Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

Regulatory Hotline

January 19, 2023RBI Releases Framework for Investments in Banking Companies

INTRODUCTION

The Reserve Bank of India (“RBI”), on January 16 of this month, rolled out the RBI (Acquisition and Holding of Shares or Voting Rights in Banking Companies) Directions, 20231 (the “Directions”) along with the Guidelines on Acquisition and Holding of Shares or Voting Rights in Banking Companies2 (the “Guidelines”) with an objective to ensure diversification and eligibility of the ultimate ownership and control in the banking companies. The Directions consolidate the provisions (with suitable modifications) of the master directions for the prior approval for acquisition of shares or voting rights in private sector banks, (“Acquisition Directions”)3 issue and pricing or shares by private sector banks (“Issue Directions”)4 and ownership in private sector banks (“Ownership Directions”)5 (together, the “Erstwhile Directions”), thereby repealing the Erstwhile Directions.

PRIOR APPROVAL FOR ACQUISITION

The Directions require any person intending to become a ‘major shareholder’, i.e. acquire shares / voting rights, directly or indirectly, of 5% or more in a bank to procure prior approval of RBI.6 The RBI, upon receipt of application, would coordinate with the concerned bank, and seek for bank’s comments and documentation with respect to the eligibility, i.e. compliance with the ‘fit and proper’ status, of the applicant.7 Upon undertaking the necessary due diligence on the applicant, the RBI may either deny or grant permission, or grant permission for acquisition of a lower shareholding than what applied for, such decision being binding on the bank and the applicant.

Interestingly, in the event where the shareholding drops below 5% and the shareholder seeks to re-raise it to 5%, fresh approval of RBI would be needed.

Additionally. the Directions have prohibited persons belonging to Financial Action Task Force (“FATF”) non-compliant jurisdictions to not acquire major shareholding in an Indian bank. In cases where any existing major shareholder is from such nation, maintenance of investments has been permitted, provided that any further acquisition would require RBI’s prior permission. Having said that, RBI may any time look into the fitness of such shareholders and provide necessary orders on their permissible voting rights in the bank.

Furthermore, RBI has provided a 6-month window to a currently operational bank, excluding any payments bank, whose shareholding is not in conformity with the below limits to submit a shareholding dilution plan.

SHAREHOLDING LIMITS

The Guidelines stipulate following shareholding limits:

|

Promoter |

Non-promoter |

|

|

26% of the paid-up share capital or voting rights of the banking company after the completion of business of 15 years (Please see Note below) from the commencement of business of the banking company. Kindly note that RBI may allow promoters to hold a higher %age of shareholding before completion of 15 years, subject to such permission being there under the licensing conditions or the shareholding dilution plan submitted to and approved by the RBI. |

10% of the paid-up share capital / voting rights of the banking company in case of natural persons, non-financial institutions, financial institutions directly or indirectly connected with large industrial houses and financial institutions that are owned to the extent of 50% or more or controlled by individuals (including the relatives and persons acting in concert) |

15 % of the paid-up share capital / voting rights of the banking company in case of financial institutions (excluding ones mentioned in column 2), supranational institutions, public sector undertaking and central/state government. |

Note: In case of Small Finance Banks (“SFBs”) transited from Urban Co-Operative Banks (“UCBs”), the 15-year period would commence from reaching the net-worth of INR 200 crores.

Please note that on a case-to-case basis, RBI may permit higher shareholding than the above prescribed limits.

CONTINUOUS MONITORING ARRANGEMENTS

The banking companies have been mandated to ensure continuous compliance of the fit and proper criteria by applicants whose applications are pending as well as those who have received approval.8

Further, a major shareholder is bound to inform the bank of any change in the previously provided information which may have an impact on its fit and proper status.

LOCK-IN REQUIREMENT

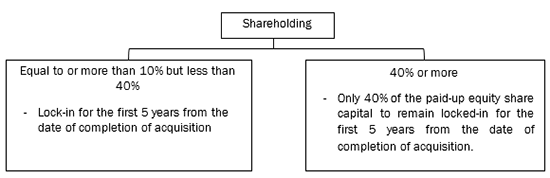

Akin to the Ownership Directions, the Guidelines prescribe lock-in requirements for following shareholders:

Importantly, any encumbrance9 of the locked-in shares is prohibited under the Directions.

REPORTING REQUIREMENTS FOR BANKING COMPANIES

The Directions require banking companies to report the details of issue and allotment of shares within 14 days of the completion of the allotment process. The banks would also need to ensure that there are no breaches in limits.

Further, any details on permitted encumbrance of shares would need to be reported to the Department of Supervision, RBI within 1 working day followed by the bank submitting the report to its board, and then within 30 days of the event, submitting such report to the Department of Regulation, RBI.

NDA VIEWS

Since the constitution of the internal working group10 (“IWG”) to review the guidelines on ownership and corporate structure for Indian private sector banks and the subsequent release of the report of IWG11, industry participants had been awaiting an overhaul in the Erstwhile Directions. While the industry reaction on the Directions and Guidelines is still awaited, the initial response seems to be a positive one.

While the Erstwhile Directions were only applicable to private sector banks12, including Local Area Banks (“LABs”), RBI has now widened the applicability to all banking companies13 including LABs and SFBs as well.

A 6-month time period has also been provided to banking companies, other than PBs, to take steps to ensure that they are in compliance with the Directions and Guidelines. In addition to requiring prior approval, the Directions and Guidelines also prescribe limits on shareholding, lock-in and ceiling on voting rights, and also mandating regular updates on developments for continuous monitoring.

The Directions and Guidelines emphasize on the fulfilment of the fit and proper criteria for the major shareholders, not only during acquisition, but on a strictly continuing basis. RBI has widened the illustrative criteria for the determination of the fit and proper status of applicants by adding the track record of applicants in non-financial matters, expanding the nature of proceedings to those of serious nature, removing the specification of disciplinary or criminal nature that was provided by the Acquisition Directions, while also requiring adherence to the Guidelines.

For acquisitions in excess of 10%, the Directions have done away with certain factors viz., the requirement of the acquisition being in public interest, the desirability of diversified ownership, and the consideration of the applicant being a financial entity, which is widely held, publicly listed and a well-established regulated financial entity in good standing in the financial community.

It should be noted that in addition to the above-mentioned prescriptions, any foreign investment into a banking company should be subject to any restrictions prescribed under the extant Foreign Direct Investment (“FDI”) policy as well.

In the recent past, we have seen regulatory authorities, namely SEBI stressing on the compliance with FATF norms. Along the same lines, RBI has prohibited persons from FATF non-compliant jurisdictions from acquiring major shareholding in banking companies which definitely seems to be the right step.

– Ritul Sarraf, Prakhar Dua & Kishore Joshi

You can direct your queries or comments to the authors

1 https://rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=12439

2 https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=12440&Mode=0

3 https://rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=10126

4 https://rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=10363

5 https://rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=10397

6 Section 12B of Banking Regulation Act, 1949 mandates every person intending to acquire shares (including both equity and preference shares) or voting rights up to 5% or more of the paid-up share capital / voting capital of a banking company to obtain prior approval of the RBI.

7 A list of illustrative criteria for determining ‘fit and proper’ status has been provided under Annexure II of the Directions.

8 Actions prescribed under para 5.2 of the Directions.

9 Regulation 28(3) of the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011.

10 https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=49945

11 https://www.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=1160

12 The Acquisition Directions defined private sector bank as banks licensed to operate in India under the Act, other than Urban Co-operative Banks, Foreign Banks and banks licensed under specific Statutes.

13 Section 5(c) of the Act defines a banking company as any company which transacts the business of banking.