Deal Talk

October 18, 2024

High Stakes, Smart Moves: Upper Layer NBFC's and

the Mandatory Listing Requirement

A. Introduction

On October 19, 2023, the Reserve Bank of India

(“RBI”) released the

Master Direction – Reserve Bank of India (Non-Banking

Financial Company–Scale Based Regulation)

Directions, 2023 (“Scale Based Regulations”).

This pivotal framework categorizes non-banking financial

companies (“NBFCs”)

into four distinct “layers” based on

their size, activities, and perceived risks: base,

middle, upper, and top. This approach is based on

a layer-wise increase in regulatory scrutiny. So,

for example, a middle layer NBFC is subjected to

greater scrutiny than a base layer NBFC.

The Scale Based Regulations mandate the RBI to

specifically identify upper layer NBFCs (“NBFC-ULs”)

based on certain qualitative and quantitative parameters

and supervisory judgment as per their position as

on March 31 of the immediately preceding financial

year.1 In September 2022, the RBI had

released a list of 16 NBFCs that were categorised

as NBFC-ULs for the year 2022-23 (“September

2022 Notification”), which was further

revised to 15 for the year 2023-24.2

One of the noteworthy conditions of the Scale

Based Regulations requires an NBFC-UL to mandatorily

list its shares on the Indian stock exchanges (“IPO”)

within three years of being classified

as an NBFC-UL (“Mandatory

Listing Requirement”). Since the

NBFC-ULs were first so categorised in the September

2022 Notification, they are required to comply with

the aforesaid requirement within three years of

such date (i.e. before September 30, 2025).

In our latest edition of Deal Talk, we explore

the diverse structures that these NBFC-ULs have

adopted to comply with the Mandatory Listing Requirement.

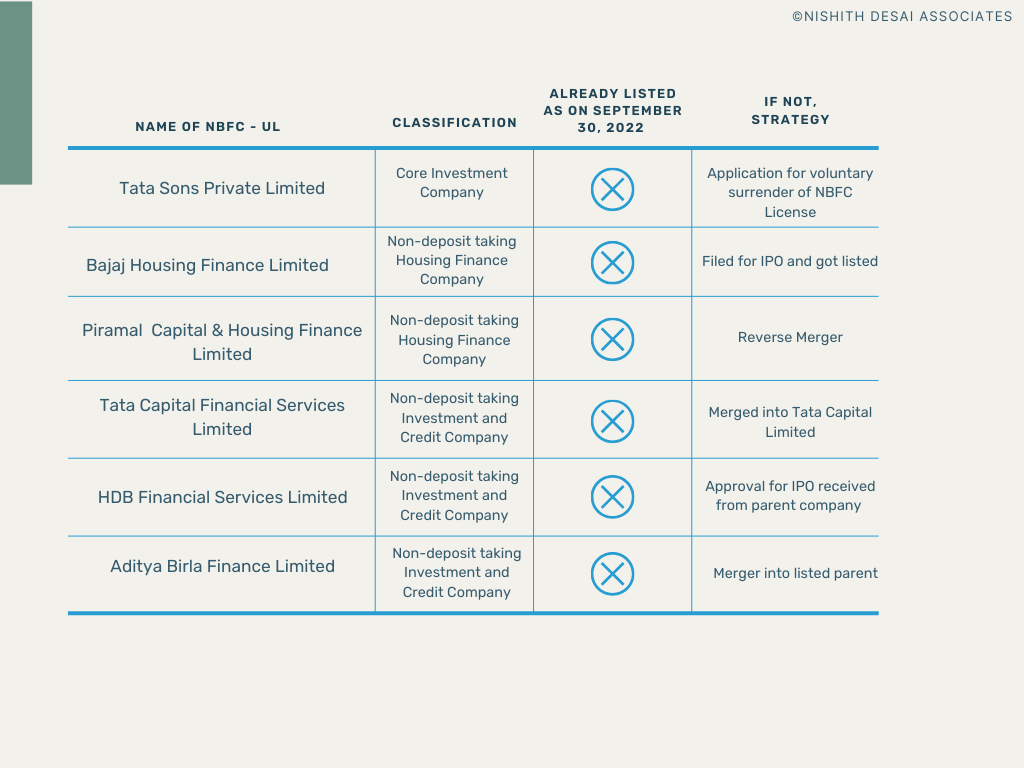

The current NBFC–ULs can be divided into

two buckets: (i) NBFC-ULs which were already listed

prior to release of September 2022 Notification

and were therefore not impacted by Mandatory Listing

Requirement (“Bucket 1”);

and (ii) NBFC-ULs which were unlisted and had to

get listed as per the Mandatory Listing Requirement

(“Bucket 2”).

Let’s look at a brief snapshot of each

NBFC-ULs within Bucket 1 and 2:

Bucket

1:

Bucket

2:

B.

“Structuring” the Mandatory

Listing Requirement

The NBFC-ULs in Bucket 2 have adopted different

strategies to comply with the Mandatory Listing

Requirement. These strategies can be broadly classified

into three routes:

The NBFC-UL achieving

listing on Indian stock exchanges pursuant to

an IPO (“Route 1”);

or The NBFC-UL merging

with an existing listed company within its group

(“Route 2”);

or The NBFC-UL voluntarily

surrendering its NBFC license to the RBI (“Route

3”).

Route

1

One of the most recent examples of NBFC-ULs that

have achieved listing on the Indian stock exchanges

is Bajaj Housing Finance Limited (“Bajaj

Housing Finance”). HDB Financial

Services Limited (“HDB”)

has also recently announced that it is in the process

of preparing draft offer documents for submission

to SEBI for an IPO pursuant to receipt of approval

from the board of its parent company (i.e. HDFC

Bank).3

So far as Tata Capital Financial Services Limited

(“TCFSL”) is concerned,

it undertook a restructuring wherein TCFSL along

with Tata Cleantech Capital Limited merged into

Tata Capital Limited (“TCL”).4

Further, the board of TCL has approved another restructuring

wherein Tata Motors Finance Ltd (“TMFL”)

will merge into TCL. As a consideration of the merger

of TMFL into TCL, TCL will issue equity shares to

the shareholders of TMFL. It has been publicly reported

that TCL may likely request for an extension of

the September 2025 deadline for complying with the

Mandatory Listing Requirement owing to the merger

of TMFL into TCL.5 However, it remains

to be seen whether it pursues Route 1 post completion

of its merger.

Route

2

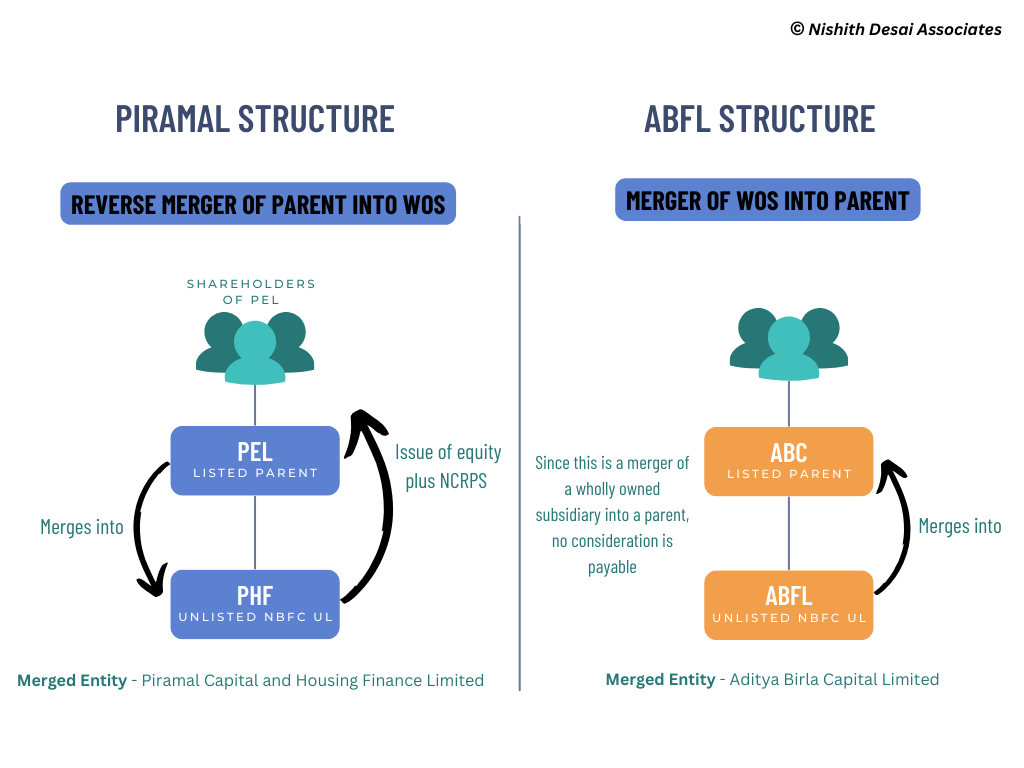

To fulfil the Mandatory Listing Requirement,

NBFC-ULs such as Piramal Capital and Housing Finance

Limited (“PHF”) and

Aditya Birla Finance Limited (“ABFL”)

have opted for the merger route by merging with

an existing listed company within their group structure.

Let’s take PHF’s example: PHF is

a wholly owned subsidiary of Piramal Enterprises

Limited (“PEL”), a

listed company that is registered with the RBI as

a non-deposit taking NBFC-ICC. The proposed merger

arrangement envisages the reverse merger of PEL

into PHF, with the surviving entity (PHF) being

subsequently listed on stock exchanges.

ABFL is opting for a similar structure to comply

with the Mandatory Listing Requirement. ABFL intends

to merge into its parent company Aditya Birla Capital,

which is currently registered with the RBI as an

NBFC-CIC and is listed.

Route

3

Tata Sons (the parent company of the Tata Group)

is currently categorized as an NBFC-CIC and is therefore

governed by the Core Investment Companies (Reserve

Bank) Directions, 2016 (“CIC Directions”).

As per Paragraph 6 of the CIC Directions, NBFC-CICs

that fall within either of these categories are

not required to be registered with

the RBI as a CIC and can operate as an “unregistered

CIC”: (a) CICs with an asset size of less

than INR 100 crores (irrespective of whether they

access public funds), or (b) CICs an asset size

of INR 100 crore and above (that do not access public

funds).

Earlier this year, Tata Sons applied to the RBI

for a voluntary surrender of its NBFC-CIC license

and requested for permission to continue as an “unregistered

CIC”.6 To operate as an unregistered

CIC, Tata Sons would effectively have to repay its

debt. In its application, Tata Sons has stated that

it has already repaid a significant amount of its

borrowings. Further, with respect to the residual

borrowings and to provide additional comfort to

the RBI at the time of evaluation of its surrender

application, Tata Sons has provided an undertaking

indicating its ability to repay it.

As per the CIC Directions, if an entity is an “unregistered

CIC”, the CIC Directions are inapplicable

to it.7 Accordingly, if Tata Sons is

classified as an “unregistered CIC”,

it will not need to comply with the Mandatory Listing

Requirement since it will no longer be considered

as an “NBFC-UL” for the purposes of

the September 2022 Notification.

Although its application

is currently pending, it will be interesting to

see what RBI decides given that Tata Sons is one

of the largest NBFC-ULs in India. Interestingly, a right to information request was filed with the RBI seeking clarity as to whether Tata Sons has sought an exemption from the Mandatory Listing Requirement. The response from RBI revealed that no such exemption has been sought.8

C. Concluding

Remarks

The September 2022 Notification was introduced

to mitigate the systemic risk associated with the

potential collapse of large-sized NBFCs that have

raised substantial public funds. As the September

2025 deadline approaches, most NBFC-ULs are working

towards meeting the Mandatory Listing Requirement

through Routes 1, 2, or 3. It would be interesting

to see how the remaining NBFC-ULs will implement

their strategies to comply with the Mandatory Listing

Requirement. These structures will also form the

bedrock for compliance strategies for NBFCs which

are declared as NBFC-ULs in the future.

Authors:

Parina Muchhala,

Anurag Shah and

Nishchal Joshipura

You can

direct your queries or comments to the relevant member.

1Annex 1, Scale Based Regulations.

2https://www.rbi.org.in/scripts/FS_PressRelease.aspx?prid=54474&fn=14.

3https://www.thehindubusinessline.com/markets/upper-layer-nbfc-hdb-financial-services-prepares-for-ipo/article68693781.ece.

4https://www.tatacapital.com/content/dam/tata-capital/pdf/investors-and-financial-reports/scheme-of-arrangement/Revised-Scheme-of-Arrangement.pdf.

5https://www.moneycontrol.com/news/business/banks/tata-capital-may-ask-rbi-for-more-time-to-list-12786905.html.

6https://www.tata.com/content/dam/tata/pdf/fy24/Tata-Sons-Annual-Report-FY24.pdf (page 9).

7Paragraph 2(2), CIC Directions.

8https://www.moneylife.in/article/rbi-says-tata-sons-has-not-sought-exemption-from-listing-requirements-ipo-before-september-2025-deadline/75404.html.

Disclaimer

The contents of this hotline should

not be construed as legal opinion. View detailed disclaimer.

This hotline does not constitute a

legal opinion and may contain information generated

using various artificial intelligence (AI) tools or

assistants, including but not limited to our in-house

tool,

NaiDA. We strive to ensure the highest quality and

accuracy of our content and services. Nishith Desai

Associates is committed to the responsible use of AI

tools, maintaining client confidentiality, and adhering

to strict data protection policies to safeguard your

information.

This hotline provides general information

existing at the time of preparation. The Hotline is

intended as a news update and Nishith Desai Associates

neither assumes nor accepts any responsibility for any

loss arising to any person acting or refraining from

acting as a result of any material contained in this

Hotline. It is recommended that professional advice

be taken based on the specific facts and circumstances.

This hotline does not substitute the need to refer to

the original pronouncements.

This is not a spam email. You have

received this email because you have either requested

for it or someone must have suggested your name. Since

India has no anti-spamming law, we refer to the US directive,

which states that a email cannot be considered spam

if it contains the sender's contact information, which

this email does. In case this email doesn't concern

you, please

unsubscribe from mailing list.

|

|

We aspire

to build the next generation

of socially-conscious lawyers

who strive to make the world

a better place.

At NDA, there

is always room for the right

people! A platform for self-driven

intrapreneurs solving complex

problems through research, academics,

thought leadership and innovation,

we are a community of non-hierarchical,

non-siloed professionals doing

extraordinary work for the world’s

best clients.

We welcome

the industry’s best talent -

inspired, competent, proactive

and research minded- with credentials

in Corporate Law (in particular

M&A/PE Fund Formation),

International Tax , TMT and

cross-border dispute resolution.

Write to

happiness@nishithdesai.com

To learn more

about us

Click here.

|

|

Chambers

and Partners Asia

Pacific 2024:

Top Tier for Tax,

TMT, Employment,

Life Sciences, Dispute

Resolution, FinTech

Legal

Legal 500

Asia Pacific 2024:

Top Tier for Tax,

TMT, Labour &

Employment, Life

Sciences & Healthcare,

Dispute Resolution

Benchmark

Litigation Asia

Pacific 2024:

Top Tier for Tax,

Labour & Employment,

International Arbitration

AsiaLaw

Asia-Pacific 2024:

Top Tier for Tax,

TMT, Investment

Funds, Private Equity,

Labour and Employment,

Dispute Resolution,

Regulatory, Pharma

IFLR1000

2024: Top

Tier for M&A

and Private Equity

FT Innovative

Lawyers Asia Pacific

2019 Awards:

NDA ranked 2nd in

the Most Innovative

Law Firm category

(Asia-Pacific Headquartered)

RSG-Financial

Times:

India’s Most

Innovative Law Firm

2019, 2017, 2016,

2015, 2014

|

|

|

|