Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

Funds Hotline

November 27, 2014SEBI Rewrites Rules on Offshore Derivative Instruments (ODI)

- SEBI has issued the Circular to align the eligibility requirements and investment conditions between FPIs and subscription of ODI positions. The Circular makes the ODI route more restrictive.

- To be eligible to subscribe to ODI positions, the subscriber should be regulated by an IOSCO member regulator or in case of banks subscribing to ODIs, such bank should be regulated by a BIS member regulator.

- The Circular clarifies that ‘opaque’ structures (i.e. PCCs / SPCs or other ring-fenced structural alternatives) would not be eligible for subscription to ODIs.

- FPI and ODI subscriptions to be clubbed for calculating the 9.99% investment limit.

- Existing ODI positions will be allowed to continue until the expiry of the ODI contract; however, rollover/renewal of such positions will be allowed on the basis of the Circular.

The Indian securities market regulator, the Securities and Exchange Board of India (“SEBI”) issued a circular1 on November 24, 2014 (“Circular”) aligning the conditions for subscription of offshore derivative instruments (“ODIs”) to those applicable to foreign portfolio investors (“FPIs”) under the Securities and Exchange Board of India (Foreign Portfolio Investors) Regulations, 2014 (“FPI Regulations”).

The Circular states that an FPI can issue ODIs only to those subscribers who meet certain eligibility criteria mentioned under regulation 4 of the FPI Regulations (which deals with eligibility criteria for an applicant to obtain registration as an FPI) in addition to meeting the eligibility criteria mentioned under regulation 22 of the FPI Regulations. Accordingly, ODIs can now only be issued to those persons who (a) are regulated by an ‘appropriate foreign regulatory authority’; (b) are not resident of a jurisdiction that has been identified by Financial Action Task force (“FATF”) as having strategic Anti-Money Laundering deficiencies; (c) do not have ‘opaque’ structures (i.e. protected cell companies (“PCCs”) / segregated portfolio companies (“SPCs”) or equivalent structural alternatives); and (d) comply with ‘know your client’ norms.

The investment restriction of keeping aggregate investments in a single portfolio company (company listed on any recognised stock exchange in India) below 10% of the total issued capital of such portfolio company has also been made applicable to ODI subscribers by the Circular (as explained in subsequent sections).

The existing ODI positions will not be affected by the Circular until the expiry of their ODI contracts. However, the Circular specifies that there will not be a rollover of existing ODI positions and for any new ODI positions new contracts will have to be entered into, in consonance with the rules specified in the Circular.

This poses some serious complications for ODI issuers as the onus to ensure compliance with the Circular is on them. In the absence of any procedural guidelines, it may become complex to devise monitoring mechanisms to ensure compliance.

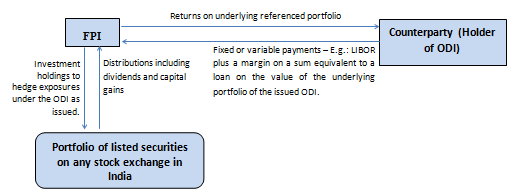

BACKGROUNDSection 2(1)(j) of the FPI Regulations provides that an “offshore derivative instrument” means any instrument, by whatever name called, which is issued overseas by an FPI against securities held by it that are listed or proposed to be listed on any recognised stock exchange in India, as its underlying.

ODI positions are derivative instruments in the nature of contractual arrangements that provide the overseas investors with economic exposure (without conveying ownership) to underlying referenced assets (typically publicly traded securities but can also include other eligible securities that an ODI issuer can validly hold under the FPI Regulations). An FPI investment on the other hand is the direct investment and exposure to the eligible securities that entitle the holder to economic interests and voting rights (if any) in the concerned securities. FPIs which issue ODIs, function as swap dealers and the swap to constitute an ODI under the FPI Regulations, is required to maintain a hedged position in the referenced securities.

The FPI Regulations specifically exclude Category III FPIs and certain category II FPIs (those that are unregulated broad-based funds who rely on their investment managers to obtain registration as Category II FPIs), from issuing, subscribing or otherwise dealing in ODIs. ODIs can only be issued (a) to those persons who are regulated by an ‘appropriate foreign regulatory authority’, and (b) after compliance with ‘know your client’ norms. Accordingly, an FII (or an eligible FPI) seeking to issue ODIs to any person must be satisfied that such person meets these two tests.

THE ELIGIBILITY CRITERIAThe Circular has added to the eligibility criteria for ODI subscribers by imposing a few of the eligibility criteria applicable to applicants for FPI registration under regulation 4 of the FPI Regulations to ODI subscribers as well. The relevant eligibility criteria from regulation 4 of the FPI Regulations which will now apply to ODI subscribers are as follows:

(a) the ODI subscriber is resident of a country whose securities market regulator is a signatory to International Organization of Securities Commission’s Multilateral Memorandum of Understanding (Appendix A Signatories) (“IOSCO”) or a signatory to bilateral Memorandum of Understanding with the SEBI;

(b) the ODI subscriber being a bank, is a resident of a country whose central bank is a member of Bank for International Settlements (“BIS”);

(c) the ODI subscriber is not resident in a country identified in the public statement of FATF as:

- a jurisdiction having a strategic Anti-Money Laundering or Combating the Financing of Terrorism deficiencies to which counter measures apply; or

- a jurisdiction that has not made sufficient progress in addressing the deficiencies or has not committed to an action plan developed with the Financial Action Task Force to address the deficiencies.

Therefore, in addition to meeting the eligibility criteria under regulation 22, the ODI subscribers will now have to meet the eligibility criteria under regulation 4 as well to be able to subscribe to ODIs. This addition to the eligibility criteria should allow SEBI to gather the relevant information about such ODI subscribers from their regulators (as registered with the IOSCO).

In the version of frequently asked questions (“FAQs”) on FPI Regulations released by SEBI on October 31, FAQ #801 stated that the meaning of “appropriate foreign regulatory authority” under regulation 22 for ODI subscribers has the same meaning as used under explanation 1 of regulation 5(b) for FPIs. The concerned explanation states that “an applicant for FPI would be considered as “appropriately regulated” if it is regulated or supervised by the securities market regulator or the banking regulator of the concerned foreign jurisdiction, in the same capacity in which it proposes to make investments in India.” However, the Circular now clarifies that an ODI subscriber only needs to meet the eligibility criteria under Regulation 4 (read along with Regulation 22 of the FPI Regulations). Accordingly, if the entity is seeking to subscribe to an ODI, it only needs to be ‘regulated’ (as required under regulation 22) and not ‘appropriately regulated’ (as used under explanation 1 of regulation 5(b) of the FPI Regulations). The distinction becomes critical for an entity like Investment Holding Companies (IHC) in Mauritius that is ‘regulated’ by the Financial Services Commission (“FSC”) (the securities regulator in Mauritius) but is not ‘appropriately regulated’ by the FSC (SEBI’s view vide FAQ # 135.2)

THE CLUBBING OF SUBSCRIPTIONS AND INVESTMENTSThe Circular has made applicable the investment restrictions under Regulation 21(7) for FPIs, to ODI subscribers as well. Regulation 21 (7) of the FPI Regulations requires that “the purchase of equity shares of each company by a single FPI or an investor group (i.e. held by a common BO3) shall be below 10% of the total issued capital of the company.”

This investment condition has been made applicable to ODI subscribers in two ways:

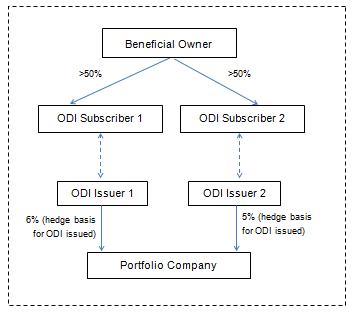

(a) The subscriptions of a common BO through two or more ODI subscribers in the underlying securities of any portfolio company will be clubbed together as a single ODI subscription to calculate the cap of 10% under regulation 21 (7).

An illustration of this rule is as follows -

In this structure, the BO’s subscriptions through ODI Subscriber 1 and ODI Subscriber 2 will be clubbed together as a total of 11% and will be taken as exceeding the 10% limit under regulation 21 (7).

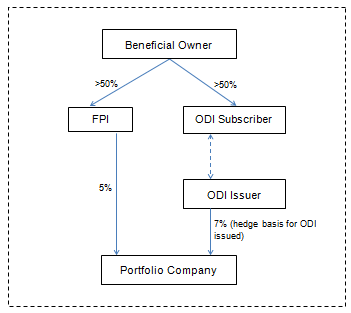

(b) The investment and subscription of a common BO through an FPI as well as ODI subscribers respectively in any portfolio company will be clubbed together to calculate the cap of 10% under regulation 21 (7).

In this structure, the BO’s investments through the FPI and subscription through ODI Subscriber will be clubbed together as a total of 12% and will be taken as exceeding the 10% limit under regulation 21 (7).

The clubbing of investments by FPIs is also computed in the same manner. While the Circular only requires aggregation of positions under multiple ODI subscriptions and FPI investments with ODI subscriptions, the position with respect to clubbing of FDI investments remains unclear.

THE REPORTING OF INVESTMENTSThe Circular imposes the onus on the ODI issuer for compliance with the conditions mentioned thereunder. The ODI issuers will be required to put in place a system for compliance and monitoring mechanisms to specially monitor the ‘clubbing’. In the absence of procedural guidelines in this regard, this may impose several administrative complexities.

The ODI issuer may take representations from the ODI subscriber with regard to its investments through other routes in different portfolio companies. The mechanisms to be put in place may be borrowed from foreign jurisdictions where similar practices are followed. For example, the United States District Court for the Southern District of New York had in the case of CSX Corporation v. The Children’s Investment Fund Management (UK) LLP4 added the shares directly held and the swaps entered into to arrive at the aggregate economic exposure that an investor held in CSX Corporation.

As a consequence of the Circular, ODI subscriptions (‘synthetic contractual arrangements’) will be clubbed together with FPI investments for reporting of ‘ownership’. ODI subscription is merely a contractual arrangement between the ODI issuer and ODI subscriber whereby the ODI subscriber only receives economic interest and not any ownership interests in the portfolio company with respect to the underlying securities. To qualify as an ODI, the ODI issuer has to maintain a hedged position. It is possible for such ODI issuer to manage the equity exposures on a portfolio basis, rather than on a transactional basis (and therefore combining positions in shares, swaps, futures, options and other listed and unlisted derivatives for economic purposes). It is not a market practice for ODI issuers who acquire shares as hedges, to vote them under the influence of the ODI subscriber. Accordingly, the clubbing of investments through ODIs may lead to unintended outcomes.

THE EXISTING ODI HOLDERSThe Circular does not affect existing ODI positions until the expiry of their ODI contracts. However, after the expiry of the ODI contracts, the positions will not be renewed/rolled-over and new positions in compliance with the Circular will have to be entered into.

The following table summarizes the changes in the ODI regime between SEBI (Foreign Institutional Investors) Regulations, 1995 (“FII Regulations”), FPI Regulations, SEBI FAQs on FPIs and the Circular.

|

Issue |

FII Regulations |

FPI Regulations |

SEBI FAQs |

Circular |

|

Who can subscribe? |

‘Unregulated’ Broad based funds (managed by regulated managers). |

‘Regulated’ funds. |

Eligible ODI subscribers have to be regulated by an “appropriate foreign regulatory authority”. (Q. 80)5 |

ODI subscribers have to be regulated + satisfy additional eligibility conditions as applicable to FPIs under regulation 4 of the FPI Regulations. |

As per the Circular, an FPI shall not issue ODIs to subscribers with ‘opaque structure(s)’, as defined under the FPI Regulations.

The FPI Regulations define an “opaque structure” to mean any structure such as PCCs, SPCs or equivalent, where the details of the ultimate BO are not accessible or where the BOs are ring fenced from each other or where the BOs are ring fenced with regard to enforcement. An exemption exists for entities which are:

- regulated in their home jurisdictions;

- each fund or sub-fund of such entity satisfies the broad-based criteria; and

- such entity gives an undertaking to provide information regarding its BO as and when SEBI seeks this information.

However, FAQ # 926 clarifies that requirement of SEBI Circular No. CIR/IMD/FIIC/21/ 2013 dated December 19, 2013 also needs to be fulfilled by such an entity, i.e. such an entity is required by its regulator or under any law to ring fence its assets and liabilities from other funds/ sub-funds.

NEXT STEPS FROM AN ODI ISSUER’S PERSPECTIVEIt seems that the Circular has been issued with an intention to align the regulation of ODI positions with the relevant conditions imposed on FPIs, so as to avoid holding of an Indian portfolio company in excess of 10% by using both direct (FPI) and indirect (ODI) routes. However, it may have adverse implications for ODI issuers because the entire onus to ensure compliance has been imposed on them.

In case of clubbing of investments for FPIs with a common BO, one of the designated depositary participants (“DDPs”) of the FPIs is designated as the lead DDP to monitor the investments made by all the FPIs to ensure that the 10% investment restriction has not been triggered. However, an ODI subscriber may not necessarily be an FPI and therefore may not need to report to a DDP. Therefore, two or more ODI subscribers (who are not FPIs) with a common BO will not be able to designate a lead DDP to track their subscriptions. The ODI issuer may not, in all cases, be able to gather all the relevant information from a single DDP to ensure compliance with the Circular.

Accordingly, what is required to be clarified now is the procedural guidelines for the ODI issuers to frame relevant policies, compliance and monitoring mechanisms to ensure that the ODI position is in compliance with the Circular.

One open alternative that may be available is that the DDPs of the relevant ODI issuers whose ODI subscribers have a common BO may designate a lead DDP to track the investments made by the ODI issuers for such ODI subscribers. This will, in turn, increase the responsibility on the DDPs and the onus may be said to be shifting from the ODI issuer to the DDP.

– Nandini Pathak, Adhitya Srinivasan, Richie Sancheti & Kishore Joshi

You can direct your queries or comments to the authors

1 As per FAQ # 80, the phrase "appropriate foreign regulatory authority" as mentioned in Regulation 22 of the FPI Regulations has the same meaning as referred under Explanation 1 of Regulation 5 (b) of the regulations. FAQ # 80, available at http://www.sebi.gov.in/cms/sebi_data/attachdocs/1416889450959.pdf.

2 As per FAQ # 135, a Mauritius based “investment holding company” should not be treated as appropriately regulated based on certificate issued by FSC-Mauritius. This position is the same as in FII regime. FAQ # 135, available at http://www.sebi.gov.in/cms/sebi_data/attachdocs/1416889450959.pdf.

3 Under para 4.2 of the Operational Guidelines for Designated Depository Participants (issued under the SEBI (Foreign Portfolio Investors) Regulations, 2014), a “beneficial owner” means an entity having direct or indirect common shareholding/beneficial ownership/ beneficial interest of more than 50%.

4 08 Civ. 2764 (LAK June 11, 2008).

5 Supra, note 1.

6 As per FAQ # 92, an FPI applicant is required to comply with all the conditions as mentioned in 32 (1) (f) of the Regulations, SEBI Circular No. CIR/IMD/FIIC/21/2013 dated December 19, 2013 and other directions issued by SEBI in this regard from time to time. FAQ #135, available at http://www.sebi.gov.in/cms/sebi_data/attachdocs/1416889450959.pdf.