Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

Tax Hotline

September 12, 2008Avaya Global Connect: ‘Non-Consideration Demerger’ held not taxable in India

Facts of the current case

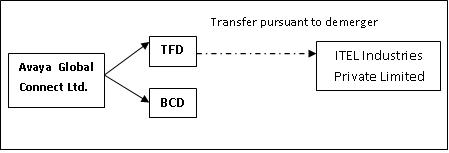

Avaya Global Connect Ltd. (“Avaya”) is a company engaged in the business of providing voice communication solutions and manufacturing of telephone instruments. Avaya had two division viz. Business Communications Divisions (“BCD”) and the Tata Fone Division (“TFD”). Avaya transferred TFD, which was engaged in the manufacture of telephone instruments, to an Indian company called ITEL Industries Private Limited (“ITEL”). A scheme of arrangement ("Scheme”) between Avaya and ITEL for transfer of TFD to ITEL was approved by the Bombay High Court. The Scheme provided for the transfer of all assets and liabilities of TFD to ITEL. The Scheme further provided that no consideration would be payable upon the demerger by ITEL to the Avaya. The value of the assets taken over by ITEL was less than the liabilities of TFD and therefore, the net worth of TFD was negative.

The tax authorities held that the transaction was a slump sale and not a demerger and sought to tax the capital gains income derived from the transaction. It may be relevant to note here that a demerger is a tax free event provided certain conditions are satisfied1. These conditions include inter alia issuance of shares by the resulting company to the shareholders of the demerged company in consideration of the demerger, and shareholders holding not less than 3/4th in value of the shares in the demerged company becoming shareholders of the resulting company.

The tax authorities argued that the transaction in question could not be characterized as a demerger within the meaning of the term as provided in Section 2(19AA) of the Income Tax Act (“Act”) as it failed to satisfy the conditions above mentioned.

Instead, the transaction would be characterized as a slump sale transaction as assets and liabilities were not valued individually and the undertaking was transferred as a going concern. The tax authorities also contended that the consideration for sale of the undertaking was the off-loading of the liabilities by Avaya to ITEL. The computation of capital gains income was made with reference to the rules provided in Section 50B2 of the Act dealing with the taxation of a slump sale. Further, since the aforesaid section provides for reducing the net worth from the sale consideration for the purposes of calculation of capital gain income, the tax authorities added back the negative net worth to the excess liabilities arriving at a capital gain of Rs. 45.95 crores (approximately USD 10.50 million).

ARGUMENTS RAISED BY AVAYAThe chief argument of Avaya was that the transaction amounted to a demerger within the meaning of Section 2(19AA) of the Act. With respect to the issuance of shares, Avaya brought to fore the fact that the undertaking had excess of liabilities over assets and therefore, the net worth of the entity was negative. In such circumstances, the question of consideration being paid to shareholders did not arise. Therefore, the condition with respect to issuance of shares to the shareholders as a consideration for the demerger would not be applicable, and hence the transaction would qualify as a tax exempt demerger.

With respect to the contention of the tax authorities regarding the transaction being a slump sale, Avaya pointed out that one of the primary conditions for a transaction to be regarded as a slump sale was that there should be a sale in the first instance which required some monetary consideration to be paid, which was missing in the present case. Hence, the transaction did not amount to a sale at all and could not be termed as a slump sale. The primary argument was that the transfer was a result of the scheme of amalgamation which was approved by the Bombay High Court and that ‘once a scheme of amalgamation is approved by the Court, it ceases to retain the character of a contract and operates by the force of statute’3. Further, Avaya placed reliance on the judgment of the Hon’ble Supreme Court wherein it was held that the presence of money consideration is an essential element in a transaction of sale. If the consideration is not money but some other valuable consideration it may be an exchange or barter but not a sale4.

Based on these arguments, Avaya put forth its case that the transaction was a tax exempt demerger. Further, considering the fact that the net worth of the undertaking was negative and that no consideration was being paid, no capital gains income could be deemed to arise under the provisions of the Act.

RULINGThe Tribunal heard both the parties at length and ruled as under:

-

A transaction involving transfer of an undertaking could be termed a demerger only when all the conditions laid down in Section 2(19AA) were comprehensibly satisfied. Non-fulfillment of even a single condition would negate its claim of being a demerger within the meaning of the Act. In the transaction in question, no shares were issued by ITEL to shareholders of Avaya and therefore, the transaction would not be termed a demerger for the purposes of claiming tax neutrality under the provisions of the Act.

-

The transaction could however, not be termed as a slump sale as no consideration changed hands. A slump sale requires transfer of an undertaking by means of a sale for a lump sum consideration. The Tribunal rightly agreed with the Supreme Court in Motor General Stores where it was held that presence of monetary consideration was an essential element in a transaction of sale. Thus, the transaction could not be termed as a sale, and should not be treated as a slump sale.

-

Further, with respect to the question whether the transfer of TFD could be brought to tax under the provisions of Section 455 of the Act, the Tribunal held that since TFD was transferred as a going concern with no value being attached to individual assets, and thus, the computation of capital gains was not possible. The basic elements required for computation of capital gain income under Section 48 of the Act, which are, cost of acquisition, cost of improvement and the date of acquisition could not be determined and therefore, no capital gains could be brought to tax.

The above decision brings a relief to the corporate community in this era of globalization where mergers and demergers have become a norm to expand and create value in existing businesses. While the provisions of the Act provide for a tax exemption in case of certain mergers and divisions, there has always been a lack of clarity with respect to taxation on account of hiving off a business unit where no consideration is being exchanged. This is especially important considering the facts of the above case where the tax authorities tried to add back the negative net worth to the excess of liability over assets thus resulting in a double exclusion of the excess liabilities in the capital gain income amount. It also brings to light the fact that the provisions relating to mergers and amalgamations which provide for a tax exemption may need to be fine tuned to provide for cases where all conditions may not be applicable for qualifying for a tax free merger/demerger. Nevertheless, this decision reiterates the fact that while such issues could be litigated at the lower levels of the judiciary, justice would finally prevail at higher levels.

- Neha Sinha & Parul Jain

__________________________________

-

Section 47(vib) read with section 2(19AA) of the Income Tax Act, 1961

-

Section 50 B of the Act provides that the net worth of the entity should be deducted from the consideration paid to calculate the profits and gains in the transaction.

-

Section 45 of the ITA is the charging section with respect to tax on capital gain income

Source: INCOME TAX APPELLATE TRIBUNAL MUMBAI BENCH Ruling Avaya Global Connect Ltd. V. ACIT [I.T.A. No. 832/Mum/07]