Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

Funds Hotline

May 23, 2016SEBI to tighten framework for offshore derivative instruments

-

The recent Press Release of SEBI suggests that SEBI has decided to tighten the norms for the ODI framework under the FPI Regulations. However, the Press Release only summarizes the minutes of SEBI’s meeting and the changes discussed will become effective only when relevant amendments are made to the applicable regulations or circulars are issued in this regard.

-

Further, the former requirement of being “appropriately regulated” applicable to Category II FPIs seems to have been extended to the ODI subscribers as well.

-

The extant Indian KYC/AML will be now be applicable to ODI subscribers, as opposed to the same being open to negotiations between the ODI issuer and subscriber.

-

In addition to the satisfaction of KYC norms at the time of on-boarding, there will be a KYC review (a) once every three years for ‘low risk clients’; and (b) once a year for all other clients.

-

The ODI subscribers will now require the prior approval of ODI issuers for transfer / onward issuance of the ODI. Further, all intermediate transfers during the month will have to be reported in the monthly reports on ODIs.

-

ODI issuers will be required to file ‘suspicious transaction reports’ with the Indian Financial Intelligence Unit.

-

ODI issuers will also be required to reconfirm ODI positions on a semi-annual basis.

-

To ensure compliance with the above, ODI issuers will be required to put in place necessary systems with respect to ODIs and carry out a periodical review of such systems and procedures.

The Indian securities market regulator, the Securities and Exchange Board of India (“SEBI”) has decided to tighten the norms for subscription to offshore derivative instruments (“ODIs”) under the Securities and Exchange Board of India (Foreign Portfolio Investors) Regulations, 2014 (“FPI Regulations”).

Despite these changes, the ODI route would still remain relevant for foreign investors who want an Indian exposure with lower overall costs and administrative overheads including engaging a custodian and filing tax returns in India and importantly, without getting registered with SEBI. P-Notes and other classes of over-the-counter (OTC) derivatives allow the subscriber a streamlined basis for accessing several markets while dealing with very limited number of counterparties. An FPI license on the other hand remains relevant for participants seeking a deeper India exposure without counterparty intermediation.

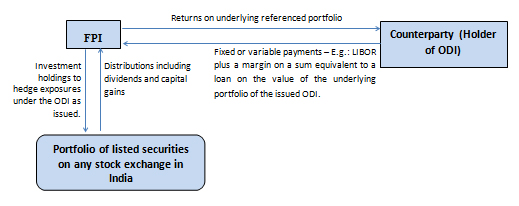

BACKGROUNDSection 2(1)(j) of the FPI Regulations provides that an “offshore derivative instrument” means any instrument, by whatever name called, which is issued overseas by an FPI against securities held by it that are listed or proposed to be listed on any recognised stock exchange in India, as its underlying. An FPI investment on the other hand is the direct investment and exposure to the eligible securities that entitle the holder to economic interests and voting rights (if any) in the concerned securities.

The decisions of SEBI have been summarized in the press release (PR No 98 / 2016, the “Press Release”); however, we wait to see the final text of the amendments or circulars for a complete analysis of the changes.

The FPI Regulations specifically exclude Category III FPIs and certain Category II FPIs (those that are unregulated broad-based funds who rely on their investment managers to obtain registration as Category II FPIs), from issuing, subscribing or otherwise dealing in ODIs.

ODIs can only be issued (a) to those persons who are regulated by an appropriate foreign regulatory authority, and (b) after compliance with ‘know your client’ norms.

The requirement to be ‘regulated by an appropriate foreign regulatory authority’ has not been explained in the FPI Regulations. Whereas, the requirement applicable to Category II FPIs of being “appropriately regulated by an appropriate foreign regulatory authority” has been explained under Reg. 5(b)(Expl. 1) to mean “being regulated or supervised by the securities market regulator or the banking regulator of the concerned foreign jurisdiction, in the same capacity in which it proposes to make investments in India”.

The Press Release seems to suggest that the explanation applicable to Category II FPIs will also apply to ODI subscribers while determining their eligibility to subscribe to ODIs under the FPI Regulations. SEBI now seems to have uniformly applied “appropriately regulated” to Category II FPI applicants and ODI subscribers.

INDIAN KYC NORMS APPLICABLE TO ODI SUBSCRIBERSAs regards the ‘know-your-client’ (KYC) requirement to be satisfied by ODI subscribers (as the second condition for subscribing to ODIs mentioned above), the norms applicable for carrying out KYC were not mentioned in the FPI Regulations. Accordingly, the ODI issuers and subscribers mutually agreed on the KYC norms followed in the jurisdiction of either the ODI subscriber / end beneficial owner or the ODI issuer. To streamline the process, the Press Release states that the KYC / AML (anti-money laundering) norms applicable in India will be applicable to ODI subscribers, i.e. the same as that for all other domestic investors. The Indian

Further, the FPI Regulations do not prescribe the threshold for determination of ‘beneficial ownership’ of ODI subscribers. The Press Release clarifies that the determination of ‘beneficial ownership’ of ODI subscribers by the ODI issuers will be made in accordance with the Prevention of Money-laundering (Maintenance of Records) Rules, 2005.

In addition to the initial KYC done at the time of on-boarding, the ODI issuers will be required to review the KYC for each client (a) once every three years for low-risk clients; and (b) every year for all other clients. The guidance on the term ‘low-risk clients’ should be provided in the amendments or circulars which are to follow from the Press Release. As regards FPIs, SEBI has recognized government and government related foreign investors such as Foreign Central Banks, Governmental Agencies, Sovereign Wealth Funds, International / Multilateral Organizations / Agencies as “low-risk” given that these entities are either owned / controlled by the government and should be perceived to be low risk entities. Similar guidance is expected from SEBI regarding categorization of certain entities as ‘low-risk’ clients for the purposes of ODI subscription.

RESTRICTIONS ON TRANSFERABILITY OF ODISThe FPI Regulations do not impose any restrictions on transferability of ODIs by the ODI subscribers. Further, as regards the onward issuance of the ODIs, the only restriction imposed by the FPI Regulations was that it is to be issued only to persons who are ‘regulated by an appropriately regulatory authority’. The Press Release suggests that the ODI subscribers will be required to take prior approval of the ODI issuer for any transfer / onward issuance of the ODIs.

Additionally, the monthly reports on ODIs which are required to be submitted by ODI issuers with the monthly summary will also contain information about intermediate transfers during the month. These requirements have been imposed to ensure that there is stronger control over ODI transactions.

REPORTING AND REVALIDATIONIn addition to compliance with the above, ODI issuers will be required to file ‘suspicious transaction reports’, if any, with the Indian Financial Intelligence Unit, in relation to the ODIs issued by it in accordance with the Prevention of Money Laundering Act, 2002. These reports are submitted when the reporting entity identifies a ‘suspicious transaction’ in accordance with the Prevention of Money Laundering Act, 2002 and the rules made thereunder.

The Press Release also required the ODI issuers to carry out ‘reconfirmation’ or ‘revalidation’ of the ODI positions on a semi-annual basis. The guidance on what is meant by ‘reconfirmation’ or ‘revalidation’ should be given in the relevant amendments or circulars which follow the Press Release.

PERIODIC EVALUATION OF SYSTEMS AND PROCEDURESThe Press Release states that ODI issuers will be required to put in place necessary controls, systems and procedures with respect to ODIs to comply with the updated compliance requirements. These systems will undergo a periodical review and evaluation by the ODI issuers.

OBSERVATIONS AND NEXT STEPSIt seems that the changes have been made with an intention to streamline the compliance and reporting requirements for the regulation of ODI positions. It remains to be seen whether the existing ODI positions will be grandfathered from these additional compliance requirements. Several institutional swap dealers dealing in Indian products have already been in compliance with most of the revised directives since they have been engaging with SEBI and incorporating their feedback in their ODI issuance program. With these norms now becoming a part of the regulatory framework, the Indian regulators should be comfortable with both the forms of market access.

Article: Watchdog tightens offshore derivative rules to stem illegal money inflow

– Nandini Pathak, Richie Sancheti & Kishore Joshi

You can direct your queries or comments to the authors