Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

M&A Hotline

January 15, 2024Public M&As in India – 2023 Wrap

-

On December 01, 2023 the market capitalization of companies listed on the National Stock Exchange surpassed the USD 4 Trillion mark. With the increase in the number of listed companies in India, the Public M&A market in India is booming as well.

-

Given the current bullish investor sentiments and the strength of Indian economy, we anticipate more deals and better development of the regulatory regime for Public M&As.

-

In this article, we revisit all open offers made in 2023 along with certain trends identified in the offers made. Additionally, we also revisit major regulatory developments which we feel will play a key role in structuring of Public M&As in 2024.

INTRODUCTION:

-

2023 has been a landmark year for Indian Public M&A, both in terms of the quantum of control deals and the proactiveness of the public market regulator – Securities and Exchange Board of India (“SEBI”).

-

Under the chairmanship of Madhabi Puri Buch, SEBI has played the role of a trendsetter, through active stakeholder consultation in the development of the regulatory regime and increased proactiveness to strike a balance between investor protection and ease of doing business. This is evident from its numerous legislative and enforcement initiatives across 2023. A total of 62 consultation papers were released by SEBI to consider proposals for amendments to different laws governing the Public M&A market in 2023. This was followed by multiple key amendments to the legislative framework, which increased scrutiny and governance of the market while also giving a much-required push for deal making in the Public M&A market.

-

In this wrap, we have provided insights into different trends observed in relation to control deals and certain key developments in the Public M&A market in 2023.

TRENDS IN RELATION TO OPEN OFFERS:

A. Deal activity during the year:

-

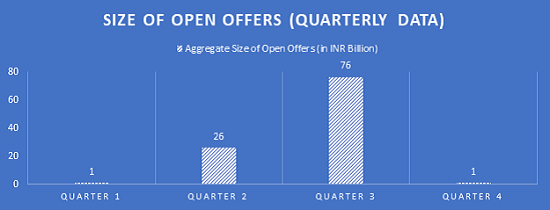

Between the period from January 01, 2023 to December 31, 2023, the Indian Public M&A market witnessed a total of 85 tender offers (open offers) being made under the SEBI (Substantial Acquisition of Shares and Takeover) Regulations, 2023 (“Takeover Code”).1 The aggregate deal value (proposed size) of these 85 tender offers was approximately INR 105 Billion.2

-

The year started out with increased deal activity, with a total of 25 open offers being made in Q1 2023. This marked a positive movement compared to Q4 2022, wherein 19 open offers were made.

-

The movement of deal activity reduced over Q2 and Q3, and the year ended with only 14 open offers being made in Q4. This was in line with the trend from the previous years, wherein deal activity slows down substantially in the last quarter of the calendar year.

-

In terms of the size of the open offer, the intermediate quarters (Q2 and Q3) saw a surge in the size of open offers being made.

-

In terms of the open offers made in the year 2023, the following were the top 5 open offers based on the size of the offer3 (in descending order of value):

-

Open Offer by Belgian government-owned telecom player Proximus group to acquire Route Mobile Limited. The size of the open offer made is approximately INR 26 Billion and this marked one of the largest ever cross-border control deals in the communication platform space in India.

-

Open Offer by Burman group for the hostile takeover of Religare Enterprises Limited. The size of the open offer made is approximately INR 21 Billion. The open offer is yet to be completed and is pending investigation by the Competition Commission of India (“CCI”) and SEBI.

-

Open Offer by Nirma Limited for the acquisition of Glenmark Life Sciences Limited. The size of the open offer made is approximately INR 13 Billion. The open offer received approval from the CCI on December 19, 2023.

-

Open offer by Aditya Birla Fashion for the acquisition of TCNS Clothing Company Limited. The size of the open offer made is approximately INR 9 Billion. The open offer was closed in August 2023 and saw full acceptance of the offer by the public shareholders.

-

Open offer by Gautam Adani led Ambuja Cements for the acquisition of Sanghi Industries Limited. The size of the open offer made is approximately INR 8 Billion. The price of the open offer was revised on December 05, 2023 and the offer is pending.

-

B. Sector and structure analysis of control deals:

-

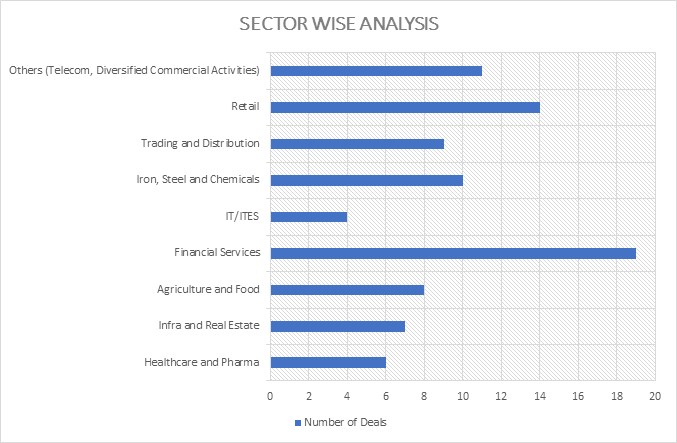

2023 saw the highest number of open offers being made in the financial services sector. A total number of 19 open offers were made in target companies involved in the financial services sector. This is in line with the rising interest of investors in the financial services sector as approximately 20 open offers were made in 2022 in the financial services sector.

-

Interestingly, a total of 6 open offers have been delayed or are pending in the financial services sector due do the requirement of approval from the Reserve Bank of India for the “change in control” of NBFCs occurring under the applicable directions. For instance, the open offer made for Rita Finance Leasing Limited failed due to refusal of approval by Reserve Bank of India for “change in control”.

-

A total of 16 open offers made in 2023 had Persons Acting in Concert (“PAC”), along with the acquirer, making the open offer.

-

Out of the 85 open offers made in 2023 – (a) 60 offers were made by individual acquirers, (b) 15 offers were made by corporate acquirers, and (c) 6 offers were made by a mix of acquirers which included both corporates and individuals.

LOOKING BACK AT KEY DEVELOPMENTS IN 2023 IN THE PUBLIC M&A MARKET:

-

Disclosure of agreements impacting management or control of a listed entity - Regulation 30A of the amended SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 ("LODR Regulations"), mandates disclosure by various stakeholders, including shareholders, promoters, and employees of a listed company, of agreements falling under Clause 5A of Para A of Part A to Schedule III of the LODR. Agreements which impact the management or control of a listed company must be reported to stock exchanges within two working days of execution of such agreement. Additionally, any subsequent amendments to these agreements will need to be separately disclosed to stock exchanges as well. Importantly, such disclosures are to be made irrespective of whether the listed company is party to such agreements. This amendment was potentially brought in as an aftermath of certain open offers which were triggered due to covenants in agreements executed by promoters of listed companies that were never disclosed to the public at the time of execution.

-

Verification of market rumour by listed companies and impact on deal making – As an aftermath of the order by SEBI (which was later on stayed by Securities Appellate Tribunal) against Reliance Industries Limited for not clarifying a market rumour in relation to the Jio-Facebook deal, SEBI amended the LODR Regulations to include mandatory verification of market rumors by listed companies. While this specific amendment is yet to come into effect, it has substantial implications on existing and potential deal-making in the Public M&A market (from the perspective of deal certainty and negotiations). In Public M&A transactions, price certainty is crucial for completion of a transaction. Price certainty is directly linked to confidentiality of transactions, as pre-mature information in the market might lead to unintended fluctuations. Floor prices for offers are generally determined by historical stock price movements, and disclosure prior to freezing of commercial terms and transaction documents (solely due to the presence of a market rumor) might lead to inorganic price movements. Timing public disclosures is critical to shield deal prices from post-announcement stock fluctuations, ensuring investor confidence. Premature announcements in the form of verification, triggered by market rumours, could jeopardize price certainty and impact deal viability.

-

Synergy between Competition (Amendment) Act, 2023 and open market purchases – As per the Competition Act, 2002 (“Competition Act”), transactions surpassing the thresholds provided in Section 5 of the Competition Act necessitate prior notification to the CCI, and no steps can be concluded until CCI approval is obtained. This waiting period, also referred to as the “standstill obligation”, poses multiple challenges to transactions that involve the acquisition of shares of listed companies on the stock exchange or an open offer, particularly due to the price fluctuations that may occur during the standstill period or delayed periods in the event of an open offer. In order to resolve this, the recently passed Competition (Amendment) Act 2023 in Section 6(2A) provides an exemption to open market purchases and open offers from the standstill obligations mentioned above, in the manner set out in the legislation. As per the available exemption, the acquisition of listed shares (through open offer or open market purchases) can be consummated prior to notifying the CCI for its approval, if: (i) the CCI is notified within the timeline and in manner as specified under law; and (ii) the acquirer does not exercise any ownership, beneficial rights or interest in such securities (including voting rights and receipt of dividends or any other distributions), until CCI’s approval is received. While this provision is yet to come into effect, this exemption would allow for better deal structuring and improved timelines for open market purchases in Public M&As, whilst preventing price fluctuations of the underlying securities.

-

Proposed reduction in the settlement period - SEBI is contemplating a significant reform in the settlement cycle for the equity cash segment, by introducing a facility for clearing and settlement of funds and securities on the same day (T+0) (i.e. an instant settlement cycle), offering an alternative to the existing T+1 settlement cycle. The proposal aims to implement this change in two distinct phases. In Phase 1, SEBI envisions the introduction of an optional T+0 settlement cycle for the equity cash segment, applicable to trades conducted until 1:30 PM. Under this proposal, settlement of funds and securities would be completed on the same day by 4:30 PM. This initial phase aims to test the feasibility and impact of a same-day settlement cycle.

Moving forward to Phase 2, SEBI suggests the introduction of an optional immediate trade-by-trade settlement for funds and securities. In this second phase, trading activities would continue until 3:30 PM. This represents a further acceleration of the settlement process compared to the T+0 cycle, potentially enhancing liquidity and efficiency in the market. To ensure a smooth transition, SEBI has recommended implementing the T+0 settlement cycle initially for the top 500 listed equity shares based on market capitalization. This implementation will occur in three tranches, starting with the top 200, followed by the subsequent 200, and concluding with the remaining top 100 based on market capitalization.

The move towards a same-day settlement cycle and an instant settlement cycle is aimed at modernizing and streamlining India’s securities markets. It holds the potential to enhance market liquidity, reduce counterparty risks, and facilitate more efficient capital deployment. Upon implementation, this would assist in the ease of executing trades in cases of Public M&As and open market purchases.

-

Comprehensive framework on Offer for Sale - Offer for Sale (“OFS”) is a transaction wherein promoters or major investors of a listed company sell existing shares of a listed company to the public. It was initially introduced in 2012 to aid promoters in achieving minimum public shareholding requirements under the law. However, in January 2023, SEBI issued a circular which provided a comprehensive framework on OFS through the stock exchange mechanism (“2023 Framework”). The 2023 Framework supersedes the 2012 framework and its amendments. The transition from the 2012 framework to the 2023 Framework reflects SEBI’s inclusive approach towards unlocking the market potential of OFS as a means for the substantial sale of shares on stock exchanges. Specifically, the 2023 Framework expands the scope of the term “eligible sellers” in OFS to include: (i) all promoter entities of companies needing to meet minimum public shareholding, and (ii) non-promoters of listed companies with a market capitalization of INR 1,000 crores and above. This broader scope allows non-promoters in listed companies with high market capitalization to undertake OFS. The cooling-off period applicable before and after the OFS has also been changed from the previous blanket 12-week period to a range of 2 weeks to 12-week cooling-off period (depending on the liquidity of the shares).

CONCLUSION

Based on the trends observed in 2023, the sentiment towards deal making in Public M&A market in India should likely continue to be bullish. In the second and third quarter of the year, it is possible that the movement in the market would depend largely on the results of the upcoming Indian general elections and the policies of the incoming government. SEBI’s role as a regulator would be key in 2024 as this year would see the implementation of a lot of initiatives (such as reduction of settlement period) which were envisaged or discussed with stakeholders in 2023. Given the on-going increase in the interest of investors in certain key-sectors such as healthcare, infrastructure, and technology, we can expect to see more deal activities in and around these sectors. Lastly, the increased interest in reverse flipping into India by organizations may also contribute to deal activity by unicorns in this market.

– Anurag Shah, Parina Muchhala, Ratnadeep Roychowdhury and Nishchal Joshipura

You can direct your queries or comments to the authors.

1This number covers only the letter of offers that were filed with SEBI between the period of January 01, 2023 to December 31, 2023.

2The total offer size is based on the proposed value of the acquisition and not on the actuals of the open offer.

3This analysis is based on the proposed size of the offer and not actuals. Additionally, the analysis does not include offers for which the letter of offer was made prior to January 01, 2023 and the offer concluded between January 01, 2023 and December 31, 2023,