Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

Dispute Resolution Hotline

June 6, 2016Corporate Litigation Landscape of India Overhauled!

- The establishment of Commercial Courts, a renewed arbitration law, passage of Insolvency & Bankruptcy Code, 2016 and constitution of National Company Law Tribunal reflects a completely overhauled judicial set up.

- The Company Law Board is scrapped and going forward the matters will be taken up by National Company Law Tribunal

- National Company Law Tribunal is proposed to deal with wide range of matters including corporate insolvency, class action and merger & amalgamation schemes.

Over the last year, India has taken tangible steps in reforming its judicial setup to bring about efficiency and speed in disposal of commercial matters. The constitution of commercial courts1, reforms in the arbitration regime2 and introduction of the Insolvency and Bankruptcy Code, 2016 (“Bankruptcy Code”) offer a completely new mechanism for resolution of commercial matters. The government has now constituted the much awaited National Company Law Tribunal (“NCLT”) which is expected to consolidate multiple forums that currently exist for resolving company law matters.

It’s been more than a decade since the passage of the Companies (Second Amendment) Act, 2002, which provided the legislative framework for constitution of the NCLT. However a constitutional challenge against constitution of NCLT delayed the process. The Hon’ble Supreme Court in Madras Bar Association vs Union of India3 finally upheld the constitutional validity of NCLT and the National Company Law Appellate Tribunal (“NCLAT”) while holding that the qualifications of technical members and the composition of the selection committee of such members as prescribed in the statute had defects and required correction. In another judgment in Madras Bar Association vs Union of India4 the Hon’ble Supreme Court found that defects as found in Companies (Second Amendment) Act, 2002 also existed in the provisions of the Companies Act, 2013.

After much debate on the issues prevalent in the constitution of NCLT & NCLAT, it has finally seen the light of day. The government on June 1, 2016 issued notifications5 bringing into effect several key sections of the Companies Act, 2013 and constituting NCLT6 and NCLAT.

Hon’ble Justice S.J. Mukhopadhaya (Retd.), Supreme Court of India is appointed as the Chairperson of NCLAT and the current Chairman of the Company Law Board (“CLB”) i.e. Hon’ble Justice M.M. Kumar (Retd.), Chief Justice of Jammu & Kashmir High Court, has been appointed as the President of NCLT.

Currently, the NCLT will take over only from the Company Law Board. The notification brings into force Section 434(1)(a) of Companies Act, 2013 which mandates transfer of cases pending before the CLB to the NCLT and requires the NCLT to dispose of such matters in accordance with the provisions of the Companies Act, 2013.

Section 421 of the Companies Act, 2013 provides that an appeal may be filed against an order of NCLT (not passed with the consent of the parties) within 45 days before the NCLAT.

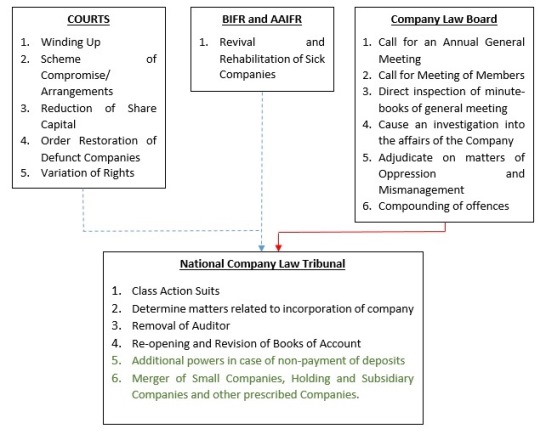

The table below reflects various types of matters which are going to be or are proposed to be dealt with by the NCLT:

-

Powers transferred to the NCLT

-

Powers to be transferred to the NCLT

The provisions granting these powers have not been notified yet.

The provisions granting these powers have not been notified yet.

IMPACT OF INTRODUCTION OF NCLT:

- Currently matters involving same companies or parties would be spread across various forums such as High Courts for winding up and merger/amalgamation schemes, CLB for oppression and mismanagement and before the Board of Industrial Financial Reconstruction (“BIFR”) pursuant to reference under Sick Industrial Companies Act, 1985. On multiple occasions, litigants would adopt the approach of moving various forums causing multiplicity of proceedings and delays. The NCLT aims at consolidating the various forums and providing a one stop shop for adjudication of company matters.

- The NCLT and NCLAT are expected to dispose-off appeals, applications and petitions filed before it within a period of 3 months from the date of the filing. An extension of 90 days may be granted by the President of NCLT or Chairperson of NCLAT for disposal of the matter.7

- Currently the High Courts were burdened with company matters including winding up proceedings. Transfer of such proceedings to NCLT is expected to reduce the burden. Additionally, as appeal from an order of NCLT will lie before the NCLAT, High Courts will have a further reduced burden, considering that earlier, appeal from the order of Company Law Board was filed before High Court. However, an area of concern is that NCLAT may be faced with a very high volume of appeals which earlier stood divided amongst various High Courts. Thus, there would be a need for multiple members of the NCLAT. However considering the requirements for being appointed as a member of the NCLAT are fairly high, there may be a dearth of such qualified members causing delay in disposition of appeals.

- With the notification of the provisions of the Bankruptcy Code, NCLT would form a forum offering a completely new and improved process for liquidation of companies in India.

CLASS ACTION

A much awaited reform brought into effect along with the introduction of the NCLT, is the statutory remedy of class action proceedings. Class action proceeding is one where a group or class of people similarly affected can initiate a proceeding collectively. This allows to reduce time and costs and also inspires confidence amongst the parties as they act collectively. Currently, class action proceedings were initiated in form of representative’s suits, minority action for oppression & mismanagement, proceedings before the consumer forums or through public interest litigation. However, none of these provided a holistic remedy.

Dearth of such a remedy was felt particularly in the wake of the Satyam Scam, where the public shareholders in India had no remedy as opposed to the bondholders in the United States. With the notification of Section 245 of the Companies Act, 2013, members and depositors in a company have the additional remedy in form of class action proceedings which could be initiated before the NCLT. The recent surge in shareholder activism in India, makes the introduction of class actions remedy highly interesting. It is a critical tool now in the hand of minority shareholders who may question the decisions made by the management and the intent thereof.

CONCLUSION:

The constitution of NCLT marks another seminal shift in the Indian judicial landscape and clearly demonstrates that the judicial system is turning for the better. The CLB stands scrapped and the matters will now be dealt with by the NCLT. Further, the notification of the provisions of Bankrupcy Code is imminent and it is expected that upon such notification NCLT would take over the corporate insolvency matter from courts. Thus, a complete overhaul of the system is taking place. This is further demonstrated by the constitution of the first commercial courts in the country. Commercial courts have been set up in Gujrat and the High Courts of Delhi, Mumbai and Himachal Pradesh have also constituted its commercial divisions. However, introduction of any new reforms brings with it its own set of challenges.The NCLAT may be overburdened with appeals. Further with statutory second appeal on any question of law to Supreme Court being available under Section 423 of the Companies Act, 2013, a large number of cases may be delayed on account of pendency of appeal before the overburdened Supreme Court.

1 Please refer to our Hotline: INTRODUCTION OF COMMERCIAL COURTS: END OF ENDLESS LITIGATION!

2 Please refer to our Hotline: ARBITRATION REFORMS IN INDIA: END OF THE ENDLESS SAGA?

3 (2010) 11 SCC 1

4 (2015) 8 SCC 583

5 Notification No. S.O. 1934(E), S.O. 1935(E) & S.O. 1933(E) dated June 1, 2016

6 11 benches of NCLT have been constituted in the following places: (1) New Delhi (consists of two benches); (2) Ahmedabad; (3) Allahabad; (4) Bengaluru; (5) Chandigarh; (6) Chennai; (7) Guwahati; (8) Hyderabad; (9) Kolkata; (10) Mumbai

7 Section 422 of the Companies Act, 2013