Deal Talk

October 07, 2024

NCLT “Squeezes In” Philips for “Squeeze Out” of

Minority Shareholders!

A. Introduction

The Kolkata Bench of

the National Company Law Tribunal (‘NCLT’)

passed an order on September 19, 2024, dismissing

the application filed by Philips India Limited

(‘Philips’) for

a capital reduction under Section 66 of the

Companies Act, 2013 (‘CA 2013’).1 The two majority shareholders

of Philips – Koninklijke Philips N.V.

and Philips Radio B.V. (‘Majority

Shareholders’) collectively held

approximately 96.13% shareholding, and the remaining

public shareholders held approximately 3.87%

shareholding out of which 0.71% is held by the

Investor Education Protection Fund (collectively,

the ‘Public Shareholding’). Philips got delisted

from the Bombay Stock Exchange on February 16,

2004, where it provided an exit option to its

existing shareholders at INR 105 per share within

one year from the date of delisting. The Public

Shareholding is held by the shareholders who

remained with Philips even post the delisting

offer. The current application

was filed by Philips for a capital reduction

under Section 66 of the CA 2013 to cancel and

extinguish 3.87% of the share capital of Philips

other than from the Majority Shareholder. In this edition of

the Deal Talk, members of our M&A Team:

Anurag Shah, Parina Muchhala, Nishchal Joshipura

and Viral Mehta discuss the reasons because

of which NCLT dismissed the petition by Philips

and breakdown the key takeaways from this order.

B. Reason

for the capital reduction and the proposal

According to Philips,

the minority shareholders (that continued even

after the delisting in 2004) who have continued

to hold the Public Shareholding are holding

illiquid asset and have not been able to monetize

their shareholding in Philips. They had received

multiple requests from the minority shareholders

in relation to their distress due to non-liquidity

of their Public Shareholding. Therefore, to help

the minority shareholders and provide them with

liquidity, Philips was undertaking the capital

reduction at a premium to the fair value. As

per the valuation report (and a fairness report),

the board of Philips determined the fair value

of the shares as INR 740 per equity share and

the capital reduction being proposed at a 24%

premium to the fair value of the shares (i.e.

INR 915 per share). The valuation methodology

used for the valuation report approved by the

board of Philips was the ‘Discounted Cash

Flow’ methodology (‘DCF’).

Shareholders representing 99.58% of Philips

approved the capital reduction, post which the

application was filed with the NCLT for approval. Certain minority shareholders

of Philips filed an objection with NCLT, Kolkata

against the capital reduction scheme filed by

Philips under Section 66 of CA 2013.

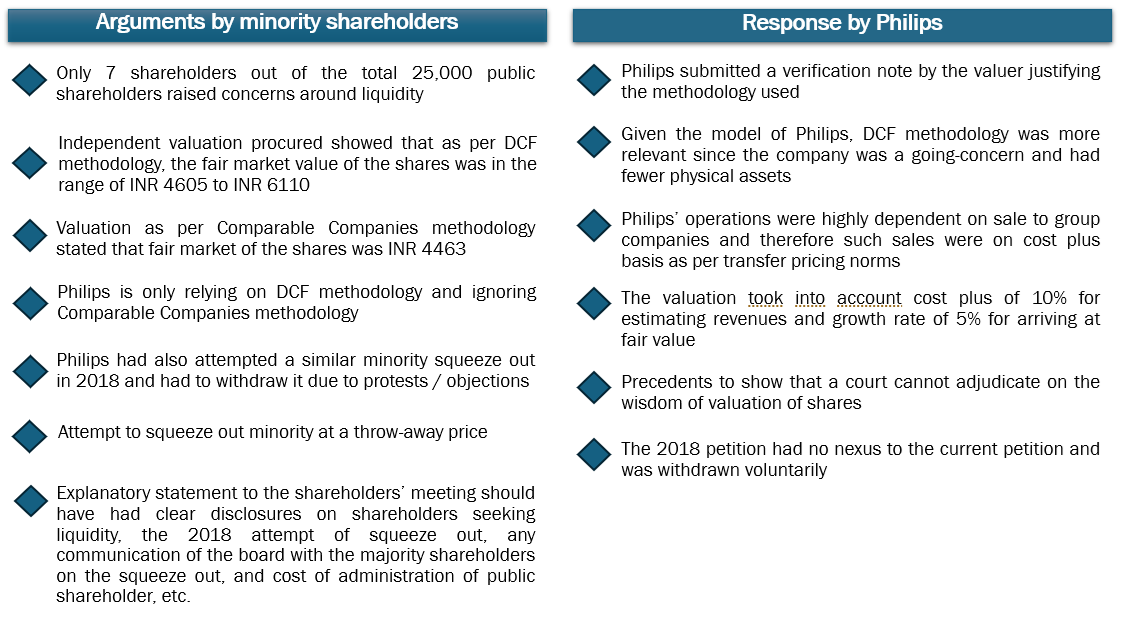

C. Arguments

by minority shareholders and Philips’ responses:

D. NCLT’s

Order

The NCLT noted that

Section 66 can be invoked for capital reduction

in the following cases:

extinguish

or reduce the liability on any of its shares in

respect of the

share

capital not paid-up; either with

or without extinguishing or reducing liability on

any of its shares cancel any paid-up

share

capital which is lost or is unrepresented by available

assets; and either with or without extinguishing

or reducing liability on any of its shares pay off

any paid-up

share

capital which is in excess of the wants of the company,

alter its memorandum by reducing the amount of its

share capital and of its shares accordingly.

As per NCLT, the proposed

squeeze out of the minority shareholders did

not fall under any of the aforementioned (a),

(b) or (c) cases. The rationale provided by

Philips for the capital reduction was: (i) providing

liquidity to the minority shareholders holding

Public Shareholding and (ii) saving administrative

cost that being incurred due to such high number

of minority shareholders. NCLT was of the view

that neither of the two formed valid reasons

for invoking Section 66. Additionally, the NCLT

also held that Section 66 specifically bars

the application of this section on buy-back

of its own securities by a company. However,

in this case, Philips was in essence buying

back the shares from the minority shareholders

and incidentally reducing the share capital. With respect to the

arguments on valuation method, NCLT was of the

view that: (a) the valuation procured by the

minority shareholders on Comparable Companies

methodology did not specify the companies to

which Philips was being compared, and (b) the

model of Philips is unique due to the cost-plus

mark-up model, and the Comparable Companies

methodology might thus not be the most suitable

methodology for valuation. NCLT was of the view

that the DCF methodology was better suited for

valuation, given that Philips had fewer physical

assets and was being run as a going concern. However, NCLT did note

that the valuation determined by the valuer

of Philips through the DCF methodology had a

huge gap when compared to the valuation determined

by the valuer of the minority shareholders through

the same method. Nevertheless, it did not get

into the merits of the same, given that it dismissed

the application due to non-invoication under

Section 66 of the CA 2013.

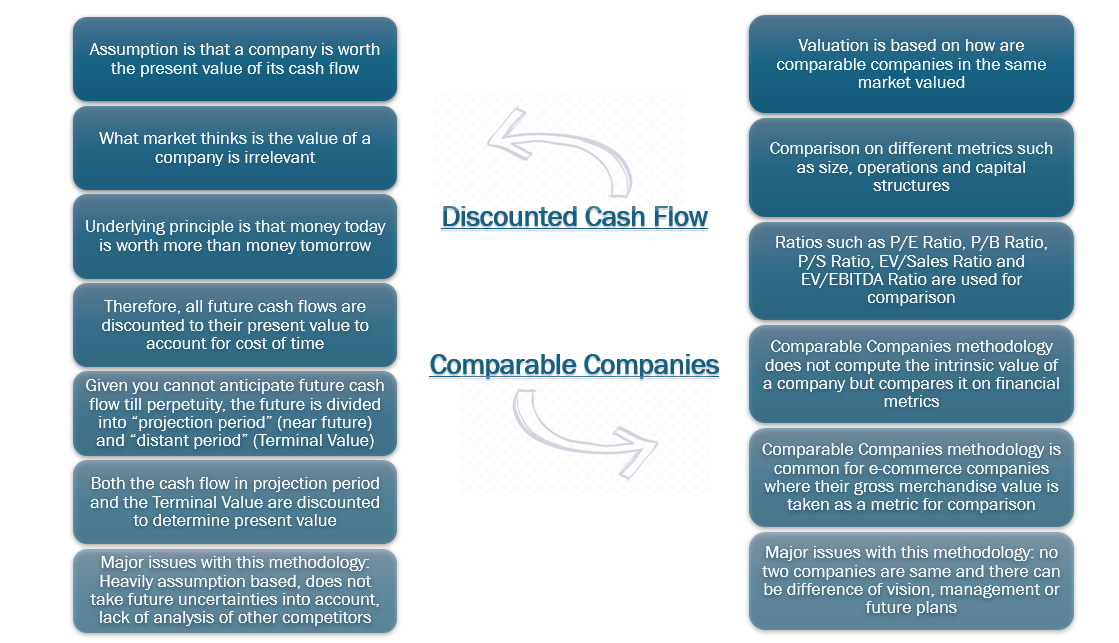

E. DCF methodology

v. Comparable Companies methodology

As noted above, one

of the key arguments presented before the NCLT

was whether the right methodology for valuation

was the DCF methodology or the Comparable Companies

methodology. Choosing the right

valuation methodology for a company is pertinent

not only from a CA 2013 perspective, but also

from a foreign exchange and tax perspective.

Specifically for tax purposes, in case of related

party transactions, we have seen many tax litigations

due to the taxpayers not using the appropriate

valuation methodology which eventually leads

to the tax authorities taking a position that

the determined valuation was incorrect. There are multiple

valuation methodologies such as the DCF method,

Comparable Company method, Net Asset method

and the Earnings Capacity method. Let’s

understand the difference between the methodologies

that were discussed by NCLT in the Philips order –

DCF methodology and the Comparable Company methodology:

F. Analysis

of the NCLT Order

Jurisprudence

on the scope and interpretation of Section 66

While the order of

the NCLT is in the interest of the minority

shareholders, it opens up a pandora’s

box of questions in relation to capital reduction

under Section 66 of the CA 2013. The position taken

by NCLT that Section 66 can only be invoked

in cases as mentioned in (a), (b) and (c) of

Section 66 (1) does not take into account the

fact that the text of Section 66 (1) of CA 2013,

also allows for the reduction of share capital

“in any manner”

and in particular by the methods prescribed

under Section 66 (1) (a), (b) and (c). There

have been multiple precedents where Section

66 has been invoked for reasons other than as

mentioned in Section 66 (1) (a), (b) and (c).

Additionally, there have been a plethora of

precedents where Section 66 has been invoked

specifically for minority squeeze-outs. Let’s explore

few of these precedents:

Based on the precedents

mentioned above, a few key points to note which

were not considered by the NCLT in its order

were as follows: (i) Section 66 can be invoked

for capital reduction in instances

other

than the indicative methods

specified in Section 66 (1) (a), (b) and (c);

(ii) Squeeze out of minority shareholders is

a valid reason for invoking capital reduction

as long as the price being paid to the minority

shareholders is fair; (iii) courts have limited

reasons due to which it can interfere in a capital

reduction, which inter alia includes:

(a) whether the capital reduction is discriminatory

towards any shareholder, and (b) if the price

determined is a fair price. Interestingly, in

the present case, NCLT did not get into the

merits of valuation issue and pre-maturely disposed

off the petition. Additionally, the NCLT’s

observation with respect to the capital reduction

by Philips essentially being a buyback is also

open to challenge, given that it did not consider

the fact that the restriction under Section

66 (6) is only with the intent to ensure that

the provisions of the capital reduction procedure

are not applied to a buyback of securities occurring

under Section 68 of CA 2013. Buyback is an entirely

different process as compared to capital reduction,

because: (a) Section 66 allows for selective

capital reduction whereas Section 68 allows

for buy-back of securities from existing shareholders

only on a proportionate basis; and (b) in case

of a buy-back, the shareholders have a right

to tender their shares for buy-back. Therefore,

NCLT’s intent to equate a minority squeeze

out with a buyback followed with capital reduction

is not aligned with the spirit of both these

sections.

Is

Section 236 a valid and available recourse for minority

squeeze out?

Interestingly, Section

236 of the CA 2013 introduces an intriguing

mechanism for majority shareholders to acquire

minority holdings in a company. Unlike Section

66, which facilitates a minority squeeze-out

through a capital reduction, Section 236 offers

a direct approach for majority shareholders

to buy out the remaining shares from the minority. Despite its potential,

Section 236 remains relatively underutilized,

partly due to its complex drafting and interpretation.

According to Section 236(1), any acquirer (or

an entity acting in concert with them), who

holds 90% or more of the company’s equity,

must notify the company of their intention to

purchase the outstanding shares. However, Section 236(3)

adds a twist: while majority shareholders are

obliged to extend an offer to minority shareholders,

the latter are not required to sell their shares

to the majority shareholder. This creates a

dynamic interplay where minority shareholders

can choose whether or not to accept the offer,

adding a layer of negotiation and strategy to

the squeeze-out process and making it a less

preferred route for the majority shareholder

seeking to consolidate shareholding in the company.

G. Concluding Thoughts

To summarize our thoughts: (a) Section 236 provides

for minority squeeze out by the majority shareholders,

however, the drafting of the section provides the

minority shareholders with the option of not tendering

their shares; (b) Section 68 provides for buyback

of securities, however the same needs to be done

on proportionate basis and therefore cannot be a

selective minority squeeze-out; and (c) Capital

reduction under Section 66 can be invoked for reasons

more than just items mentioned in (a), (b) and (c)

of Section 66 (1), with a minority squeeze-out by

the company being just one of the reasons.

Authors:

Anurag Shah,

Parina Muchhala,

Nishchal Joshipura and

Viral Mehta

You can

direct your queries or comments to the relevant member.

1CP/312(KB)2023.

Disclaimer

The contents of this hotline should

not be construed as legal opinion. View detailed disclaimer.

This hotline does not constitute a

legal opinion and may contain information generated

using various artificial intelligence (AI) tools or

assistants, including but not limited to our in-house

tool,

NaiDA. We strive to ensure the highest quality and

accuracy of our content and services. Nishith Desai

Associates is committed to the responsible use of AI

tools, maintaining client confidentiality, and adhering

to strict data protection policies to safeguard your

information.

This hotline provides general information

existing at the time of preparation. The Hotline is

intended as a news update and Nishith Desai Associates

neither assumes nor accepts any responsibility for any

loss arising to any person acting or refraining from

acting as a result of any material contained in this

Hotline. It is recommended that professional advice

be taken based on the specific facts and circumstances.

This hotline does not substitute the need to refer to

the original pronouncements.

This is not a spam email. You have

received this email because you have either requested

for it or someone must have suggested your name. Since

India has no anti-spamming law, we refer to the US directive,

which states that a email cannot be considered spam

if it contains the sender's contact information, which

this email does. In case this email doesn't concern

you, please

unsubscribe from mailing list.

|

|

We aspire

to build the next generation

of socially-conscious lawyers

who strive to make the world

a better place.

At NDA, there

is always room for the right

people! A platform for self-driven

intrapreneurs solving complex

problems through research, academics,

thought leadership and innovation,

we are a community of non-hierarchical,

non-siloed professionals doing

extraordinary work for the world’s

best clients.

We welcome

the industry’s best talent -

inspired, competent, proactive

and research minded- with credentials

in Corporate Law (in particular

M&A/PE Fund Formation),

International Tax , TMT and

cross-border dispute resolution.

Write to

happiness@nishithdesai.com

To learn more

about us

Click here.

|

|

Chambers

and Partners Asia

Pacific 2024:

Top Tier for Tax,

TMT, Employment,

Life Sciences, Dispute

Resolution, FinTech

Legal

Legal 500

Asia Pacific 2024:

Top Tier for Tax,

TMT, Labour &

Employment, Life

Sciences & Healthcare,

Dispute Resolution

Benchmark

Litigation Asia

Pacific 2024:

Top Tier for Tax,

Labour & Employment,

International Arbitration

AsiaLaw

Asia-Pacific 2024:

Top Tier for Tax,

TMT, Investment

Funds, Private Equity,

Labour and Employment,

Dispute Resolution,

Regulatory, Pharma

IFLR1000

2024: Top

Tier for M&A

and Private Equity

FT Innovative

Lawyers Asia Pacific

2019 Awards:

NDA ranked 2nd in

the Most Innovative

Law Firm category

(Asia-Pacific Headquartered)

RSG-Financial

Times:

India’s Most

Innovative Law Firm

2019, 2017, 2016,

2015, 2014

|

|

|

|