Research and Articles

Hotline

- Capital Markets Hotline

- Companies Act Series

- Climate Change Related Legal Issues

- Competition Law Hotline

- Corpsec Hotline

- Court Corner

- Cross Examination

- Deal Destination

- Debt Funding in India Series

- Dispute Resolution Hotline

- Education Sector Hotline

- FEMA Hotline

- Financial Service Update

- Food & Beverages Hotline

- Funds Hotline

- Gaming Law Wrap

- GIFT City Express

- Green Hotline

- HR Law Hotline

- iCe Hotline

- Insolvency and Bankruptcy Hotline

- International Trade Hotlines

- Investment Funds: Monthly Digest

- IP Hotline

- IP Lab

- Legal Update

- Lit Corner

- M&A Disputes Series

- M&A Hotline

- M&A Interactive

- Media Hotline

- New Publication

- Other Hotline

- Pharma & Healthcare Update

- Press Release

- Private Client Wrap

- Private Debt Hotline

- Private Equity Corner

- Real Estate Update

- Realty Check

- Regulatory Digest

- Regulatory Hotline

- Renewable Corner

- SEZ Hotline

- Social Sector Hotline

- Tax Hotline

- Technology & Tax Series

- Technology Law Analysis

- Telecom Hotline

- The Startups Series

- White Collar and Investigations Practice

- Yes, Governance Matters.

- Japan Desk ジャパンデスク

Investment Funds: Monthly Digest

August 24, 2023Governance Standards for AIFs in India

INTRODUCTION

The rise of Alternative Investment Funds (“AIFs”)1 has attracted special attention from the regulator over the past couple of years. One of the chief concerns of the Securities and Exchange Board of India (“SEBI”) has been around regulation of governance standards for AIFs. This includes accountability, conflict mitigation and management, investor protection, ethics, sustainability, and proper risk allocation.

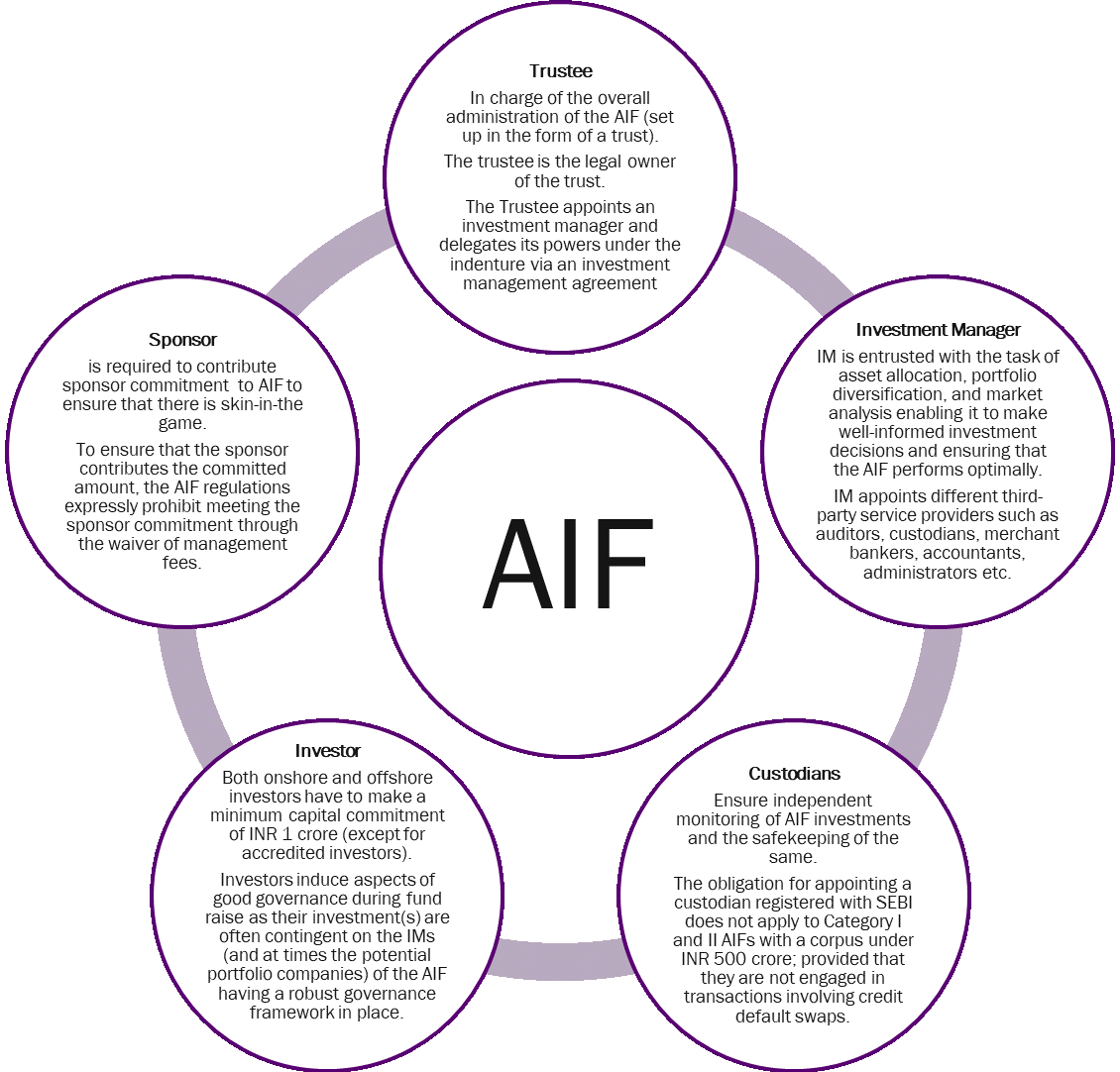

The SEBI (Alternative Investment Funds) Regulations, 2012 (“AIF Regulations”) stipulate an organizational framework for proper governance of AIFs by defining roles, obligations and liabilities of the sponsor, manager (“IM”), trustee and decision-making investment committee, if any (“ICOM”).

In this issue of the monthly digest, we shed light on expectations of both the regulator and investors for governance standards for AIFs, market best practices, and consequences for non-compliance.

STEWARDS OF RESPONSIBLE GOVERNANCE

Good governance is a moral obligation on all the stakeholders of an industry. Nevertheless, the market regulator has provided numerous provisions in the AIF Regulations to ensure that each steward of management of an AIF ensures the same.

The roles of the key management stewards in an AIF are captured below.

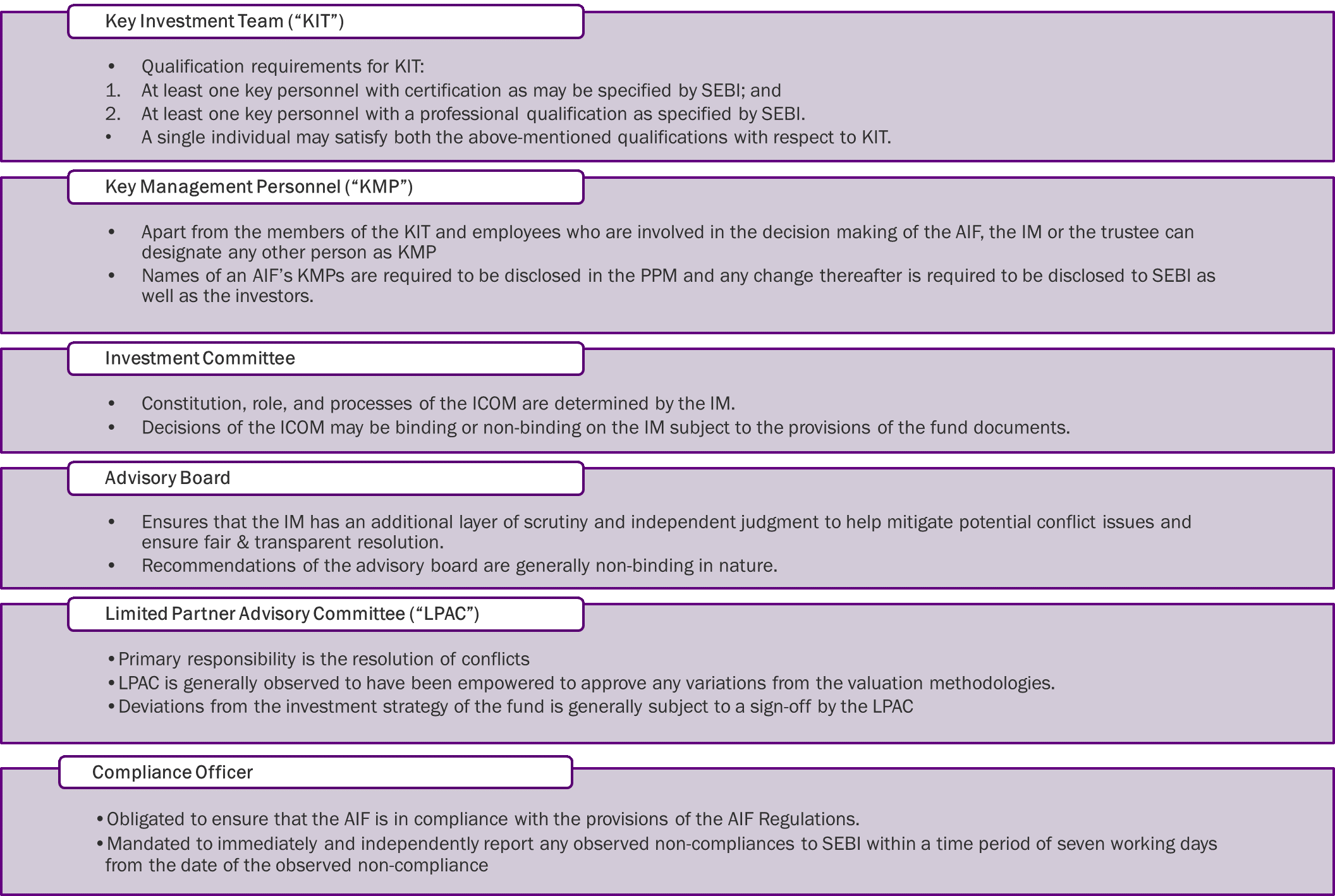

In addition to the identified stewards of governance mentioned above, there are certain individuals and bodies of individuals who are involved in the overall governance of an AIF, as depicted below.

EXPECTATIONS OF GOOD GOVERNANCE

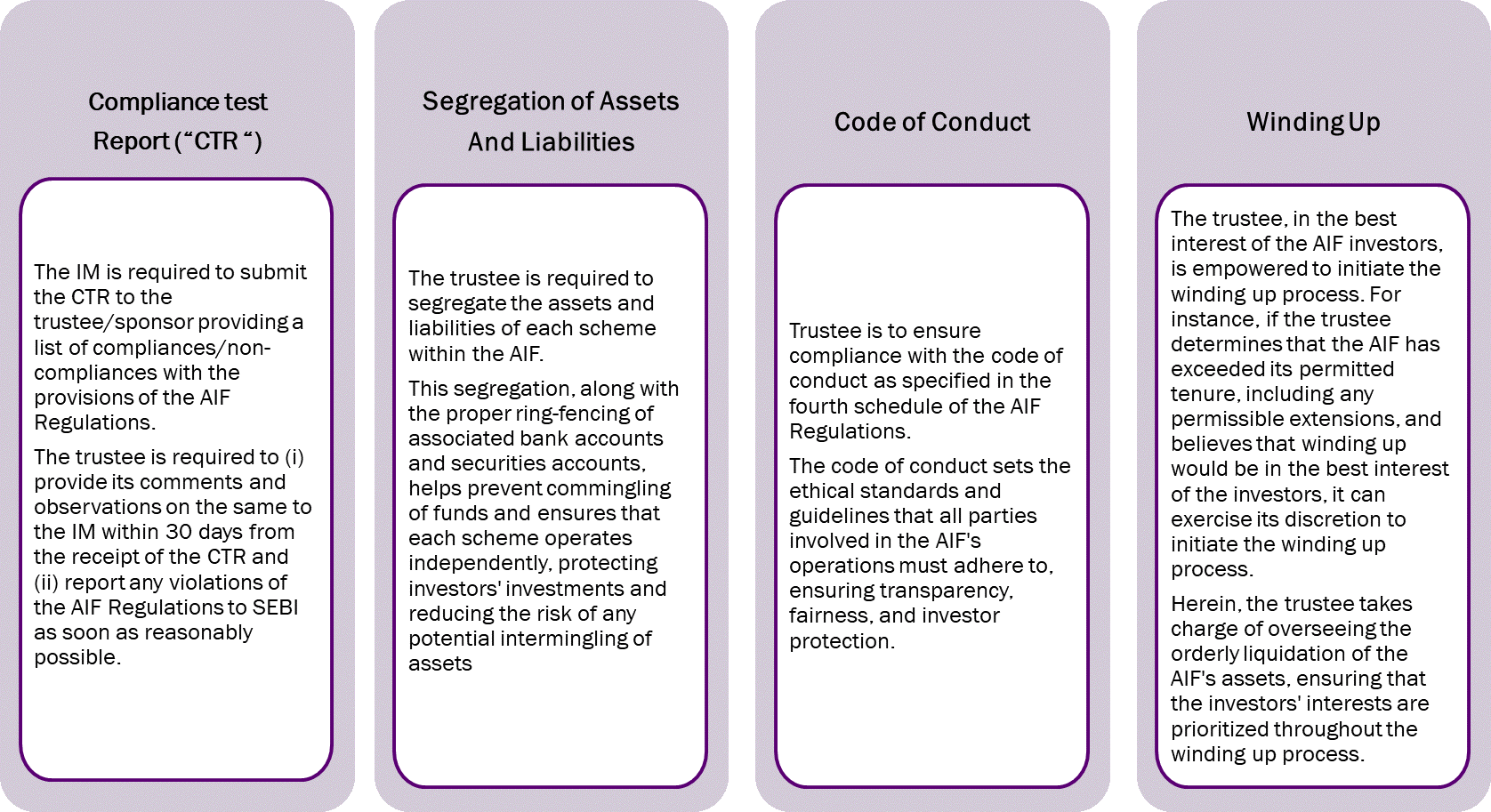

As the legal owner, the Trustee assumes significant responsibility of ensuring the AIF's compliance with all applicable laws and regulations. In this regard, the key obligations of the trustee that bolster good governance are elaborated in the diagram below.

SEBI has recently amended the AIF Regulations2 to mandate the valuation of AIFs securities to be carried out as per the (i) SEBI (Mutual Fund) Regulations, 1996 or (ii) valuation guidelines endorsed by any AIF industry association3 by an independent valuer who meets SEBI standards wherein the IM shall be responsible for the true and fair valuation of the AIF’s portfolio. The changes brought in by the recent valuation norms specified by SEBI and the implications thereof are discussed here.

From a governance perspective, the standardization of valuation norms shall streamline the valuation process for all the parties involved and investors would be able to easily familiarize themselves with the valuation methodologies adopted by the AIF. Furthermore, the obligation on IMs to document any deviations from the valuation policies / procedures of the AIF (along with the rationale for the same) enables investors to verify whether such deviations are justified for reaching the fair value of the AIF’s portfolio. In this regard, the investors may also request for enhanced information sharing rights from the IM so as to immediately receive information regarding such deviations (along with the rationale for the same).

The disclosure of such information to the investors ensures that there is adequate transparency – a cornerstone of good governance. By virtue of such disclosures, the investors are also better placed to understand the functioning of the AIF and proactively react to adverse situations (if any) that arise during AIF’s tenure. Captured in the diagram below are the several obligations of the IM that enable investors to better function within the AIF ecosystem.

ROLE

-

Conflict of Interest

SEBI mandates the sponsor / IM to disclose any conflicts that arise or are likely to arise to the investors and formulate policies and procedures to identify, monitor and mitigate any conflicts that may arise in the future.

AIFs are now required to provide for an online dispute resolution process for the efficient redressal of investor complaints. To ensure that frivolous disputes are not raised against AIF investors, the fit and proper status of the IM may be revoked in case of a failure to deposit 100% of the admissible value of the claim.

-

Disclosure and Reporting Requirements

The AIF Regulations mandate certain disclosures that need to be made by the AIF to the investors from time to time. Such disclosure requirements which include, but are not limited to, periodical disclosure of financial, risk management, operational, portfolio and transactional information, enquiries / legal actions by regulatory bodies in any jurisdiction, and any material liability that arises during the AIF’s tenure (as and when such material liability arises).

In addition to the aforementioned disclosure requirements, Category I and Category II AIFs are also required to annually provide investors with the financial details of its portfolio companies and information pertaining to any material risks (and mitigation strategies thereof). In case of Category III AIFs, such reports are to be provided to the investors on a quarterly basis within 60 days from the end of the quarter.

SEBI may also call for any clarification/information from the IM which needs to be provided to it within the specified timeline.

-

Performance Benchmarking

The IM is also required to ensure that a performance benchmarking report is annexed with the PPM or provided to the investors in instances wherein the IM mentions the track record of the previous funds managed or sponsored by it.

-

Valuation Norms

The valuation of AIFs securities to be carried out as per the (i) SEBI (Mutual Fund) Regulations, 1996 or (ii) valuation guidelines endorsed by any AIF industry association by an independent valuer who meets SEBI standards wherein the IM shall be responsible for the true and fair valuation of the AIF’s portfolio

-

Miscellenous

The IM is required to abide by the code of conduct specified in the fourth schedule of the AIF Regulations.

IM is required to approve the policies and procedures of the AIF in order to ensure compliance with the AIF Regulations, the AIF’s private placement memorandum (“PPM”), contribution agreements (“CAs”) and other fund documents, ensure transparency, and address investor complaints.

CONCLUSION

SEBI has from time to time, introduced new amendments and imposed additional obligations for key stewards of governance of an AIF including trustees, IMs, sponsors, and ICOMs. Aimed at bridging any potential gaps within the governance systems governing AIFs, such measures are intended to reinforce a robust and transparent operational environment for the AIFs.

Notably, some of the changes are reflective of SEBI's proactive stance, such as the introduction of the dematerialization of AIF which underscores SEBI's commitment to modernizing processes and enhancing investor protection. This move streamlines unit transactions and ensures easy record-keeping mechanisms. However, at the same time the specification of stringent eligibility criteria for members constituting the key investment team has significant implications for the IMs to look for experienced individuals resulting in increased costs for the IM.

While SEBI's endeavours to implement robust governance mechanisms for AIFs are welcoming to certain extent, it is also essential to strike a delicate balance that addresses the nuanced impact of these provisions on both IMs and investors of AIFs. Achieving this balance is crucial to fostering a thriving AIF as an asset class that contributes to the broader financial landscape while ensuring the protection and prosperity of investors and fund participants alike.

– Athul Kumar, Dibya Behera & Nandini Pathak

You can direct your queries or comments to the authors.

1The growth of AIF industry has been significant in the last few years. Interestingly, prior to 2022, AIFs as an asset class had raised less than INR 4.5 lakh crore of capital which has now crossed INR 7 lakh crore alone in 2022; Sohini Mitter, AIFs can grow 4-5x to become as big as mutual funds industry, say fund managers, Business Today https://www.businesstoday.in /mutual-fun ds/story/ai fs-can-grow -4-5x-to-b ecome-as-b ig-as-mutu al-funds-i ndustry-s ay-fund-m anagers-3 71121-202 3-02-22

2SEBI (AIF) (Second Amendment) Regulations, 2023 dated June 15, 2023.

3AIF industry associations are associations that represent at least 33% of the number of AIFs for carrying out the benchmarking process. A few entities that have been currently notified as benchmarking agencies by AIF associations include CRISIL, NSE Indices Ltd, and Preqin.