Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

Debt Funding in India Series

July 5, 2022Credit Default Swap: Grooming the Infamous Device

I. Origin of Credit Default Swap in India

Capital infusion is often required for a company to carry on its business and broadly there are two ways to furnish this need: (a) to infuse equity into the organization, and (b) to avail loans. When a company avails a loan, even if the same is secured by an underlying asset, such loan translating into a non-performing asset for the lender, is a reality. Credit Default Swap (“CDS”) is one such mechanism through which the lenders try mitigating their risk.

Simply put, CDS functions like an insurance for the lenders against the defaults which may be committed by the borrowing entity. CDS is a derivative contract, wherein the lender pays a periodic amount to a CDS protection seller, and the CDS protection seller agrees to repay the defaulted amount including the principal and the interest upon the occurrence of a contractually agreed default event. Thereby, the lenders ‘swap’ their default risk with the third party CDS protection seller, hence, the name ‘credit default swap’.

CDS has been in existence, since the early 1990s, however, it is J.P. Morgan that has been credited with bringing CDS to prominence, in order to reduce their credit risk from their books to comply with the capital adequacy norms and make more funds available for lending.1 In the Indian context, the Reserve Bank of India (“RBI”) has issued the Master Direction – Reserve Bank of India (Credit Derivatives) Directions, 2022,2 (“Master Directions”) in suppression of the existing guidelines3. This article is an attempt to deconstruct the Master Directions.

II. Functioning of CDS vis-à-vis the Master Directions

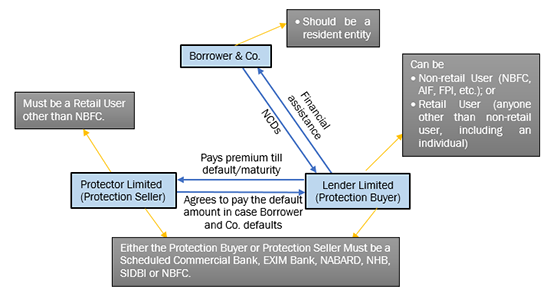

The below illustration depicts the functioning of CDS as per the Master Directions. For the purposes of the illustration, Borrower & Co. Private Limited (a borrower), avails financial assistance from Lender Limited (an NBFC) and secures the financial assistance by issuing debt instruments like a non-convertible debenture. To mitigate its risk, Lender Limited enters into a credit default swap contract with Protector Limited (an Insurance company). Simply put, the CDS mechanism works as demonstrated below:

A. Applicability: The Master Directions shall come into force on May 09, 2022. It shall apply to the derivative contracts whose value is derived from the credit risk of an underlying debt instrument if such transactions are undertaken in over-the-counter (OTC) markets and on recognized stock exchanges in India. Accordingly, these regulations will not be applicable to derivatives which are traded privately.

B. Eligible Participants and Classifications:

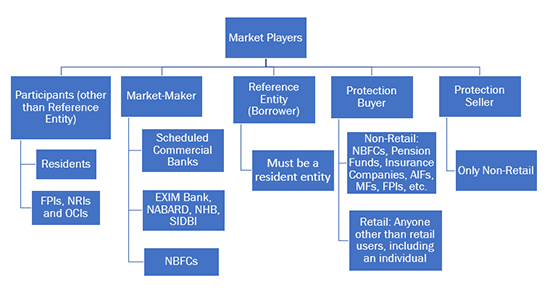

The various market players involved in a CDS transaction can be classified as follows:

-

Reference Entity: The entity issuing the debt instruments (“Reference Entity”) against whose credit risk the CDS contract is entered into shall be a resident entity eligible to issue any of the following instruments:

-

commercial papers4 and non-convertible debentures of original or initial maturity of 1 (one) year;

-

Rated INR corporate bonds and debentures; and

-

Unrated INR corporate bonds and debentures issued by the special purpose vehicles set up by infrastructure companies.

-

-

Resident and Non-Resident: Both (i) residents, and (ii) the following non-residents (a) foreign portfolio investors (FPIs), (b) non-resident Indians (NRIs) and (c) overseas citizens of India (OCIs) on repatriation basis are eligible to undertake the credit derivative transactions.5 Further, the aggregate limit of the notional amounts of CDS protection sold by FPIs shall not exceed 5% (five percent) of the outstanding stock of corporate bonds.6

-

Market-Maker: The following entities shall be eligible to act as market-makers in credit derivatives:

-

Scheduled Commercial Banks, except Small Finance Banks, Payment Banks, Local Area Banks and Regional Rural Banks;

-

Non-Banking Financial Companies (NBFCs), including Standalone Primary Dealers (SPDs) and Housing Finance Companies (HFCs), with a minimum net owned funds of Rs. 500 crores as per the audited balance sheet as of March 31 of the previous financial year and subject to specific approval of the Department of Regulation, Reserve Bank;7 and

-

Export Import Bank of India, National Bank of Agriculture and Rural Development, National Housing Bank and Small Industries Development Bank of India.

To bring in control and transparency in the derivatives market, the Master Directions mandate that at least one of the parties to a credit derivative transaction shall be a market-maker (listed in (i) to (iii) above) or a such other entities authorized by the RBI.

-

-

Retail and Non-Retail Users: The users, i.e. a party to the CDS contract other than the market-maker, shall be classified either as a retail user or a non-retail user. The definition of the non-retail user is exhaustive, and the following is the list of the same8:

-

NBFCs, including SPDs and HFCs, other than market-makers;

-

Insurance Companies regulated by Insurance Regulatory and Development Authority of India (IRDAI);

-

Pension Funds regulated by Pension Fund Regulatory and Development Authority (PFRDA);

-

Mutual Funds regulated by SEBI;

-

Alternative Investment Funds (AIFs) regulated by SEBI;

-

Resident companies with a minimum net worth of Rs. 500 crores as per the latest audited balance sheet; and

-

FPIs registered with SEBI.

The non-retail users have the option of being classified as retail users. On the other hand, the definition of retail users is residuary in nature, i.e., any user not eligible to be classified as a non-retail user shall be a retail user, which will include an individual as well.

-

-

Protection Sellers and Buyers: Both, retail as well as non-retail users are entitled to buy protection against credit risk (“Protection Buyer”). However, only the non-retail users listed above in paragraph 4, excluding NBFCs, are allowed to sell the protection against the credit risk, subject to obtaining approval from their respective regulator (“Protection Seller”).9

The various market participants as discussed in this Section II (B) are illustrated below10:

Market Participants

Residents; and

Non-residents:

(a) foreign portfolio investors (FPIs),

(b) non-resident Indians (NRIs), and

(c) overseas citizens of India (OCIs)

Reference Entity (the borrowing entity for simplicity)

A resident entity allowed to issue:

(a) commercial papers and non-convertible debentures of initial maturity of 1 year;

(b) Rated INR corporate bonds and debentures; and

(c) Unrated INR corporate bonds and debentures issued by the special purpose vehicles set up by infrastructure companies.

Market-Maker

(a) Scheduled Commercial Banks;

(b) NBFCs

(c) Export Import Bank of India, National Bank of Agriculture and Rural Development, National Housing Bank and Small Industries Development Bank of India

Non-retail users

(a) NBFCs;

(b) Insurance Companies;

(c) PFRDA;

(d) Mutual Funds;

(e) AIFs;

(f) Resident Companies; and

(g) FPIs

Retail users

Any user other than the above listed Non-retail users

Protection Sellers

(a) Insurance Companies;

(b) PFRDA;

(c) Mutual Funds;

(d) AIFs;

(e) Resident Companies; and

(f) FPIs

Protection Buyers

Any retail or non-retail user

III. Regulatory Controls and Governance of CDS under the Master Directions

CDS contracts though devised to offset the risk of the lenders have often been infamously credited for the global financial crisis of 2008-2009. American International Group, one of the biggest insurance companies with strong fundamentals, which had been selling the CDS protection, had to be bailed out by the government due to its inability to pay off the CDS protection buyers.11 This was a direct result of the lack of control and regulatory atmosphere over the CDS contracts and no requirement to maintain regulatory capital in cases of CDS contracts. Further, as CDS does not fall in the bucket of insurance, it remained unregulated and anyone could buy or sell the CDS, without the requirement of setting aside any reserve or regulatory capital.12

The RBI, taking a cue from the history of the CDS, has tried to place certain mechanisms to regulate and make the system more transparent and reliable for the participants. Some of these measures are discussed below:

-

Single-Name CDS: The CDS contracts can be entered into between the market-makers and users in relation to the credit risk where there is only a single Reference Entity.13

-

Regulator Restrictions: In addition to the requirements under the Master Directions, the Protection Sellers are required to obtain prior approval from their respective regulator for selling the protection in relation to the CDS contracts.14 Further, the users and the market-makers are prohibited to enter into CDS transactions if there are any regulatory restrictions on them which shall include non-compliance with the applicable prudential norms and capital adequacy requirements for credit derivatives issued by their respective regulators.15

-

Reference Obligations and Deliverable Obligations: The reference obligations refer to the instruments issued by the Reference Entity which shall be utilized for determining the value of the instruments. The deliverable obligations refer to the instruments issued by the Reference Entity which shall be delivered by the Protection Buyer to the Protection Seller during the settlement of the CDS contract upon the occurrence of a credit default event.

The Master Directions clarifies that asset-backed securities/mortgage-backed securities and structured obligations such as credit enhanced/guaranteed bonds, convertible bonds, etc. shall not be permitted as reference obligations. Further, the reference obligations and deliverable obligations shall be in dematerialized forms. This shall ensure that there is a record of settlement and the settlement is completed in an efficient manner.

-

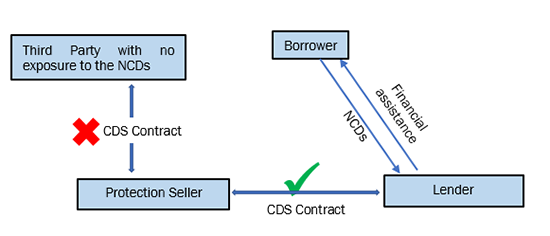

Related party CDS contract: The Master Directions prohibit the market participants, i.e. the users and the market-makers to enter into a CDS contract if the Reference Entity is related to either the Protection Seller or the Protection Buyer. This shall protect the un-related party from any loss that it may incur due to additional information available to the related party. For instance, if the borrowing entity has a common director in the Protection Buyer (investor) or the Protection Seller, then CDS contract is not permissible.

If the related parties are government-owned entities, then the aforesaid restriction shall not apply, but such transactions shall be on an arm’s length basis. Market-makers shall be bound to ensure that such related party CDS transactions are undertaken on an arm’s length basis and adequate measures are put in place for the same.16 Therefore, casting a duty on the market-maker ensures that the CDS transactions shall be in good faith, as the market-makers shall always be one of the parties to the CDS transactions.

-

Exit from CDS Contract: The market participants can exit their CDS contract either by (a) novating the CDS contract in favour of a third party, (b) settling the CDS contract upon the occurrence of a credit default event, or (c) termination of CDS contract upon maturity of the underlying debt instrument.

-

Novation: Either party to the CDS contract can assign its right and obligation to any other eligible third party (“Transferee”) by entering into a tripartite agreement with the Transferee and the party continuing with the CDS contract (“Remaining Party”), after obtaining consent from the Remaining Party. In case of Novation the Transferee is required to carry out a due diligence exercise.17 These provisions shall aid in protecting the interest of the Transferee and ensure that the Transferee is not penalized due to the lack of any significant details of the CDS contract.

-

Settlement: The market participants are permitted to settle the CDS contracts either bilaterally or through any clearing and settlement arrangement which has been approved by the RBI. Further, the CDS contracts can be settled in cash, physically, or through auction. The mechanism for the cash and auction settlement of the CDS contract is yet to be determined by the Credit Derivatives Determinations Committee, once it has been formed.18

-

-

Control and Regulatory Mechanisms

The Master Directions have tried to protect the interests of the market participants and also endeavoured to address some of the shortcomings of the CDS contracts by putting in place the following mechanisms:

-

The retail users are permitted to enter into the CDS contracts only for the purpose of hedging the credit risk pertaining to the underlying debt instrument. Accordingly, the retail users shall not be permitted to enter into a CDS contract for speculation and wagering purposes. The retail users need to have exposure to the debt instruments. Further, (a) the notional amount of the CDS contract should not be higher than the value of the debt instruments and (b) the CDS contract should not be for a period later than the maturity of the debt instrument. The retail users are provided a period of 1 (one) month from the date they cease to have underlying exposure, before which they need to exit the CDS contract.19

-

Standardization of CDS contracts: This shall help in ease of business for the market participants as well as provide terms that are based on international best practices, which in turn shall aid in attracting potential investors and lenders to enter into the Indian CDS market. Further, the Fixed Income Money Market and Derivatives Association of India (FIMMDA) shall be required to establish trading conventions and publish important aspects for the CDS contract, including standard maturity period, standard premium, upfront fee calculation, etc.20

-

Non-Negotiable terms under the CDS Contract: The CDS contracts shall mandatorily provide: (a) reference entity, reference obligation, and deliverable obligation(s); (b) credit event definitions; and (c) the method and procedure of settlement.21

-

Specific Exclusions under the CDS Contract: The following clauses shall not be incorporated under a CDS contract that shall: (a) entitle the Protection Seller to unilaterally cancel the CDS contract, but for in the event the Protection Buyer defaults; (b) prevent the Protection Seller from making the payment to the Protection Buyer upon the occurrence of a credit event and fulfilment of other conditions in accordance with the terms of the CDS contract; and (c) provide the Protection Seller to claim any relief from the Protection Buyer on account of payment made for credit event.22

-

Reporting Requirements for OTC CDS Transaction: Market-makers are required to report all OTC CDS transaction, to the trade repository of the Clearing Corporation of India Limited (CCIL) within 30 (thirty) minutes of such transaction. Further Clause 8.6(ii) of the Master Directions states “market-makers are required to report all unwinding, novation, settlement transactions, any credit, substitution or succession event to the trade repository of CCIL.” However, no timeline has been mentioned for reporting the aforesaid transactions stated in Clause 8.6(ii).

-

Reporting Requirements for Exchange-traded CDS Transaction: Exchanges shall report all CDS transactions to the trade repository authorized for the purpose by the Reserve Bank on a daily basis by the end of the day, in the form and manner prescribed by the Reserve Bank, which shall include the gross notional amount of protection sold by FPIs to CCIL.23

-

Penalty for Violation: The RBI is entitled to take any penal or regulatory action against the person or agency which violates the provisions of the Master Directions or any other applicable law, and can disallow such person or agency from dealing in the credit derivatives market for a period not exceeding 1 (one) month at a time, after providing a reasonable opportunity to such person or agency.24 The penalty provision seems to be appropriate, as it empowers the RBI to take action against the violators which includes prohibiting them from the derivative market, but the same should have been limited to the violation of these provisions as a violation of ‘any other applicable law’ is very wide and such violations may not even impact or be in relation to the derivative transactions.

-

IV. Hits and Misses by the RBI

At the time of writing this paper, the Master Directions seems to be a little incomplete as there are many mechanisms like cash and auction settlement, valuation of premium, calculation of maturity dates, etc. remains undecided. Further, there is a requirement of clarity on some significant aspects, as discussed below, which may turn the tides:

-

It is only known that the Credit Derivatives Determinations Committee shall comprise of the market-makers as well as the users, but the voting percentage of the exact composition has not been revealed.

-

The timelines for reporting any novation, settlement transactions, any credit, substitution, or succession event related to the OTC CDS transactions to the trade repository of CCIL are not provided.

-

The non-retail users are allowed to buy protection for hedging or ‘otherwise’. The term ‘otherwise’ is very wide in nature and in absence of any clarification or qualifier, it may be understood to include ‘speculations’. Accordingly, the non-retail users can buy protection for speculative purposes without having any underlying exposures to any debt instrument. Therefore, such naked CDS contracts may lead to a rise in the manipulation of the ratings of a debt instrument.

-

The auction settlement mechanism of the CDS contract needs to clarify whether a related party to the reference entity can take part in the auction of the reference/deliverable obligation.

-

Whether the Protection Sellers, after the settlement of the CDS contract with the Protection Buyer, shall have any recourse to the Reference Entity as a financial creditor or a lender under the applicable laws.

On the other hand, the Master Directions are not devoid of positives. Some significant features are discussed below:

-

The Master Directions have set up necessary regulatory control and linked the eligibility of the market participants to the approval of their respective regulators.

-

Capital adequacy norms for the Protection Sellers are made applicable as per the applicable laws, which was one of the dominant reasons for the failure of the CDS contracts which ultimately snowballed into the global financial crisis of 2008-09.

-

Adequate protection mechanisms and necessary terms to be incorporated and prohibited under the CDS contracts have been listed out to safeguard the Protection Buyers.

-

Strong penal provisions along with the strict reporting timelines shall assist in transparent and good corporate governance.

V. Conclusion

The provisions of the Master Directions clearly demonstrate that the object of the RBI is to develop the CDS market in India and attract potential market players to be part of the same. At the same time, the RBI has tried to maintain a stance that there shall be adequate checks and balances on the CDS transactions, through the regulatory regime. Such measures shall definitely go a long way in assisting the CDS to shed its disreputable history. For now, it remains to be seen whether these measures are good enough to tame the CDS contracts in the Indian market.

You can direct your queries or comments to the authors

1 James Freeman, The Credit Crisis and Its Creation. An out-of-control free market or one distorted by regulation?, The Wall Street Journal, May 13, 2009 available at: https://www.wsj.com/articles/SB124217981370213553; John Lanchester, Outsmarted. High finance vs. human nature, The New Yorker, June 1, 2009, available at: www.newyorker.com/magazine/2009/06/01/outsmarted, last accessed March 14, 2022; Matthew Philips, 9/26/08 How Credit Default Swaps Became a Timebomb, Newsweek, September 26, 2008, available at: https://www.newsweek.com/how-credit-default-swaps-became-timebomb-89291, last accessed March 14, 2022.

2 Master Direction – Reserve Bank of India (Credit Derivatives) Directions, 2022, notification no. RBI/2021-22/88, FMRD.DIRD.10/14.03.004/2021-22, dated February 10, 2022.

3 Guidelines on Credit Default Swaps (CDS) for Corporate Bonds, notification no. RBI/2010-11/542, IDMD.PCD.No. 5053 /14.03.04/2010-11, dated May 23, 2011.

4 Commercial paper is a short-term debt instrument issued by companies to raise funds. It is an unsecured money market instrument issued in the form of a promissory note. See, https://economictimes.indiatimes.com/markets/stocks/news/what-is-commercial-paper/articleshow/72979332.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

5 Schedule 1 of Foreign Exchange Management (Debt Instruments) Regulations, 2019 read with Clause 3(i)(b) of the Master Directions.

6 Clause 6(v) of the Master Directions read with the Transactions in Credit Default Swap (CDS) by Foreign Portfolio Investors – Operational Instructions, notification no. RBI/2021-22/155 A.P. (DIR Series) Circular No. 23, dated February 10, 2022.

7 Further, if an NBFC fails to meet the requirements stated in paragraph 3(ii) above, after obtaining the approval to act as a market maker, the NBFC shall cease to act as a market-maker. Provided that, the obligations of such NBFC as a market-maker shall continue with reference to the existing CDS contracts.

8 Clause 5.2(ii) of the Master Directions.

9 Clause 6 of the Master Directions.

10 Please refer to Section II (B) to see the restrictions or conditions, if any, attached to such participants.

11 Michael Aneiro, For Some, Disaster Is Spelled CDS, May 19, 2012, available at: https://www.barrons.com/articles/SB50001424053111904571704577404123059816922?tesla=y, last accessed March 15, 2022.

12 Floyd Norris, Naked Truth on Default Swaps, The New York Times, May 20, 2010, available at: https://www.nytimes.com/2010/05/21/business/economy/21norris.html, last accessed March 15, 2022.

13 Clause 4 of the Master Directions.

14 Clause 6(iv) of the Master Directions.

15 Clause 8(ii) read with Clause 12(i) of the Master Directions.

16 Clause 8.1(i) of the Master Directions.

17 Clause 8.1(iii) of the Master Directions read with the Novation of OTC Derivative Contracts, Notification No. DBOD.No.BP.BC.76/21.04.157/2013-14, December 9, 2013. The Master Directions require that the novation is carried out in accordance with the provisions of circular issued by the RBI on Novation of OTC Derivative Contracts dated December 9, 2013 (excluding Paragraphs 2, 5.1, and 5.2), which inter alia includes carrying out a due diligence exercise by the Transferee.

18 Clause 8.1(iv) and (v) of the Master Directions.

19 Clause 8.2 of the Master Directions.

20 Clause 8.3 of the Master Directions.

21 Clause 8.4(i) of the Master Directions.

22 Clause 8.4(ii) of the Master Directions.

23 Clause 10.1(ix) and (x) of the Master Directions.

24 Clause 15 of the Master Directions.