Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

Competition Law Hotline

May 13, 2011Indian Merger Control Regulations Finally Notified!

The Competition Commission of India (“CCI”) on May 11, 2011 issued the Competition Commission of India (Procedure in regard to the transaction of business relating to combinations) Regulations, 2011 (“Combination Regulations”). These Combination Regulations will now govern the manner in which the CCI will regulate combinations which have caused or are likely to cause appreciable adverse effect on competition in India (“AAEC”). Prior to the issuance of the said Combination Regulations, the CCI has issued a draft form of the regulations on March 2, 2011 (“Draft Regulations”) which were the subject of much debate and discussion. We, at Nishith Desai Associates, analyzed the provisions of these Draft Regulations in our hotline dated March 8, 2011 titled ‘Acquirers Beware: Indian Merger Control Regulations Notified!’

Having taken the views of representatives in varied fields including industry associations, legal luminaries and economists, amongst others, the draft regulations have been modified by the regulator to the present form. The Combination Regulations are to take effect from June 1, 2011 to supplement the notification of Sections 5 and 6 of the Competition Act, 2002 (“Competition Act”) relating to ‘combinations’. With the publication of these Combination Regulations, the CCI has been finally saddled with all the powers required to act as an economic regulator and exercise ‘merger-control’ over the Indian soils. The effects of the enactment of the Combination Regulations are vast since under Section 32 of the Competition Act, the CCI has been conferred with extra-territorial jurisdiction to fulfill its mandate of eliminating practices having AAEC. What this means is that every acquisition that involves the acquirer or the target, wherever incorporated having assets or a turnover in India may be subject to scrutiny by the CCI. In this hotline, we analyse the key provisions and implications of these Combination Regulations on the acquisition of shares, voting rights, control, assets and mergers involving India.

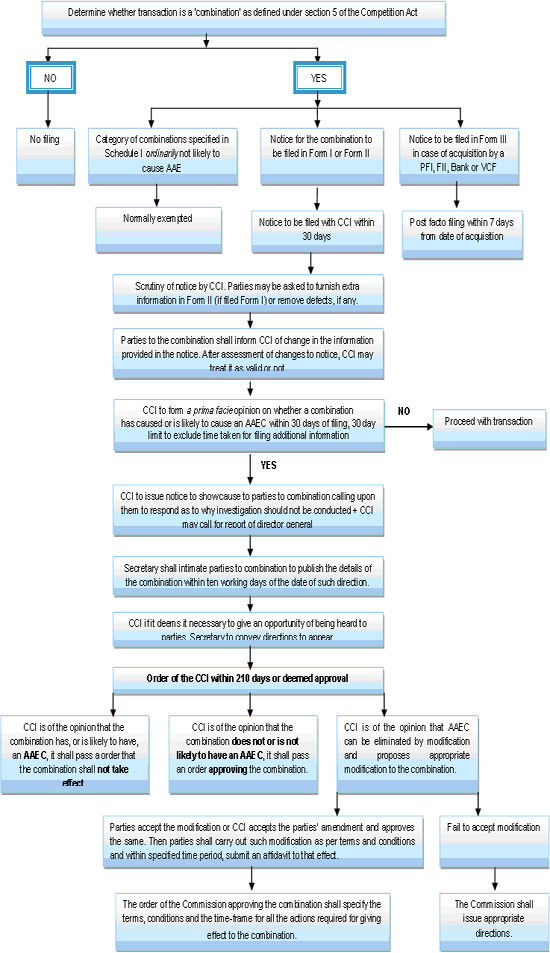

PROCESS CHART:Although Section 6 of the Competition Act prescribes the basic framework for notifying a combination to the regulator, the Combination Regulations elaborates the same. The flow chart below captures the procedure prescribed by the Combination Regulation in the event a combination requires the nod of the CCI.

ð ‘Execution of documents’ and not ‘closing of transaction’ prior to June 1, 2011 provide a safe harbor from the rigours of the Competition Act

With the merger control provisions coming into effect from June 1, 2011, there was uncertainty as to whether transactions spilling over the June 1, 2011 were subject to the notifications requirements under the Competition Act. Acquirers can breathe a sense of relief as the Combination Regulations clarify that the provisions of the Competition Act attract only those ‘combinations’ where the:

(a) approval of the proposal relating to merger or amalgamation by the board of directors of the enterprises concerned with such merger or amalgamation, as the case may be has been granted on or after June 1, 2011;

(b) execution of any agreement or other document for acquisition of shares, voting rights or assets or acquiring of control has been executed on or after June 1, 2011.

The word ‘other document’ has been defined to mean any binding document, by whatever name called, conveying an agreement or decision to acquire control, shares, voting rights or assets.

Implication: Where a merger or amalgamation has been approved by the board of directors or where a binding document such as a share purchase agreement has been executed for the acquisition of shares, voting rights or assets or control, before June 1, 2011, such transactions will not be subject to the notification requirements of the Combination Regulations even if the closing of the transaction happens on or after June 1, 2011. Therefore it appears that it is not the ‘closing of a transaction’ test but ‘execution of a binding commitment’ test prior to June 1, 2011 that determines whether the CCI nod is required or not.

This provision also removes the ambiguity in cases of investments in tranches where one tranche has been completed, but the second tranche is due completion post June 1, 2011.

Having stated the above, corporate India is likely to witness a flurry of transactions been signed on or before May 31, 2011 in order to avoid any review under the recently notified Combination Regulations.

ð Certain categories which are ‘ordinarily’ not likely to cause an AAEC need not ‘normally’ be notified - onus to notify shifts on acquirer

Deviating from the strict interpretation of Section 6 of the Competition Act, which requires all combinations to be notified to the CCI, Schedule I to the Combination Regulations specifies categories of transactions which are ordinarily not likely to have an AAEC and therefore would not normallyrequire to be notified to the CCI.

The transactions described in Schedule 1 include:

· Acquisitions of shares or voting rights as an investment or as an investment in so far as the total shares or voting rights held by the acquirer directly or indirectly does not exceed 15% of the total shares or voting rights of the company.

· Consolidation of holdings in an entity where the acquirer already had 50% or more shares or voting rights except in cases where the transaction results in a transfer from joint control to sole control.

· An acquisition of assets unrelated to the business of the acquirer other than an acquisition of a substantial business operation.

· Acquisitions of stock-in-trade, raw materials, stores, current assets (in the ordinary course of business).

· Acquisitions of bonus or rights shares, not leading to acquisition of control.

· Combinations taking place entirely outside India with insignificant local nexus and effect on markets in India.

AMBIGUITIES· Creeping acquisitions have not been addressed – whilst there is an exemption of acquisition of 15% of shares and voting rights, it is not clear as to whether this exemption is a onetime exemption or not. The Securities and Exchange Board of India (Substantial Acquisitions and Takeover) Regulations, 1997 (“Takeover Regulations”) permits an acquirer that has acquired atleast 15% of the shares and voting rights in accordance with the regulations to acquire up to 5% of the shares and voting rights of the said target in every financial year up to a maximum threshold of 55%, without triggering public announcement requirements. This form of creeping acquisitions has not been addressed in the Combination Regulations which makes it ambiguous as to whether every acquisition of shares and voting rights over and above the initial 15% needs to be notified to the CCI.

· The term ‘insignificant local nexus’ is vague and very subjective – whilst the Combination Regulations seem to have clarified that transactions taking place outside India and having insignificant local nexus in India need not be notified, there are no objective criteria to determine what ’insignificant local nexus’ is.

Implication: Although the exclusion of Schedule 1 transactions is seen as a respite to acquirers, enabling ordinary course of business transactions to occur without involving the CCI, the subjectivity of the words ‘ordinarily not likely to have an AAEC’ and ‘would not normally require to be notified’, makes Schedule 1 not a ‘straight jacket exclusion’ that can be applied to transactions described therein but shifts the burden on the acquirer to determine whether the combination is subject to notification or not. Further, the above transactions which are not subject to be notified could still be subject to review of the CCI under section 3 (anti competitive agreement), section 4 (abuse of dominant position) and more importantly under the catch all provision of Section 20 of the Competition Act which grants the CCI a retrospective power to “look back” into transactions that have taken effect one year prior thereto.

It appears that the CCI, in trying to appease the needs of acquirers has, on the contrary, ventured into a safe zone making it the obligation of the acquirer to determine the obligations under the Competition Act resulting in more uncertainty on the manner in which the Combination Regulations will be applied.

ð Combinations to be notified to CCI in prescribed forms along with prescribed filing fees

The Combination Regulations provides for the following forms:

|

Type of form |

Description |

Filing fees |

|

Form I |

A simplified form requiring basic information (as compared to the one prescribed by the Draft Regulations). To be filed ‘ordinarily’ for all combinations including the list of transactions specified in Regulation 5 (2) of the Combination Regulations. |

INR 50,000 (approx., USD 1150) |

|

Form II |

An exhaustive form requiring varied details. For cases where parties to the combination decide at their option to notify the combination under Regulation 5 (3) of the Combination Regulations or where CCI believes that it requires information in Form II, in cases where parties have filed a Form I |

INR 1,000,000 (approx. USD 22,400) |

|

Form III |

Post facto filing to be made by a public financial institution, registered foreign institutional investor, bank or registered venture capital fund, under a covenant in a loan agreement or an investment agreement within seven days of an acquisition, share subscription or financing facility entered into. |

No fee payable |

|

Form IV |

Publication of the details of the combination. |

No fee payable |

Implications: The onus in deciding which form to file seems to have been shifted to the acquirer. The significance of filing Form I or Form II is linked to the time that the CCI may take to make a decision with respect to a combination. Should the regulator require information to be filed in Form II as opposed to that already filed as Form I, the time taken for filing Form II is excluded from the outer limit of 210 days prescribed for the CCI to make a decision. Therefore parties to a combination may have to weigh the balance between filing additional information by way of Form II and restricting the time period taken by the CCI to 210 days. It must be noted however, the Regulation 5(4) still gives the CCI the power to require further information whether Form I or Form II has been filed and the time taken for filing this additional information is against excluded from the 210 day limit. The benefit (if any) of filing Form II is therefore significantly reduced.

Regulation 5 of the Combination Regulations prescribes an inclusive list of transactions that would necessarily require to be notified in Form I with the CCI. The categories of combinations provided in Regulation 5 (2) of the Combination Regulations include transactions such as:

· the parties to the combination are predominantly engaged in exports1 of goods or services from India and continue to be predominantly engaged in exports of goods or services from India after the combination takes effect2;

· an acquisition or acquiring of control over an enterprise is by a liquidator, administrator or receiver appointed through court proceedings or through any scheme approved under the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 or under the Sick Industrial Companies (Special Provisions) Act, 1985 any other modification or re-enactment of the law;

· an acquisition resulting from a gift or inheritance;

· an acquisition of a trustee company or that arises from a change of trustees of a mutual fund established under the Securities and Exchange Board of India (Mutual Fund) Regulations 1996, as amended from time to time;

Some of the aforementioned categories of transactions can be regarded as ‘passive acquisition’ or transactions that are likely to have ‘insignificant impact in India’ and therefore to that extent it is difficult to understand the rationale for inclusion of the above transactions under the requirement of notification.

ð Waiting period

· As per the provisions of the Competition Act, CCI shall pass a final order or issue a direction within 210 days from the date of filing or else the combination shall be deemed to have been approved.

· However, as per the provisions of the Combinations Regulations, CCI shall endeavour to pass a final order or issue a direction within 180 days from the date of filing.

· The Combinations Regulations mandate CCI to form a prima facie opinion on whether a combination has caused or is likely to cause an AAEC within the relevant market in India, within 30 days of filing.

Implication: Whilst the Combination Regulations indicate that CCI shall endeavor to come to a final decision within 180 days, the statutory time limit i.e. waiting period continues to remain 210 days and consequently the 180 day time period is optical in nature and not binding on the CCI Further it may be noted that all time taken to file additional information sought by the CCI is excluded from the computation of the 210 day period, drawing away from the 210 day period being the outer most limit for an approval. Even the 30 day period for arriving at the prima facie opinion is extendable should additional information be sought by the CCI.

ð No pre merger consultation

The Draft Regulations provided for an informal and verbal consultation with the officials of the CCI for any enterprise which proposed to enter into a combination. However, the Combination Regulations have omitted the pre merger consultation provisions taking away the ability of parties to seek clarifications from the CCI before triggering the filing requirements.

Implication: Considering that there exists no jurisprudence on merger control in India, introduction of pre merger consultation provisions in line with international standards was considered as a welcome move. However, these provisions have been abstained from the final Combination Regulations which takes away the advantage that parties could have had in presetting the timeline for the transaction.

ð Impact on transactions involving listed companies

In combination involving listed companies, a primary transaction may trigger notification with CCI and subsequent open offer obligation under the Takeover Regulations. This means that the primary or secondary transaction cannot be effected unless clearance from CCI is obtained. In cases where clearance from the CCI is not received within the statutory time period required to complete the open offer as prescribed under the Takeover Regulations, then as per the extant provisions of the said Takeover Regulations, the acquirer has to pay interest to shareholders for delay beyond the statutory period required to complete payment to the tendering shareholders on account of non-receipt of statutory approvals.

Implications: This puts the acquirer of a listed company in a disadvantageous position due to conflict between securities law and Combination Regulations. This concern remains to be ignored in the Combinations Regulations. Should the CCI pass an adverse order, the cessation of the primary and secondary transaction may become expensive.

ð Confidential and Unpublished price sensitive information

Under the Combination Regulations, parties to the combination are required to file substantial information along with the prescribed forms and are entitled to seek confidentiality of the information filed. There is no presumption of confidentiality in relation to the information filed with the CCI unless confidentiality is claimed. Although, confidentiality may be claimed with respect to the sharing of information with the public, there is no such restriction on the sharing of information if required by other regulatory / sectoral authorities under applicable law. Further, the CCI has also been given the powers to approach other statutory authorities concerned with such a combination to seek inputs there from in connection with the transaction which may further lead to sharing of confidential information so filed.

Implications: There is a presumption that along with the forms filled with the CCI, given the nature of information required therein, confidential information will also be disclosed. In an acquisition involving or concerning a listed entity, there could be a conflict between the company/ promoter and the acquirer with respect to information sharing, with the company claiming that the same is ‘unpublished price sensitive information’ and the acquirer being desirous of complying with the information requirements under the Competition Act. Although a party to the combination is entitled to seek confidentiality in relation to the information filed with the CCI, the acquirer may never the less be deemed to be in the possession of unpublished price sensitive information and would be required to be on high alert as it could face the risk of insider trading.

ð Conflict of interest and duplication

Under the Combination Regulations, it is obligation of the acquirer to make filing/ provide information to CCI. In a combination involving co-investors / multiple acquirers, in order to be regarded as person acting in concert at all times, investors / multiple acquirers may notify separately and therefore is a possibility that the same transaction may be subject to duplicate filings with CCI. Further, at times there may be disagreement between the acquirers and the sellers about the quantum of confidential information that can be shared with CCI.

ð No provision for withdrawal of application due to change in market circumstances / conditions

The Combination Regulations do not provide for an ability to withdraw a filing, once made, should the conditions affecting the combination change, making the combination unlikely to fall within the ambit of the Competition Act.

Implications: Considering that the time involved in getting a clearance from CCI may span up to 7 months, there is likelihood that the information submitted along with the forms may become outdated or irrelevant at the time of actual grant of clearance. Further, there also remains possibility of change in market conditions / circumstances requiring parties to the combination withdraw their application. The current provisions relating to combinations under the Combination Regulations do not provide for withdrawal of application / updation of information in above circumstances.

ð Other key provisions

a. Single notification involving multiple tranches. The Combination Regulations clearly stipulate that where the ultimate intended effect of a business transaction is achieved by way of a series of steps or smaller individual transactions which are inter-connected or inter-dependent on each other, one or more of which may amount to a combination, a single notice, covering all these transactions, may be filed by the parties to the combination.

b. Flexibility to follow accounting standards for disclosure of information in forms. As per the notes to the Forms to be filled for the purpose of the Combination Regulations, accounting standard as notified by the Government of India, from time to time, or the International Financial Reporting Standards or the US Generally Accepted Accounting Principles shall be followed for the purposes of computing figures (including turnover).

c. Joint ventures under Competition Act. The Combination Regulations do not provide any specific regulations/ guidelines governing joint ventures in India unlike anti-trust laws of other jurisdictions. Joint venture being highly flexible concept is increasingly becoming popular form of competitor collaboration and therefore is likely to attract the provisions relating to anti-competitive agreement, abuse of dominance and regulations of combinations and therefore specific guidance in relation to the same becomes important. However, joint ventures are listed as a defence to an anti competitive agreement in the event it increases efficiency.

d. Definition of enterprise. The definition of an ‘enterprise’ implies an ongoing entity and therefore new company may not specifically be classified as an enterprise under Section 5.

e. De-minimus provisions continue. It may be noted that vide its notification on March 4, 2011 the Government of India had exempted the acquisitions of small enterprises whose turnover is less than INR 7.5 billion (approx USD 167 million*) or whose assets value is less than INR 2.5 billion (approx USD 56 million*) from the definition of combination as defined under Section 5 of the Competition Act. However, it is still to be clarified as to whether or not this enterprise value is only limited to the assets/ turnover in India.

Conclusion:With the recent notification of the Combination Regulations, all the provisions of the Competition Act have finally been implemented - the process of which began almost a decade ago! This means all transactions, by whatever name called, will have to comply with the provisions of the Competition Act in order to avoid consequences of violation thereunder.

While there existed some jurisprudence on anti competitive and abuse of dominant position under the erstwhile anti-trust laws of India before their implementation, the same is not the case in relation to merger control. This will pose a challenge for both the competition law regulator and corporate India as merger control provisions may probably change the dynamics of doing transactions in India. While on the one hand the promising competition law regulator assures that combinations notified with them will be handled effectively, there remain concerns for the public at large as to whether the same will turn into another department monopolized by bureaucrats and red tapism.

__________________

1 A party to the combination shall be deemed to be predominantly engaged in export of goods or services from India if at least seventy five percent (75%) of the turnover of the party to the combination is derived from exports out of India.

2 Provided that the market share of the combined entity is less than fifteen percent (15%) in the relevant market in India.

* For reference USD 1 = INR 45