June 10, 2022

Trend in Focus: Continuation Funds with Indian considerations

Background

GPs globally have used GP led secondary transactions (such as strip sale, extensions, continuation funds etc.) when in the opinion of the GP, the investments would not yield the expected returns at the originally expected due time of making exits for closed-end funds (each, a “Fund”).

The Fund is expected to exit its investments during the harvesting period, and in any case, upon the completion of its tenure. However, sometimes it may be more conducive from a value generation perspective to have a longer holding period for some of these investments. This requires a fine balance of expectations as not all LPs may be on board with extending the holding period and may prefer liquidity by the end of the originally communicated tenure of the Fund.

Traditionally, GP led secondaries were not seen favourably by LPs and the assets which were not sold during the tenure of the Fund were commonly referred to as “zombie assets”. However, over the past few years, the branding of GP led secondaries has improved especially in the light of COVID-19, and GP-led secondaries are being used more commonly to continue investments in assets which can yield better returns in future commonly referred to as the “trophy assets”. Due to this, reliance on GP-led secondary transactions has increased which reportedly now make up a deal flow of more half the deal flow in private equity secondaries transactions globally.1

In this edition of the monthly digest, we discuss the ways to structure secondary transactions with focus on continuation funds, the advantages and disadvantages of using continuation funds from an LP and GP perspective, and viability of such structures in India.

Framework

Typically, GP-led secondaries may be in the form of offers to investors (strip sale or tender offer) and / or restructuring of the Fund (extension of term with LP secondaries or launching a new fund). Hence, such transactions may be structured as inter-alia (i) multi-asset continuation fund; (ii) single-asset continuation fund; (iii) portfolio sale; (iv) tender offers and (v) as stapled transactions.

While approaching the end of a Fund’s tenure, if the GP recognizes the need to continue to hold certain assets for longer, and is able to demonstrate the same to its LPs, the GP may request its LPs for an extension of the term to continue its investment in certain assets.

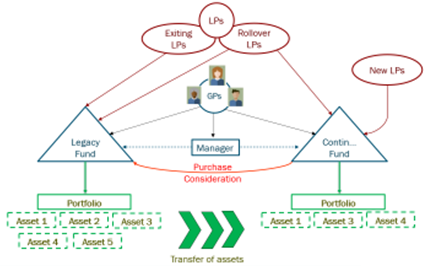

In some cases, where no further extension is permitted under law, or if most of the LPs would like to exit and certain new LPs are buying into the continuing assets, such new LPs may prefer participating through a new fund vehicle to avoid any legacy issues with the existing Fund (the “Legacy Fund”). In such cases, the Legacy Fund is wound up and the ‘rollover LPs’ as well as the continuing assets are transferred to a new Fund and new LPs also participate in such new fund (the “Continuation Fund”). Bringing in new LPs with additional capital is likely to strengthen the argument for a Continuation Fund for the GP, and justify the costs of setting up a new legal structure.

Typically, LPs of the Legacy Fund are given an option to either cash-out or rollover. Cashing-out implies that some LPs of the Legacy Fund who do not wish to continue (for liquidity reasons, or other concerns such as a relatively concentrated portfolio in the Continuation Fund) exit the Legacy Fund. As discussed subsequently, conflict concerns and valuation related issues form the key considerations for both exiting and rolling over LPs in a Continuation Fund.

For rollover LPs, a tax efficient way of continuing would be a priority, and negotiating tax costs being built into the Continuation Fund economics could be a concern for the new LPs coming into the Continuation Fund. Rollover LPs may also agree to committing additional capital for follow-on investments by the Continuation Fund in such continuing assets.

In India, the tenure of a closed-end alterative investment fund (“AIF”) is required to be ascertained and disclosed at the time of launch of the fund. The AIF is permitted to extend its tenure for two additional years with two-third of LPs by value approving such extension. The practical issue which will arise in the Indian context for a Continuation Fund is that it takes at least a couple of months to obtain a license to launch an AIF in India (which is not a scheme of an existing AIF). The need for a Continuation Fund often arises towards the end of the Legacy Fund’s tenure, and the GP does not have the benefit of time to wait for regulatory licenses. While launching a new scheme is an option, the legacy issues for new LPs cannot be wished away in a scheme structure because there is no legal ring-fencing of assets and liabilities between different schemes of an AIF.

Key Considerations and Indian regulations

-

Fee, carry and skin-in-the-game

As compared to a new fund, the GP’s scope of services with respect to a Continuation Fund is limited (no deal sourcing, no extensive diligence, no IC memos). Therefore, the conversation on management fees with the Continuation Fund LPs is accordingly toned and LPs do not consider exact rolling over of GP economics on fees to the Continuation Fund palatable. It is, however, relevant to factor in both the management fees and deal expenses borne by the Legacy Fund for the benefit of Legacy Fund LPs and the GP while admitting new LPs into the mix. The ‘key person event’ related provisions in a Continuation Fund are also considered unnecessary because the portfolio is already constructed, and the exit path more certain. For this reason, it is arguable that a Continuation Fund should not be considered a Successor Fund.

Depending on the commercial reality of the Legacy Fund at the time of launch of a Continuation Fund, the structuring of carried interest will differ. There may be crystallisation of carried interest at the time of transfer for rolling over LPs, with modification on the waterfall for new LPs in the Continuation Fund (common would be to have a graded waterfall in such a scenario). GPs may negotiate part payment of carried interest, while the rest being reinvested in the Continuation Fund. Rolling over LPs may also negotiate a performance fee rather than a carried interest.

As regards skin-in-the-game, the sponsor and / or GP of the Legacy Fund is expected to substantially rollover its interests to the Continuation Fund, and often also commit additional capital. Depending on the commercial reality, LPs may also seek a last money out type of a commitment from the sponsor. For an Indian AIF, there is a compulsory sponsor commitment imposed by SEBI which is expected to be a ‘continuing interest’ in the AIF.

-

Conflicts of interest and Valuation

When the assets of the Legacy Fund are acquired by the Continuation Fund, the GP is the common party on both the sides. This poses a direct conflict of interest for both the Legacy Fund and the Continuation Fund LPs because there is a reason to both buy reasonably but also sell beneficially. Further, it is important for LPs to examine whether the GP is striking the right balance between alignment of LP interests and its own economics.

The GP would typically make a presentation to the LPAC of the Legacy Fund, seeking a waiver of conflict in respect of a proposed Continuation Fund. The GP is foremost expected to be transparent, and be agreeable to disclosure of all necessary information required by the LPAC for processing its request. The key documents to be submitted are the independent valuation report of the continuing assets, the proposed economics for exiting LPs versus rolling-over LPs (this would include the valuation for transfer), the legal and tax analysis of continuation related restructuring and projections from the GP’s perspective as part of the overall plan for the Continuation Fund. The LPAC may, depending on the fact pattern, even ask the GP to seek an LP approval in addition to LPAC’s clearance of conflict.

As the assets involved are privately held and traded assets, there are no precise valuation of the assets. How do you achieve an absolutely independent valuation in such a conflict laden situation when one of the buyer or the seller ‘appoints’ the valuer? Third party GPs or LPs (or a combination as an expert panel) may be brought in to finally set the price. Existing LPs of the Legacy Fund who require liquidity, may coordinate and request for a tender offer of the assets of the Legacy Fund. In this case, the valuation may not be done by the buyer but instead to be determined through market forces. The LPs may achieve higher valuation due to the critical mass involved as many LPs coordinate to sell their share in the market. The Manager may also consider using a book-building process derived from investors submitting prices and sizes of interests they are looking to acquire; and/or pegging the sale price to a minimum “floor” price determined by a third-party sale of an equivalent interest in the asset

The Institutional Limited Partners Association (ILPA) also provides a guidance on LP and GP considerations in a Continuation Fund.2

The Securities Exchange Commission in the United States has recently agreed to propose new rules under the Investment Advisors Act of 1940 with the intent of increasing regulation of private fund advisors and protection of investors.3 The new rules have increased the disclosure requirements on the GPs and also propose that the registered private fund advisor shall obtain a fairness opinion from an independent opinion provider in connection with an adviser-led secondary transaction. The fairness opinion shall ensure that there is no foul play and the Investors rolling over to the Continuation Fund shall be able to receive considerable profits.

In India, SEBI provides broader codes of conduct for the AIF manager pertaining to transparency, conflict management, disclosures to investors as well as SEBI which would require the AIF manager to employ best market practices in respect of a Continuation Fund.

-

Conundrum of the LPs, side letters and tax

Unlike a new fund allocation, when LPs decide to rollover to a Continuation Fund, their diligence is focused more on the assets of such Continuation Fund rather than limiting it to the GP. A higher scrutiny is applied by the new LPs on the GPs’ track record as well. LPs also need to consider single-asset risks, or risks pertaining to a concentrated portfolio. LPs may also insist more on indemnities covering breach of representations and warranties on top of traditional indemnities depending on the assets being continued. LPs also carry out an independent price discovery and buyer assessment exercise in such cases while making a decision.

As regards fund terms, rollover LPs may seek favourable terms which should be considered outside the scope of the ‘most favoured nation’ side letter provisions of the new LPs because the condition for such favourable rights being offered would be an extended exposure to the portfolio through participation in the Legacy Fund. This LP-ask has to be carefully examined on a case-by-case basis because the GP is constantly struggling with conflict mitigation and management on the side while negotiating terms for a Continuation Fund. SEBI in its template private placement memorandum requires the AIF manager to undertake that none of side letter terms cause adverse economic impact on other investors in an AIF. This could also hinder LP-GP negotiations for a Continuation Fund unless appropriate disclosures and waivers are arranged at the outset, with LPs as well as SEBI.

Takeaway

While it may have been a panic planning strategy for GPs a decade ago, the emergence, relevance and acceptance of Continuation Funds in the present-day context is different (in a good way!). However, formation of Continuation Funds, as well as allocation towards Continuation Funds (whether as a rollover LP or a new LP) would come with a complex set of legal, tax, regulatory and governance issue, and each structure should be examined differently depending on factors such as the GPs’ realized track record, the assets being continued, the risk profile of the LPs considering a rollover, size and substance of the new LPs participating in the assets, efficiencies of leveraging an existing structure as compared to launching a new vehicle, and the valuation procedure being adopted by the GP.

– Srishti Chhabra & Nandini Pathak

You can direct your queries or comments to the authors

1 https://www.privateequityinternational.com/story-of-the-year-continuation-funds-on-the-rise/

2 GP-led Secondary Fund Restructurings : Considerations for Limited and General Partners (April 2019) available at

3 Proposed rule: Private Fund Advisers; Documentation of Registered Investment Adviser Compliance Reviews,” U.S. Securities and Exchange Commission. Release Nos. IA-5955; File No. S7-03-22. Available at