Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

Investment Funds: Monthly Digest

September 19, 2024Roundup of Key Changes to framework governing AIFs in August: Borrowing, LVFs and VCFs

-

A practical analysis of the borrowing framework instituted by SEBI for Category I and Category II AIFs

-

Changes with respect to the extension of term of LVFs come into effect

-

SEBI delves into the modalities of Migrated Venture Capital Funds, specifically the timelines for migration for varying types of VCFs and consequences of non-migration

The Indian securities market regulator, Securities and Exchange Board of India (“SEBI”) was busy last month issuing circulars with guidelines for a variety of investment funds, including Category I and II Alternative Investment Funds (“AIF(s)”) and sub-categories such as Large Value Funds (“LVF(s)”) and Venture Capital Funds registered under the SEBI (Venture Capital Funds) Regulations 1996 (“VCF Regulations”) (“VCF(s)”).

I. Borrowing by Category I and Category II AIFs

By way of its circular dated August 19, 20241 (“Circular on Borrowing”), SEBI implemented its proposal (with a few tweaks) permitting Category I and Category II AIFs to temporarily borrow funds to cover short-term drawdown shortfalls. Our earlier publication (available here) discusses and analyses the proposal as well as SEBI’s rationale for the same.

According to the Circular on Borrowing, Category I and Category II AIFs may borrow funds to make investments subject to, among others, the following conditions:

-

Disclosure of intent to borrow in the relevant placement memorandum;

-

Borrowing to invest may only be done as a last recourse, in the case of an emergency where despite its best efforts, the manager has been unable to secure the necessary funds from the delaying investors and the investment opportunity is imminent;

-

The amount borrowed to be the lower of the following:

- 20% of the investment proposed to be made in the investee company;

- 10% of the investable funds of the scheme; or

- the commitment pending to be drawn down from investors other than the investor who has failed to provide the drawdown amount.

-

The manager may only pass on the cost of the borrowing to the investors who have failed to provide the drawdown amount for the investment opportunity at hand;

-

The flexibility to borrow to meet shortfalls in drawdown amounts cannot be used as a means to provide different drawdown timelines to investors.

Additionally, SEBI has retained the proposed 30-day cooling off period between two borrowings, with such period being calculated from the date of repayment of the previous borrowing.

Practical Considerations

Notably, SEBI has retained a majority of the conditions discussed during its Board Meeting on June 27, 2024. However, this has resulted in practical challenges being carried over to the current framework, particularly regarding the percentage thresholds. The primary concern is that these borrowing limits may undermine the intended purpose of permitting temporary borrowing.

To understand, consider a fund with a corpus of INR 200 crore, investable funds of INR 180 crore looking to make its first investment of INR 40 crore in an investee company. The fund has 4 investors that have each committed INR 50 crore and the manager has called on INR 10 crore from each investor for the purpose of the present investment opportunity. If one of the investors delays payment of the drawn down amount, the manager is faced with a shortfall of INR 10 crore. Per the thresholds applicable, the manager may borrow the lower of:

-

INR 8 crore;

-

INR 18 crore; or

-

INR 35 crore

Therefore, the manager’s ability to borrow is limited to INR 8 crore, which does not cover the shortfall required to make the investment of INR 40 crore as committed.

Now consider the final investment of INR 45 crore being made by the fund in an identified portfolio entity. Each investor is called to contribute their final INR 11.25 crore, with one investor delaying payment again. The manager may now borrow the lower of:

-

INR 9 crore;

-

INR 18 crore; or

-

INR 0

In either case, the manager is severely restricted by the lower of each of these thresholds, ultimately disallowing the manager to make up the shortfall. This issue becomes even more acute towards the end of the fund’s commitment period, when the remaining commitments from non-delaying investors are minimal, further constraining the borrowing capacity.

Further, smaller funds, specifically with 4 or fewer investors may be unable to make up the shortfall as the 20% of investment proposed to be made in the investee company will always be lower than the delayed investor’s pro rata contribution to the particular investment opportunity.

Certain aspects of the instituted borrowing framework may benefit from further informal guidance from SEBI. Terms such as “last recourse”, the “imminence” of an investment opportunity, and the “best efforts” of a manager involve a degree of subjectivity, which could lead to varied interpretations and applications. Given the potential for different scenarios to arise, this subjectivity is likely to manifest in numerous permutations. Until the market evolves to establish commercial standards for these thresholds, or SEBI provides additional clarity, it will be interesting to observe how the framework is practically implemented.

Analysis

SEBI’s Circular on Borrowing introduces important regulatory measures but also reveals significant practical limitations. The thresholds for borrowing may inadvertently restrict funds’ ability to address shortfalls effectively, particularly towards the end of a fund’s commitment period or for smaller funds with fewer investors. Additionally, the prohibition on adjusting drawdown timelines based on investor type could create misalignments with industry practices, potentially complicating fund management. To address these issues, SEBI may need to offer further guidance, ensuring that regulations accommodate the practical realities of managing diverse investor needs while maintaining financial stability and compliance.

II. Extension of tenure by LVFs

SEBI has also brought its changes on the extension of the tenure of LVFs into effect through the Circular on Borrowing. These changes are in line with the particulars approved by SEBI in its Board Meeting and have been discussed in our earlier digest, available here.

III. Modalities for migration of VCFs

SEBI recently introduced a framework for Migrated Venture Capital Funds (“MVCF(s)”) through the SEBI (AIF) (Third Amendment) Regulations, 2024. The specifics of these amendments were discussed in detail in our last digest, which is available here.

Following these amendments, SEBI issued a separate circular on August 19, 2024, outlining the modalities for the migration of VCFs to the AIF Regulations (“Circular on VCFs”).2 This Circular primarily addresses how the residual tenures of different MVCFs are to be calculated.

SEBI consistently refers to the tenure of Venture Capital Funds in relation to the expiration of the liquidation period for a specific scheme, as outlined in Regulation 24(2) of the VCF Regulations (“Liquidation Perion”). When read in conjunction with Regulation 23 of the VCF Regulations, this refers to the expiration of the term specified in the placement memorandum of the respective scheme. After this expiration, trustees (in the case of VCFs structured as trusts) are required to notify SEBI and the investors of the circumstances leading to the winding up of the fund or scheme. This notification triggers a 3-month period during which the scheme’s assets must be liquidated, with the proceeds distributed to investors after settling liabilities.

SEBI's intent to shepherd all VCFs towards regulatory standardization, where feasible, is evident in the stringent measures taken against VCFs that choose not to migrate to the updated regulatory framework. Specifically, VCFs with schemes whose Liquidation Period has not yet expired will face increased scrutiny and regulatory reporting obligations, aligning them more closely with the reporting standards applicable to AIFs under the AIF Regulations. Along the same lines, VCFs with at least one scheme that has not been wound up following the expiration of its Liquidation Period have been cautioned about potential regulatory action.

As mentioned in our previous digest, multiple VCFs have been penalized by SEBI for operating beyond their prescribed tenure. However, these VCFs were not given a clear route for winding up, as they were inadequately governed by the VCF Regulations and did not fall under the AIF Regulations' framework. The new framework for MVCFs has now provided long-awaited clarity for this category of funds, addressing the regulatory gaps that previously existed.

SEBI has specified that upon migration, MVCFs, along with their respective investors, investments held, and units issued, will be deemed to be governed under the AIF Regulations. Consequently, SEBI has outlined the applicability of various provisions of the Master Circular for AIFs dated May 07, 2024, and subsequent circulars to MVCFs.

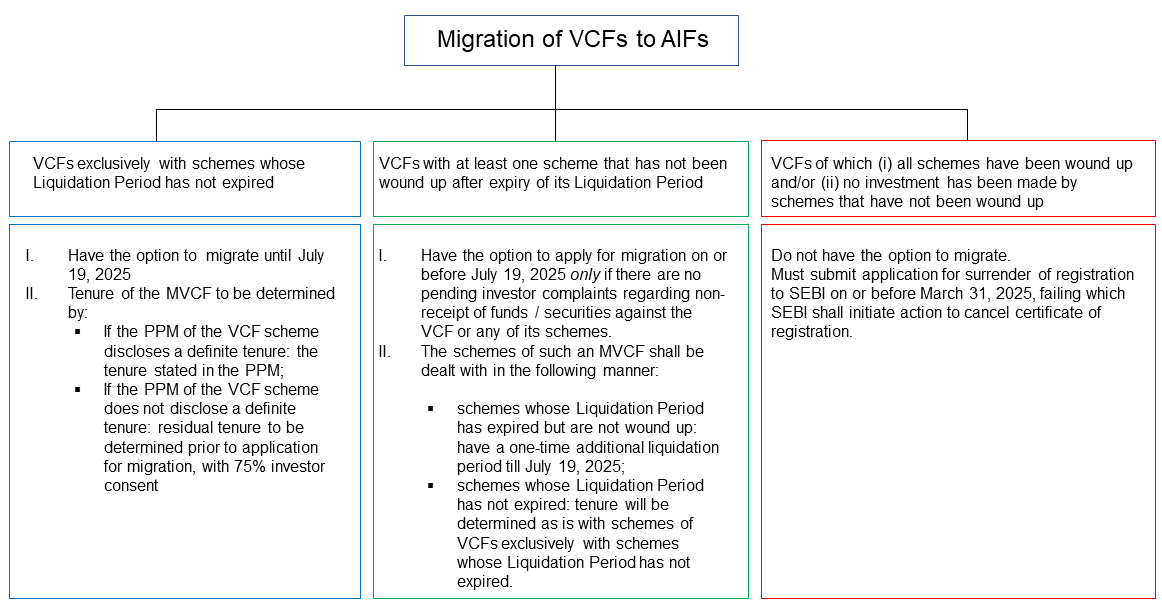

The specific modalities of migration of VCFs to AIFs has been summarized below:

Analysis

SEBI’s recent changes to the regulatory framework for MVCFs represent a significant step toward standardizing the governance of these funds. By integrating VCFs into the AIF regulatory regime, SEBI aims to close the regulatory gaps that previously allowed certain VCFs to operate beyond their tenures without clear guidance on winding up. The introduction of strict reporting requirements and potential penalties for non-compliance underscores SEBI’s commitment to enhancing transparency and accountability in the fund management space. Furthermore, the specific focus on the liquidation period ensures that investors’ interests are protected by mandating timely liquidation and distribution of assets. These changes not only provide long-overdue clarity for funds caught between the old VCF and the new AIF regimes but also strengthen investor confidence by aligning VCF practices with the more robust AIF standards.

Authors

- Payal Saraogi and Radhika Parikh

Funds Team

Nishith Desai, Global Strategy

Parul Jain, Fund Formation and International Tax

Radhika Parikh, Fund Formation and GIFT City

Prakhar Dua, Fund Formation and FSR

You can direct your queries or comments to the relevant member.

1SEBI/HO/AFD/AFD-POD-1/P/CIR/2024/112

2SEBI/HO/AFD/AFD-POD-1/P/CIR/2024/111