Deal Talk

September 19, 2024

Deal Breaker or Deal Maker?: Deconstructing the “Deal

Value Threshold” Under The Competition Act, 2002

A. Introduction

On September 9, 2024, the Competition Commission

of India (“CCI”), Government

of India and the Ministry of Corporate Affairs collectively

unveiled a ground-breaking set of updates to the merger

control regime in India, effective from September 10,

2024. This significant overhaul comes through the notification

of amendments to the Competition Act, 2002 (“Act”)

and new sets of rules and regulations operative under

the framework of the Act.

At the heart of these changes is the notification

of the widely anticipated “deal value threshold”

(“DVT”), which now forms

part of the Indian merger control regime through a conjoint

reading of the Act, the Competition (Amendment) Act,

2023 (“Amendment Act”),

and the Competition Commission of India (Combinations)

Regulations, 2024 (“2024

Combination Regulations”).

In our most recent edition of the “Deal Talk”,

we deconstruct this critical concept in the following

manner:

-

we delve into the rationale for introduction

of the DVT in the Indian merger control regime;

-

we outline the key parameters that are to be

considered during assessment of applicability of

the DVT to transactions; and

-

we set out a framework of the manner in which

the DVT shall operate within the existing merger

control regime.

At each point across this Deal Talk, we have set

out certain critical noting points (relevant for parties

at the time of structuring transactions) through a corresponding “Note

to Deal Teams”.

B. Why was DVT introduced?

The DVT is an additional criterion that has been

introduced under Section 5 of the Act, which assesses

the requirement of prior notifiability of transactions

to the CCI through a “value of the transaction”

test. Through the amendments proposed in the Amendment

Act, DVT has been codified in the form of Section 5

(d) of the Act, which is in addition to the Section

5 (a), (b) and (c) threshold analysis that has been

prescribed in the existing regime. It is to be noted

that while the DVT itself has been added to the Act,

detailed criteria to be met to satisfy the DVT are also

set out within the 2024 Combination Regulations.

This is in stark contrast to the existing Sections

5 (a), (b) and (c) thresholds, each of which provides

an “enterprise level” or “group level”

asset or turnover threshold as the basis for calculation.1

The following components are to be met for a transaction

to be considered notifiable to the CCI due to application

of DVT under Section 5 (d) of the Act read with the

2024 Combination Regulations:

-

The “value of the transaction” (in

connection with an acquisition of shares, voting

rights, assets or control or a merger or amalgamation)

being analysed must exceed INR 2,000 crores (i.e.,

approximately USD 238.4 million or EUR 215.1 million);2

(“Value Test”)

and

-

The enterprise being acquired, taken control

of, merged or amalgamated must have “substantial

business operations” in India (“Business

Test”).3

(the Value Test and Business Test, collectively,

the “DVT Framework”).

Before delving into a detailed assessment of how

the Value Test and Business Test are to be calculated

and met (which has been set out in the next section),

it is important to understand why the DVT was introduced.

DVT was first conceptualised in the Competition Law

Review Committee’s Report released in 2019, which

noted that: (a) under the Act, the CCI did not have

the residuary power to review non-notifiable transactions

to assess “appreciable adverse effect on competition”;

(b) foreign jurisdictions such as Germany, Austria,

etc. utilise a transaction value criterion in order

to assess transactions in digital markets; and (c) a

large number of transactions having a larger deal value

were not being notified to the CCI as the enterprise

was able to avail exemptions under the then applicable

merger control regime.4

Major exempt

deals under the old merger control regime

In order to understand point (c) above in greater

detail, let us take examples of a few transactions that

had large deal values but were not notified to the CCI

due the availability of the Previous De Minimis Exemption

(as defined below):5

-

Zomato’s Acquisition of Blinkit:

On August 10, 2022, Zomato Limited (“Zomato”)

completed the acquisition of Blink Commerce Private

Limited (formerly known as Grofers India Private

Limited) (“Blinkit”).

The consideration paid by Zomato was through issuance

of 628,530,012 fully paid-up equity shares of Zomato

worth INR 55.45 per equity share for a total of

91.04% shareholding of Blinkit, which amounted to

INR 3,485 crores (i.e. approximately USD 415.4 million

or EUR 374.8 million).6 In effect, the

transaction was structured as a share swap.

This transaction was not notified to the CCI since

the transaction was able to avail the previously applicable

de minimis exemption thresholds7 (“Previous

De Minimis Exemption”).8

-

Zomato’s Acquisition of Uber Eats:

A similar transaction structure was also utilised

by Zomato for the acquisition of Uber Eats in January

2020.9 The Uber Eats acquisition was

an all-stock transaction where in lieu of their

shares, the existing shareholders of Uber Eats were

issued 9.99% ownership in Zomato. The approximate

deal value for the deal was USD 350 million (i.e.

approximately INR 2,485 crores or EUR 315.7 million).

This acquisition was not notified to CCI given

that it could also avail the Previous De Minimis

Exemption.

-

Facebook’s Acquisition of WhatsApp:

The killer acquisition of WhatsApp by Facebook was

the talk of the town in 2014. Facebook acquired

100% of WhatsApp for a deal value which was touted

to be approximately USD 19 billion (i.e. approximately

INR 159378 crores or EUR 17 billion).10

While antitrust regulators in the European Union

and the United States of America got the opportunity

to scrutinize and assess whether the acquisition

impacted competition in their respective jurisdictions,

the CCI could not assess this acquisition.

-

PVR-Inox Merger: In 2022, PVR

Limited (“PVR”) and

INOX Leisure Limited (“Inox”),

popularly known for being rivals in the film exhibition

industry, merged via a court-sanctioned amalgamation

of Inox into PVR as per the Companies Act, 2013.

The resultant entity that was to be created was

called “PVR Inox Limited”. As a result

of the transaction, existing shareholders of Inox

were to receive shares of PVR based on a swap ratio

set out within the scheme of amalgamation.11

The merger was intended to assist PVR and Inox with

maintaining their long-term operations in order

to survive the increasing threat posed by the growing

popularity of OTT platforms. Further, it was also

likely to lead to the resultant entity becoming

one of the largest players in the film exhibition

industry in India.12

Despite the transaction leading to a tremendous

consolidation of the market share of PVR and Inox

(as mentioned above), it was able to avail the Previous

De Minimis Exemption and was not notified to the

CCI. PVR and Inox’s respective turnovers did

not breach the turnover thresholds specified under

the Previous De Minimis Exemption due to the reduction

in revenues caused by the shutdown of theatre entry

during the pandemic.13

C. How to analyse a transaction

to assess whether it crosses DVT?

Now that we have understood the intent for enactment

of the DVT and its potential impact on transactions,

let’s deep dive into understanding how the Value

Test and Business Test shall practically operate:

Limb 1: Value Test – How to determine

the value?

The “value of the transaction” is supposed

to include all forms of direct or indirect “valuable

consideration” that may also be immediate

or deferred, cash or otherwise.14 Thus,

the DVT intends to capture within its ambit all forms

of cash and non-cash deal structures (such as a share

asset swap, purchase price adjustment mechanisms, etc.),

where the consideration value may not be prima facie

ascertainable or the transaction may not otherwise

breach the asset or turnover thresholds specified under

Sections 5 (a), (b) or (c) of the Act.

The line items that are to be included within the

calculation of the “value of the transaction”

have been set out within the 2024 Combination Regulations15

and are reproduced below.

Importantly, these line items may be read with the “General

Statement on the Competition Commission of India (Combinations)

Regulations, 2024” released by the CCI,16

which sheds light on the potential intent of CCI in

respect of certain provisions added to the 2024 Combination

Regulations (“CCI Interpretative Guidance”).

|

Sr. No.

|

Regulation No.

|

Line Item

|

CCI Interpretative

Guidance (if any)

|

Note to Deal Teams

|

|

1

|

4 (1) (a)

|

Covenants, undertakings, obligations or restrictions

imposed on the seller or any person (if such

consideration is agreed separately)

|

In the context of non-compete covenants,

nothing is to be added to the value of the transaction

if:

|

-

The intent here should be to remove any

ambiguity with respect to the consideration

for a covenant. For example, it is common

for shareholders’ agreements of private

companies to specify that a non-compete

covenant is being provided by the promoters

to the acquirer to ensure that the promoters

will discharge day-to-day functions in a

pre-determined manner.

|

|

2

|

4 (1) (b)

|

Interconnected steps and transactions (provided

in Regulations 9(4) and 9(5) of the 2024 Combination

Regulations)

|

–

|

-

It appears that the time period that

may be considered to interconnect transactions

for this line item can be taken from Explanation

(c), which states that any acquisitions

by one of the parties or their group entity,

in the enterprise, at

any time during the period of 2 years before

the relevant date17 are

to be considered as part of the value of

the transaction.

-

It is important to note that while the

value of any previous transactions in an

enterprise by an acquirer or their group

entities (in the past 2 years) will be added

to the value of the transaction, in case

such consolidated transaction is notifiable,

it will not amount to gun-jumping under

the Act for the previous transaction(s)

and no penalty can be levied on the acquirer

under Section 43A of the Act.

-

It is also pertinent to note here that

given this line item is related to interconnected

transactions, where the law requires notification

of a step even if it is exempted, this would

mean that even if in the previous 2 years

the investor undertook a transaction which

was not notifiable due to availability of

an exemption (such as under the Exemption

Rules, as defined below), in such

case as well, the value of the exempted

transaction would be required to be aggregated

for determining the value of the current

transaction.

|

|

3

|

4 (1) (c)

|

Consideration payable during 2 years from

the date on which the transaction would come

into effect, for arrangements entered into as

part of the transaction or incidental thereto

[Examples provided: Technology assistance,

licensing of intellectual property rights, usage

rights of any product / service / facility,

supply of raw materials / finished goods, branding

and marketing]

|

-

CCI’s amendments to this line item

(as opposed to the language proposed within

the Draft Combination Regulations, 2023),

have been made “to make the scope

of value of arrangements as more specific

by introducing a specific payment dimension

for a given time frame”.

-

Regulation 4 (1) (c) uses the words “arrangements

... part of the transaction or incidental

thereto”. This is different from

the language set out in Regulation 4 (1)

(b), which makes a reference to “transactions”.

|

-

This line item would, in addition to

the examples mentioned by CCI, also include

mandatory obligations on an investor to

infuse further capital within a specified

timeline or contractually agreed mandatory

follow-on investment obligations.

|

|

4

|

4 (1) (d)

|

For call option shares and shares and shares

to be acquired thereof, assuming full exercise

of the option

|

-

If the exercise price is based on future

outcomes set out in transaction documents, “best

estimate” to be considered. Explanations

(f), (g) and (h) to be referred to for valuation

issues.

-

Explanation (f) (please refer below)

places the onus of such valuation either

on the board of directors or the approving

authority of the acquirer.

|

-

In case of Indian acquirers, the board

of directors may not want to sign off on

a specific option price / value as on date

unless they are completely satisfied with

the values being ascribed to the call option

as part of the deal, specifically considering

their fiduciary duties under the Companies

Act, 2013. Basis applicable law in other

jurisdictions, similar concerns may emerge

for members of the board of directors of

foreign acquirers as well.

-

Deal team members of the acquirer (who

may fall within the phrase “any

other approving authority of the person

obligated to file notice”) may

also not want to undertake responsibility

of assessment of the value, as it remains

unclear whether they may incur any personal

consequences in case the CCI subsequently

finds that gun-jumping has occurred in respect

of such transaction.

-

Explanation (g) (please refer below)

adds even more ambiguity to the deal as

a whole, because in case the board of directors

or deal team members are uncomfortable with

or are unable to sign off on a specific

valuation with reasonable certainty, the

transaction will be deemed to exceed the

Value Test.

-

In case neither of the above authorities

are comfortable with signing off on a valuation,

the best estimate is supposed to be the “maximum

payable amount”.

However, the manner of its determination

has not been set out in the Explanation

(h) (please refer below).

|

|

5

|

4 (1) (e)

|

For consideration payable, as per best estimates,

based on the future outcome specified under

transaction documents

|

|

-

This line item also helps in determining

the value of transactions in cases which

include purchase price adjustments based

on future events (such as the EBITDA of

the enterprise). At the time of the transaction

being structured, the parties shall in best

estimate undertake the purchase price adjustments

to determine the value of the transaction

as on date.

|

In addition to the above line items, certain explanations

have also been provided to aid with their interpretation.

The critical explanations are as set out below:

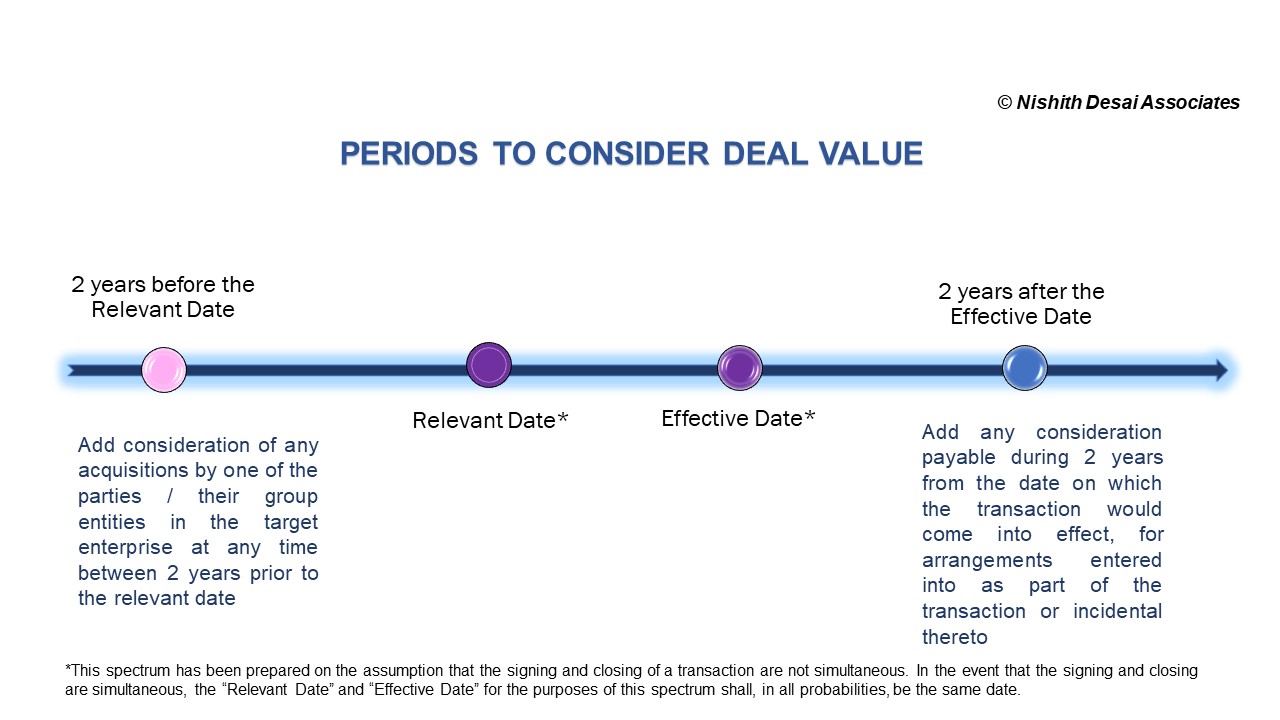

-

Explanation

(c): The value of the transaction must include

the consideration of any acquisitions by one of

the parties / their group entities in the enterprise

at any time between 2 years prior to the relevant

date.

-

Explanation

(f): In cases of mergers / amalgamations

or where the true and complete value of the transaction

is not recorded in the transaction documents, the

value of the transaction or such component shall

be such as may be considered by the board of directors

or any approving authority of the acquirer.

-

Explanation

(g): In case the transaction value cannot

be established with reasonable certainty by the

board of directors or any approving authority of

the acquirer, the value shall be deemed to exceed

the Value Test.

-

Explanation

(h): “Best estimate” is to be

determined through an estimate set out by the board

of directors or any approving authority of the acquirer.

In case they do not record the best estimate, the “maximum

payable amount” shall be considered as the

best estimate.

A spectrum

of the way the look-back periods under #2 and #3 of

the above table shall operate for a specific transaction

have been captured below:

Limb 2: Business Test – Does the

enterprise have substantial business operations in India?

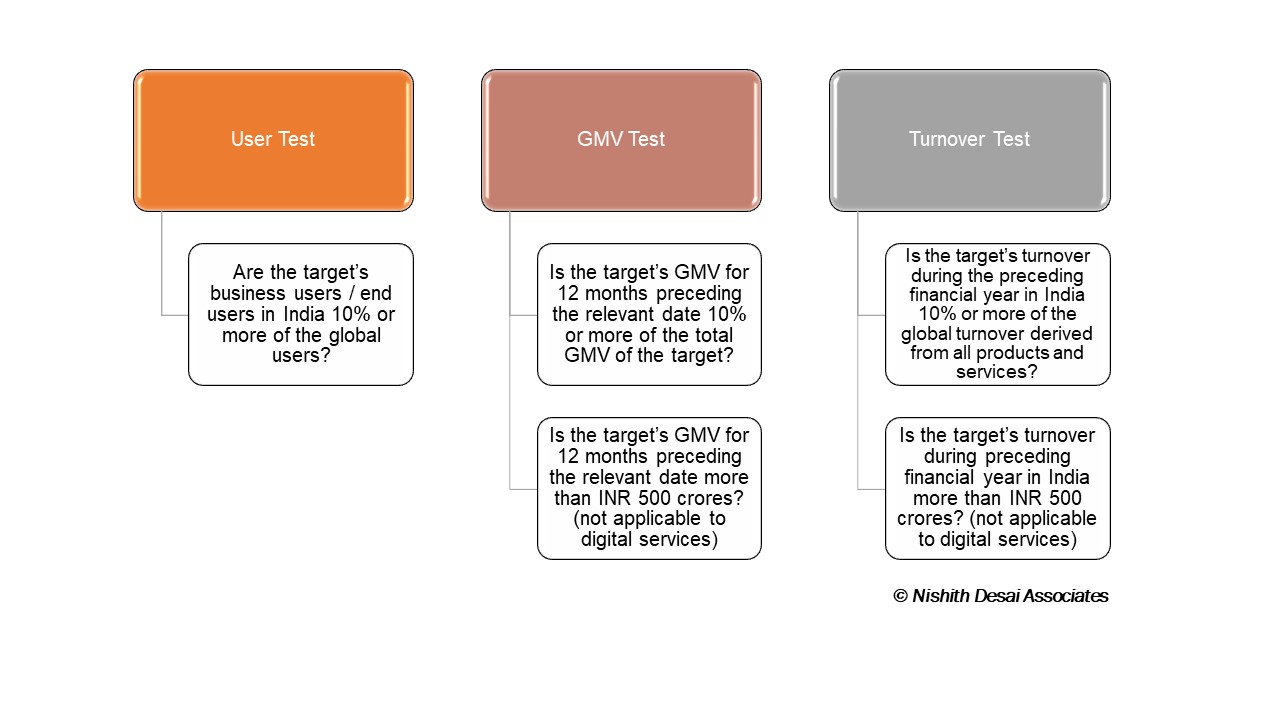

An enterprise has “substantial business operations”

in India, in case if either of the conditions set out

in (a), (b) or (c) below are met:

For digital services20 provided, the

business users / end users21 in India should

be 10% or more of the total global users (“User

Test”);

or The gross merchandise value22 for

12 months preceding the relevant date must be: (a) 10%

or more of the total global gross merchandise value;

and

(b) more than INR 500 crores (i.e. approximately USD

59.5 million or EUR 53.7 million) (and this part (b)

not applying to digital services) (“GMV

Test”);

or

The turnover during the preceding financial year

in India is: (a) 10% or more of the global turnover

derived from all products and services;

and

(b) more than INR 500 crores (i.e. approximately USD

59.5 million or EUR 53.7 million) (and this part (b)

not applying to digital services) (“Turnover

Test”).

It is to be noted that the 2024 Combination Regulations

do not currently specify how the Business Test is likely

to be applicable and calculated in respect of such enterprises

that are providing digital and non-digital services,

and it will be interesting to see how this calculation

will occur in practice.

A pictorial

representation of the Business Test is as below:

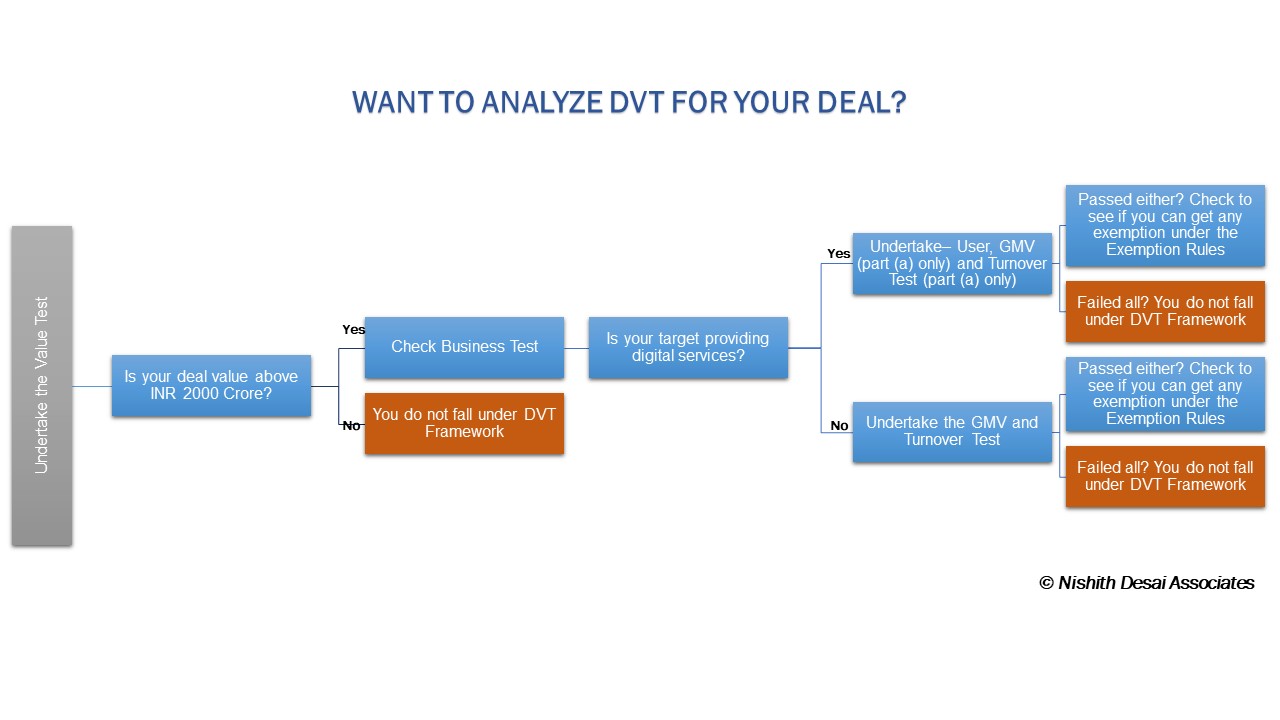

A diagrammatical

representation of how the DVT Framework would work is

as below:

Let’s simplify how a deal team should

analyse a transaction for merger notification.

The addition of the DVT will lead to parties assessing

their transactions through recourse to the following

step chart:

Part 1 –

Transaction Type Analysis

-

Step 1: Check whether the transaction involves:

(x) an acquisition of control, shares, voting rights,

or assets; (y) acquisition of control by an acquirer

having direct or indirect control over an enterprise

involved in a similar or identical business;

or

(z) a merger or amalgamation. This will help

assess whether the transaction may fall under Section

5 (a), (b) or (c) of the Act.

-

Step 2: Once the transaction qualifies the

test of Step 1 above, check whether the transaction

meets the enterprise or group level thresholds set

out within Sections 5 (a), (b)

or

(c) of the Act.23 If yes, the transaction

may become a notifiable “combination”

unless it is exempt from notification under Part

2 (A) below (“Non-DVT Case”).

-

Step 3: Irrespective of whether the transaction

falls within Step 2 above, check whether the “value

of the transaction” meets the criteria set

out in the DVT Framework. If yes, the transaction

may become a notifiable “combination”

unless it is exempt from notification under Part

2 (B) below (“DVT Case”).

Note to Deal Teams: Given the

overarching nature of Step 3 (i.e. DVT Case), deal teams

may consider assessing Step 3 first in case their transactions

have a considerably higher value.

Part 2 (A) –

Exemption Assessment for Non-DVT Case

-

Step

4 for Non-DVT Case: Check whether the transaction

is eligible to obtain any exemptions. The potentially

available exemptions are as under:

Non-DVT Case: Exemptions from

notification, if any, to be available either under:

(i) the Schedule to the Competition (Criteria for

Exemption of Combinations) Rules, 2024 (“Exemption

Rules”); or (ii) the thresholds set

out under the revised Section 5 (e) of the Act (as

amended by Section 6 of the Amendment Act) (popularly

called the “De Minimis Exemption”).24

Part 2 (B) –

Exemption Assessment for DVT Case

-

Step

4 for DVT Case: Check whether the transaction

is eligible to obtain any exemptions. The potentially

available exemptions are as under:

DVT Case: Exemption of notification,

if any, is available

only under

the Exemption Rules.

Note to Deal Teams: A DVT Case

cannot avail the De Minimis Exemption that is available

to a Non-DVT Case under the revised merger control regime.

This is in line with the legislative intent to assess

transactions (particularly within digital markets) where

enterprises may have lower turnover and assets (and

can avail the De Minimis Exemption), but the true value

of such enterprise lies in non-monetary factors such

as the number of digital users, business models, etc.

which is captured in the high valuation of the enterprise

through a high valuation multiple.

D. Let’s reanalyse

the previously exempt transactions under the new merger

control regime!

Now that we know how to analyse whether your deal

exceeds the DVT, let us apply the analysis practically

to ascertain whether the transactions mentioned above

would be notifiable to CCI if DVT existed at that time:

-

Zomato’s acquisition of Blinkit:

-

The total consideration for the acquisition

of 91.04% shareholding of Blinkit by Zomato

(through the share swap) was INR 3,485 crores.

This would mean that the “value of the

transaction” would satisfy the Value Test

(i.e. INR 2,000 crores or above).

-

Blinkit is a quick-commerce business

with operations across all major cities in India,25

which would imply that Blinkit would satisfy

the Business Test.

-

Considering that the criteria set out

in the DVT Framework are being met, the Previous

De Minimis Exemption would not have been available

to Zomato for the acquisition of Blinkit.

-

By acquiring 91.04% shareholding of Blinkit,

Zomato acquired nearly 100% shareholding of

Blinkit, there by acquiring “control”26

over Blinkit. Therefore, given the structure

of the deal, Zomato could also not have been

able to avail any exemption under the Exemption

Rules.

Based on the above, the Zomato-Blinkit acquisition

under the DVT Framework would be notifiable

if it was undertaken in the context of the revised

merger control regime that includes the DVT.

-

Zomato’s acquisition of UberEats:

The Zomato-Uber Eats acquisition would

be notifiable under the DVT Framework if

it was undertaken today. Interestingly, CCI had

undertaken an investigation into the Zomato-Uber

Eats acquisition to assess if the acquisition caused

an “appreciable adverse effect on competition”,

given that Zomato’s market share in food delivery

market went up to 55% post the acquisition.27

The above acquisition is an important example of

the lacunae within the erstwhile thresholds under

the previous merger control regime, and how recourse

to the DVT may be important to assess the competition

impact of such transactions.

Note to Deal Teams: In cross-border

share swap deals, where an Indian company acquires a

foreign company in lieu of issuance of its own shares

as consideration, it is also very important to assess

the Business Test holistically with respect to both

the companies.

-

Facebook’s acquisition of WhatsApp:

In the event that the DVT was applicable in 2014,

Facebook would have had to undertake the Business

Test (given that the Value Test is getting satisfied

due to the high deal value) for WhatsApp in India

to ascertain whether a notification to the CCI was

required. If WhatsApp satisfied the Business Test,the

transaction would have been notifiable to the CCI

owing to the DVT.

Note to Deal Teams: In case

a transaction has been structured as a global level

acquisition (involving Indian subsidiaries and operations),

the “value of the transaction” for the purposes of notifiability

to the CCI under the DVT would be the total deal value

and not just the value of the Indian asset or operations,

given that each step in the global transaction would

be considered as interconnected to the acquisition of

the Indian asset / operations.

-

PVR-Inox Merger:

Interestingly, the non-notification of this merger

to the CCI was challenged before the CCI on grounds

that such transaction would lead to a potential

abuse of dominance of the resultant entity in the

relevant market under Section 4 of the Act. The

CCI rejected these allegations, noting that: (a)

the mere existence of dominance (without any abuse

of such dominance) is not punishable under Section

4 of the Act; and (b) if such abuse of dominance

is demonstrated by the resultant entity, the same

would be examined post facto, as the transaction

had not been consummated as on the date that the

information had been filed before it.28

This order was subsequently appealed before

the National Company Law Appellate Tribunal (“NCLAT”)

and the appeal was rejected.29

If the DVT was in effect at the time of structuring

of this deal, the parties may have had to assess

whether the merger was likely to exceed the Value

Test, considering that the transaction would, in

all likelihood and basis the business operations

of PVR and Inox, cross the Business Test. If the

transaction would have satisfied the Value Test,

it would have been notifiable to the CCI

owing to the DVT.

Note to Deal Teams: While mergers

(structured as a share swap of shares of the resultant

entity) will not have a specific consideration set out

within the scheme filed with the regulator (given that

they will only specify a share swap ratio), a deal value

will have to be arrived at using the Value Test, in

order to ensure that the transaction is not notifiable

on account of DVT.

Further, another softer concern to be kept in

mind during the structuring of such transactions is

that even if such transactions may otherwise be non-notifiable

due to availability of exemptions, the resultant impact

on market share may led to the CCI taking investigating

such transactions. Accordingly, all backing information

to justify the availability of an exemption must always

be maintained by all parties.

E. Final Thoughts

The deal examples examined above make it clear: the

introduction of the DVT was crucial for the CCI to evaluate

transactions that could influence market competition

but previously slipped through the cracks due to the

recourse to the Previous De Minimis Exemption or De

Minimis Exemption, and their lack of residual powers

for scrutiny of such non-notifiable deals.

Concepts similar to the DVT are in place worldwide,

such as the “size of the transaction threshold”

in the United States.30 Though still in its

early stages, the DVT is expected to become more refined

as the CCI’s decisional practices evolve and as

further clarifications (such as FAQs) are released.

Despite being in its infancy, the DVT is poised to have

a substantial impact on how deals having an Indian nexus

are structured and negotiated going forward.

Author:

Parina Muchhala,

Anurag Shah,

Nishchal Joshipura and

Viral Mehta

You can

direct your queries or comments to the relevant member.

1These thresholds were recently revised

through a circular released in March 2024. Our analysis

of this development is available at:

https://www.nishithdesai.com/NewsDetails/14949.

2We have converted the Indian Rupee values

across this Deal Talk to United States Dollar (“USD”)

and Euro (“EUR”) based

on the conversion rates publicly available as on September

14, 2024.

3Section 6, Amendment Act (which inserts

Section 5(d) and a proviso to the Act).

4https://www.ies.gov.in/

pdfs/Report-Competition

-CLRC.pdf.

5The information in this section is based

on publicly available information as on September 14,

2024.

6Outcome of board meeting held on August

3, 2023, available at:

https://nsearchives.nseindia.com/

corporate/

ZOMATO_03082023151908_

ZomatoOutcomeSigned.pdf.

7The previous de-minimis exemption thresholds

are available at:

https://www.mca.gov.in/

Ministry/pdf/Notification

_30032017.pdf.

According to these thresholds, in case the assets of

the target were below INR 350 crores,

or

the turnover of the target was below INR 1,000 crores,

the transaction was exempt from notification to the

CCI.

8https://www.cnbctv18.com/

business/companies/

exclusive--zomato-board-to-sign-off-

blinkit-acquisition-on-june-17

-13731672.htm.

9https://investor.uber.com/

news-events/news/

press-release-details/2020/

Zomato-Acquires-Ubers-Food-

Delivery-Business-in-India/

default.aspx.

10https://www.forbes.com/

sites/parmyolson/2014/

10/06/facebook-closes-

19-billion-whatsapp-deal/.

11https://s3.ap-southeast-1.amazonaws.com/

cdn.inoxmovies.com/

Downloads/

6ffdee4d-1839-41e6-

a2be-95a14f8985d1.pdf.

12See generally:

https://www.businessinsider.in/

business/news/pvr-inox-now-fifth-

largest-listed-multiplex-chain-

globally-awaits-good-movies/

articleshow/98621386.cms.

13In Re: Consumer Unity &

Trust Society and PVR Limited and Inox Leisure

Limited (Order under Section 26(2) of the Act,

Competition Commission of India, Case. No. 29 of 2022).

14Regulation 4 (1), 2024 Combination Regulations.

15Regulation 4, 2024 Combination Regulations.

16https://www.cci.gov.in/

images/whatsnew/en

/general-statement-

combination-

regulations1725954145.pdf.

17According to Regulation 2 (1) (c) of

the 2024 Combination Regulations, the “relevant

date” means the date on which the approval of

the proposal relating to merger or amalgamation is accorded

by the board of directors, or the date of execution

of agreement or the date of such other document for

acquisition or acquiring of control referred to in sub-section

(2) of Section 6 of the Act.

18See generally, Regulation

3.137 (Part II: Notion of Undertaking Concerned), Commission

Consolidated Jurisdictional Notice under Council Regulation

(EC) No 139/2004.

19Paragraph #7 (e), Order under Section

43A of the Competition Act, 2002, Combination Registration

No. C-2015/02/249.

20As defined within Explanation 2 (d)

to Regulation 4 (2), “Digital service” means

the provision of a service or one or more pieces of

digital content, or any other activity by means of an

internet whether for consideration or otherwise to the

end user or business user, as the case may be.

21As defined within Explanation 2 (e)

and 2 (f) to Regulation 4 (2) respectively, “business

user” means any natural or legal person supplying

or providing goods or services, including through the

use of digital services; and “end user”

means any natural or legal person using digital services

other than as a business user, for informational or

transactional purpose. The proportion of business users

or end users is to be computed on the basis of average

number of such users for 365 days preceding the relevant

date.

22As defined within Explanation 2 (a)

to Regulation 4 (2), “gross merchandise value”

means cash, receivables, or other consideration either

for or facilitating, sale of goods and / or provision

of services, by an enterprise, on its own or as an agent

or otherwise.

23These thresholds were recently revised

through a circular released in March 2024. Our analysis

of this development is available at:

https://www.nishithdesai.com/NewsDetails/14949.

24Ibid.

25https://blinkit.com/aboutus.

26The definition of “control”

applicable for the purposes of the Act has been modified

through the Amendment Act.

27https://www.livemint.com/

companies/start-ups/

zomato-acquires-uber-eats

-business-in-india-to-consolidate

-position-11579578326776.html.

28In Re: Consumer Unity &

Trust Society, Case No. 29 of 2022 (Competition

Commission of India).

29https://www.business-

standard.com/

companies/news/

nclat-set-aside-cuts-petition-

seeking-cci-probe-in-pvr-inox

-merger-123081000932_1.html.

30https://www.ftc.gov/

enforcement/premerger-notification-program/

hsr-resources/steps-determining-

whether-hsr-filing.

Disclaimer

The contents of this hotline should

not be construed as legal opinion. View detailed disclaimer.

This hotline does not constitute a

legal opinion and may contain information generated

using various artificial intelligence (AI) tools or

assistants, including but not limited to our in-house

tool,

NaiDA. We strive to ensure the highest quality and

accuracy of our content and services. Nishith Desai

Associates is committed to the responsible use of AI

tools, maintaining client confidentiality, and adhering

to strict data protection policies to safeguard your

information.

This hotline provides general information

existing at the time of preparation. The Hotline is

intended as a news update and Nishith Desai Associates

neither assumes nor accepts any responsibility for any

loss arising to any person acting or refraining from

acting as a result of any material contained in this

Hotline. It is recommended that professional advice

be taken based on the specific facts and circumstances.

This hotline does not substitute the need to refer to

the original pronouncements.

This is not a spam email. You have

received this email because you have either requested

for it or someone must have suggested your name. Since

India has no anti-spamming law, we refer to the US directive,

which states that a email cannot be considered spam

if it contains the sender's contact information, which

this email does. In case this email doesn't concern

you, please

unsubscribe from mailing list.

|

|

We aspire

to build the next generation

of socially-conscious lawyers

who strive to make the world

a better place.

At NDA, there

is always room for the right

people! A platform for self-driven

intrapreneurs solving complex

problems through research, academics,

thought leadership and innovation,

we are a community of non-hierarchical,

non-siloed professionals doing

extraordinary work for the world’s

best clients.

We welcome

the industry’s best talent -

inspired, competent, proactive

and research minded- with credentials

in Corporate Law (in particular

M&A/PE Fund Formation),

International Tax , TMT and

cross-border dispute resolution.

Write to

happiness@nishithdesai.com

To learn more

about us

Click here.

|

|

Chambers

and Partners Asia

Pacific 2024:

Top Tier for Tax,

TMT, Employment,

Life Sciences, Dispute

Resolution, FinTech

Legal

Legal 500

Asia Pacific 2024:

Top Tier for Tax,

TMT, Labour &

Employment, Life

Sciences & Healthcare,

Dispute Resolution

Benchmark

Litigation Asia

Pacific 2024:

Top Tier for Tax,

Labour & Employment,

International Arbitration

AsiaLaw

Asia-Pacific 2024:

Top Tier for Tax,

TMT, Investment

Funds, Private Equity,

Labour and Employment,

Dispute Resolution,

Regulatory, Pharma

IFLR1000

2024: Top

Tier for M&A

and Private Equity

FT Innovative

Lawyers Asia Pacific

2019 Awards:

NDA ranked 2nd in

the Most Innovative

Law Firm category

(Asia-Pacific Headquartered)

RSG-Financial

Times:

India’s Most

Innovative Law Firm

2019, 2017, 2016,

2015, 2014

|

|

|

|