Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

Tax Hotline

December 6, 2008The Vodafone Judgment: Tax Uncertainty for M&A and PE Deals

One of the most anticipated judgments in recent times, the Order of the Bombay High Court (“Court”) in the Vodafone controversy, is finally out. This judgment raises uncertainties with respect to taxation of cross-border mergers and acquisitions between two foreign entities, involving direct or indirect subsidiaries or affiliates in India. It also brings uncertainty to private equity funds which acquire shares of foreign companies in a similar fashion.

We had published our detailed commentaries on the Vodafone Controversy as it had unfolded in the courtroom and we do not wish to spill more ink recounting the arguments, which are available at the footnote.* The broad facts of the case are briefly summarized as follows:

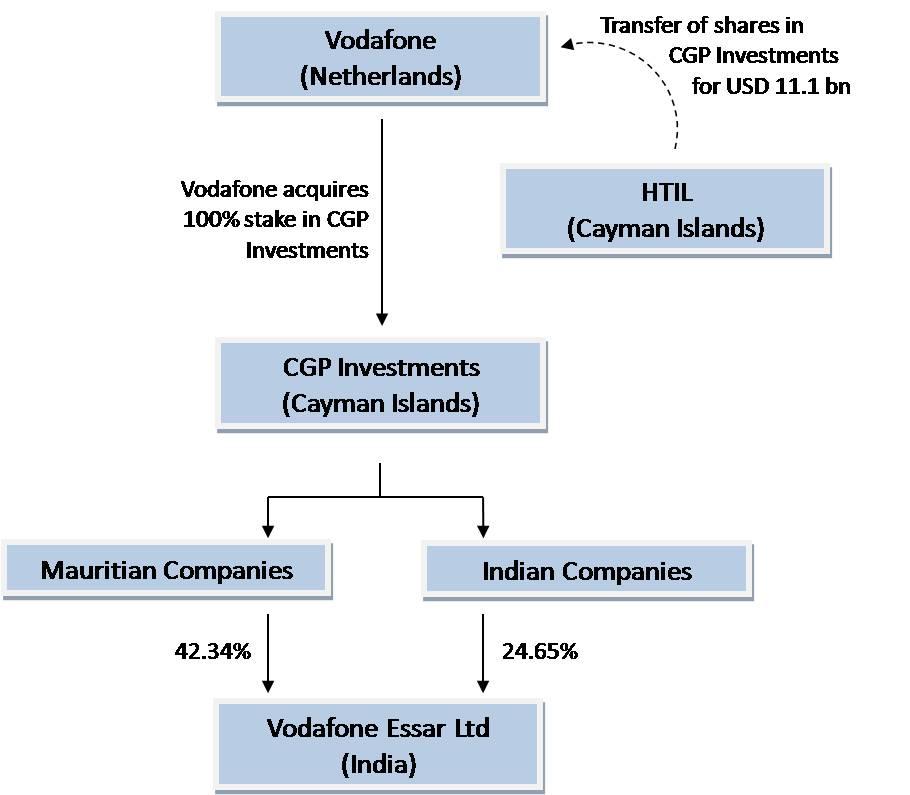

Shares of CGP Investments, a company incorporated in the Cayman Islands were transferred by HTIL, another Cayman Islands company to Vodafone International Holdings BV (“Vodafone”) for a consideration of about USD 11.1 billion. CGP Investments held stake in a series of Mauritian and Indian Companies which cumulatively held about 67% stake in Vodafone Essar Limited (“VEL”). The Indian Revenue Authorities (“Revenue”) issued show cause notices (“Notices”) to both Vodafone and VEL as to why they should not be held as “assesses in default”, the former on the ground of failure to withhold taxes at source and the latter as a “representative assessee”. Both VEL and Vodafone filed respective writ petitions before the Court challenging the validity of these Notices

The Court has dismissed Vodafone’s writ petition on the ground of non-maintainability. As we had reported on December 3, 2008, the Court has dismissed the writ petition and has made five important observations. In today’s commentary, we have analyzed these observations and have also set out our analysis of the judgment. The five observations made by the Court before dismissing the petition are:

-

Vodafone had approached the Foreign Investment Promotion Board (“FIPB”) before effecting the transfer of shares of the Cayman Islands entity. Therefore it was within the jurisdiction of the Revenue to proceed against Vodafone and the Notice served was valid;

-

The transaction amounted to an indirect transfer of controlling interest in VEL, an Indian company and hence an indirect transfer of capital asset situated in India;

-

The transaction created a “real link” between India and Vodafone, so as to bring the consideration to tax in line with the “Effects Doctrine” as understood in USA;

-

The agreement entered into between Vodafone and the vendor was not furnished before the revenue authorities or the Court;

- The writ petition to impugn the Notice was not maintainable when an alternative statutory remedy was available to Vodafone

It must also be pointed out that while the Court made the above observations, it has not held that Vodafone is liable to pay tax or penalties under the ITA.

It is pertinent to note that the Vodafone controversy is not limited to the writ petition filed by Vodafone but also the writ petition filed by VEL. However, the order seems to dismiss the entire controversy solely on the submissions made by Vodafone without hearing the submissions of VEL. With due respect, this seems to be in the teeth of the principles of natural justice which require a party to be heard before any judgment is passed.

While the writ petition has been dismissed by the Court, the issues relating to the Vodafone controversy have not been settled and the Order leaves much to be desired.

________________________________

* We had published our daily commentaries on the Vodafone Controversy as it had unfolded in the courtroom. These commentaries can be accessed here: June 27, 2008, June 30, 2008 July 2, 2008, July 8, 2008, July 9, 2008, July 10, 2008, December 3, 2008