Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

Regulatory Digest

July 12, 2024Mid-Year FPI Wrap 2024: Developments in the Foreign Portfolio Investor Regime

The significant developments in the FPI space in the first half of 2024 are:

-

Release of updated Master Circular for FPIs.

-

Amendment to circular mandating additional disclosures by FPIs that fulfil certain objective criteria.

-

Circular on relaxation of timeline for disclosure of material changes by FPIs.

-

Circular on flexibility to FPIs dealing with their securities post expiry of their registration.

-

Relief for NRI, OCI & RI Investors in GIFT IFSC based FPIs.

INTRODUCTION

The first half of 2024 saw SEBI introducing multiple changes in the framework governing Foreign Portfolio Investors (“FPIs”). From issuing thought-provoking consultation papers to releasing materially impacting circulars, SEBI managed to keep all the stakeholders on their toes. .

In this issue of our regulatory digest, we discuss the developments in the FPI space from January 1, 2024 to June 30, 2024.

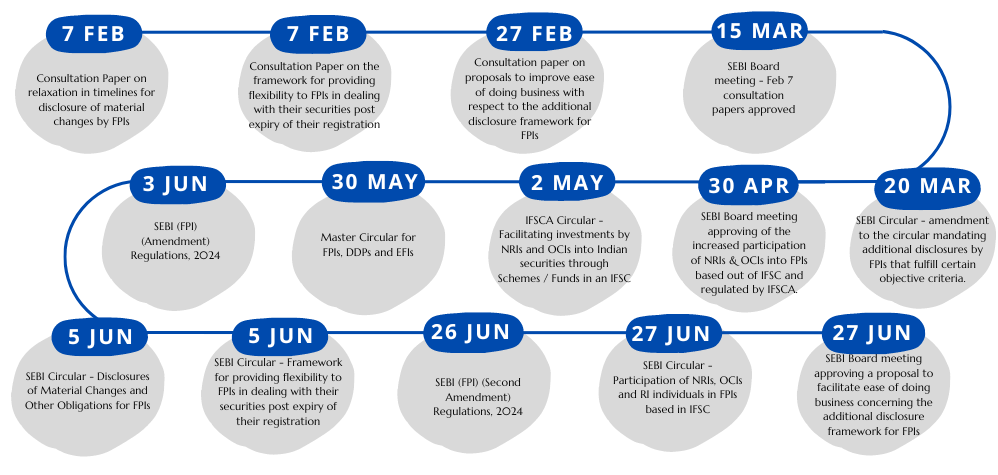

Figure: Timeline of the updates in the FPI regime

Master circular for FPIs, DDPs and EFIs

The SEBI (Foreign Portfolio Investors) Regulations, 2019 (“FPI Regulations”) outline the eligibility criteria, categories of FPIs, investment conditions and restrictions, general reporting obligations, and other guidelines for FPIs and Designated Depository Participants (“DDPs”). Soon after their notification on September 23, 2019, the FPI Regulations were supplemented by consolidated operational guidelines (“Operational Guidelines”) for FPIs, DDPs, and Eligible Foreign Investors (“EFIs”), which were released on November 05, 2019, and facilitated the implementation of the regulations. On December 19, 2022, the Master Circular for FPIs, DDPs, and EFIs (“Erstwhile Master Circular”) consolidating various SEBI circulars and guidelines was released by SEBI in supersession of the Operational Guidelines.

Recently on May 30, 2024, SEBI released an updated Master Circular for FPIs, DDPs, and EFIs (“Master Circular”)1, consolidating all the SEBI circulars and guidelines applicable to FPIs. The Master Circular superseded the Erstwhile Master Circular and serves as a comprehensive guide for FPIs, covering various aspects like the registration process of FPIs, know your customer (“KYC”) requirements, investment conditions/restrictions and avenues available to FPIs, conditions for issuance of offshore derivative instruments, position limits available for derivatives exposure by FPIs, investor charter for FPIs, requirement of certain objectively identified FPIs to provide granular information of all entities holding any ownership, economic interest, or control in the FPI, on a full look through basis, etc.

Amendment to Circular mandating additional disclosures by FPIs that fulfil certain objective criteria

On August 24, 2023, SEBI issued a circular2 (“Additional Disclosure Circular”) mandating certain objectively identified FPIs to provide granular details of all entities holding any ownership, economic interest, or exercising control in the FPI, on a full look through basis, up to the level of all natural persons, without any threshold. For this purpose of providing the granular details, SEBI identified the following two types of FPIs:

-

FPIs holding more than 50% of their Indian equity Assets Under Management (“AUM”) in a single Indian corporate group (“50% concentration criteria”);

-

FPIs that individually, or along with their investor group, hold more than INR 25,000 crore (~USD 3 billion) of equity AUM in the Indian markets.

A detailed mechanism for independently validating the conformance of FPIs with the conditions and exemptions has been laid out in a Standard Operating Procedure (“SOP”) framed and adopted by all DDPs, in consultation with SEBI. However, since the release of the Additional Disclosure Circular and the SOP, there has been a huge uproar amongst the market participants with regards to their practical applicability. In an attempt to resolve some of these issues, on March 20, 2024, SEBI released a circular3 exempting certain FPIs breaching the 50% concentration criteria from providing the granular details, subject to the following conditions:

-

The apex Indian company of such corporate group has no identified promoter. The details of the corporate groups with apex companies having no identified promoters is available here. This link is updated by depositories as and when required.

-

The FPI holds not more than 50% of its Indian equity AUM in the corporate group, after disregarding its holding in the apex company.

-

The composite holdings of all such FPIs (that meet the 50% concentration criteria excluding FPIs which are either exempted or have disclosed the granular information) in the apex company is less than 3% of the total equity share capital of the apex company.

The responsibility of tracking the information regarding the breach of the above-mentioned 3% holding in the apex company and making the same public, before the start of trading on the next day has been given to the depositories and is available here.

Relaxation of timeline for disclosure of material changes by FPIs

On June 05, 2024, SEBI released a circular relaxing the timelines for disclosure of material changes by FPIs.4 This circular resolved the issues which were earlier faced by the FPIs relating to the determination of ‘material change’, and adherence to the seven-day timeline. The circular introduced the division of ‘material change’ into two types, with different timelines for intimation of change in material information and submission of supporting documents for the two types of FPIs.

Please see our hotline SEBI Relaxes the Timelines for Disclosure of Material Changes by Foreign Portfolio Investors for a detailed analysis of the above circular.

Flexibility to FPIs dealing with their securities post expiry of their registration

On June 05, 2024, SEBI released another circular providing a detailed framework for FPIs dealing with their securities post expiry of their registration.5 The framework introduced by this circular was initially released for comments from the general public vide a SEBI consultation paper on February 07, 20246, which was subsequently approved by SEBI in its 15th March, 2024 board meeting.

This circular inter alia provides for regularization of FPI registration in case of non-payment of fees within the expiry of the current FPI registration period and disposal of FPIs’ securities post expiry of registration.

Please see our hotline SEBI provides flexibility to FPIs in dealing with their securities post expiry of their registration for an analysis of the above circular.

Relief for NRI, OCI & RI Investors in GIFT IFSC based FPIs

SEBI in its April 30, 2024 board meeting, approved a framework for permitting increased participation of Non – Resident Indians (“NRIs”), Overseas Citizens of India (“OCIs”) and Resident Indian (“RI”) individuals into SEBI registered FPIs based out of International Financial Services Centres (“IFSC”) in India and regulated by the International Financial Services Centres Authority (“IFSCA”).7 Pursuant to the board meeting, on May 02, 2024 and June 27, 2024, both IFSCA8 and SEBI9 respectively released circulars laying down the guidelines and framework for FPIs intending to avail this flexibility.

The framework provides for 100% aggregate contribution by NRIs, OCIs, and RI individuals in an FPI based out of IFSC, subject to certain conditions.

Please see our hotline Relief for NRI, OCI and RI Investors: SEBI allows Increased Participation in GIFT IFSC based FPIs for a detailed analysis of the approval and IFSCA circular.

SEBI Board Meeting

In its board meeting held on June 27, 2024,10 SEBI approved a proposal to exempt University Funds and University related Endowments, registered or eligible to be registered as Category I FPI, from the additional disclosure requirements as prescribed under the Additional Disclosure Circular, subject to the following conditions:

-

The entity’s Indian equity AUM is less than 25% of its Global AUM;

-

The entity’s global AUM is more than INR 10,000 crore equivalent;

-

The entity has filed appropriate returns/ filing to the respective tax authorities in its home jurisdiction. This is to serve as evidence of the nature of the entity being a non-profit organization which is exempt from tax.

A Circular laying down the specific eligibility for availing the exemption is awaited.

NDA VIEWS

The changes brought about by SEBI to the FPI framework demonstrate SEBI’s attempt to maintain an equilibrium between providing the requisite policy support to the FPIs and sustaining integrity of the Indian markets. The circulars introduced during this period have, inter alia, led to removing the ambiguity surrounding disclosure of change in material information and introduced processes for liquidating securities post expiry of the FPI registration, collectively contributing to a more favourable investment climate. The increased aggregate NRI/OCI/RI contributions to the IFSC based FPIs have provided newer investment opportunities to such investors. With Sensex touching 80,000 for the first time on the 3rd of July, newer jurisdictions taking larger share of the investment pie, Indian Government bonds getting impetus by JP Morgan and other global indices, and more Indian companies going for IPO, we believe that the ‘ease of doing business’ efforts of the Indian market regulator should continue.

Authors

- Ashwin Singh, Ritul Sarraf, Prakhar Dua and Kishore Joshi

You can direct your queries or comments to the relevant member.