govern NBFC-HFCs.

Pursuant to the rulemaking powers of the RBI in respect of NBFCs, two of the key rules within these regulations/ directions enacted by the RBI that are relevant from a deal-making perspective pertains to the prior approval of the RBI that is required pursuant to the: (i) Change in Shareholding Rule (as defined hereinafter); and (ii) Change in Management Rule (as defined hereinafter). Other than these, prior approval of the RBI is also required pursuant to the Change in Control Rule (as defined hereinafter).

These rules particularly impact foreign institutional investors, such as impact investors and development finance institutions investing heavily in NBFCs. Within this backdrop, this article briefly analyses the scope of the Change in Shareholding Rule and Change in Management Rule. It also undertakes an examination of the practical challenges that NBFCs and investors alike may face when navigating the requirement of approval under these rules.

Understanding the Change in Shareholding Rule and Change in Management Rule

The RBI originally released the Change in Shareholding Rule and Change in Management Rule vide the Non-Banking Financial Companies (Approval of Acquisition or Transfer of Control) Directions, 2015 (“RBI Directions 2015”),5 which was then separately imported and similarly worded within the underlying directions applicable to each class of NBFC to which these rules were intended to apply (such as the Non-Systemically Important Regulations,6 Systemically Important Regulations7 and the HFC Directions8). Subsequently, the RBI Directions 2015 were withdrawn.

Broadly, as per the RBI Directions 2015, prior written approval of the RBI was required to be procured by an NBFC in the following three circumstances:

-

any takeover or acquisition of control of an NBFC, which may or may not result in change of management (“Change in Control Rule”);

-

any change in the shareholding of an NBFC, including progressive increases over time, which would result in acquisition/ transfer of shareholding of 26% or more of the paid-up equity capital of the NBFC, excluding changes pursuant to a buy-back of shares or reduction of capital approved by a competent court (“Change in Shareholding Rule”); and

-

any change in the management of an NBFC, which would result in change in more than 30% of the directors, excluding independent directors or re-election of directors on retirement by rotation (“Change in Management Rule”).

As mentioned above, the language of these rules was also slightly amended for specific classes of NBFCs. For instance, the Change in Shareholding Rule for an HFC accepting public deposits, under the HFC Directions, is as follows: “any change in the shareholding of an HFC accepting/ holding public deposits, including progressive increases over time, which would result in acquisition/ transfer of shareholding of 10 per cent or more of the paid-up equity capital of the HFC by/to a foreign investor”.9

The language for the Change in Shareholding Rule and Change in Management Rule, as per the Scale Based Regulations, is broadly as below:

-

any takeover or acquisition of control of an NBFC, which may or may not result in change of management;

-

any change in the shareholding of an NBFC, including progressive increases over time, which would result in acquisition/ transfer of shareholding of 26%, excluding changes pursuant to a buy-back of shares or reduction of capital approved by a competent court; and

-

any change in the management of an NBFC, which would result in change in more than 30% of the directors, excluding independent directors or re-election of directors on retirement by rotation.

It is to be noted that the phrase “of the paid-up equity share capital of the Company” (which was present within the RBI Directions 2015, Non-Systemically Important Regulations, Systemically Important Regulations and the HFC Directions) is not added into the Scale Based Regulations (language for both of these are in red in the respective paragraphs above).

Requirements under these rules

For procuring an approval pursuant to the Change in Shareholding Rule or the Change in Management Rule, the NBFC must make a written application to the RBI on its letterhead, providing details of the proposed changes requiring its approval, along with specified supporting documents such as the information required in the annexure, a source of funds declaration, declarations in respect of the Negotiable Instruments Act, a bankers’ report, and a declaration on the status of specified supervisory compliances.10

Upon a perusal of these documents, and subject to the satisfaction of the RBI, a no-objection certificate is issued by it to the NBFC, granting its approval for consummation of the requested changes that are set out in the application. Upon receipt of this certificate / approval from the RBI, the NBFC has to provide a public notice of the proposed changes occurring due to the Change in Shareholding Rule or Change in Management Rule, at least 30 days prior to consummation of the change(s) for which approval was sought.11 Once this time has elapsed (and assuming that no objections have been received pursuant to the public notice provided by the NBFC), the requested change(s) may be consummated.

A flow-chart of the steps to be followed by parties during investments into NBFCs, to assess the applicability and trigger of the Change in Shareholding Rule and Change in Management Rule and receive the RBI approval, is as follows:

Analysis

There are two important takeaways, from a deal-making perspective, based on our analysis of the Change in Shareholding Rule and Change in Management Rule:

Firstly, the text of both of these rules is company-centric in nature. In other words, the obligation to procure prior approval from the RBI is on the NBFC. However, approval is sought in respect of the underlying transaction, being the change in shareholding or management effectuated due to the entry of the incoming investor. Accordingly, any applications pursuant to the Change in Shareholding Rule or Change in Management Rule will be undertaken by the NBFC, for the incoming investor. The practical consequence of these rules is that the management of the NBFC, along with the incoming investor, will have to undertake a conjoint effort to obtain RBI approval for consummation of the transaction. However, the NBFC will be submitting the application and will therefore be the sole direct point of contact with the RBI for the entire approval process.

Secondly, the text of the Change in Shareholding Rule is extremely broad in scope. Due to the presence of the phrase “including progressive increases over time” , the following types of transactions shall need to be assessed to determine the potential requirement of prior approval of the RBI: (i) multiple separate investments occurring simultaneously into an NBFC, which while individually smaller in size, may cumulatively lead to a 26% change in the share capital; (ii) any progressive increase in the share capital of an NBFC, which even if lower than 26% in terms of the individual post-closing shareholding of the incoming investor, leads to a 26% change in the share capital from the previous approval received from the RBI; and (iii) any single subsequent tranche of investment, by an investor that is partly invested in the NBFC, in case consummation of any subsequent tranche leads to a 26% change in the share capital of an NBFC.

Therefore, parties must ensure that right from the structuring and preliminary documentation stage, the contours of their deal are analysed to assess the requirement of RBI’s approval under this rule.

Impact of the Change in Shareholding Rule and Change in Management Rule on transactions

The process of seeking approval of the RBI does not stop at the stage of submission of the application under the Change in Shareholding Rule and Change in Management Rule, as the RBI has the power to seek further clarification by way of written responses or relevant supporting documents, until it has enough relevant information to provide an approval. Additionally, since the timeline for grant of approval is not specified, this may impact the deal timelines and outcome.

We have highlighted some key considerations arising from this process, for both the incoming investor and the NBFC, below:

Key considerations for the incoming investor

-

Absence of timelines for approval

Neither the Scale Based Regulations nor the HFC Directions provide timelines within which the approval shall be received. Accordingly, the incoming investor may have to account for this timeline and its impact on the ‘closing’ of the proposed transaction at the documentation stage. The investor must also ensure that an adequate buffer is built in within the ‘long stop date’ set forth in the transaction documents, and in such a manner that such date accounts both for: (i) the time taken to receive an approval; and (ii) the 30-day timeline for the public notice.

Importantly, in the event that the proposed transaction may be subject to other regulatory approvals in India (such as the approval of the Competition Commission of India in respect of combinations exceeding the specified thresholds under Sections 5 and 6 of the Competition Act, 2002), the investor may additionally consider requiring the NBFC to apply for all such approvals simultaneously.

-

Wide-reaching scope of additional requisitions sought in respect of the incoming investor and proposed nominee director

Being a discretionary body, the RBI has the power to requisition as many additional supporting documents or information that it deems necessary and adequate to conduct its “due diligence” on the incoming investor.

Currently, the: (i) scope of information and documents that may be sought by the RBI, and (ii) the number of requisitions that can be sent across to the parties prior to grant of an approval, has not been specified within any of its directions. Especially in respect of the Change in Shareholding Rule, this may lead to circumstances wherein the RBI may requisition supporting documents or information that may be high in volume, confidential in nature, or require adequate internal clearances within the investor’s organization prior to their release. Common examples of such requisitions may include information about the group companies of an incoming investor in order to identify the ultimate beneficial owner of the investor, and details about the foreign regulators exercising jurisdiction upon the investor (along with all applicable registration certificates). While these requisitions are not generally time-bound at the NBFC’s end, the RBI has the discretion to impose a timeline within which responses and documents should be provided, which may further exacerbate the challenges of larger institutional investors in sourcing these documents.

Further, given the absence of direct communication between the investor and the RBI, the investor may not always be able to understand the underlying concerns of the RBI or assist them in its resolution through direct communication, as all communications of the RBI occur only with the authorized representatives of the NBFC. This may be particularly detrimental in case the RBI believes that information submitted to it (within the supporting documents) is incomplete, inadequate or incorrect and requests for additional clarifications or amendments to the documents. Here, the investor would not be able to provide a direct explanation or response to the RBI and may have to liaise with the NBFC to convey the same, which may not be time efficient and can continue to leave room for misconstruction.

Lastly, in respect of the Change in Management Rule, the proposed board nominee of the incoming investor may have to be amenable to respond to any additional requisitions requiring their personal identification details/ personal documents.

-

Consequences for non-receipt of approval under the Change in Shareholding Rule

Non-receipt or denial of an approval would typically imply that the proposed transactions cannot be consummated. We have recently seen the RBI impose monetary penalties of over INR 1,00,000 (Indian Rupees One Lakh) on Nido Home Finance Limited12 and West End Housing Finance Limited13 for a failure to seek prior written approval of the RBI for change in shareholding pursuant to the HFC Directions.

-

Consequences for non-receipt of approval under the Change in Management Rule

Each of the Scale Based Regulations and HFC Directions are silent on the direct consequences in relation to a director that has already been appointed to the board, for whom prior approval under the Change in Management Rule has not been sought from the RBI. However, recent practice of the RBI reveals that NBFCs will be fined with a penalty in case of non-compliance with this rule – a recent fine of INR 5,00,000 was imposed by the RBI on Bajaj Housing Finance Limited, Pune, for non-receipt of prior approval under the Change in Management Rule.14 Penalties have also been imposed for similar violations on M/s Srestha Finvest Limited,15 Ashoka Viniyoga Limited,16 Sappers Finance and Consultancy Private Limited17 and M/s Swagatam Marketing Private Limited.18

-

Confidentiality concerns arising from the disclosure of deal details in the Public Notice

The public notice to be provided pursuant to receipt of approval under the Change in Shareholding Rule and Change in Management Rule must feature within at least one leading national newspaper and one leading local vernacular newspaper (in the registered office of the NBFC). It must also indicate the intention of selling/ transferring ownership or control, provide particulars of the transferee, and the reasons for consummation of the transaction for which approval was sought.19

The disclosures under this public notice may lead to certain confidential or sensitive deal details becoming public information. Accordingly, in the event that the transaction is intended to be confidential, the incoming investor must: (i) at the structuring stage, analyse the requirement of an RBI approval, to understand whether approvals and the public notice will be triggered; and (ii) if the investor proceeds to the negotiation and documentation stage, ensure that sensitive details are not disclosed within the public notice, to the extent possible.

Key considerations for the NBFC

-

Timelines for approval

The business models of NBFCs are generally capital-intensive, and often require funding within specified timelines in order to meet their targets. As mentioned above, the absence of specified timelines for grant of approval leads to the absence of clarity in respect of the ‘closing’ of the transaction. Additionally, even upon receipt of approval, the NBFC is supposed to provide a public notice for at least 30 days, which further extends the deal timeline.

Accordingly, the NBFC must evaluate the deal timelines carefully and map it with their immediate and long-term funding requirements, in order to ensure business continuity.

-

Additional requisitions from the RBI

Given the company-centric nature of the Change in Shareholding Rule and Change in Management Rule, the NBFC will have to ensure that: (i) all documents and information are submitted to the RBI by them on behalf of the investor in a timely manner; and (ii) the authorized representatives of the NFBC (generally, the signatories to the RBI application or the compliance officers) are in constant touch with the RBI to ensure that the timelines and expectations of the regulator are balanced with the investor’s turnaround time and disclosures. Additionally, care must be taken to ensure that miscommunication is avoided to the extent possible.

-

Conditional approvals

There may be cases in which the RBI may grant a ‘conditional’ approval pursuant to the Change in Shareholding Rule. By way of example, in the event that approval is sought for an investment undertaken through issuance of compulsory convertible preference shares, the RBI may grant approval for such investment, subject to the condition that prior approval is sought again upon their conversion into equity shares.

The NBFC must monitor such approvals and ensure that their conditions are met going forward.

-

Consequences for not taking prior approval under the Change in Shareholding Rule and Change in Management Rule

According to the erstwhile RBI Directions 2015, if a public notice was not provided in respect of the proposed transaction (upon receipt of approval), the RBI was entitled to undertake “adverse regulatory action including cancellation of the certificate of registration” against the NBFC.20 While there is absence of abundant clarity with respect to the scope of the “regulatory action” that may be undertaken by the RBI (other than cancellation of the certificate of registration or the imposition of penalties, details of which have been provided above), the NBFC must ensure that the applicable provisions of the governing directions are adhered to.

Conclusion

The Change in Shareholding Rule and Change in Management Rule have a significant impact on investments into Indian NBFCs. The practical process/ challenges that may be associated with receipt of an RBI approval must be adequately assessed and factored into the transaction structuring and documentation, by the incoming investor and NBFC alike, in order to avoid a potential deal breakdown and other unintended consequences.

Authors

Parina Muchhala and Nishchal Joshipura

You can direct your queries or comments to the relevant member.

1Section 45I (f), RBI Act, available at: https://rbidocs.rbi.org.in/ rdocs/Publications/ PDFs/RBIA1934170510.PDF.

2See generally, Chapter III-B, RBI Act.

3Scale Based Regulations, available at: https://rbidocs.rbi.org.in/ rdocs/notification/ PDFs/NT1127AD09AD866 884557BD4DEEA150ACC91A.PDF.

4Ibid, Direction 4.3.

5RBI Directions 2015, available at: https://rbi.org.in/Scripts/NotificationUser.aspx?Id=9934&Mode=0.

6Regulation 61, Non-Systemically Important Regulations, available at: https://rbidocs.rbi.org.in/rdocs/content/pdfs/NSIND01092016_AN.pdf.

7Regulation 66, Systemically Important Regulations, available at: https://rbidocs.rbi.org.in/rdocs/content/pdfs/45MD01092016_AN1.pdf.

8Regulation 45, HFC Directions, available at: https://rbidocs.rbi.org.in/rdocs/content/pdfs/MD100017022021_A.pdf.

9Direction 45.2, HFC Directions 2021.

10Direction 4, RBI Directions 2015, as found in Direction 46 of the HFC Directions and Direction 42 of the Scale Based Regulations.

11Ibid.

12‘RBI imposes monetary penalty on Nido Home Finance Limited (formerly known as Edelweiss Housing Finance Limited), Mumbai’, available at: https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=56383.

13‘RBI imposes monetary penalty on West End Housing Finance Limited, Mumbai, Maharashtra’, available at: https://rbi.org.in/scripts/BS_PressReleaseDisplay.aspx?prid=56571.

14RBI imposes monetary penalty on Bajaj Housing Finance Limited, Pune’, available at: https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=57242.

15‘RBI imposes monetary penalty on M/s Srestha Finvest Limited, Chennai, Tamil Nadu’, available at: https://www.rbi.org.in/commonman/Upload/English/PressRelease/PDFs/PR264_M.pdf.

16‘RBI imposes monetary penalty on Ashoka Viniyoga Limited, New Delhi’, available at: https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=58479.

17‘RBI imposes monetary penalty on Sappers Finance and Consultancy Private Limited, Kolkata’, available at: https://www.rbi.org.in/ commonman/Upload/ English/PressRelease/ PDFs/PR1322_21112023.pdf.

18‘RBI imposes monetary penalty on M/s Swagatam Marketing Private Limited, Kolkata, Maharashtra’, available at: https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=54242.

19Direction 5, RBI Directions 2015 as found in, Direction 47 of the HFC Directions and Direction 42 of the Scale Based Regulations.

20Regulation 6, RBI Directions 2015.

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.

Research PapersMergers & Acquisitions New Age of Franchising Life Sciences 2025 |

Research Articles |

AudioCCI’s Deal Value Test Securities Market Regulator’s Continued Quest Against “Unfiltered” Financial Advice Digital Lending - Part 1 - What's New with NBFC P2Ps |

NDA ConnectConnect with us at events, |

NDA Hotline |