Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

M&A Hotline

August 13, 2009Securities Appellate Tribunal Rules on Open Offer Price in Indirect Acquisitions

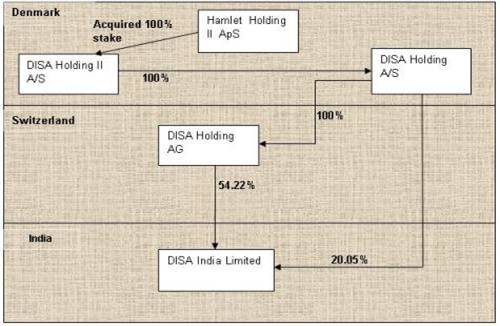

In the case of acquisition of shares of DISA Holding II A/S, a Dannish company (“Foreign Target”), by Hamlet Holding II ApS, a Dannish company (“Acquirer”), which resulted in indirect acquisition of DISA India Limited (“Indian Target”), Securities Appellate Tribunal (“SAT”) recently ruled on the determination of the methodology for calculating the open offer price in case of indirect acquisitions.

A. FACTS

The diagrammatic representation of the shareholding resulting in indirect acquisition of the Indian Target is as under:

i. Facts resulting in indirect acquisition of Indian Target

· On March 9, 2008 the Acquirer executed a Share and Stock Purchase Agreement withthe shareholders of Foreign Target, purchasing 100 percent of their shareholding in the foreign Target.

· By virtue of the aforesaid acquisition, the Acquirer indirectly acquired 74.27 percent of the paid up share capital of the Indian Target.

ii. SEBI’s Informal Guidance

· The indirect acquisition of the Indian Target by Acquirer triggered the provisions of Regulation 14(4) of the Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 1997 (“Takeover Code”) which required the Acquirer to make a public announcement within three months from the date of consummation of the overseas acquisition.

· The Acquirer got registered as a shareholder with Foreign Target only on September 4, 2008 even though the Share and Stock Purchase Agreement between the Acquirer and the Foreign Target was executed on March 9, 2008.

· The Acquirer, approached Securities and Exchange Board of India (“SEBI”) under the Securities and Exchange Board of India (Informal Guidance) Scheme, 2003 to obtain an informal guidance regarding the date of consummation of the acquisition in terms of Regulation 14(4). SEBI, as per its letter dated December 15, 2008 clarified that September 4, 2008 would be treated as the date of consummation as per Regulation 14(4) of the Takeover Code. On the same day, SEBI condoned the delay in making the public announcement and the Acquirer was advised to make the public announcement within 15 days from December 15, 2008.

· The Acquirer made a public announcement on December 17, 2008 and the offer price of Rs.1657 was worked out by the Acquirer in terms of Regulation 20(4)(c) of the Takeover Code.

iii. Objections by SEBI

· After the public announcement, Foreign Target along with DISA Holding A/S and Disha Holding AG, (together referred to as “Appellants”), through their merchant banker submitted the draft letter of offer to SEBI for its comments.

· SEBI, vide its letter dated February 09, 2009, required the Appellants to amend the offer letter on the following two points:

o The offer price may be calculated in terms of Regulations 20(4)1 read along with Regulation 20(12)2 of the Takeover Code;

o The date of the public announcement for the parent company i.e. Foreign Target should be taken as the date of Share and Stock Purchase Agreement i.e. March 09, 2008.

· Aggrieved by the aforesaid observations, Appellants filed an appeal to SAT

B. ISSUE FOR CONSIDERATION

i. Whether Regulation 20(4)(c) and / or Regulation 20(12) shall be applicable for computation of the open offer price for the indirect acquisition of the Indian Target?

ii. For the purpose of computing the offer price as per Regulation 20(12), what should be the relevant date of the public announcement for the parent company?

C. ARGUMENTS ADVANCED

i. Contentions on behalf of SEBI

· The open offer price should be calculated in terms of Regulation 20(4) read with Regulation 20(12) and the date of public announcement for the parent company should be taken as March 9, 2008, which is the date on which the Share and Stock Purchase Agreement was executed between the Acquirer and Foreign Target.

· The word "public announcement" under Regulation 20(12) is used with reference to the Foreign Target and would mean the act of making known publicly the acquisition of the Foreign Target and this, was made known on March 9, 2008 when the Share and Stock Purchase Agreement was executed between the Acquirer and the Foreign Target.

· The Appellants should work out the offer price of the shares of the Indian Target by treating March 9, 2008 as the date of public announcement with reference to the Foreign Target.

ii. Contentions on behalf of the Appellants

· The Appellants on the other hand contended that Regulation 20(12) does not apply to the instant case and that the price has been rightly calculated in terms of Regulation 20(4)(c) of the Takeover Code.

D. OBSERVATIONS OF SAT

i. Regulation 20(12) not applicable

· Regulation 20(12) pre-supposes the condition wherein if the parent company gets acquired, the Takeover Code would get triggered and a public announcement would be made. In this case, neither of the two was done since the Foreign Target was an unlisted company and thus would not fall within the meaning of “target company” as defined under the Takeover Code.

· A mere intimation of acquisition to the general public and would not amount to public announcement under the Takeover Code, since a public announcement is said to be made when all the requirements provided under Regulation 16 of the Takeover Code have been complied with, including publication of the same in news papers. Thus it cannot be said that the date of public offer is March 9, 2008, since on that date, only the Share and Stock Purchase Agreement was executed between the Acquirer and the Foreign Target and that by itself does not mean intimation to the public.

ii. Offer price rightly calculated under Regulation 20(4)(c)

· Regulation 20(4) prescribes three different modes in clauses (a), (b) and (c) for determining the offer price and the highest of the three shall be the offer price for the open offer.

· As per the aforesaid Regulation, the Appellants determined the offer price which came to Rs.1,656.15. Accordingly, the Appellants fixed Rs.1,657 per share as the offer price in the public announcement.

E. SAT RULING

SAT finally ruled that since the offer price under Regulation 20(12), with reference to the date of public announcement for the Foreign Target was not applicable to the instant case, Regulation 20(12) would not apply for computation of the open offer price for the Indian Target. Accordingly open offer price would be computed as per Regulation 20(4) of the Takeover Code.

F. CONCLUSION

The timing for trigger of open offer and the methodology for computing open offer price in case of indirect acquisitions has always been a subject matter of interpretation. Considering the slew of global acquisitions that are taking place resulting in indirect acquisition of Indian listed entities, this SAT ruling clarifies some of the ambiguities surrounding such indirect acquisitions which in turn is developing wealth of jurisprudence for the foreign acquirers.

__________________________

1 Regulation 20(4) provides for the mode of computation of open offer price in case of general acquisitions under the Takeover Code. The section reads as follows:

For the purposes of sub-regulation (1), the offer price shall be the highest of—

(a) the negotiated price under the agreement referred to in sub-regulation (1) of regulation 14;

(b) price paid by the acquirer or persons acting in concert with him for acquisition, if any, including by way of allotment in a public or rights or preferential issue during the twenty-six week period prior to the date of public announcement, whichever is higher.

(c) the average of the weekly high and low of the closing prices of the shares of the target company as quoted on the stock exchange where the shares of the company are most frequently traded during the twenty-six weeks or the average of the daily high and low of the prices of the shares as quoted on the stock exchange where the shares of the company are most frequently traded during the two weeks preceding the date of public announcement, whichever is higher.

2 The offer price for indirect acquisition or control shall be determined with reference to the date of the public announcement for the parent company and the date of the public announcement for acquisition of shares of the target company, whichever is higher, in accordance with sub-regulation (4) or sub-regulation (5).