Areas of Service

- Practice

- Capital Markets

- Competition Law

- Financial Services & Regulatory

- Fund Formation

- Human Resources Law (Employment and Labour)

- Intellectual Property

- International Dispute Resolution and Investigations Practice

- International Tax

- International Tax Litigation

- Joint Ventures

- Mergers & Acquisitions

- Private Client

- Private Equity Investment

- Sovereign Wealth Fund and Pension Fund

- Technology Law

- Industry

- 5G Sector

- AgriTech Sector

- Artificial Intelligence

- Automation and Robotics Sector

- Automobile

- Aviation BFSI

- Cleantech

- Crypto & Blockchain

- Cybersecurity

- Digital Health

- Digital Lending

- Drones

- E-Mobility

- Education

- FinTech

- Fashion

- Food & Beverages

- Funds

- Healthcare

- Hotels

- Insurance

- Media & Entertainment

- Medical Devices

- Nanotechnology

- Oil & Natural Gas

- Pharmaceutical and Life Sciences

- Quantum Computing

- Real Estate Investments

- Social Sector

- Space Exploration and Technology

- Sports

- Technology

- Telecom

BFSI

Banking and Financial Services

The financial sector of a country is the backbone of its economy and its policies are often defined by the political, social and economic state of the nation. The global financial crisis of 2008 has further brought to the fore the strong linkages between the financial sector and the real economy. It is in this context that a financial system and its regulatory framework should be studied.

The modern banking and financial services industry in India has developed considerably since its inception, both in terms of its reach and advancement. The history of the regulated financial sector in India, so far, can be broadly divided in three phases:

Phase I: 1786 till 19691

Phase II: 1969 to 1991 (Nationalization era)

Phase III: Post 1991 (Liberalized phase)

The growth of the banking and financial services industry was slow in the first phase. With the view to streamline the functioning and activities of commercial banks, the Government of India came up with the Banking Companies Act, 1949 which was later changed to Banking Regulation Act, 1949 (“Act”). The Reserve Bank of India was vested with the extensive powers for the supervision of banking in India as a Central Banking Authority.

The second phase was marked by the nationalization of fourteen major commercial banks in 1969 and thereafter six other banks in 1980. The objective behind nationalisation of these banks was to ensure that credit was channelled to various priority sectors of the economy, which were hitherto neglected, and in accordance with the national planning priorities. By the end of the second phase, almost 80% of the banking industry in India was under government ownership. Triggered by the larger macro-economic compulsions and a current account crisis, comprehensive reforms were undertaken in 1991 following the Narasimham Committee Report on the Financial System. As a result of these reforms, the Banking Regulation Act was amended in 1993 and the financial sector was opened to new private sector banks.

The Indian financial sector has changed considerably since the economic reforms of 1991. The financial and insurance sector has shown a growth rate of 9.8% during 2016-2017. The key indicators of banking, namely, aggregate bank deposits and bank credits have shown growth rate of 11.8% and 5.1% respectively, as on March 31, 2017.2 The financing, insurance, real estate and business services sectors together account for approximately US$ 305.8 billion or 20.5% of India’s gross domestic product (“GDP”) in 2016.3 Alongside, the financial sector has played a pivotal role in providing finance to infrastructure and supporting growth. Bank credit to the infrastructure sector, which had been steadily sliding over the first eight months of the current financial year, has recorded its sharpest contraction of 6.7 per cent in November 2017.4 Post demonetisation, India’s growth rate slowed down to 7.1% in the financial year 2016-17 as compared to 8% in the previous year, which was led by the decrease in consumption.5

Growth had slid to a three-year low of 5.7 percent for the three months to June on the spillover effects of the note ban and the GST implementation.6 However, the economy bounced back up and picked up to 6.3 percent in the three months ending in September of 2017. On November 17, 2017, international credit rating agency Moody's upgraded India`s sovereign credit rating for the first time in nearly 14 years, stating that continued progress on economic and institutional reforms would further boost its growth potential.7

The financial sector of India comprises of various sub sectors like banks, non-banking financial companies (“NBFCs”), insurance sector entities and capital market related entities like stock and commodity exchanges, brokers, mutual funds, domestic and foreign investment vehicles (including foreign institutional investors), merchant bankers etc. Besides the institutionalised sector, it is also believed that India has a sizeable unorganized financial sector.

In India, the Ministry of Finance, Government of India has the overarching mandate to govern the financial sector and is responsible for the economic and financial matters concerning the country. The Reserve Bank of India (“RBI”) is the country’s central bank and the primary monetary authority. Besides being the banker’s bank and the banker to the Government, RBI regulates and supervises the financial system and particularly the banking and NBFC sector along with foreign exchange transactions. The securities market is regulated by the Securities and Exchange Board of India (“SEBI”). Other financial regulators include the8, the Pension Fund Regulatory and Development Authority and the Insurance Regulatory and Development Authority of India (“IRDA”).

Banking and financial services exhibit different industry characteristics, risks and returns and hence could be examined independently.

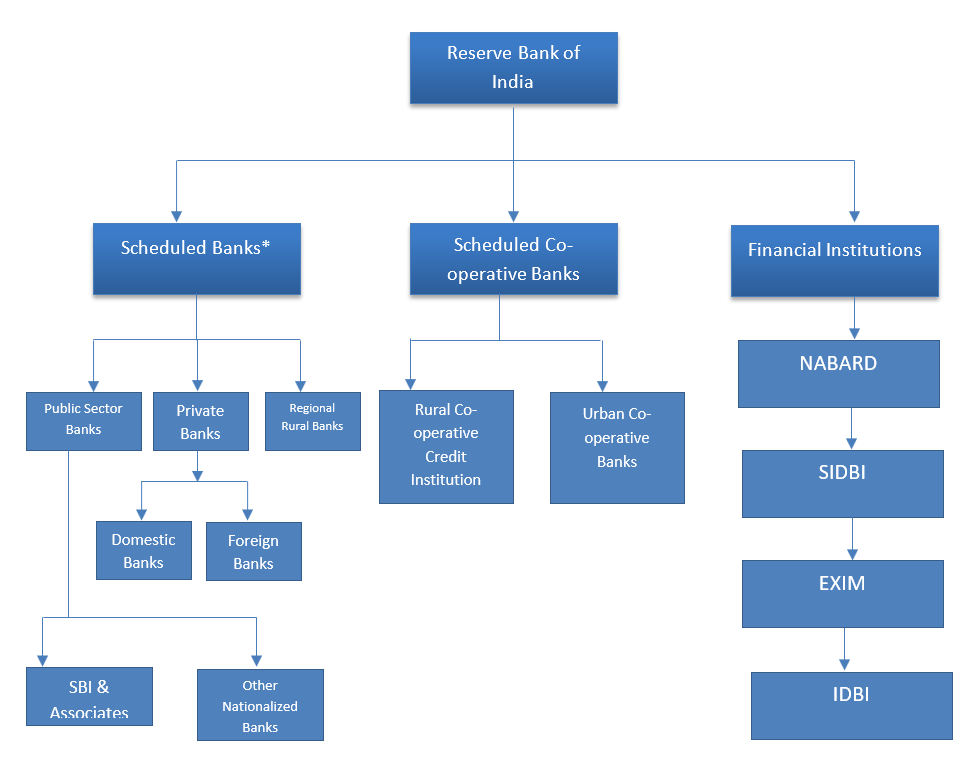

Banking

A banking system primarily performs three functions: (i) operation and handling of the payment system; (ii) mobilization of savings and (iii) allocation of these savings into various investment projects. The Indian banking sector is a mix of public, private and foreign ownerships. As of January 2018, The Indian banking system consists of 27 public sector banks, 26 private sector banks, 46 foreign banks, 56 regional rural banks, 1,574 urban cooperative banks and 93,913 rural cooperative banks, in addition to cooperative credit institutions9.

A two-year plan to strengthen the public sector banks through reforms and capital infusion of Rs 2.11 lakh crore (US$ 32.5 billion), has been unveiled by the Government of India that will enable these banks to play a much larger role in the financial system and give a boost to the MSME sector.10

The State Bank of India has the largest branch network among all banks with a net interest income of USD 9.13 billion in 201511, whereas Standard Chartered is the largest branched bank in India amongst the foreign banks.12 The Indian banking industry has recently witnessed the rollout of innovative banking models like payments and small finance banks. In FY 2015-16, the RBI granted “in-principle” approval to 11 payments banks and 10 small finance banks.13 The RBI, on 19 August, 2015, had granted “in-principle” approval to 11 applicants to set up payments banks under the Guidelines for Licensing of Payments Banks, 2014,14 & 10 small finance banks in FY 2015-16Although banks have enjoyed a monopoly in payment systems, they have begun to face stiff competition from other financial intermediaries (like term-lending institutions, NBFCs and insurers) in financial intermediation and financial services. Until recently, India had been operating on the universal banking model where banks offer retail, wholesale and investment banking services under one roof. However, banks are slowly migrating towards the differentiated model whereby they find a niche area and mainly provide services in their chosen area offering only a limited range of services.15

Structure

The structure of the Indian banking industry can be analysed on the basis of its organized status, business as well as product segmentation.

* Banks which have a paid up capital and reserves of Rs 5 lakhs or more and meet other specific criteria, are included in the second schedule of the RBI Act, 1934, and are called scheduled banks.

Entry Norms

Besides the Government owned banks, the entry of which is completely controlled by the Government, entry of players in the private banking space is highly regulated. The minimum statutory requirements for setting up new banks in India are stipulated in the Banking Regulation Act, 1949. Presently, a license from RBI is required to carry on the business of banking in India. Section 22 of the Act lists the conditions to be fulfilled before RBI may, in its discretion, grant the license. Further in respect of foreign banks, in addition to the conditions specified in case of domestic banks, RBI may require to be satisfied that the law of the country in which the foreign bank is incorporated does not discriminate against banking companies registered in India. The RBI thoroughly examines the application for new banks, as and when received, before granting the banking license. The prescribed minimum capital for licensing of new banks in the private sector is Rs. 500 crores and the bank is also required to maintain a minimum capital adequacy ratio of 13 percent of its risk weighted assets for a minimum period of three years after the commencement of its operations.16

In an attempt to extend banking services to the unserved sections of the population, the RBI came up with Guidelines for Licensing of Small Finance Banks in the Private Sector. In accordance with these guidelines, a small finance bank is required to be registered as a public limited company under the Companies Act, 2013 and should also be licensed under Section 22 of the Act. The small finance bank will operate for the furthering of financial institution.

Foreign Banks can operate in India through both a branch model as well as a subsidiary model and recently, it has been proposed that the entry of foreign banks should be through setting up of their wholly-owned subsidiaries only17. Apart from the branch and the subsidiary route, a foreign bank can also operate in India through foreign direct investment (“FDI”). As per the Consolidated FDI Policy effective from August 28, 2017 (“FDI Policy”), FDI upto 74% is allowed in Private Banking Sector (Automatic Route up to 49% and Government Route beyond 49% and up to 74%). This 74% limit is inclusive of investment under Portfolio Investment Scheme. FDI in Public Banking Sector is allowed up to 20%, through Government Route and subject to the Banking Companies (Acquisition & Transfer of Undertakings) Act, 1970/1980. Further, the RBI allowed foreign banks to invest in local private banks and supranational institutions up to a limit of 10%.18

Also, RBI has notified directions pertaining to the procedure to be followed for acquisition of shares or voting rights in private sector banks.19 As per the said directions, any person who intends to acquire shares or compulsorily convertible debentures/bonds or voting rights or convert optionally convertible bonds of 5% or more in a private bank will require the prior approval of RBI. The guidelines also lay down the procedure for obtaining approval in case of subsequent increase of shareholding of a ‘major shareholder’.

All foreign investments are freely repatriable except in cases where investment is subject to lock-in period or invested under non-repatriable schemes. Branch offices are permitted to remit outside India profit of the branch net of applicable Indian taxes, on production of specified documents to the satisfaction of the relevant Category 1 - Authorized Dealer through whom the remittance is effected.20

Operational Norms

Branch Licensing

The branch authorization policy was liberalized in 2005 when the RBI moved from the system of granting authorizations for one branch at a time, to the system of aggregate approvals on an annual basis21. As per India's commitment to the World Trade Organization, RBI has agreed to permit minimum 12 branches of foreign banks every year. For establishing a branch office it is necessary that the foreign bank should have had a profit making track record during the immediately preceding five financial years in the home country and its net worth should not be less than USD 100,000 or its equivalent.22 A foreign bank will not require the prior approval of RBI for establishing a branch office if it has obtained necessary approvals under the Act.

Prudential Norms and Capital Requirements

The RBI stipulates prudential norms concerning income recognition, asset classification and provisioning, to be applicable to all banks including the foreign banks operating in the country.

RBI has issued the ‘Guidelines on Implementation of Basel III Capital Regulations in India’. These guidelines have become effective from January 1, 2013 in a phased manner. Presently, India is transitioning from Basel II Framework to Basel III Framework. The RBI has extended the timeline for full implementation of the Basel III capital regulations till March 31, 2019.23 The Basel III capital regulations continue to be based on three-mutually reinforcing pillars, viz. minimum capital requirements, supervisory review of capital adequacy, and market discipline of the Basel II capital adequacy framework. As per Basel III, a bank shall comply with the capital adequacy ratio requirements at two levels: (a) the consolidated group level and the standalone level. Basel III, inter alia, stipulates that banks are required to maintain a minimum of Pillar I 9% Capital to Risk Weighted Assets Ratio (CRAR).

Priority Sector Lending

Banks in India are required to meet prescribed targets for lending to the priority sector in pursuance of the overall objective of financial inclusion. The prescribed limits for lending to the priority sector are, however, different for foreign banks and domestic banks.

Domestic Banks: 40% of their Adjusted Net Bank Credit (“ANBC”) or credit equivalent amount of off-balance sheet exposure, whichever is higher24. In case of shortfall in allocation of lending to the priority sector, domestic banks are required to allocate the balance amount as contribution to the Rural Infrastructure Development Fund established by National Bank for Agriculture and Rural Development (“NABARD”), or funds with other financial institutions, as specified by the RBI.

Foreign Banks: The prescribed limit for the foreign banks is 40% of ANBC or credit equivalent amount of off-balance sheet exposure, whichever is higher, out of which, foreign banks with 20 branches and above must provide for 18% for agriculture, 7.5% for micro and small enterprises (“MSE/s”), 10% for advances to weaker sections and an incremental export credit up to 2%. For foreign banks with less than 20 branches, the total priority sector lending target is 40% as well, out of which they will be allowed up to 32% for export credit.25 Foreign banks with 20 branches and above have to achieve the Total Priority Sector Target within a maximum period of five years starting from April 1, 2013 and ending on March 31, 2018 as per the action plans submitted by them and approved by RBI.26 In case of shortfall, foreign banks are mandated to deposit the balance amount with funds set up by Small Industries Development Bank of India (“SIDBI”) or with other financial institutions, as stipulated by RBI.

Other Key Statutory Requirements

Statutory pre-emption of resources has been mandated for all banks in the form of Cash Reserve Ratio (“CRR”) and Statutory Liquidity Ratio (“SLR”), to provide for the safety of depositors and other stakeholders. CRR and SLR have been used by the RBI at different times as tools to implement the monetary policy. Otherwise, the RBI has allowed the banking industry to move towards a more market driven mechanism.

Regulation

The sector is mainly regulated by RBI. RBI insures bank deposits upto Rs 1 lakh of all commercial banks (including branches of foreign banks functioning in India, local area banks and regional rural banks) through its wholly owned subsidiary the Deposit Insurance and Credit Guarantee Corporation of India (“DICGC”).

Key legislations that administer the banking sector are the Act, the Reserve Bank of India Act, 1934 and the Companies Act, 2013. Other important laws include the Negotiable Instruments Act, 1881, Bankers Books Evidence Act, 1891, Payment and Settlement Systems Act, 2007, Recovery of Debts due to Banks and Financial Institutions Act, 1993, Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002, Foreign Exchange Management Act, 1999 (“FEMA”), Prevention of Money Laundering Act, 2002 etc. In addition, the RBI releases notifications and circulars from time to time governing various aspects of the functioning of the sector. The newly introduced Insolvency and Bankruptcy Code, 2016 consolidates the multiplicity of laws that deal with financial failure and insolvency. It creates a new institutional framework, consisting of a regulator, insolvency professionals, information utilities and adjudicatory mechanisms, that will facilitate a formal and time bound insolvency resolution process and liquidation. In fact, the government is also proposing a separate framework for bankruptcy resolution in failing banks and financial sector entities.

Special courts in the form of Debt Recovery Tribunals have been set up to assist banks and financial institutions in the recovery of the debts due to them.

Taxation

Since a domestic bank can only be established as a company in India, the income tax rate applicable to a domestic company applies, which is 30% (excluding 5% surcharge if net income exceeds INR 1 crore, and 3% education cess). The tax rate for foreign banks, which currently operates in India through branches, is 40% (excluding 2% surcharge if net income exceeds INR 1 crore, and 3% education cess).

Recent Developments and Industry Outlook

The Indian banking industry has grown considerably in the last couple of decades. According to the Economic Survey 2012, banking and insurance in 2011 were India’s second fastest growing sectors after communications, and accounted for approximately 5.8% of India’s GDP, at current prices.

Financial inclusion, which broadly covers access to and use of the financial sector, remains the main thrust of the Government and the RBI. Despite the expansion of the banking network in India, a large part of the population is still not part of the banking system. While the banking connectivity in India increased more than threefold to 211,234 villages in 2013 from 67,694 in 201027, the government has observed that the coverage of banking services in unbanked villages was skewed towards BC model and the ratio of branches to BC is very low. Accordingly, the RBI has asked scheduled commercial banks (including Regional Rural Banks) to open more brick and mortar branches in villages with no banking facilities and with a population of more than 5,000 by March 2017.28 The Government and RBI continue to take several initiatives to expand the coverage of the financial sector. Towards the financial inclusion front, the Pradhan Mantri Jan Dhan Yojana was launched on 28th August, 2014 to provide universal access to banking facilities with at least one basic banking account for every household. As on November 9, 2016, US$ 6,971.68 million were deposited, while 255.1 million accounts were opened under the scheme.29

Information Technology (“IT”) remains a critical tool to achieve financial inclusion as also to increase the efficiency of the banking industry as a whole, and receives continued attention from all stakeholders concerned. Over the last couple of decades, Automated Teller Machines (“ATM”), core banking systems, internet and mobile banking and point of sale (“PoS”) terminals are few key technological developments which have revolutionized banking in India.

The domestic banking industry is set for an exponential growth in the coming years with its asset size poised to touch US$ 28,500 billion by the turn of the 202530. Industry reports estimate that the total banking sector credit is expected to increase at a CAGR of 18.1 percent to USD 2.4 trillion by 201731. In light of these observations and projections, it seems that the Indian banking industry is set to grow exponentially and will continue to remain one of the fastest growing and highest contributing sectors of the Indian economy, despite the various challenges such as financial inclusion which the industry may face in future.

Financial Services

The Indian financial services sector comprises of commercial banks, insurance companies, non-banking financial companies (“NBFCs”) and other financial entities. The financial services sector consists of the following segments:

The regulation and supervision of the financial services sector is carried out by various regulatory authorities. However, the RBI regulates majority components of the financial system. RBI supervises urban cooperative banks, NBFCs and other financial institutions. The capital markets, mutual funds and other capital market intermediaries are regulated by the Securities and Exchange Board of India (“SEBI”) and the insurance sector is regulated by the Insurance Regulatory and Development Authority (“IRDA”).

NON BANKING FINANCIAL COMPANIES

NBFCs are a diverse mix of financial institutions which mainly carry out the business of receiving deposits, financing, leasing, and investing in securities, chit funds and lease purchase.

Although the business of NBFCs is quite similar to banking, there are key regulatory differences: (i) an NBFC cannot accept demand deposits; (ii) an NBFC is not a part of the payment and settlement system and therefore, it cannot issue cheques drawn on itself; and (iii) deposit insurance facility of DICGC is not available for NBFC depositors.

NBFCs play a complimentary role to the banking sector and assume importance in meeting the financial void in the businesses, products, customers as well as the geographies not covered by the banks and other financial institutions. The ability of NBFCs to offer innovative products in consonance with needs of the customers is well recognized. However, banks can have their exposure to the NBFC sector through investments in NBFCs.

Industry Structure:

NBFCs may be classified into a) deposit taking NBFC (“NBFC-D”) or b) non-deposit taking NBFC (“NBFC-ND”). Further, NBFC-ND may be classified into a systematically important NBFC or other non-deposit holding companies.

The RBI classifies the NBFCs into seven categories based on their business:

(i) Asset Finance Company (AFC); (ii) Investment Company (IC); (iii) Loan Company (LC); (iv) Infrastructure Finance Companies (IFC); (v) Systematically Important Core Investment Companies; (vi) Infrastructure Debt Fund Non-Banking Finance Company; and (vii) Non-Banking Finance Company-Micro Finance Institution (NBFC-MFI). RBI also categorizes NBFCs with asset size of INR 50 million or more as per the last audited balance sheet as considered as systematically important NBFCs.

Entry norms

Every NBFC should be registered with RBI before commencing the business. Further, such NBFC should be a company registered under the Companies Act, 2013 and should have a minimum net owned fund of INR 200 lakh32. However, to avoid dual regulation, following categories of NBFCs are exempted from the requirement of registration with RBI subject to certain conditions, since they are regulated by other regulators:

Housing Finance Companies (regulated by National Housing Bank), Merchant Banker/Venture Capital Fund Company/stock-exchanges/stock brokers/sub-brokers (regulated by Securities and Exchange Board of India) and Insurance companies (regulated by Insurance Regulatory and Development Authority). Similarly, Chit Fund Companies are regulated by the respective State Governments and Nidhi Companies are regulated by Ministry of Corporate Affairs, Government of India.

As per the FDI Policy issued by the Department of Industrial Policy and Promotion, foreign direct investment in an NBFC is permitted up to 100% under the automatic route in 18 NBFC approved activities mentioned below, subject to prescribed minimum capitalization norms:

Merchant Banking, Underwriting, Portfolio Management Services, Investment Advisory Services, Financial Consultancy, Stock Broking, Asset Management, Venture Capital, Custodial Services, Factoring, Credit Rating Agencies, Leasing & Finance, Housing Finance, Forex Broking, Credit Card Business, Money Changing Business, Micro Credit and Rural Credit. Further, FDI has been allowed upto 100% under automatic route in ‘Other Financial Services’. Other Financial Services will include activities which are not regulated by any financial sector regulator.33

Operational Norms

RBI has issued detailed directions on prudential norms vide Non-Banking Financial Companies Prudential Norms (Reserve Bank) Directions, 1998. The directions, inter alia, prescribe guidelines on capital adequacy, income recognition, asset classification and provisioning, exposure norms, disclosure requirements, restrictions on investments etc. There are several other regulations governing NBFCs which RBI issues from time to time. Further, RBI also releases separate guidelines for specialized NBFCs. With respect to refinancing of infrastructure or other project loans, RBI has extended guidelines applicable to banks for such refinancing to NBFCs as well.34

Regulatory overview

RBI mainly regulates the functioning of NBFCs in India. The scope of business for a NBFC is limited by the RBI Act, 1934 to certain areas. The comprehensive regulations governing NBFCs were introduced in 1998. The RBI takes measures to reduce the scope of regulatory arbitrage between NBFCs, banks and other financial institutions.

NBFCs are strictly monitored by the RBI. As per the extant guidelines35, NBFCs-ND with assets less than INR 500 crore are required to submit annual return. Other returns, depending upon the quantum of public deposits, audited balance sheet, liquid assets are also required to be filed by NBFCs. NBFCs-D are required to furnish, every year, audited accounts including auditor’s certificate on repayment of deposits capacity of NBFC, statutory annual return on deposits, quarterly and half yearly returns etc.36 NBFCs having assets of Rs 100 crores and above but not accepting public deposits are required to submit a monthly return on important financial parameters of the company. All companies’ not accepting public deposits have to pass a board resolution to the effect that they have neither accepted public deposit nor would accept any public deposit during the year. NBFCs are also required to adhere to KYC Guidelines and Anti Money Laundering Standards issued by the RBI from time to time.

Since NBFCs are set up as companies, the tax rates applicable to companies apply to NBFCs.

Trends and Progress

So far, NBFCs have scripted a great success story contributing above 14% to the economy as of March, 2015 as compared to 8.4% in 2006.37 However, while the aggregate balance sheet of the NBFC sector expanded by 14.5 per cent during 2016-17, their net profit was down by 2.9 per cent.38 The NBFC business remains a small percentage of the overall banking business. In comparison to the assets of the banking system, asset size of the NBFC sector was around 13 percent whereas deposits of the sector were less than 0.15 percent of bank deposits as on March 31, 2013.39

The RBI and Ministry of Finance through their recent working group reports have recognized the importance of NBFCs for the financial system and suggested expansion of the NBFC sector while strengthening the regulatory framework.

INSURANCE

The insurance sector in India consists of 54 insurance companies of which 24 are in life insurance business and 30 are non-life insurers. Government's policy of insuring the uninsured has gradually pushed insurance penetration in the country and proliferation of insurance schemes are expected to catapult this key ratio beyond 4 per cent mark by the end of this year, reveals the ASSOCHAM latest paper. In terms of total premium volume, India is the 12th largest market in the world.40 In the life insurance business, India ranked 10th among 88 countries in the year 2014.41 The structure of the insurance industry is depicted below42:

Regulatory Overview

The IRDA was established pursuant to the Insurance Regulatory and Development Act, 1999. IRDA is entrusted with the duty to regulate, promote and ensure the orderly growth of the insurance and re-insurance business in India. Broadly, the main regulations that regulate the insurance business in India are the Insurance Act, 1937, the Life Insurance Act, 1956, the General Insurance Business (Nationalization) Act, 1971, the Marine Insurance Act, 1963, and the Motor vehicles Act, 1988.

Entry Norms

The IRDA has enacted the Insurance Regulatory and Development Authority (Registration of Indian Insurance Companies) Regulations, 2000 (“Registration Regulations”). Under the Registration Regulations, an application for registration may be made for the following class of businesses (a) life insurance business; (b) general insurance business; (c) health insurance business exclusively; and (d) reinsurance business. The IRDA has notified the Insurance Regulatory and Development Authority of India (Registration of Insurance Marketing Firm) Regulations, 2015 for registration of entities desirous of soliciting or procuring insurance products, undertaking insurance service activities and distributing financial products specified in the said regulations. Further, IRDA periodically issues specific regulations for each class of insurance business such as health insurance, insurance business in special economic zones etc.

Trends and Progress

For financial year ending March 31, 2016, motor insurance accounted for 48.52% of the gross direct premiums earned (valued at USD 6.5 billion) and the health segment seized 12.36% share in gross direct premiums earned in the country. The RBI has also raised the limit of foreign investment in the insurance sector from 26 to 49 percent under the automatic route.43

In the Union Budget 2015-16, the Government announced the introduction of the Pradhan Mantri Jeevan Jyoti Beema Yojana, a government-backed Life Insurance scheme, as well as the Pradhan Mantri Suraksha Bima Yojana, a government-backed accident insurance scheme, both of which were formally launched by the Prime Minister on 9th May, 2015. Recently, the Government has also extended Rashtriya Swasthya Bima Yojana (RSBY), a government-run health insurance scheme for the poor, to cover unorganised sector workers in hazardous mining and associated industries. However, the Government has proposed to introduce a new health insurance scheme, aimed at helping families below the poverty line, which seeks to offer a health cover of up to Rs 6 lakh per family and for senior citizens, in age group of 60 years and above, a top-up of Rs. 30,000. The Government further announced the introduction of the Crop Insurance Scheme in the Union Budget 2016-17 and has already allocated USD 840.21 million to the same. Also, IRDA recently allowed life insurance companies that have completed 10 years of operations to raise capital through Initial Public Offerings (IPOs)44. Government has approved the ordinance to increase Foreign Direct Investment (FDI) limit in Insurance sector from 26 per cent to 49 per cent which would further help attract investments in the sector. 45

SECURITIES MARKETS

Securities or the capital markets are a crucial segment of the financial sector. It provides a platform to connect various stake holders and facilitates the channelizing or reallocation of funds and also of savings to investments which spreads the risk and increases liquidity of the financial markets.

The securities market has essentially three categories of participants – the issuers, investors and the intermediaries. The regulator develops fair market practices and regulates the conduct of the issuer of securities and the intermediaries in order to protect the interests of supplier of funds.

The banking/financial institutions and financial sector in general is the most active participant in the securities market. Out of the total INR 39,653 crores raised through 71 issues during April, 2015- December, 2015, banking/financial institutions raised INR 18,764 crores through 12 issues and the other participants in the financial sector raised INR 7,405 crores through 10 issues46.

Structure

The securities market can essentially be divided into the primary market and the secondary market. New issues or securities are offered in the primary market through public issues or private placement whereas the securities already issued are traded at the secondary market. The two main stock exchanges in India are the National Stock Exchange (NSE), and the BSE Limited(BSE). Both permit trade in the equity/cash, as well as derivatives segments. A third exchange, the Metropolitan Stock Exchange (MSEI) (formerly known as MCX Stock Exchange Limited (MCX-SX)) was granted registration in the Cash and Equity Derivative Segment in July, 2012.

Stock Exchanges have broadly four market segments – Equities, Debt, Derivative and Currency Derivatives. National Stock Exchange (“NSE”) and Bombay Stock Exchange (“BSE”) are the two main stock exchanges in India, NSE being the larger of the two in terms of the volumes of trades. On September 28, 2015 the erstwhile Forward Markets Commission merged with SEBI. The merger was stimulated to bring about convergence in regulations and to harness the economies of scope and scale for the Government, exchanges, financial firms, and other stakeholders at large.

Primary Market

Recently, SEBI has adopted various measures to make the primary securities market more efficient. In order to enable more listed issuers to raise further capital using the ‘fast-track route’, the requirement of market capitalisation of the public shareholding of the issuer has been reduced from 3,000 crore to 1,000 crore in case of further public offers (FPOs) and to 250 crore in case of rights issues, subject to certain compliances.47 Further, SEBI has notified the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 for consolidating and streamlining the provisions of existing listing agreements for different segments of the capital market. SEBI has also made various amendments to several regulations with respect to takeovers, listing, and relaxations in regulatory requirements to enables companies, including start-ups, to raise funds from the public for their projects. Considering the abridged prospectus was becoming voluminous and thereby defeating its very purpose, SEBI has now capped the number of pages to ten. In order to strengthen the compliance and monitoring of listed entities, SEBI has envisaged and implemented four levels of monitoring for listed entities.

Secondary Market

In order to further fortify the infrastructure of the securities market, it was considered imperative for stock exchanges and clearing operations to assess and monitoring their system capacities. Resultantly, guidelines were issued which, inter alia, specified eligibility criteria to be complied by the stock exchange while providing trading platforms in equity derivative and currency derivatives segments respectively.48 SEBI has laid down a detailed framework with regard to cyber security and cyber resilience that stock exchanges, clearing corporations and depositories are required to adopt. Further, based on the recommendations of Depository Systems Review Committee, depositories were advised to establish a clear, comprehensive and well documented risk management framework to promote accountability.49

Entry and Operations

The entry to the securities market for all participants is highly regulated and thus requires prior approval from the market regulator, SEBI.

SEBI further has specific regulations for the entry and functioning of various participants of the securities market like Merchant Bankers, Mutual Funds, Portfolio Managers, Credit Rating Agencies, Stock Brokers and Sub-Brokers, Share Transfer Agents, Underwriters, FPIs (“FII”), Foreign Venture Capital Investors (FVCI), Venture Capital Funds and recently Alternative Investment Funds (“AIF”) which, inter alia, aim to cover all investment vehicles including those that are presently unregulated.

Legal & Regulatory

The securities market has four regulators – Ministry of Finance, Government of India (Department of Economic Affairs), Ministry of Corporate Affairs, Government of India, the RBI and SEBI.

The central Government enacted the Securities Contract (Regulation) Act, 1956, the SEBI Act, 1992 and the Depositories Act, 1996 which laid down the framework for the functioning of the securities market. SEBI, as the main market regulator, has formulated rules for the efficient and proper functioning of various market participants. Other self-regulatory participants like stock exchanges and depositories have also made rules for the functioning of other participants.

The other main regulations governing the functioning of the capital markets are the SEBI (Issue of Capital and Disclosure (ICDR) Regulations 2009, SEBI (Intermediaries) Regulations, 2008, SEBI (Prohibition of fraudulent and Unfair Trade Practices relating to securities market) Regulations, 2003, SEBI (Prohibition of Insider Trading) Regulations, 1992, SEBI (Listing Obligations and Disclosure Requirements), 2015, the Companies Act, 2013, Indian Contract Act, 1872 and Income Tax Act, 1961.

Taxation & Other Charges

The various charges and taxes levied on a securities market transaction include Brokerage, Transaction Charge, SEBI Turnover Fees, Stamp Duty, Service Tax and Securities Transaction Tax (“STT”) and Dividend Distribution Tax; brokerage and Dividend Distribution Tax being the highest two charges. The cost levied differs based on whether the transaction is of cash, futures or option and whether delivery is taken or transaction is intraday. In case of options, there is a separate charge if the options are exercised.

Further, income tax in the form of capital gains is levied on the sale of securities in the following manner:

* STT will be deducted on equity oriented scheme at the time of redemption/ switch to the other schemes/ sale of units. Mutual fund would also pay securities transaction tax wherever applicable on the securities sold.

# Surcharge at the rate of 15% is levied in case of individual, HUF, AOP, BOI, Artificial juridical person unit holders where their income exceeds INR 1 crore.

$ Surcharge at the rate of 7% is levied for domestic corporate unit holders where the income exceeds INR 1 crore but less than INR 10 crores and at the rate of 12% where income exceeds INR 10 crores.

% Short term/ long term capital gain tax will be deducted at the time of redemption of units in case of NRI investors only.

^ Long-term means where securities have been held for more than 36 months.

These rates are as per the Finance Act, 2016 and are exclusive of the applicable surcharge and education cess.

The taxation of entities differs for various entities depending on their legal form and structure and is governed by the Income Tax Act, 1961.

1 Although banking as money-lending has been in existence in India since ancient times, the first bank in India, i.e., the Bank of Bengal, was set up in the year 1786, which was followed by the establishment of a number of other banks. The first major consolidation happened in 1920 when the three Presidency Banks, i.e., the Bank of Bombay, the Bank of Bengal and the Bank of Madras, amalgamated to form the Imperial Bank of India, which was later nationalized to form the State Bank of India. Several other present day banks like Allahabad Bank, Punjab National Bank, Bank of India, Canara Bank and Bank of Baroda were set up in the late 19th or early 20th century. The Reserve Bank of India, India’s central bank, was founded in 1935

2 Provisional Estimates of Annual National Income, 2016-2017 and Quarterly Estimates of Gross Domestic Product, 2016-2017, Ministry of Statistics and Programme Implementation, Government of India (May 31, 2017)

3 Indian Brand Equity Foundation Report, (October, 2016)

4 Reserve Bank of India, Sectoral Deployment of Bank Credit, November 2017

5 Central Statistics Office, Ministry of Statistics and Programme Implementation, Government of India

6 Ibid

7 Ibid

8 It has been merged with SEBI since September, 2015

9 Indian Brand Equity Foundation- Banking Sector in India- January 2018

10 Ibid

11 Indian Brand Equity Foundation Report, 2016

12 As per RBI's 'Quarterly Statistics on Deposits and Credit of Scheduled Commercial Banks' (June, 2016), in terms of the deposit and credit, nationalised banks, as a group, accounted for 52.1% of the aggregate deposits, while SBI and its associates’ share stood at 21.9%. The deposits share of private sector banks and foreign banks in aggregate were 18.5% and 4.6%, respectively. As regards bank credit, nationalised banks hold the highest share at 51.2%, with SBI and its associates contributing 22.5%. The private sector banks and the foreign banks contribution was 18.6% and 5.2%, respectively

13 Supra note 3

14 https://www.rbi.org.in/Scripts/BS_PressReleasedisplay.aspx?prid=34754

15 Keynote Speech by Sri R. Gandhi on Differentiated Banks: Design Challenges

16 Guidelines for ‘on tap’ Licensing of Universal Banks in the Private Sector dated August 1, 2016 issued by RBI

17 Scheme for Setting up of Wholly Owned Subsidiaries (WOS) by foreign banks in India notified by RBI

18 Master Direction – Ownership in Private Sector Banks, Directions, 2016

19 Prior Approval for acquisition of shares or voting rights in Private Sector Banks: Directions, 2015

20 Notification No. FEMA 22(R)/RB-2016 dated March 31, 2016

21 As regards the foreign banks, they were made subject to certain additional conditions such as bringing an assigned capital of US $25 million at the time of opening their first branch in India

22 Foreign Exchange Management (Establishment in India of a branch office or a liaison office or a project office or any other place of business) Regulations, 2016

23 Implementation of Basel III Capital Regulations in India – Capital Planning notified on March 27, 2014

24 Within the prescribed limit of 40%, agriculture sector lending should be 18% of ANBC or credit equivalent, whichever is higher, 10% should be lent to the weaker sections, , 7.5% for micro and small enterprises as well as an incremental export credit up to 2% (further sub limits have been prescribed)

25 Guidelines for Priority Sector Lending- Targets and Classification dated April 23, 2015

26 Reserve Bank of India- Priority Sector Lending - Targets and Classification- July 24 2017

27 Supra note 3

28 Circular FIDD.CO.LBS.BC.No. 82/02.01.001/2015-16

29 Indian Brand Equity Foundation- banking Sector in India- January 2018

30 IBA-FICCI-BCG report titled ‘Being five star in productivity-Roadmap for excellence in Indian banking’ (2011)

31 IBEF Report, (August 2015). Available at http://www.ibef.org/download/Banking-August-20151.pdf

32 Specialized NBFCs like MFIs, CICs etc. have different minimum net owned fund requirement

33 RBI/2016-17/90 A.P. (DIR Series) Circular No. 8

34 RBI/2015-16/417 DNBR.CC.PD.No.082/03.10.001/2015-16

35 RBI/2015-16/119 DNBS (IT).CC.No. 02/24.01.191/2015-16

36 Directive 8 of the NBFC-D Directions, 1998 & Directive 15 of the NBFC-D Companies Prudential Norms Directive, 2007

37 Pwc-ASSOCHAM Report on Non-Banking Companies: The Changing Landscape

38 Reserve Bank of India- Financial Stability Report- June 2017

39 https://www.rbi.org.in/scripts/FS_Speeches.aspx?Id=870&fn=14#A2

40 World Insurance in 2016 published by Swiss Re

41 World Insurance in 2014 published by Swiss Re

42 Source: IRDA, TechSci Research

43 Notification No. FEMA. 366/2016-RB dated March 30, 2016

44 IRDAI (Listed Indian Insurance Companies) Guidelines, 2016

45 Indian Brand Equity Foundation- Indian Insurance Industry Analysis- January 2018

46 SEBI Monthly Bulletin (May, 2016)

47 http://www.sebi.gov.in/cms/sebi_data/boardmeeting/1435638883533-a.pdf

48 CIRCULAR NO.MRD/DP/17/2015, dated October 8, 2015

49 http://www.sebi.gov.in/cms/sebi_data/attachdocs/1421059348668.pd