Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

Investment Funds: Monthly Digest

June 30, 2023Corporate Debt Market Development Fund & Other Key Amendments Introduced by SEBI

BACKGROUND

The Securities and Exchange Board of India (“SEBI”) recently released the SEBI (Alternative Investment Funds) (Second Amendment) Regulations, 2023 (“Amendment Regulations”).1 Further, SEBI has also released three circulars, namely, ‘Modalities for launching Liquidation Scheme and for distributing the investments of AIFs in-specie’ (“Liquidation Circular”), ‘Issuance of units of AIFs in dematerialised form’ (“Demat Circular”), and ‘Standardised approach to valuation of investment portfolio of AIFs’ (“Valuation Circular”) (collectively, “SEBI Circulars”) clarifying the details pertaining to the implementation of the Amendment Regulations.

A summary of the changes introduced by the Amendment Regulations and the framework clarified / introduced by the SEBI Circulars in the Alternative Investment Funds (“AIF”) industry is provided below, along with our analysis.

CORPORATE DEBT MARKET DEVELOPMENT FUND

SEBI has introduced a Corporate Debt Market Development Fund (“CDMD Fund”) under the SEBI (AIF) Regulations, 2012 (“AIF Regulations”), which is being constituted as a specific fund, reported to be managed by SBI Mutual Fund.2 The express purpose of CDMD is to make investments into eligible corporate debt securities from the debt-oriented schemes of mutual funds specified by SEBI during periods of market dislocation. Such periods of market dislocation will be determined by SEBI.

An overview of the CDMD Fund has been tabulated below:

|

Sr No |

Criterion |

Details |

|

1. |

Structure |

To be set up as a Trust3 under the Indian Trusts Act, 1882.

|

|

2. |

Documents to be filed with SEBI |

|

|

3. |

Tenure |

|

|

4. |

Continuing interest |

Sponsor to maintain a continuing interest of > INR 5 crore and not by means of management fee waiver.8 |

|

5. |

Investors |

(i) asset management companies (as defined under SEBI (Mutual Funds) Regulations, 1996 (“MF Regulations”)) and (ii) specified debt-oriented schemes of mutual funds.9 |

|

6. |

Winding up |

With prior SEBI approval.10 |

|

7. |

Eligible Investments |

Securities which are (i) listed and have an investment grade rating; (ii) residual maturity > 5 years; and (iii) have no material possibility of default or adverse credit news.11

Further investments can also be made in liquid and low-risk debt instruments in periods other than a market dislocation. |

|

8. |

Price of Eligible Securities |

Fair Price (adjusted for liquidity risk, interest rate risk and credit but not at distress prices).12

For the asset classes valuation of which is covered under the MF Regulations, valuation is to be undertaken as per the principles mentioned therein. |

|

9. |

Holding Period of Securities |

Until maturity or until a reversal of market dislocation13 |

|

10. |

Investment Restrictions |

|

|

11. |

Listing |

The units cannot be listed on any stock exchange. |

|

12. |

In-Specie Distribution |

Only at the time of winding up, upon affirmative consent of 75% of unitholders by value. |

|

13. |

Trustee |

A Trustee to be appointed to undertake functions of a Trustee under the MF Regulations. The board of the Trustee shall comprise of 2/3rd independent directors appointed with prior SEBI approval. |

|

14. |

Obligation of the Trustee |

The Trustee is required to appoint (i) an audit committee, which shall ensure compliance with the PPM; and (ii) a governance committee to:

|

Remarkably, SEBI has permitted CDMD to undertake priority distributions during periods of market dislocation wherein the sellers of corporate debt securities may observe a share of loss higher than their pro rata holding.15 This constitution of the CDMD Fund as vehicle that is empowered to undertake priority distributions comes in the backdrop of SEBI raising an issue against AIFs with a priority distribution model as the same could be used to structure funds that may evergreen loans extended by regulated lenders.16 Further, the CDMD Fund has also been empowered to borrow as much as ten times its corpus.17

UNLIQUIDATED INVESTMENTS

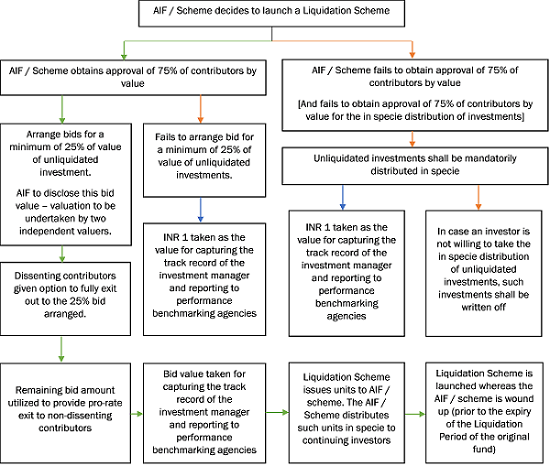

SEBI has now amended the AIF Regulations to provide 3 methods of handling unliquidated investments, viz:

-

Transfer into a liquidation scheme (“Liquidation Scheme”) subject to requisite contributor consent;

-

In specie distribution subject to requisite contributor consent; and

-

Mandatory in specie distribution.

Liquidation Scheme

In this regard, the Liquidation Scheme is envisioned to be a close-ended scheme with its tenure being determined at the filing of the PPM18 not subject to any extension. Unliquidated investments of the Liquidation Scheme (if any) will be dealt with in the manner stipulated by SEBI. The Liquidation Scheme has been given special dispensations with respect to the requirements under the AIF Regulations including but not limited to minimum corpus requirement, minimum investment requirement, minimum tenure, and diversification norms. SEBI has also provided clarity on the liquidation period which can either be (i) a period of one year post the expiry of an AIF’s / scheme’s tenure; or (ii) an AIF’s / scheme’s extended tenure for full liquidation of investments (“Liquidation Period”).19

Additionally, SEBI has disallowed evergreening of AIF by stipulating that (i) Liquidation Schemes are not permitted to extend their tenure or sell its unliquidated investments to another Liquidation Scheme, and (ii) AIFs have to mandatorily distribute units of any Liquidation Scheme held by it upon the expiration of its tenure / extended tenure – thus preventing the units of a Liquidation Scheme from being carried over to another Liquidation Scheme.

In-Specie Distribution

The Liquidation Circular elaborates on the method of undertaking in specie distribution without establishing a separate Liquidation Scheme. To carry out such in-specie distribution, the AIF / scheme is required to obtain the approval of 75% of contributors by value and arrange a bid for a minimum of 25% of unliquidated investments. The bid amount so raised shall be utilized to provide a full exit to any dissenting contributor(s) and any unsubscribed portion of the amount would be utilized to provide a pro rata exit to contributor(s) who assented to the in-specie distribution. It is to be noted that the bid value and the valuation of the unliquidated investments (undertaken by two independent valuers) ought to be disclosed to all contributors.

We note that the Amendment Regulations, have introduced a relatively narrower concept of ‘investments of a scheme which are not sold due to lack of liquidity’, than what was proposed in the consultation paper. The concept, currently, lacks clarity – as to how the industry participants can evidence the lack of liquidity. Further, the narrower scope may also result in a situation wherein all unliquidated investments may not be permitted to be transferred to a Liquidation Scheme. Other implications with respect to the carry forward of unliquidated investments have been discussed here. Lastly, it is to be noted that the investment manager, trustee / designated partner(s) / director(s) and key management personnel of AIF would be responsible for compliance with the procedure laid down in the Liquidation Circular.

EXPERIENCE AND PROFESSIONAL QUALIFICATION

SEBI has omitted the experience criteria stipulated for key investment team of the manager and has replaced the same with a requirement to obtain ‘relevant certification which may be prescribed by SEBI from time to time. The certification requirement has to be fulfilled by at least one of the key personnel of the manager’s key investment team.20

This certification requirement is being laid down as a continuing requirement wherein the relevant personnel would be required to obtain a fresh certification prior to the expiration of existing certification’s validity in order to ensure compliance.21 Likewise, the compliance officer is now required to meet the eligibility requirements as laid down by SEBI22 and is to report any observed non-compliance to SEBI within a period of 7 working days.23 The implications with respect to a qualifying criteria for compliance officers have been discussed here.

SEBI, in its board meeting, has noted that the removal of experience threshold has been undertaken to ensure objectivity while ascertaining the eligibility of AIF registrations in addition to having a more skill based approach. Nevertheless, there was significant industry feedback against this proposal – the industry players sought to have an option of meeting either the certification requirement or the experience threshold. However, SEBI has now incorporated the certification requirement into the AIF Regulations despite the negative industry feedback.

We note that this requirement can prove quite onerous and cumbersome to highly skilled and experienced investment managers who would now have to continually obtain the relevant certifications in spite of having a stellar track record as an AIF manager. Ideally, the experience criteria should have been retained as an alternative to the certification requirement. We have discussed the implications of a new certification criteria in our previous digest here.

DEMATERIALIZATION OF UNITS

In furtherance of the SEBI consultation paper on the dematerialization of AIF units24 and the subsequent board approval25, SEBI has now amended the AIF Regulations to mandate the issuance of AIF units in a dematerialized form.26 The thresholds and timelines for AIFs to undertake the dematerialization of their units are tabulated below.

|

Particulars Corpus |

Dematerialization of all units issues |

Issuance only in dematerialized form |

|

≥ INR 500 crore |

By October 31, 2023 |

November 01, 2023 onwards |

|

< INR 500 crore |

By April 30, 2024 |

May 01, 2024 onwards |

This requirement of mandatory dematerialization is not applicable to schemes / AIFs that would see their tenure end on or prior to April 30, 2024. Nevertheless, it is to be noted that such dematerialized units are not freely transferable. Depositaries would need the approval of the AIF or the investment manager to transfer the units of AIFs. Moreover, the conditions of transfer of AIF units shall still be governed by the fund documents (primarily the PPM).

The mandate of dematerialization would be quite taxing on smaller AIFs, especially angel funds. Such funds generally do not have a large enough corpus to commercially justify the additional costs incurred due to dematerialization. It is to be noted that the Alternative Investment Policy Advisory Committee (in its October 11, 2022 meeting) had recommended to consider the externalities caused by the demat requirement on the ease of doing business of small fund managers / angel funds. However, this recommendation was not formally suggested as a proposal in its subsequent meeting. Other implications with respect to the dematerialization of AIF units have been previously discussed here.

BUYING / SELLING FROM / TO ASSOCIATES / RELATED SCHEMES / MAJORITY INVESTOR

In furtherance of the SEBI consultation paper on Investor consent for buying/selling investments from/to associates of AIFs,27 and the subsequent board approval28, SEBI has now amended the AIF Regulations to ensure that an AIF / scheme will not buy or sell investments, from or to (i) associates; (ii) AIFs / schemes that are managed / sponsored by the investment manager or the sponsor; or (iii) an investor who has contributed a minimum of 50% of the concerned scheme’s / AIF’s corpus without first obtaining an affirmative vote of investors representing 75% of the investors by value.29

Further, it is to be noted that the investor contributing at least 50% of the concerned scheme’s / AIF’s corpus may not vote for the purposes of such related-party transactions.30

From a fund governance perspective, this is a welcome change as enhanced transparency is provided to AIF investors regarding the various related-party transactions of the AIF in addition to some amount of control (via affirmative vote) over the same. Other implications with respect to AIF’s dealing with associates have been discussed here.

VALUATION

SEBI has now amended the AIF Regulations to mandate the valuation of AIFs securities shall be carried out as per the MF Regulations or per valuation guidelines endorsed by any AIF industry association31 by an independent valuer who meets SEBI standards wherein the investment manager shall be responsible for the true and fair valuation of the AIF’s / scheme’s investments. As per the Valuation Circular, the investment manager is required to ensure that the independent valuer appointed meets the following eligibility criteria.

The independent valuer shall:

-

Not be an associate of the manager or sponsor or the trustee of the AIF;

-

It shall have at least 3 years of experience in valuation of unlisted securities; and

-

It shall either be (i) a valuer registered with the Insolvency and Bankruptcy Board of India and be a member of Institute of Chartered Accountants of India or Institute of Company Secretaries of India or Institute of Cost Accountants of India or CFA Institute; or (ii) it is a holding or subsidiary company of a credit rating agency registered with SEBI.

The investment manager is empowered to deviate from established policies and procedures of valuation where the same does not result in fair and appropriate valuation upon providing the rationale for such a deviation. In this regard, following is specified:

-

At each asset level, in case there is a deviation of more than 20% between two consecutive valuations or a deviation of more than 33% in a financial year, the manager shall inform the investors the reasons for the same.

-

Any change in the methodology and approach for valuation of investments of scheme of AIF, shall be construed as material change significantly influencing the decision of the investor to continue to be invested in the scheme of the AIF.32

-

The manager shall disclose the following as part of changes in PPM to be submitted annually to SEBI and its investors:

-

Details of changes in the valuation methodology and approach, if any, for valuation of each asset class of the scheme of the AIF;

-

Details of changes in accounting practices/policies, if any, of the investee company and the scheme of the AIF; and

-

Details of impact of the aforesaid changes in terms of valuation of the investments of the scheme of the AIF.

-

Further, to ensure the timely and appropriate reporting of valuation of investment portfolio to performance benchmarking agencies, the following is specified:

-

Manager of AIF shall ensure that a specific timeframe for providing audited accounts by the investee company to the AIF is included as one of the terms in investment agreement with the investee company, so as to enable AIFs to report valuation based on audited data of investee companies as on March 31 to performance benchmarking agencies within the specified timeline of six months; and

-

Manager of AIF shall ensure that valuation based on audited data of investee company is reported to performance benchmarking agencies only after the audit of books of accounts of the AIF in terms of Regulation 20(14) of AIF Regulations, within the stipulated timelines.

CONCLUSION

The Amendment Regulations has incorporated into law the proposals first introduced by SEBI in its January and February (2023) consultation papers. The CDMD Fund Framework, which was not previously discussed in the consultation papers, has the potential to bolster investor confidence in the corporate debt market due to the presence of a government-linked entity in the market. The enhancements made to the secondary market liquidity in the corporate debt market at time of stress may lead to increased participation and the overall growth of the ecosystem.

However, one is yet to observe industry reactions to the Amendment Regulations. Although, the primary concept of the CDMD Fund would not have a large impact on the AIF industry as it is a one of kind fund that the Government has set up to ensure liquidity in the debt market during times of market dislocation. Nonetheless, the increasing regulatory focus on brownfield regulatory concerns such as improving fund governance and investor protection is a tell-tale sign of the AIF industry maturing in India. In the backdrop of the rise in credit funds last year, and its increasing relevance in the current market conditions, the new CDMD Fund framework is perfectly timed to spark a renewed vigor in the corporate debt markets.

It is to be noted that SEBI has not taken in the regard most of the industry feedback while giving the proposals, the effect of law. The industry representation clearly outlined changes to the changes proposed by SEBI such as the optionality of the certification requirement and the exemption to angel funds from the requirement of dematerialization.

Nevertheless, the increasing linkages between the AIF Regulations and the MF Regulations is a concern to the Indian funds industry as the former is an investment vehicle for sophisticated investors whereas the latter is an investment vehicle for the retail investors. The application of stringent investment restrictions to AIFs in line with mutual funds is not reasonable, not in line with global norms, and reduces the utility of AIFs as an asset class.

– Athul Kumar, Srishti Chhabra & Nandini Pathak

You can direct your queries or comments to the authors.

1SEBI AIF (Second Amendment) Regulations, 2023, June 15, 2023

2Sivani Bazaz, India's corporate debt market fund will help boost liquidity and confidence in the bond market, CNBC

3Regulation 19O. (1) of the AIF Regulations

4Regulation 19O. (1) of the AIF Regulations

5Regulation 19O (3) of the AIF Regulations.

6Regulation 19O (5) of the AIF Regulations

7Id.

8Regulation 19P (3) of the AIF Regulations

9Regulation 19P (1) of the AIF Regulations

10Regulation 19O (6) of the AIF Regulations

11Regulation 19Q (1) of the AIF Regulations

12Regulation 19Q (5) of the AIF Regulations

13Regulation 19Q (3) of the AIF Regulations

14‘Fund capital’ means the aggregate of the corpus of the CDMD Fund and its maximum permissible borrowing as per the explanation to regulation 19Q (8) of the AIF Regulations

15Regulation 19Q (6) of the AIF Regulations

16Consultation paper on proposal with respect to pro-rata and pari-passu rights of investors of AIFs, May 23, 2023

17Regulation 19Q (9) of the AIF Regulations

18Regulation 29A of the AIF Regulations

19Regulation 2 (1) (pb) of the AIF Regulations

20Regulation 4 (g)(i) of the AIF Regulations

21Proviso to regulation 4 (g) of the AIF Regulations

22Regulation 20 (18) of the AIF Regulations

23Regulation 20 (19) of the AIF Regulations

24Consultation paper on dematerialisation of units of AIFs, February 3, 2023

25SEBI Board Meeting, PR No.: 6/2023, March 29, 2023

26Regulation 10 (aa) of the AIF Regulations

27Consultation paper on Investor consent for buying/selling investments from/to associates of AIFs, February 03, 2023

28SEBI Board Meeting, PR No.: 6/2023, March 29, 2023

29Regulation 15 (1)(ea) of the AIF Regulations

30Proviso to regulation 15 (1)(ea) of the AIF Regulations

31Regulation 23 of the AIF Regulations

32IF to be in compliance of SEBI circular No. CIR/IMD/DF/14/2014 dated June 19, 2014 and SEBI Circular No. CIR/IMD/DF/16/2014 dated July 18, 2014.