Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

Investment Funds: Monthly Digest

May 5, 2022IFSCA notifies the FME Regulations, 2022

The International Financial Services Centres Authority (“IFSCA”) has released the International Financial Services Centres Authority (Fund Management) Regulations, 2022 (“FME Regulations”)1 which will come into force from May 19, 2022 (“Effective Date”).

IFSCA has streamlined the regulatory framework around registration of pooling vehicles (as financial products) such as venture capital schemes and other alternative investment funds (collectively referred to as “AIFs”) in International Financial Services Centre (“IFSC”) such that the manager operating such products is required to obtain registration with IFSCA rather than registering the products each time with IFSCA.

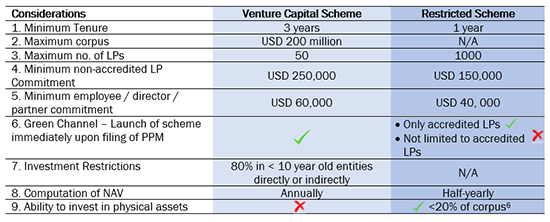

Once an AIF manager is registered with IFSCA, it is permitted to launch a fund within 21 days of filing the private placement memorandum (“PPM”) of the fund with IFSCA (and incorporating all observations of IFSCA received pursuant to such filing), or even through a green channel without having to wait for IFSCA’s comments in case it is a fund with only accredited investors or a venture capital scheme. This is expected to boost both time and cost efficiencies for fund management activities in IFSC.

This marks a paradigm shift from the existing regulatory regime for AIFs in India and is consistent with global best practices for regulation of fund management. While the FME Regulations provide a comprehensive framework for the regulation of asset management industry in the IFSC, in this hotline, we cover aspects related to AIFs in the FME Regulations.

BACKGROUND

Prior to the establishment of IFSCA in 2020, SEBI had introduced operating guidelines for setting up AIFs in IFSC in 2015 and 2018, which were amended up to August, 2020. While section 18 of the Special Economic Zone, Act, 2005 originally allowed the Securities and Exchange Board of India (“SEBI”) to prescribe guidelines for units in IFSCs, the IFSCA Act, 2019 (through section 13 read with section 33) amends the SEBI Act, 1992 and the Securities Contract (Regulation) Act, 1956 (“SCRA”) to take away the power of SEBI under section 18 of the SEZ Act, 2005. Section(s) 13 and 33 of IFSCA Act, 2019 came into force on October 01, 2020.

Accordingly, the SEBI (Alternative Investment Funds) Regulations, 2012 (“AIF Regulations”) except all amendments made by SEBI to the AIF Regulations after October 01, 2020 were applicable to AIFs in IFSC. The FME Regulations render the AIF Regulations inapplicable in IFSC from the Effective Date of the FME Regulations.

Since its inception, IFSCA has considerably sped up the emergence of the Gujarat International Finance Tec-City (“GIFT City”) as India’s first IFSC.

Recognising the important role of the funds industry in capital allocation, IFSCA constituted a Committee of Experts on Investment Funds chaired by Mr. Nilesh Shah in May 2021 to review global best practices and make recommendations to IFSCA on the roadmap for regulation of the fund management industry in IFSCs (“Expert Committee”).2

The Expert Committee submitted its report to the IFSCA on January 31, 2022 summarising its recommendations.3 Considering the recommendations of the Expert Committee, the IFSCA released a consultation paper4 containing the draft International Financial Services Centres Authority (Fund Management) Regulations, 2022 for industry comments and feedback (“Draft FME Regulations”).5 Pursuant to public consultation on the Draft FME Regulations, the IFSCA has now released the FME Regulations. The FME Regulations will come into force from May 19, 2022.

KEY FEATURES

1. Classification of FME and Schemes

Registration of the fund manager (rather than separately for each fund) is likely to facilitate smoother and quicker fund launches allowing fund managers to suitably manage investor (LP) expectations. This will also ensure ease of doing business for the fund managers as a single registration would facilitate multiple activities.

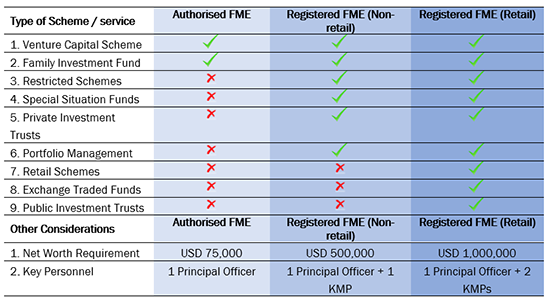

The FME Regulations classify FMEs into three (3) categories on a risk-based approach. Depending on the license obtained, the FME will be allowed to launch relevant schemes / carry out activities as described below.

In effect, a Registered FME (Retail) can inter alia do all that an Authorised FME or Registered FME (Non-retail) can do, and a Registered FME (Non-retail) can inter alia do all that an Authorised FME can do.

Venture Capital Schemes and Restricted Schemes can be set up as trusts, limited liability partnerships or companies in IFSC. While the ‘Variable Capital Company’ framework has been presented to IFSCA by an expert committee constituted in this regard for funds in IFSCs, currently there are no (residuary or similar enabling) provisions in the FME Regulations for allowing funds / schemes to be set up ‘in any other form as notified by IFSCA’. If the variable capital company framework is to be launched in IFSC, it would require amendments to the FME Regulations.

Venture Capital Schemes are considered as Category I AIFs whereas Restricted Schemes are divided into three categories, similar to the AIF Regulations, as Category I / II / III AIFs depending on type of investments sought to be made. Accordingly, for managers who are looking to launch AIF type schemes in IFSC may consider a Registered FME (Non-retail) license. Specifically, for venture capital managers, depending on commercial requirements, an Authorised FME license may be preferred over a Registered FME (Non-retail). IFSCA has left out details pertaining to Special Situation Funds such as minimum corpus, eligible investors, additional investment conditions to be separately notified by IFSCA.

The key differences between a Venture Capital Scheme and a Restricted Scheme (which is also for funds allocating towards start-ups) are provided below:

2. Matters of Fiscal Discipline

FME Contribution – ‘Skin-in-the-game’

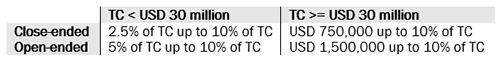

Unlike the AIF Regulations, the ‘skin-in-the-game’ (or FME contribution) requirement under the FME Regulations for Venture Capital Schemes and Restricted Schemes (including Special Situation Funds) depends on the target corpus (“TC”) of the scheme, and is capped as depicted below.

The TC of a scheme is estimated by the GP in its PPM and other offering documents. The exact raising of the entire TC cannot be guaranteed due to both internal (first time GP, no track record) and external (macro- economic issues, global pandemic, political upheaval) factors which may only be estimated. Accordingly, this provision creates a large scope for confusion among industry participants. This anomaly from the AIF Regulations should be fixed.

The introduction of a cap could be a matter of commercial concern in cases where the GP wants (or is expected by its anchor LPs) to allocate a higher proprietary capital into the fund / scheme. Despite all the other progressive efforts, this change moves IFSC’s needle farther away from global standards on sponsor commitment. The only relief is the ability to waive this requirement for Venture Capital Schemes and Restricted Schemes (Non-Retail) with the permission of at least 2/3rd of LPs in the scheme by value or at the discretion of the GP if 2/3rd of the LPs are accredited investors, or if the scheme is a fund-of-fund investing in schemes with similar requirements.

The FME Regulations require investment of the FME contribution to be made into the scheme in proportion to LPs’ investment within 45 days (extendable). The reference to 45 days seems stray as it has not been pegged to any date (such as the date of drawdown from other investors). Further, the confusing phrase ‘continuing interest’ from the AIF Regulations has been carried over into the FME Regulations under a different brand of ‘shall be … maintained on an ongoing basis’. IFSCA should clarify that the requirement will be considered satisfied if the FME and / or its associates maintain an irrevocable (but transferable as per the FME Regulations) commitment into the fund / scheme of the minimum amounts, and contribute such amounts in a proportionate manner alongside the LPs.

Net-worth

As depicted earlier under ‘Classification of FMEs and Schemes’, the net-worth requirement for an FME is directly proportionate to the risk level of the activities being carried out by it. The FME Contribution (if contributed by the FME itself and not its associates) is included for the purpose of determining net worth of FME. Therefore, in cases where FME Contribution is not mandatory, the FME will have to still maintain funds to satisfy the net worth conditions in FME Regulations.

Borrowing and Leverage

There are no limits on either borrowing or leverage to be undertaken by a Venture Capital Scheme or a Restricted Scheme; however, (i) appropriate disclosures are required to be made in the PPM; (ii) deviations are required to be approved by 2/3rd of LPs by value; and (iii) an appropriate and comprehensive risk management framework is to be maintained by the FME.

Co-investment

The entire scope of co-investment provisions for Venture Capital Schemes and Restricted Schemes is unclear at present because IFSCA will separately specify the SPV framework pursuant to which a separate vehicle may be instituted by the FMEs in IFSCs to facilitate co-investments. The FME Regulations provide that the SPV can also undertake leverage for co-investment, however, it is difficult to analyse effect of this provision in absence of the framework to be announced by IFSCA. While the provisions also allow a separate class of units to be issued by the main fund / scheme for tracking co-investments (rather than a separate vehicle), due to the absence of legal ring-fencing among different classes of units of a fund / scheme, LPs may prefer a separate co-investment vehicle.

3. Matters of Good Governance

KMP Requirements

The FME Regulations require the FME to meet certain minimum staffing and competency requirements. These relate to relevant key managerial personnel (“KMPs”) and their requisite qualification and experience in the activities relating to fund management, the number of directors, appointment of compliance officer, etc. Clarity on these ‘substance requirements’ in IFSC have been a long ask from the industry.

The KMPs are required to have experience of at least 5 years in activities pertaining to securities market or financial products. In addition to experience criteria, the KMPs are also required to fulfil the professional qualification criteria as specified in the FME Regulations.

While an Authorised FME is required to have only one (1) principal officer based in IFSC to carry out fund management, risk management and compliance, a Registered FME (Non-retail) is required to have one (1) more KMP (in addition to the principal officer) designated as the compliance and risk manager responsible for compliance with the FME Regulations and risk management to be based in IFSC. The appointment of and changes to KMPs is subject to prior approval of IFSCA. The condition for the compliance and risk manager to satisfy the 5-year experience criteria seems a bit odd as it does not correspond to the function such officer has to perform.

The FME Regulations also require that the proposal on portfolio composition has to be initiated by a person who is based in the office of the FME in IFSC. This does not preclude the FME to allocate its non-IFSC based employees to research and analyse appropriate investment opportunities for the relevant fund(s)/scheme(s), where such reports would then be ultimately taken to the officers based in IFSC for such officers to design the final proposal on portfolio composition by the board / designated partners / decision-making investment committee (as applicable).

Environmental, Social and Governance (ESG)

The reliance and the importance of ESG cannot be ignore in the current times. Businesses are required to be sustainable as well to be able to serve and impact the society at large. In this context, the FME Regulations provide that an FME with AUM above USD 3 billion shall:

-

Establish policies on governance pertaining to material sustainability related risks and opportunities;

-

Disclose in its annual report how the FME identifies, assesses and manages material sustainability-related risks;

-

Establish and disclose in its annual report the process of factoring sustainability-related risks and opportunities into fund manager’s investment strategies and processes.

Funds / schemes with any participation from sophisticated institutional investors such as development finance institutions (DFIs) are typically required by such LPs to have a strong ESG framework for both their own governance, and the governance of their investee entities. However, a regulatory step towards enforcing ESG is a positive indication of India’s priorities to the global diaspora.

Promotion of financial innovation

The FME Regulations empower IFSCA to relax strict enforcement of any requirements of the FME Regulations for reasons to be recorded in writing, in the interest of development of financial markets in IFSC.

The IFSCA has also been granted the power to exempt any persons from operation or all or any of the requirements of these regulations for a period of 18 months. Such exemption may be provided for furthering innovation in aspects relating to testing new products, strategies, processes, services, business models, use of technology, etc. in live environment of regulatory or innovation sandbox in the financial markets.

4. Grandfathering and transitionary provisions

The FME Regulations come into effect on the Effective Date and would repeal the existing framework on the regulation of AIFs in the IFSC. In this regard, the FME Regulations provide that the AIF Regulations shall not apply to IFSC. The FME Regulations also supersede a few circulars7 issued by SEBI / IFSCA in this regard.

The FME Regulations deem all actions taken under the erstwhile regime before the Effective Date to have been taken under the FME Regulations. The PPM / applications filed to IFSCA before the Effective Date are deemed to have been filed under corresponding provisions of the FME Regulations.

In so far as existing AIF managers are concerned, the FME Regulations provide that all existing fund managers of AIFs registered by IFSCA shall seek fresh registration from IFSCA under FME Regulations within 6 months from the Effective Date.

IN CONCLUSION

The FME Regulations mark a critical milestone in development of IFSC as global financial hub, and a globally aligned effort in the regulation of the funds industry in IFSC. It may be worthwhile for SEBI to start examining whether a similar regulatory framework should be adopted for funds in India, alongside the variable capital company framework.

While the FME Regulations are a step in the right direction, clarity on few other aspects may be provided.

-

Clarity on accredited investors: The FME Regulations provide that any person who fulfils the eligibility criteria prescribed by the IFSCA should be considered as accredited investor. SEBI has already released a detailed procedure for accreditation of investors for the purposes of AIF Regulations in India. The investors who have obtained accreditation pursuant to the SEBI circular released in August, 2021 should automatically be considered accredited under the FME Regulations during the validity of the said accreditation in India, and not be required to obtain dual accreditation.

-

Scope and applicability of advertisements: The FME Regulations define advertisement in an inclusive manner, whereas it should be clearly defined and exhaustive to avoid any inadvertent non-compliances. The scope for such inadvertent non-compliances in case of fund management business is quite high. For example, during a roadshow, investors may seek information about past performance of the manager. Such communications by the manager should not be considered advertisement. All forms of reverse solicitation should be exempted. Private placement and all communications with accredited investors should be excluded from the definition of advertisements.

-

Individuals to be allowed to act as fund managers: The FME Regulations do not seem to permit individuals to register as a fund manager. The AIF Regulations, however, permit ‘persons’ to be appointed as managers of AIFs established in India. Individuals should be permitted to be registered as FMEs subject to conditions as IFSCA may consider necessary.

-

Taxability of AIFs set up in IFSC: The FME Regulations provide that the respective schemes may be construed as Category I/ II/ III AIF under the Income-tax Act, 1961 (“ITA”). The ITA accords a tax pass through status to AIFs which have been granted a certificate of registration as a Category I / II AIF and is regulated by SEBI / IFSCA.8 Considering that under the FME Regulations, the FME (not the AIF) will be registered and not the fund, definition of investment fund may be required to be amended for such funds / schemes to continue to benefit from a tax pass-through under the ITA. This change will be crucial to ensure clarity and certainty on taxation of funds set up in IFSC. Even the exemption from filing income-tax returns9 and obtaining permanent account number10 by foreign investors is extended to AIFs which have been granted a certificate of registration as a Category I / II AIF and is regulated by SEBI. As a stop gap solution, the IFSCA may issue a certificate of registration to each scheme to ensure that tax pass through is available to funds based in IFSC as well however it may defeat the purpose of shifting registration burden on the FME. Similarly, other provisions of ITA like section 56(2)(viib) providing exemption to AIFs from angel tax, section 10(4D), section 47 of ITA providing tax regime for Category III AIFs in IFSC will also be required to be amended to apply to funds managed by FMEs registered with IFSCA.

-

Regulatory issues in setting up of FME in IFSC: A vexing issue which Indian managers exploring set-up of funds in IFSC have been facing is the requirement to obtain an approval from the Reserve Bank of India (“RBI”) for investment in the manager entity in IFSC. While the RBI issued a circular11 permitting investment of sponsor contribution from a sponsor Indian Party directly to an overseas fund including a fund set up in IFSC, the circular did not resolve the issue on capitalisation of the manager entity. This has been on of the key impediments for establishment of AIFs in IFSC by Indian AIF managers. While the push from IFSCA is visible, the RBI and IFSCA should try and find a common ground to resolve this issue.

-

Other SEBI Regulations: Category I/ II AIFs are provided certain relaxations from few SEBI regulations. For example, lock-in of 6 months is not applicable to Category I/ II AIFs under the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 201812, Category I AIF is exempted from the requirement to make an open offer under SEBI (Substantial Acquisition of Shares and Takeover) Regulations, 201113. These regulations provide that the term not defined therein will have the meaning provided under the SCRA. Therefore, to ensure that these benefits are available to funds set up in IFSC, these SEBI regulations should be appropriately amended.

In conclusion, the regime for fund formation in IFSC seems to be coming in line with international practices. However, in order for a robust and efficient mechanism for fund formation to be in place other ancillary laws will also have to be changed quickly to provide certainty and clarity to investors and fund managers.

– Srishti Chhabra, Ipsita Agarwalla, Nandini Pathak & Parul Jain

You can direct your queries or comments to the authors

1 Please note the FME Regulations provide a comprehensive framework for the regulation of asset management industry in the IFSC. It is divided into 12 chapters and covers various aspects of asset management such as AIFs, portfolio management, mutual funds, exchange traded funds, environment and social governance, investments trusts (both infrastructure investment trusts and real estate investment trusts) etc.

2 Press Release - Constitution of an Expert Committee on Investment Funds (May 25, 2021) available at

https://ifsca.gov.in/Viewer/PressReleases/179

3 Report of the Expert Committee on Investment Funds available at

https://ifsca.gov.in/Viewer/ReportandPublication/26.

4 Consultation Paper on Proposed IFSCA (Fund Management) Regulations, 2022 available at

https://ifsca.gov.in/Viewer/ReportandPublication/25

5 Press Release - Invitation for public comments on Draft International Financial Services Centres Authority (Fund

Management) Regulations, 2022 available at https://ifsca.gov.in/Viewer/PressReleases/271.

6 Permitted only for close ended schemes

7 The FME Regulations has repealed the following circulars issues by SEBI/IFSCA:

-

SEBI (International Financial Services Centres) Guidelines, 2015 - Permissible investments by Portfolio Managers, Alternate Investment Funds and Mutual Funds operating in IFSC (May 23, 2017) (“IFSC Guidelines”) available at https://www.sebi.gov.in/legal/circulars/may-2017/securities-and-exchange-board-of-india-international-financial-services-centres-guidelines-2015-permissible-investments-by-portfolio-managers-alternate-investment-funds-and-mutual-funds-operatin-_34951.html

-

Operating Guidelines for Alternative Investment Funds in International Financial Services Centres (November 26, 2018) available at https://www.sebi.gov.in/legal/circulars/nov-2018/operating-guidelines-for-alternative-investment-funds-in-international-financial-services-centres_41070.html

-

IFSC Guidelines - investments by Alternative Investment Funds operating in IFSC (August 9, 2019) available at https://www.sebi.gov.in/legal/circulars/aug-2019/securities-and-exchange-board-of-india-international-financial-services-centres-guidelines-2015-permissible-investments-by-alternative-investment-funds-operating-in-ifsc_43867.html

-

Alternative Investment Funds (AIFs) in International Financial Services Centres (December 9, 2020) available at https://ifsca.gov.in/Document/Legal/alternative-investment-funds-in-ifsc09122020071200.pdf

-

Application for Grant of Certificate of Registration as Alternative Investment Fund (June 02, 2021) available at https://ifsca.gov.in/Document/Legal/circular_aif_2ndjune02062021052631.pdf

-

Alternative Investment Funds (AIFs) in International Financial Services Centres (June 25, 2021) https://ifsca.gov.in/Document/Legal/circular-for-sponsor-contribution-and-mutual-fund-investment-by-aif-in-ifsc28062021101503.pdf

8 Explanation 1 to section 115UB of the ITA

9 Notification S.O. 2672(E) dated July 26, 2019; the said notification exempts a non-resident or a foreign company having income chargeable under the ITA from any investment in an ‘investment fund’ (AIFs which have been granted a certificate of registration as a Category I / II AIF and is regulated by SEBI) set up in an IFSC located in India, from filing of income-tax return in India

10 CBDT Notification No. 58/2020/F. No. 370133/08/2020-TPL dated August 10, 2020; the said notification exempts a non-resident or a foreign company, investing in an ‘investment fund’ (AIFs which have been granted a certificate of registration as a Category I / II AIF and is regulated by SEBI) set up in an IFSC located in India, from obtaining a permanent account number

11 RBI/2021-22/38; A.P.(DIR Series) Circular No. 04 dated May 12, 2021

12 Regulation 17(c) of SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018

13 Regulation 10(4)(f) of SEBI (Substantial Acquisition of Shares and Takeover) Regulations, 2011