Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

Competition Law Hotline

July 1, 2022NCLAT Order in Amazon/FCPL Is a Missed Opportunity for Answering Substantive Questions of Law

Background

There has been significant news coverage surrounding Amazon and Future Retail’s disputes related to the latter’s proposed sale of retail assets to the Reliance Group. We have in a previous hotline, covered some aspects of the dispute, while analysing the Supreme Court’s decision recognizing emergency arbitration awards.

In the latest development in the Amazon-Future Retail saga, the National Company Law Appellate Tribunal (NCLAT) on 15 June 2022, upheld the Competition Commission of India (CCI)’s order from December 2021,1 (NCLAT Order) wherein the CCI revoked the approval granted to Amazon.Com NV Investment Holdings LLC (hereinafter Amazon) for an acquisition of stake in Future Coupon Private Ltd. (FCPL)2 citing misleading and inadequate disclosures relating to the strategic intent of the transaction. The CCI also imposed a penalty of INR 202 Crores on Amazon, for failing to notify an inter-connected and notifiable transaction (CCI Order).3

Transaction Structure

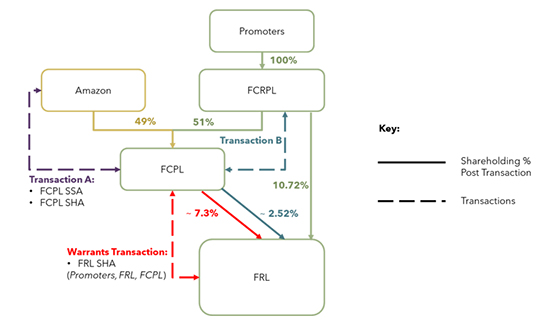

Based on disclosures made to the CCI at the time of notifying the transaction, Amazon was to invest a total of INR 1430 Crores in FCPL by way of a preferential allotment, resultantly subscribing to shares representing 49% of the total share capital of FCPL.

Immediately prior to, and at the same time as Amazon’s investment in FCPL – (a) Future Corporate Resources Private Limited (FCRPL) transferred shares held by it in FRL to FCPL, representing ~2.52% of FRL’s share capital; and (b) FCPL acquired equity warrants, which upon conversion would represent ~7.3% of FRL’s share capital and subsequently entered a shareholders’ agreement between FCPL, FRL and FRL’s Promoters (FRL SHA).

Resultantly, upon completion of the transactions, FCPL would hold up to 9.82% of the share capital of FRL. As a part of Amazon’s investment in FCPL, Amazon acquired certain rights, which included the requirement of prior written consent of Amazon, for FCPL to decide on or implement any matter under the FRL SHA.

The rights held by Amazon under the FCPL SHA, inter alia included: (a) a requirement for prior written consent of Amazon for the alienation of FRL’s retail assets; and (b) a bar on transfer of FRL’s retail assets to a ‘Restricted Person’ as defined in the FCPL SHA.

Genesis of the Dispute

Following the approval of a transaction involving the sale of FRL’s retail assets to the Reliance Industries (Reliance Group) in August 2020, Amazon alleged that the transaction would stand void, since Reliance Group was explicitly identified as a “Restricted Person.”

Amazon initiated emergency arbitration proceedings and applied for emergency interim relief under SIAC Rules. An emergency award was rendered in favor of Amazon on October 25, 2020. Due to the non-compliance by FRL and FCPL with the terms of the emergency award, Amazon filed for enforcement of the award. While a Single Judge of the Delhi High Court (Del HC) passed orders for enforcement, the Order was stayed by a Division Bench in appeal. In an appeal filed by Amazon against the Division Bench order, the Supreme Court allowed Amazon’s appeal, and recognized the validity of an emergency award passed in an India-seated arbitration.

Meanwhile however, FCPL filed an application before the CCI on 25 March 2021, alleging that statements made by Amazon in proceedings before the emergency arbitrator and other fora including Del HC, were in stark contradiction to statements made by Amazon in its Notice dated 23 September 2019 to the CCI.

The CCI issued a Show Cause Notice to Amazon on 4 June 2021 under Sections 43A, 44 and 45 of the Competition Act, 2002 (CA02) for failing to notify the FRL SHA (which was an interconnected and notifiable transaction in terms of Regulations 9(4) and 9(5) of the CCI (Procedure in regard to the transaction of Business relating to Combinations) Regulations, 2011 (Combinations Regulation)), and furnishing false/incorrect information and concealing/ suppressing material facts in its Notice dated 23 September 2019.

The CCI’s Order

Upon hearing Amazon and other parties (including unrelated third parties such as the Confederation of All India Traders (CAIT)), the CCI held that:

-

Imposed a penalty of INR 200 Crores under Section 43A of the CA02 for Amazon’s failure to notify a notifiable combination in terms of Section 6(2) of CA02;

-

Imposed a penalty of INR 1 Crore under Section 44 of CA02, and an additional penalty of INR 1 Crore under Section 45 of CA02, for suppressing and misrepresenting the actual purpose and strategic intent of Amazon’s investment in FCPL; and

-

Revoked the approval granted vide CCI’s Order dated 28 November 2019 to Amazon’s investment in FCPL (C-2019/09/688) and directed Amazon to re-file the Notice for the Combination in the detailed Form-II format.

In arriving at its adverse findings against Amazon, the CCI noted that a review of internal documents and communications of Amazon indicated that the actual rationale of the Combination was to become the single largest shareholder of FRL when retail is opened to Foreign Direct Investment (FDI), as opposed to the stated rationale of the combination, i.e., FCPL's potential to create long-term value and provide return on its investment; and to enhance Amazon's existing portfolio of investments in the payments landscape in India.

The CCI also noted that basis the evidence on record, Amazon had failed to disclose that the FRL SHA was negotiated as part of the Combination and was a prerequisite for Amazon's investment in FCPL; and that the Other Commercial Agreements were integral to the Combination, and were conceived, contemplated, negotiated, and consummated as part of the Combination.

The NCLAT’s Order

The NCLAT’s Order upholds the CCI’s Order on all grounds raised before it. However, in doing so it provides no additional guidance on several substantive questions of law raised before it.

Standard of Disclosures and Materiality under CA02

It was an undisputed fact that Amazon had disclosed the FRL SHA to the CCI as a part of its Notice, and that the FRL SHA was kept in abeyance till the receipt of the CCI’s approval.4 Nonetheless, the CCI argued that the disclosure was limited to a mere footnote,5 and that when asked specifically as to the strategic intent of the transaction, Amazon misled the CCI.6

The NCLAT Order reproduces significant portions of the notice filed by Amazon to the CCI, and in fact reproduces tables which summarize the rights acquired by Amazon in FRL, with a view to protect its investment (at Page 229 of the NCLAT Order). The table explicitly discloses Section 14 of the FRL SHA which prevents FCL and its promoters from selling, divesting, disposing or transferring its retail assets to Restricted Persons.7

Therefore, while the CCI has argued that it was misled to believe that the FRL SHA was an insignificant part of the transaction, the record would seem to suggest that all relevant disclosures were made before the CCI. The CCI is duly empowered under the CA02 to ask specific questions on all materials placed on the record before the CCI, and specifically seek representations from the notifying parties as to their intended actions. Merely because the CCI in the course of its review, omitted examining the FRL SHA in detail, doesn’t necessarily put the onus on the notifying party to proactively clarify any particular aspect of the notification beyond what is strictly required under the CA02 and the Combinations Regulations.

Here, whereas the NCLAT had the opportunity to assess several important questions of law, e.g., What is the standard for adequate and effective disclosures under the CA02? Since the rationale for a transaction can be dynamic and changing, there could be multiple rationales for a transaction. How much disclosure is sufficient? Who defines the theory of harm? How much burden should be placed on Parties to pre-emptively disclose rationale in order to guide the regulator’s analysis?

Instead, the NCLAT merely emphasizes the variance between internal communications purportedly relating to the rights under the FRL SHA – and the strategic intent for the investment in FCPL as disclosed by Amazon in the Notice – and characterizes it as a fraudulent disclosure.8

The NCLAT’s Order therefore appears to confound the statutory requirements for a valid notice under the CA02, since (a) the FRL SHA was disclosed to the CCI; and (b) the ‘long-term strategic intent’ of a transaction is not an explicit requirement under the Form-I specified by the CCI.

Further, even if it were to be admitted that Amazon failed to disclose the true long-term strategic intent of the acquisition, the CCI as well as the NCLAT fail to establish materiality of such disclosure to the CCI’s own review process. The alleged theory of harm extended by the CCI, is remote enough to dismiss any claims of materiality of disclosures relating to long-term strategic intent since:

-

Amazon’s rights under the SHA were merely investor protection rights which clearly identified Restricted Persons, and required Amazon’s prior approval before disposal, sale, divestment or transfer of FRL’s retail assets – since the value of its investment in FCPL’s coupon business was inherently tied to such retail assets.

-

Such rights would be strategic in nature if Amazon were in a position to acquire such assets – which was not possible till a corresponding modification to the FDI policy permitted Amazon to do so. Thus, the chance of such an event occurring was remote, and contingent on Government policy (beyond the control of Amazon);

-

Even if Amazon were to exercise any of the rights under the SHA so as to enter the physical retail space in India, or to leverage its hyper-local fast delivery capabilities, the transfer of such assets would have in and as of itself been a notifiable combination, thereby providing the CCI with the opportunity of re-visiting its effects analysis; and

-

Even if such a transfer of assets were to take place, there was a low likelihood of appreciable adverse effects on competition (AAEC), irrespective of how the market were to be defined. By CCI’s own admission: (i) FRL’s market share in the overall market for retail is limited, owing to the presence of several organized and unorganized sector players; (ii) Amazon does not have any holdings in the offline retail space and would be considered a new entrant (in case online and offline retail are considered to be separate relevant markets); (iii) Amazon’s market share in the retail market is limited (in case online and offline retail are considered distribution channels of the same relevant market).

Notwithstanding the veracity of the arguments above, there was enough material on record to color the CCI’s harm theory as a fairly remote one and cast questions over the materiality of the disclosure vis-à-vis CCI’s own review process. The NCLAT Order side-steps these questions and fails to provide any guidance on what can be considered a material misstatement or omission.

Limitation Period and CCI’s Residuary Powers

Section 20(1) of the CA02 empowers the CCI to review combinations based on its own knowledge or information, to inquire into whether such combinations have caused or are likely to cause any AAEC. However, the proviso to Section 20(1) limits the CCI’s powers of review to one-year from the date of such combination taking effect.

Notably, the powers of the CCI under Section 20(1) of CA02 are distinct from the powers of the CCI under Section 20(2) of CA02, which requires it to inquire into all combinations notified to it under Section 6 of the CA02 and does not specify any limitation period as such. Equally however, there is no express powers to revoke approval granted under Section 20 of CA02.

As such the powers of CCI to undo a combination (under various triggering circumstances) or direct any other form of divestiture, under the CA02, are limited to: (a) its powers under Section 31 of CA02, which requires it to adhere to the process prescribed therein, to direct modifications/ divestures in the course of reviewing a notice under Section 6(2) of CA02; (b) its powers under Section 20(1) of CA02 which enables it to initiate reviews of combinations not notified before it, and pass orders in accordance with Section 31 of CA02; and (c) its general powers under Section 28 of CA02, for which a finding of dominance and the likelihood of abuse is a precondition.

In the absence of any specific provision that covers a case of recalling an appealable order of the CCI, the statutory basis of CCI revoking its approval to the Amazon/FCPL transaction is unclear. In fact, the CCI itself has relied on its residuary powers under Section 45(2) of CA02 to recall the orders.

Here again the NCLAT had the opportunity to clarify the scope of CCI’s powers of recall/review of orders, clarify the scope of the limitation set forth under Section 20(1) of the CA02, and delineate the scope of CCI’s exercise of residuary powers. Instead, the NCLAT merely reiterates the CCI’s arguments of (a) an inherent power of review/recall in instances where the Order is obtained by “fraud”; and (b) that the power of review/recall is covered within the scope of residuary powers vested with the CCI under Section 45(2) of CA02.

The NCLAT’s approach is problematic for multiple reasons. Firstly, it is a settled principle of law that the power to review/recall and Order is not an inherent power vested in regulators, and that it must be expressly vested upon a regulatory by way of a statute.9 Any action of a body created under a statute which is in excess of powers granted to it is ultra vires.10 The CAO2 expressly omits any power of review for the CCI, and instead the erstwhile Section 37 of the CA02, which granted the CCI with the power of review, was deleted by the Competition (Amendment) Act, 2007.11 In one of the more recent cases evaluating the CCI’s powers of review, the Del HC had held that the CCI did have inherent powers of review/recall, but the same was limited to decisions taken in the exercise of administrative powers.12 Resultantly, while orders of the CCI passed under Section 26(1) of the CA02 were held to be eligible for recall, the rationale for the same was (a) the lack of any express statutory appeal for orders under Section 26(1); and (b) the administrative nature of orders passed under Section 26(1).13 Even then, the Del HC expressly stated that, the power to review/recall had to be exercised sparingly and within well-recognized parameters of review/recall without going into detailed arguments, and that the jurisdiction could be exercised only if the same was possible without entering into any factual controversy.14

Given this, it is unclear as to how the NCLAT concluded that despite orders under Section 31 of the CA02 being appealable, and in the absence of any explicit power of review vested upon the CCI, the CCI had an inherent power to recall an oder under Section 31 of the CA02. Moreover, it is unclear whether in the absence of such an inherent or statutory power to recall/ review orders passed under Section 31 of the CA02, the CCI could have sought to save its actions under Section 45(2) of CA02– which is merely residuary in nature, and cannot go beyond the scope of the CA02.

Separately, it was the CCI’s case that the FRL SHA was a separate yet interconnected and notifiable transaction, which was not notified to it. Notwithstanding the fact that the FRL SHA was indeed disclosed to the CCI, even if it were to be assumed that Amazon failed to notify the FRL SHA – then any inquiry into the FRL SHA would be governed by Section 20(1) of the CA02, which limits the CCI’s powers of review to 1 year from the date of a combination coming into effect. The NCLAT Order is silent on the applicability of the limitation both to the CCI’s ability to review the FRL SHA, and the applicability of the limitation under Section 20(1) of CA02 to any other inquiry into a consummated transaction, including those that were consummated basis CCI’s orders under Section 31 of CA02.

Proportionality in Penalties

Over the 15 years of enforcement preceding the CCI’s Order in Amazon/FCPL, the CCI has imposed an average penalty of 50 lacs with the maximum penalty being 5 crores, for breaching the provisions of Section 43A of the CA02 (See Appendix). However, in sharp contrast to those trends, the CCI imposed a penalty of INR 200 Crores upon Amazon. While admittedly, this amount was arrived at basis the statutory maximum permitted under Section 43A, the CCI Order provides no details of aggravating factors that led to a disproportionate increase of 40X over the historic maximum penalty imposed by the CCI.

The need for reasoned and proportionate exercise of discretion has been highlighted routinely by Courts – including most recently when the Supreme Court in the Excel Crop Care15 case, underscored the need for exercising discretion in a manner that was commensurate to the gravity of misconduct. The Supreme Court specifically highlighted that punitive discretion needs to be governed by rule of law and not by arbitrary, vague or fanciful considerations.

Admittedly, the Excel Crop Care case were issued in the context of Section 27 of the CA02 and determination of relevant turnover. Nonetheless, any discretionary powers vested upon the CCI must be exercised proportionately, failing which it would be violative of Article 14 of the Constitution of India.

Here again the NCLAT merely reiterates the CCI’s contention of Amazon having “fraudulently” obtained the order, and upholds the penalty imposed. The NCLAT Order does not provide any guidance on the validity of such a significant departure from CCI’s own past exercise of discretion. In fact, there is sufficient basis for considering various attenuating factors, that should have resulted in a lesser penalty.

The CCI while approving the combination of Reliance and Bharti AXA (vide Combination Registration No.C2011/0/1)16, wherein AXA had an `Option’ to acquire up to 24% shares of Bharti AXA Life Insurance and Bharti AXA General Insurance as and when permitted by FDI regulations, observed that `such an acquisition by AXA at a later date is not part of the present combination and shall be dealt accordingly as per the applicable laws at that time’. Yet, despite a similar clause being put into question in the Amazon/FCPL case, the CCI positioned Amazon’s omission to elaborate upon the strategic intent of the clause, as a grave and fraudulent omission. The Supreme Court in its judgement in Electrosteel Castings Limited V UV Asset Reconstruction17, observed that as per the settled proposition of law, mere mentioning and using the word `Fraud’/`Fraudulent’ without any material particulars, would not amount to pleading of `Fraud’. Despite this, the NCLAT Order provides no basis for terming Amazon’s omission to specifically point out its long-term strategic goals, as “fraud”, or establish any fraudulent intent on the part of Amazon.

Where the NCLAT Order Falls Short

The NCLAT Order, while lengthy (running into over 300 pages) is largely a reproduction of the CCI’s original order, and arguments advanced by Amazon and the CCI. The substantive part of the NCLAT’s Order rushes to conclusion without clarifying several important questions of law stemming from the CCI’s Order and raised in appeal. These include:

-

The scope and applicability of the limitation provided under the proviso to Section 20(1) of the CA02, and whether the CCI has the power to revoke an approval granted beyond the limitation period prescribed therein, even if such approval was granted based on misrepresentations?

-

Whether the CCI has an inherent power to recall its orders, and whether such inherent power (if it exists) can be exercised on grounds where no potential AAEC can be made out?

-

Whether disclosure of material facts, devoid of elaboration, can be considered to be misrepresentation for the purposes of Sections 44 and 45 the CA02?

-

Whether and to what extent, the disclosure of “strategic intent” of a transaction, is material to the CCI’s analysis of combinations notified under Section 6 of the CA02?

-

Whether the CCI is required to provide justifications while exercising its discretionary powers on imposition of penalties, especially when departing significantly and disproportionately from its own prior exercise of discretion?

Instead, and for the most part, the substantive part of the NCLAT’s Order defers to the CCI’s argument of its inherent and discretionary powers – for recall of orders, and imposition of penalties – to uphold the CCI’s Order. The NCLAT Order fails to provide any guidance on the scope and applicability of limitation periods, or for that matter the scope of what all can be considered to be a material misstatement or material omission for the purposes of CCI’s review of combinations.

The NCLAT Order is a missed opportunity on multiple fronts, something that one hopes could be remedied in appeal by the Supreme Court, under the statutory appeal allowed under the CA02.

Appendix – Penalty Trends in Section 43A Cases

|

S. No |

Case |

Penalty? (Y/N) |

Amount (INR) |

Link |

Date |

|

1. |

Investcorp |

N |

0 |

17-12-2021 |

|

|

2. |

Amazon-FCPL |

Y |

202,00,00,000 |

17-12-2021 |

|

|

3. |

CPPIB |

Y |

50,00,000 |

22-11-2019 |

|

|

4. |

Telenor |

Y |

5,00,000 |

03-07-2018 |

|

|

5. |

Intellect Design Arena |

Y |

10,00,000 |

07-05-2018 |

|

|

6. |

Adani Transmission |

Y |

10,00,000 |

30-07-2018 |

|

|

7. |

Shrem Infraventures et al. |

Y |

10,00,000 |

08-08-2018 |

|

|

8. |

Bharti Airtel (1) |

Y |

10,00,000 |

27-08-2018 |

|

|

9. |

Reliance Jio Infocomm |

Y |

5,00,000 |

11-05-2018 |

|

|

10. |

Bharti Airtel (C-2017/05/510) |

Y |

5,00,000 |

11-05-2018 |

|

|

11. |

Bharti Airtel (C-2017/05/509) |

Y |

5,00,000 |

11-05-2018 |

|

|

12. |

Akira Marketing |

Y |

1,00,000 |

24-01-2018 |

|

|

13. |

ITC Ltd. |

Y |

5,00,000 |

11-12-2017 |

|

|

14. |

LT Foods |

Y |

5,00,000 |

11-05-2018 |

|

|

15. |

Future Consumer Enterprise |

Y |

10,00,000 |

09-06-2017 |

|

|

16. |

RMGB and State Bank of Bikaner and Jaipur |

Y |

1,00,000 |

14-02-2017 |

|

|

17. |

Clariant Chemicals |

Y |

1,00,000 |

16-08-2016 |

|

|

18. |

Schulke & Mayr GmbH |

Y |

25,00,000 |

13-01-2017 |

|

|

19. |

SRF Limited |

Y |

10,00,000 |

16-08-2016 |

|

|

20. |

SHGB and Punjab National Bank |

Y |

1,00,000 |

14-02-2017 |

|

|

21. |

Diasys Diagnostics |

Y |

2,00,000 |

31-08-2016 |

|

|

22. |

Avago Technologies |

Y |

10,00,000 |

07-06-2017 |

|

|

23. |

Hindustan Colas |

Y |

5,00,000 |

14-09-2016 |

|

|

24. |

Rydel Automotive |

Y |

25,00,000 |

02-02-2017 |

|

|

25. |

Baxalta Inc. |

Y |

1,00,00,000 |

08-03-2016 |

|

|

26. |

EMC Limited |

Y |

5,00,000 |

26-04-2017 |

|

|

27. |

Elli Lily |

Y |

1,00,00,000 |

14-07-2016 |

|

|

28. |

J&JDC, Ethicon, Google |

Y |

5,00,000 |

30-12-2015 |

|

|

29. |

Cairnhill |

Y |

5,00,000 |

13-04-2017 |

|

|

30. |

Sundaram Finance |

N |

0 |

14-07-2016 |

|

|

31. |

Piramal Enterprises |

Y |

5,00,00,000 |

02-05-2016 |

|

|

32. |

UltraTech Cement |

Y |

10,00,000 |

12-03-2018 |

|

|

33. |

GE |

Y |

5,00,00,000 |

16-02-2016 |

|

|

34. |

Zuari |

Y |

3,00,00,000 |

10-02-2015 |

|

|

35. |

SCM Soilfert |

Y |

2,00,00,000 |

10-02-2015 |

|

|

36. |

Tesco Overseas Investments |

Y |

3,00,00,000 |

27-05-2014 |

|

|

37. |

Thomas Cook |

Y |

1,00,00,000 |

21-05-2014 |

|

|

38. |

Uttam Galva Steel |

N |

0 |

31-12-2013 |

|

|

39. |

Zulia Investments, Kinder Investments |

Y |

50,00,000 |

01-08-2013 |

|

|

40. |

Etihad Airways |

Y |

1,00,00,000 |

19-12-2013 |

|

|

41. |

Titan International Inc. |

Y |

1,00,00,000 |

02-04-2013 |

|

|

42. |

DFHL |

Y |

50,00,000 |

03-01-2013 |

|

|

43. |

Infosys Ltd. |

N |

0 |

17-05-2012 |

|

|

44. |

Reckitt Benckiser |

N |

0 |

08-05-2012 |

|

|

45. |

Siemens |

N |

0 |

19-04-2012 |

|

|

46. |

Alok Industries |

N |

0 |

12-04-2012 |

|

|

47. |

VMSA/RCAP |

N |

0 |

12-04-2012 |

|

|

48. |

TTPL/Capgemini |

N |

0 |

12-04-2012 |

|

|

49. |

Sterlite Industries |

N |

0 |

12-04-2012 |

|

|

50. |

Sasan Power |

N |

0 |

12-04-2012 |

|

|

51. |

Electromags Automotive |

N |

0 |

01-03-2012 |

– Srishti Chhabra & Indrajeet Sircar

You can direct your queries or comments to the authors

1 Amazon-Future Coupons case: NCLAT upholds CCI order, directs e-commerce giant to pay Rs 200 crore, Economic Times ( June 14, 2022), available at https://economictimes.indiatimes.com/industry/services/retail/amazon-future-coupons-case-nclat-upholds-cci-order-directs-e-commerce-giant-to-pay-rs-200-crore/articleshow/92172736.cms

2 Proceedings against Amazon.com NV Investment Holdings LLC under Sections 43A, 44 and 45 of the Competition Act, 2002 available at https://www.cci.gov.in/combination/order/details/order/1148/1

3 Id. at paragraph 83.

4 Amazon.com NV Investment Holdings LLC v. Competition Commission of India & Ors. (Competition Appeal (AT) No. 01 of 2022), National Company Law Appellate Tribunal, page 31, 39-40 available at https://efiling.nclat.gov.in/nclat/order_view.php?path=L05DTEFUX0RvY3VtZW50cy9DSVNfRG9j

dW1lbnRzL2Nhc2Vkb2Mvb3JkZXJzL0RFTEhJLzIwMjItMDYtMTMvY291cnRzLzIvZGFpbHkvMTY

1NTEwMTQ0MDIyODEzMzc1NzYyYTZkODAwNTcwNjMucGRm

5 Proceedings against Amazon.com NV Investment Holdings LLC under Sections 43A, 44 and 45 of the Competition Act, 2002, paragraph 5, available at https://www.cci.gov.in/combination/order/details/order/1148/1

6 Id. at paragraph 66-71.

7 Amazon.com NV Investment Holdings LLC v. Competition Commission of India & Ors. (Competition Appeal (AT) No. 01 of 2022), National Company Law Appellate Tribunal, pages 231 (paragraph 270) available at

https://efiling.nclat.gov.in/nclat/order_view.php?path=L05DTEFUX0RvY3VtZW50cy

9DSVNfRG9jdW1lbnRzL2Nhc2Vkb2Mvb3JkZXJzL0RFTEhJLzIwMjItMDYtMTMvY29

1cnRzLzIvZGFpbHkvMTY1NTEwMTQ0MDIyODEzMzc1NzYyYTZkODAwNTcwNjMucGRm

8 Id. at paragraph 264-266.

9 Patel Narshi Thakershi & Ors. v. Pradhyumansinghji (1971) 3 SCC 844

10 Sukhdev Singh V Bhagatram Sardar Singh, 1975 1 SCC

11 The Competition (Amendment) Act, 2007 ( Act no. 39 of 2007), paragraph 30, page 9 available at

https://www.mca.gov.in/Ministry/actsbills/pdf/Competition_Amendment_Act_2007.pdf

12 Google Inc. & Ors. V. Competition Commission of India & Ors., W.P. (C ) No. 7084/ 2014

13 Id. at paragraph 18.

14 Id. at paragraph 20.

15 Excel Crop Care Limited. V/s CCI Citation 8 SCC 47 (2017)

16 https://cci.gov.in/May2011/OrderOfCommission/CombinationsOrders/RILOrder270711.pdf

17 Electrosteel Castings Limited V UV Asset Reconstruction 2021 SCC OnLine SC 1132.