Companies Act SeriesNovember 11, 2023 MCA’s Digital Leap: Dematerialization of Securities by Private CompaniesBACKGROUND:On October 27, 2023, the Ministry of Corporate Affairs (“MCA”) introduced a significant amendment via the Companies (Prospectus and Allotment of Securities) Second Amendment Rules, 2023 (“Amended PAS Rules”).1 The Amended PAS Rules encompass two pivotal changes: (i) surrendering share warrants issued by public companies prior to the commencement of the Companies Act, 2013 (the “Act”) and get the shares in dematerialized mode; and (ii) private companies, other than small companies2, to mandatorily issue the securities only in dematerialized form and facilitate the dematerialization of all its existing securities. It is pertinent to note that Amended PAS Rules refer to ‘securities’, which as defined under the Securities Contracts (Regulation) Act (“SCRA”)3, includes all types of instruments such as equity shares, preference shares, debentures, warrants, etc. As a background to this, the dematerialization of securities in India was mandatory only for public listed companies until October 2018. The dematerialization of securities involves the transformation of physical paper certificates representing ownership of securities into electronic records. In 1996, the National Securities Depository Limited (“NSDL”) and Central Depository Services Limited (“CDSL”), were established to oversee this transition.4 The process of dematerialization requires investors to open demat accounts with Depository Participants (“DP”) who acted as intermediaries between them and the depository. Overall, the shift from physical to electronic securities, facilitated by depositories like NSDL and CDSL, ushered in a new era of efficiency, security, and accessibility in the Indian capital market.5 Later, the MCA issued the Companies (Prospectus and Allotment of Securities) Third Amendment Rules, 2018 (“2018 Amendment Rules”)6, effective from October 02, 2018. As per the 2018 Amendment Rules, every unlisted public company (including a private company which is a subsidiary of public company), other than a nidhi or government company, was mandated to issue the securities only in dematerialized form and facilitate the dematerialization of all its existing securities. It may be noted that the wholly owned subsidiary (“WoS”) of an unlisted public company was exempted from this requirement under 2018 Amendment Rules. Now, the Amended PAS Rules have extended the similar set of conditions to private companies as well. HIGHLIGHTS OF THE AMENDED PAS RULES:

KEY TAKEAWAYS & IMPLICATIONS:

CONCLUDING THOUGHTS:From the regulator’s standpoint, it is purely an attempt towards providing greater transparency in shareholding and securities transaction, enhancing better acceptance of securities as collateral, mitigating disputes and risks associated with securities issued or held in physical form. This move of the MCA substantially reduce the risk of loss, theft, or tampering with physical certificates and acts as deterrent to fraudulent activities related to physical certificates like benami transactions, money laundering and back-dated issuance of physical certificates. Greater transparency in the securities market and effective deterrence of economic offences means providing a business conducive ecosystem for the domestic and global investors. In view of the stringent KYC forms that has to be undergone for opening demat account, all domestic and global investors will now be required to furnish ultimate beneficial ownership and senior management details in addition to other disclosures. This will assist the regulator in developing a robust centralized database for the country which would eventually simplify the process of determining beneficial ownership and enhancing the tax collection efficiency. The involvement of IEPF in handling grievances related to dematerialized securities is a positive development. It provides a dedicated platform for addressing investor concerns, potentially leading to swifter resolution and increased investor confidence. Lastly, the amendments brought in the Indian Stamp Act, 18999 with effect from July 1, 2020 had revised the stamp duty rates applicable for issue and transfer of securities in dematerialised mode and they are significantly lower than the rates previously in force. These centralized and reduced stamp duty rates for dematerialised securities would significantly reduce the overall transaction cost. Further, with the compulsory dematerialization of securities by private companies, they are now required pay only reduced stamp duty rates under the Indian Stamp Act, 1899. As the physical share certificates will cease to exist, the question of paying the higher stamp duty rates on physical certificates under certain state specific stamp laws should not arise going forward. Although, there are operational and compliance costs involved in implementing the requirements under Amended PAS Rules for both private companies as well as their shareholders (such as payment of one-time and annual fees to the depository, RTA, DPs etc.), the overall benefits of this initiative should outweigh these concerns.

You can direct your queries or comments to the authors. 1Notification, Ministry of Corporate Affairs, October 27, 2023, available at https://egazette.gov.in/WriteReadData/2023/249772.pdf. 2As per section 2(85) of the Companies Act, 2013, a “small company” means a company, other than a public company — (i) a paid-up share capital equal to or below Rs.4 crore or such a higher amount specified not exceeding more than Rs.10 crores and (ii) a turnover equal to or below Rs.40 crore or such a higher amount specified not exceeding more than Rs.100 crore; Provided that nothing in the clause shall apply to: (A) a holding company or a subsidiary company; (B) a company registered under section 8; or (C) a company or body corporate governed by any special act. 3Available at https://www.sebi.gov.in/acts/contractact.pdf. 4Dematerialisation of shares: How companies race against time and investors reminisce about a bygone era, available at https://economictimes.indiatimes.com/markets/ stocks/news/dematerialisation-of-shares-how- cos-race-against-time-and- investors-reminisce-about-a-bygone-era/articleshow/66787265.cms. 5About NSDL, available at https://nsdl.co.in/about/. 6Notification, Ministry of Corporate Affairs, September 10, 2018, available at https://www.mca.gov.in/Ministry /pdf/CompaniesPro spectus3amdRule_1 0092018.pdf. 7Rule 9 (3), as introduced by Amended PAS Rules. 8NSDL, FAQs on Dematerialization of Securities, available at https://nsdl.co.in/ faqs/faq.php 9Available at https://lddashboard.legislative.gov.in/ sites/default/ files/A1899-2.pdf DisclaimerThe contents of this hotline should not be construed as legal opinion. View detailed disclaimer. |

|

BACKGROUND:

On October 27, 2023, the Ministry of Corporate Affairs (“MCA”) introduced a significant amendment via the Companies (Prospectus and Allotment of Securities) Second Amendment Rules, 2023 (“Amended PAS Rules”).1 The Amended PAS Rules encompass two pivotal changes: (i) surrendering share warrants issued by public companies prior to the commencement of the Companies Act, 2013 (the “Act”) and get the shares in dematerialized mode; and (ii) private companies, other than small companies2, to mandatorily issue the securities only in dematerialized form and facilitate the dematerialization of all its existing securities. It is pertinent to note that Amended PAS Rules refer to ‘securities’, which as defined under the Securities Contracts (Regulation) Act (“SCRA”)3, includes all types of instruments such as equity shares, preference shares, debentures, warrants, etc.

As a background to this, the dematerialization of securities in India was mandatory only for public listed companies until October 2018. The dematerialization of securities involves the transformation of physical paper certificates representing ownership of securities into electronic records. In 1996, the National Securities Depository Limited (“NSDL”) and Central Depository Services Limited (“CDSL”), were established to oversee this transition.4 The process of dematerialization requires investors to open demat accounts with Depository Participants (“DP”) who acted as intermediaries between them and the depository. Overall, the shift from physical to electronic securities, facilitated by depositories like NSDL and CDSL, ushered in a new era of efficiency, security, and accessibility in the Indian capital market.5

Later, the MCA issued the Companies (Prospectus and Allotment of Securities) Third Amendment Rules, 2018 (“2018 Amendment Rules”)6, effective from October 02, 2018. As per the 2018 Amendment Rules, every unlisted public company (including a private company which is a subsidiary of public company), other than a nidhi or government company, was mandated to issue the securities only in dematerialized form and facilitate the dematerialization of all its existing securities. It may be noted that the wholly owned subsidiary (“WoS”) of an unlisted public company was exempted from this requirement under 2018 Amendment Rules.

Now, the Amended PAS Rules have extended the similar set of conditions to private companies as well.

HIGHLIGHTS OF THE AMENDED PAS RULES:

-

A. For the share warrants issued by public company

a) For share warrants issued by public companies prior to commencement of the Act and not converted into shares till date – (i) within 3 (three) months from the commencement of the Amended PAS Rules, need to furnish details of such share warrants to the registrar of companies (“RoC”) in Form PAS-7; and (ii) within 6 (six) months from the commencement of the Amended PAS Rules, these companies are required to place a notice in Form PAS-8 on its website and publish the same in a vernacular and English newspaper, for the bearers of such share warrants and require such bearers of share warrants to surrender the share warrants and get the shares dematerialized.

b) In case of non-compliance in surrendering the share warrants, the non-converted share warrants will be transferred to the Investor Education and Protection Fund (“IEPF”).7

-

B. Dematerialisation of securities of Private company

a) Every private company, which is not a small company as on last day of financial year (“FY”) closing on or after March 31, 2023 as per the audited financial statements for such FY, should, within 18 (eighteen) months of closure of such FY, comply with the conditions of Amended PAS Rules.

Hence, for all the existing private companies, whose FY ended on March 31, 2023, the deadline to comply is on or before September 30, 2024.

b) This broadly involves the following steps – (a) amendment of articles of association (“AoA”) of the company to authorise shareholders to hold securities in dematerialised form; (b) appointment of a Securities and Exchange Board of India (“SEBI”) registered Registrar and Transfer Agent (“RTA”); and (c) obtaining an International Securities Identification Number (“ISIN”) from NSDL or CDSL by following the required procedure and documentation.

c) The ISIN should be obtained strictly within 18 (eighteen) months’ timeline. It is pertinent to note that a separate ISIN needs to be procured for all the existing different type of securities issued by such private company.

d) Post the completion of 18 (eighteen) months’ time period, such private company is required to mandatorily issue securities only in dematerialised form. Further, if any existing shareholder of a private company intends to transfer its securities, such shareholder will have to first dematerialize all such securities before executing the share transfer.

e) Apart from the above, Amended PAS Rules clarifies that the conditions contemplated under sub-rules (4) to (10) of 2018 Amendment Rules shall equally apply to a private company as well.

f) In case of any non-compliance of requirements under the Amended PAS Rules, there are no specific penal provisions stipulated under Section 29 of the Act read with Amended PAS Rules, as a general rule, the penalties under Section 450 of the Act would apply.

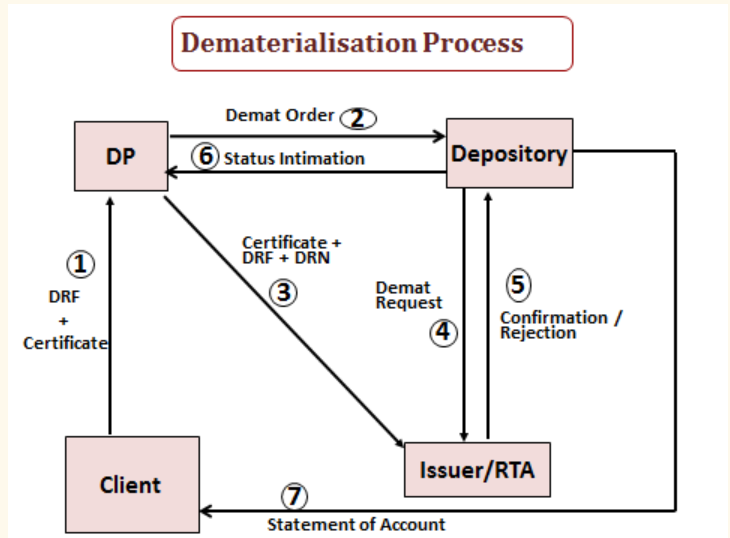

Diagram representation of dematerialisation of existing physical securities

(Source – NSDL-FAQ8)

KEY TAKEAWAYS & IMPLICATIONS:

-

Holding - Subsidiary companies: As per Amended PAS Rules, the conditions pertaining to dematerialization of securities applies to all private companies other than a small company or government company. It is pertinent to note that, by virtue of definition of a small company under the Act, irrespective of the turnover or paid-up share capital, a subsidiary and holding company do not qualify as small company. As a result, private company subsidiaries of a foreign entity shall adhere to these Amended PAS Rules and dematerialize all their securities.

Practically, this will be challenging because almost all the foreign body corporates that are doing business in India through their private company subsidiaries would now be required to open a demat account with a SEBI registered DP to hold their shareholding in demat mode. Further, opening a demat account entails providing significant Know Your Customer (“KYC”) information with the DP and obtaining a permanent account number (“PAN”) with Indian tax authorities. There is a fee component involved for opening and annual maintenance of demat accounts. Hence, though opening of demat account is a one-time exercise, there is recurring cost to maintain it and for the investors investing for the first time in private companies, the overall investment timelines may potentially increase, particularly in case of foreign investors.

-

No exemption granted to WoS of private companies: Under 2018 Amendment Rules, a WoS of an unlisted public company has been exempted from complying with the requirement of dematerialization of securities. However, it is interesting to note that such exemption has not been extended to a WoS of a private company under Amended PAS Rules. Resultantly, a private company which is a WoS of another private company would still have to comply with dematerialization requirement. However, in case of a private company which is a WoS of public company, considering such WoS is a deemed public company, the exemption granted under 2018 Amendment Rules for such WoS would continue to be available.

Also, there is no exemption for section 8 companies incorporated as limited by shares. This should effectively address the major concerns of lack of ownership identification in Section 8 companies and any fraudulent activities using such structures.

-

Restriction on share transfer in depository system: One of the fundamental features of a private company (and by virtue of its definition under the Act), the transfer of shares or securities of a private company is always subject to restrictions and procedures contained in its AoA. This principle applies irrespective of the nature of holding of securities in a private company (that is, physical or dematerialized form). The dematerialization of securities which has now been made mandatory for a private company under Amended PAS Rules should not in any manner dilute this requirement.

Operationally, however, in the depository system, the DP can directly act upon the executed Delivery Instruction Slips (“DIS”) submitted by the transferor and process the demat share transfer requests without seeking approval of company (particularly, a private company) to verify whether such share transfer is in compliance with its AoA restrictions. To avoid any such practical and legal risk, it is recommended that the private companies put in place adequate checks and filters at the depository’s level (for example, freezing of ISIN) and/or they should inform the DPs, as practically as possible, about the legal restrictions in the charter documents and that, the DPs is bound to act strictly as per those AoA restrictions / procedures prior to processing any share transfer requests.

-

Control over nominee shareholding under depository system: In case of WoS or otherwise, it is common that the registered owner and the beneficial owner of securities may be different. For instance, Section 187 (1) of the Act provides for a company to hold any shares in its subsidiary company through a nominee(ies) in order to meet the minimum of shareholders requirement under the Act. Further, Section 89 of the Act requires declaration of beneficial interest held in shares with the RoC where the registered and beneficial owners are different. These principles apply to the securities held in dematerialized form as well.

As per Section 10 of the Depository Act, 1996, the depository shall remain the registered owner but will not have voting rights. It is the beneficial owner who is entitled to all the rights and benefits attached to securities and further, all the shareholders are treated as beneficial owners under the depository system though a particular shareholder may be acting just as a nominee. This legal position may impose practical challenges for the holding company to control the actions of nominee shareholder(s).

These conceptual and procedural differences between the Act and Depository Act will need to be critically evaluated between the beneficial owner and nominee(ies) before entering into such arrangements going forward. Practically, certain options can be explored, such as, having a joint demat account between the actual and nominee shareholders for nominee shares, having restrictions on transfer or creation of pledge on nominee shares in the AoA, freezing of ISIN for limited purposes, etc. However, each of these options requires careful deliberations as they involve diverse legal and operational aspects as well as compliance cost.

CONCLUDING THOUGHTS:

From the regulator’s standpoint, it is purely an attempt towards providing greater transparency in shareholding and securities transaction, enhancing better acceptance of securities as collateral, mitigating disputes and risks associated with securities issued or held in physical form. This move of the MCA substantially reduce the risk of loss, theft, or tampering with physical certificates and acts as deterrent to fraudulent activities related to physical certificates like benami transactions, money laundering and back-dated issuance of physical certificates. Greater transparency in the securities market and effective deterrence of economic offences means providing a business conducive ecosystem for the domestic and global investors.

In view of the stringent KYC forms that has to be undergone for opening demat account, all domestic and global investors will now be required to furnish ultimate beneficial ownership and senior management details in addition to other disclosures. This will assist the regulator in developing a robust centralized database for the country which would eventually simplify the process of determining beneficial ownership and enhancing the tax collection efficiency.

The involvement of IEPF in handling grievances related to dematerialized securities is a positive development. It provides a dedicated platform for addressing investor concerns, potentially leading to swifter resolution and increased investor confidence.

Lastly, the amendments brought in the Indian Stamp Act, 18999 with effect from July 1, 2020 had revised the stamp duty rates applicable for issue and transfer of securities in dematerialised mode and they are significantly lower than the rates previously in force. These centralized and reduced stamp duty rates for dematerialised securities would significantly reduce the overall transaction cost. Further, with the compulsory dematerialization of securities by private companies, they are now required pay only reduced stamp duty rates under the Indian Stamp Act, 1899. As the physical share certificates will cease to exist, the question of paying the higher stamp duty rates on physical certificates under certain state specific stamp laws should not arise going forward.

Although, there are operational and compliance costs involved in implementing the requirements under Amended PAS Rules for both private companies as well as their shareholders (such as payment of one-time and annual fees to the depository, RTA, DPs etc.), the overall benefits of this initiative should outweigh these concerns.

– Palomita Sharma, Sapna Kataria, Chandrashekar K and Maulin Salvi

You can direct your queries or comments to the authors.

1Notification, Ministry of Corporate Affairs, October 27, 2023, available at https://egazette.gov.in/WriteReadData/2023/249772.pdf.

2As per section 2(85) of the Companies Act, 2013, a “small company” means a company, other than a public company — (i) a paid-up share capital equal to or below Rs.4 crore or such a higher amount specified not exceeding more than Rs.10 crores and (ii) a turnover equal to or below Rs.40 crore or such a higher amount specified not exceeding more than Rs.100 crore; Provided that nothing in the clause shall apply to: (A) a holding company or a subsidiary company; (B) a company registered under section 8; or (C) a company or body corporate governed by any special act.

3Available at https://www.sebi.gov.in/acts/contractact.pdf.

4Dematerialisation of shares: How companies race against time and investors reminisce about a bygone era, available at https://economictimes.indiatimes.com/markets/ stocks/news/dematerialisation-of-shares-how- cos-race-against-time-and- investors-reminisce-about-a-bygone-era/articleshow/66787265.cms.

5About NSDL, available at https://nsdl.co.in/about/.

6Notification, Ministry of Corporate Affairs, September 10, 2018, available at https://www.mca.gov.in/Ministry /pdf/CompaniesPro spectus3amdRule_1 0092018.pdf.

7Rule 9 (3), as introduced by Amended PAS Rules.

8NSDL, FAQs on Dematerialization of Securities, available at https://nsdl.co.in/ faqs/faq.php

9Available at https://lddashboard.legislative.gov.in/ sites/default/ files/A1899-2.pdf

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.

Research PapersDecoding Downstream Investment Mergers & Acquisitions New Age of Franchising |

Research Articles |

AudioCCI’s Deal Value Test Securities Market Regulator’s Continued Quest Against “Unfiltered” Financial Advice Digital Lending - Part 1 - What's New with NBFC P2Ps |

NDA ConnectConnect with us at events, |

NDA Hotline |